Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

Amazon’s (AMZN) proposed 20-for-1 stock split shouldn’t surprise investors. After all, since Google’s (GOOG)(GOOGL) similar 20-for-1 proposed stock split last month, the e-commerce behemoth is the only one left in the FAAMG class with a four-digit stock price. Based on AMZN stock’s last closing price of $2,785, its post-split price would drop to $139.

The common narrative is for its stock to be much more accessible to retail investors. It could also encourage more options trading activity in AMZN stock. We also discussed the boost to options trading in our previous analysis on the GOOG stock split.

But, we think the most crucial reason for CEO Andy Jassy & Team for its stock split is to leverage its stock-based compensation (SBC). The company faced a series of senior executives’ departures before raising its base pay in February. We think it indicates that Amazon is considering using a higher proportion of SBC to compete in the increasingly tight tech talent market. Amazon also alluded to the narrative as reported by Bloomberg: “The e-commerce giant, in an emailed statement, said the split is aimed at giving employees more flexibility in how they manage their equity.”

The company also announced a $10B stock repurchase authorization that replaced its previous $5B authorization.

We discuss what the AMZN stock split means for investors. Notably, it doesn’t change our long-term bullish outlook on its fundamental thesis.

AMZN Stock Key Metrics

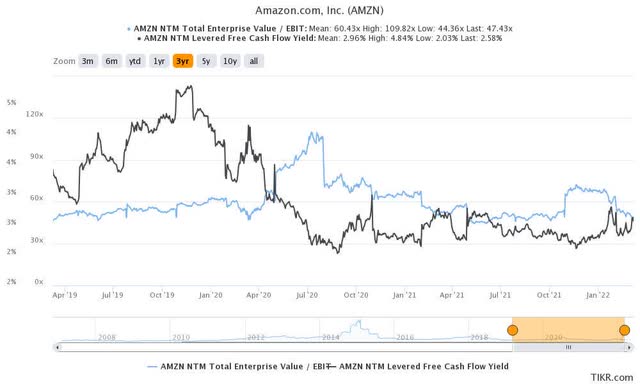

AMZN stock valuation: EV/NTM EBIT & NTM FCF yield % (TIKR)

Readers can glean from the above and observe that AMZN stock’s NTM EBIT multiple of 47.4x is markedly below its 3Y mean of 60.4x. Its stock price has largely stagnated since its 2020 highs, as Amazon’s e-commerce segment faced significant pandemic-related comps. However, Amazon has been making solid progress in growing its EBIT, driven primarily by AWS’s robust growth.

Nevertheless, its NTM FCF yield of 2.6% is still below its 3Y mean of 3%. We discussed in a previous article explaining the significant investments in its logistics and fulfillment by Amazon (FBA) infrastructure over the last 2.5 years.

It required the company to dedicate a significant amount of CapEx. But, Amazon’s aggressive investments have positioned it exceptionally well moving forward. Therefore, we believe the headwinds over its NTM FCF yield should normalize moving ahead. That could place AMZN stock in a prime position for re-rating subsequently.

Why Does Amazon Want to Split its Stock?

Amazon highlighted that one of the key reasons was to help its employees manage their SBC better. We think it demonstrated that the company could be leveraging SBC to improve its total compensation to attract and retain talent.

Notably, Amazon increased its “base pay cap for US employees to $350,000, more than doubling its previous $160,000 maximum salary for most employees.” The company also accentuated (edited):

The increases are much more considerable than we’ve done in the past. This past year has seen a particularly competitive labor market, and in doing a thorough analysis of various options, weighing the economics of our business and the need to remain competitive for attracting and retaining top talent, we decided to make meaningfully bigger increases to our compensation levels than we do in a typical year. (Insider)

We believe that the significant rise in its base pay was its response to a series of departures from its senior ranks. Insider reported previously that these executives highlighted better compensation in other companies as one of the critical factors. Insider added (edited):

Amazon senior execs who recently left the company have cited stalling growth, higher pay elsewhere, and tough culture. And the perception of low base pay emerged this year as one of the top reasons corporate employees were considering leaving, according to the results of an internal sentiment survey conducted this summer.

Therefore, having a more flexible SBC policy could help Amazon reduce cash burn. Insider also reported that cryptocurrency and Web 3.0 companies had attracted top talents from the mega tech firms to fill their ranks. Furthermore, these executives have been drawn to the startup culture, a boon to companies like Amazon in their earlier days. Insider reported:

Eight tech recruiters told Insider that they’re seeing a significant trend of high-profile executives and developers leaving established firms to cryptocurrency and other decentralized tech ventures.

Intersection Growth Partners added (edited):

We are unquestionably seeing some of the best and brightest of Silicon Valley, or tech, move over to crypto. We have pulled several “very senior folks” out from Amazon, Meta (FB), and Google. We’ve been at this a long time, and we’ve never seen a change happen this quickly. (Insider)

Wedbush also articulated that the changes in its compensation policy were a key impetus to split its stock. It added (edited):

Workers feel less slighted if they receive an entire share of stock rather than a fraction of a share.

Furthermore, a recent Google survey highlighted that employee compensation could be a significant headwind facing mega tech companies in 2022. Insider shared that (edited):

Google employees are getting increasingly dissatisfied with their compensation, according to an internal culture survey viewed by Insider. Google’s results of its annual employee survey called Googlegeist showed that compensation is one area where staffers are most unhappy.

Therefore, we think SBC would be a critical lever that these companies can pull, given the less volatile nature and robust long-term uptrend of their stock prices.

Is AMZN Stock A Buy, Sell, Or Hold?

We discussed in our post-earnings article and our previous article highlighted earlier that we think Amazon is solidly positioned to ride the recovery in e-commerce growth. The company has undoubtedly been buffeted by the reopening headwinds that affected many of its e-commerce peers. But, Amazon has also capitalized on the pandemic tailwinds to drive significant investments to its FBA footprint. JPMorgan (JPM) also weighed in (edited):

The growth in revenue coincides with a slowdown in Amazon’s spending following years of heavy investment. AMZN has caught up on fulfillment capacity after doubling its network since the pandemic began, & we expect AMZN to reap the benefits of its roughly 2.5-year investment cycle in 2022. The long-term picture for Amazon is favorable as well. E-commerce could account for 20.3% of adjusted US retail sales in 2022, up from 19% in 2021. The share could eventually rise to more than 40%. (Barron’s)

Thus, we believe that Amazon remains in a strong leadership position to leverage the multiple secular drivers in e-commerce and cloud spending moving forward.

As such, we reiterate our Buy rating on AMZN stock.

Be the first to comment