JHVEPhoto

Kinder Morgan (NYSE:KMI) is one of the largest energy infrastructure companies in North America with a $40 billion market capitalization and a dividend yield of more than 6%. The company’s share price is still well below its mid-2015 highs and its early-2020 partial recovery, and despite that consistent weakness, the company has the ability to generate strong returns.

Kinder Morgan Infrastructure

Kinder Morgan has some of the strongest infrastructure assets out of any midstream company.

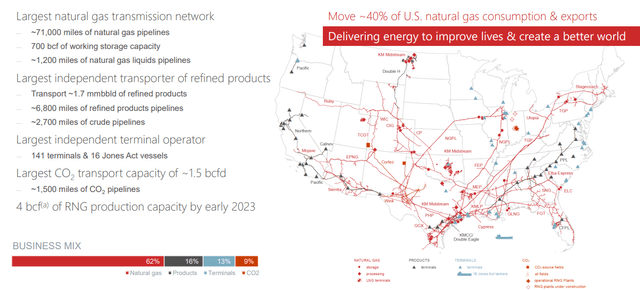

(Source: Kinder Morgan Infrastructure – Kinder Morgan Investor Presentation)

The company leads in several segments as it operates as a “toll company”. The company touches more than 40% of U.S. natural gas consumption and exports with the largest network in the company. The company has more than 70 thousand miles of natural gas pipelines with a massive 700 bcf of storage capacity and ~1200 miles of NGL pipelines.

The company is also the largest independent terminal and transporter of refined products in the U.S. and the largest CO2 transported at ~1.5 bcf / day. The company has a new RNG production business that’s expanding and we expect that expansion to continue helping to highlight the company’s asset strength.

In a market where opposition to pipelines is increasing, the company has a strong and tough to replace portfolio of assets that we expect it to use to drive substantial returns.

Kinder Morgan Financial Performance

Financially, Kinder Morgan has an impressive portfolio of assets with a company with a market capitalization of $40 billion.

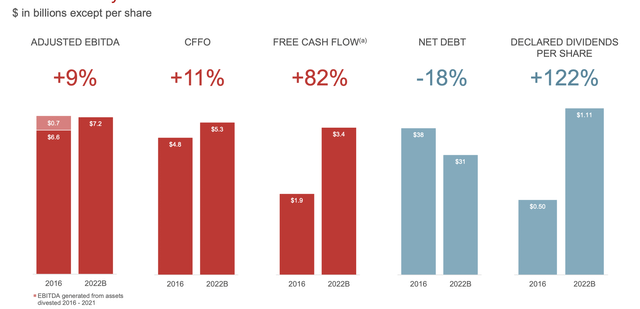

The company has managed to increase adjusted EBITDA to $7.2 billion with CFFO at more than $5 billion and $3.4 billion in FCF post capital spending, indicating a FCF yield of roughly 8%. The company over the past 6-years since the original oil crash forced a massive dividend cut, has reduced its net debt by 18% and recovered its dividends substantially.

The company’s dividend yield is a reliable almost 6% and we expect the company to continue increasing it opportunistically. The company’s debt load is manageable and any debt paid off will help to improve that EBITDA to DCF spread. Having a 8% FCF yield post capital expenditures is strong for any company, especially a reliably producing midstream company.

Kinder Morgan Strategy

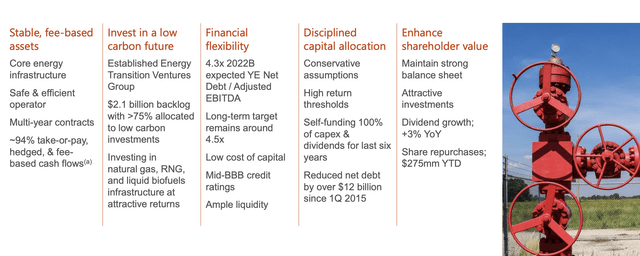

Kinder Morgan is focused on an efficient strategy to operate and continue generating shareholder returns.

Kinder Morgan is focused on stable, fee-based cash flow. The company has 94% take-or-pay hedged cash flow that forms the base of its asset portfolio and will enable strong returns. The company is continuing to invest with growth capital that it can comfortably afford, primarily allocated to low carbon investments that the company can comfortably afford.

Kinder Morgan Growth Investment

Kinder Morgan is focused on continuing to invest in growth while chasing new opportunities.

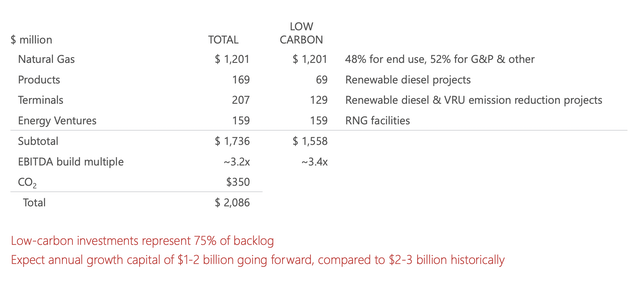

The company has $2.1 billion of total capital spending forecast and it’s assigning $1.6 billion as the low-carbon multiple which is ~75% of capital. The company is expecting $1-2 billion of growth capital going forward, which is a roughly 4% yield from growth capital going forward, and we expect that to enable the company to capturing growth opportunities.

The company is investing on projects with a ~3.4x EBITDA build multiple, meaning ~$600+ million in EBITDA from this growth capital or a 7% EBITDA growth increase. Long-term we expect the company’s growth capital to result in a mid-single digit EBITDA increase, enabling continued cash flow increases and shareholder returns across the board.

Kinder Morgan Shareholder Returns

Kinder Morgan has several avenues to continue generating shareholder returns.

The company has an 8% FCF yield and that’s after spending almost 5% on growth capital. That growth capital is expected to have a ~3.3x EBITDA multiple, which with manageable debt, should translate heavily to bottom line cash flow for the company. That forms the basis of the company’s ability to continue generating shareholder rewards.

We expect Kinder Morgan overall to continue generating double-digit shareholder returns with a reliable incredibly hard to replace portfolio of assets. That helps to highlight how the company is a valuable addition to any portfolio at this time.

Thesis Risk

The largest risks to our thesis are two-fold.

The first is opposition to new infrastructure construction. Many new pipeline projects are deeply unpopular and that will likely restrict continued growth abilities. The company might hit a point where non-carbon focused growth projects no longer have the needed support to get permits etc., and be forced to curtail growth activities.

The second is volume uncertainty. Midstream assets are tied to several basins along with the company’s assets. As a result, the company is deeply connected to volume demand across the country, especially in major basins such as the Permian Basin and exports. Should that volume uncertainty change, that’ll hurt the company’s ability to continue achieving maximum utility from its assets.

Conclusion

Kinder Morgan has a unique and strong portfolio of assets. The company is still more than 50% below its early-2016 highs, however, the fact that it was overvalued there is unimportant in relation to the company’s current valuation where we see the company as a strong opportunity. The company currently has a 6% dividend yield and is continuing to invest in growth.

The company’s ~$1.5 billion midpoint in annual capital spending is comfortably affordable. The company’s capital spending growth is expected to result in mid-single digit EBITDA growth. That will cause overall double-digit shareholder returns making the company a valuable long-term investment for shareholders.

Be the first to comment