Cindy Shebley

Q2 recap and thesis

My last article on Amazon (NASDAQ:AMZN) was co-produced with Envision Research. That article was published last month to preview its Q2 earnings. In particular, we focused on its inventories and the bullwhip effects. In this article, I will provide a review of its Q2 earnings.

Specifically, I wanted to focus on three areas. First, I will revisit its inventory, which remains a concern for me. Actually, its inventory buildup has worsened more than I anticipated in my preview article. Secondly, I will review its AWS and provide an outlook for its continued growth. And finally, I will also analyze its pending acquisition of the primary care organization, One Medical. The deal marks another attempt for AMZN to break into the healthcare space and I will provide an outlook on its potential.

Overall, I feel these shares are appealing to investors who can commit for the long term (say 5 years or longer). Many of the catalysts that I see now will take years to materialize, and I see too many risks in the near term. And I will start with my concern about its inventories immediately below.

Bullwhip effects and inventory

A key concern involves the bullwhip effects and AMZN’s inventory buildup. The details are provided in my preview article and the gist is:

- The bullwhip effect describes the tendency of businesses to over-estimate the amount of inventory they will need for a range of reasons (fear of lost sales, the misreading of market signal, et al).

- Its inventory as of Q1 stood at a peak level in 5 years as measured by days of inventory outstanding or inventory as a percentage of sales.

- It is very expensive to maintain such a large inventory and it creates considerable risks.

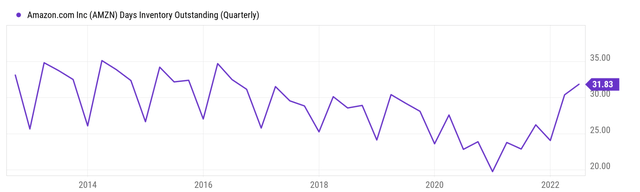

Now, based on the results reported in Q2, the buildup has become a bit worse despite the success it had with its Prime Day sales. As you can see from the following chart, its current days of inventory outstanding stand at 31.83. In Q1, the inventory stood at 30.37. So, its inventory has actually built up by about another 5%.

Seeking Alpha

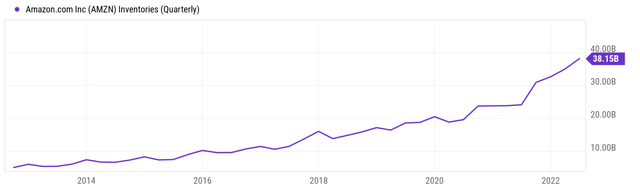

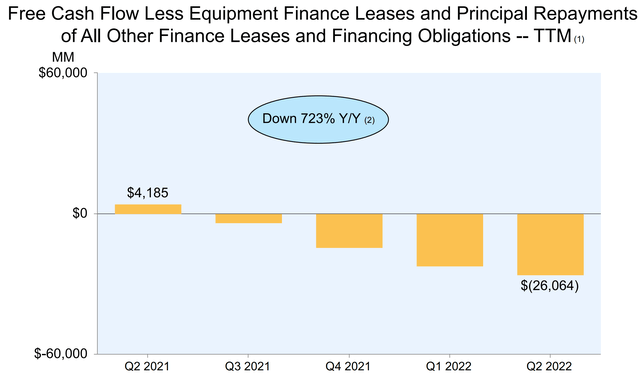

To provide a sense of the magnitude of the inventory, AMZN had more than $35B tied up in inventory as of Q1 and the number grew to $38.15B in Q2. It ended 2021 with a total inventory of $32.6B (as of Dec 31, 2021). As a result, its current inventory has swollen by almost $6B in the past 6 months alone (or about 17% in relative terms). The inventory is (and will continue to be) part of the cause of its cash problems. As you can see from the chart below, its FCF decreased from a positive $4B in Q2 2021 to the current level of negative of $26 billion as of Q2 – which serves as another yardstick to measure the magnitude of its inventory buildup.

Seeking Alpha

AMZN Q2 earnings report

AWS keeps shining

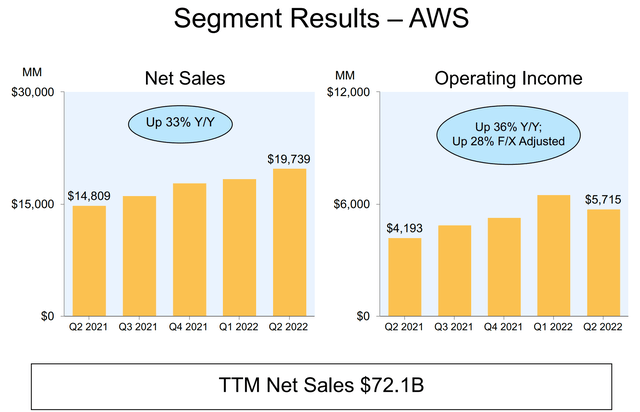

AWS keeps being the bright spot and posting impressive growth. Net sales reached $19.7 billion in Q2, representing a spectacular 33% year-over-year growth. The annualized sales are now projected to be nearly $79 billion. Moreover, AWS is still in the early stages of enterprise and public sector adoption. The growth is only starting and AMZN intends to keep investing in it aggressively as CFO Brian Olsavsky commented below (abridged and emphases added by me).

… OPS improvement that we see of a $1.5 billion and offsetting that is increased costs in AWS, as we build out depreciation. We also are adding – continuing to add people in that space; product engineers, salespeople, customer support. Speaking more broadly, we know AWS is a huge opportunity to early days in the adoption curve for companies and governments. And we invest with that – with that confidence in mind and customers have responded and we’re going to keep investing there.

And indeed, as of Q1 of 2022, AWS is the leader in the cloud space. It boasts the top market share of 33%, leading the second player (Microsoft Azure with a 21% market share) by a large margin. Google Cloud came in third with an 8% market share.

AMZN Q2 earnings report

One Medical acquisition

Amazon announced its acquisition of One Medical, a primary care company, shortly before the Q2 ER. The transaction represents the company’s latest entry into the health care services market.

The One Medical deal is estimated to be worth a total of $3.9 billion with both shares and net debt included. The deal’s completion is contingent on the usual shareholder and regulatory approval. Amir Dan Rubin will continue to lead One Medical when/if the deal is closed. I see many synergistic opportunities given AMZN’s existing telehealth, online pharmacy PillPack, wearables, and even its nutritious food through Whole Foods or Amazon Fresh. There is indeed potential for AMZN’s expanded role in the healthcare space as commented by One Medical’s CEO Amir Dan Rubin (abridged and emphases added by me). However, on the other hand, I also see this $3.9B acquisition as a baby step only toward AMZN’s ambition to capture a greater slice of the $4 trillion healthcare market.

The opportunity to transform health care and improve outcomes by combining One Medical’s human-centered and technology-powered model and exceptional team with Amazon’s customer obsession, history of invention, and willingness to invest in the long-term is so exciting… There is an immense opportunity to make the health care experience more accessible, affordable, and even enjoyable for patients, providers, and payers.

Final thoughts and risks

My overall thought is that under current conditions, AMZN shares are appealing to investors who can commit for the long-term (say 5 years or longer). All the growth drivers will take years to materialize in my view, including AWS, expansion into the healthcare space, and even the digestion of its current inventory and overcapacity that it has built up in the past few years.

At the same time, I see several new term risks. As the CFO commented earlier, the investment in AWS will require continued heavy capital spending for years to come. Admittedly, the three leading cloud providers (AWS, Azure, and Google Cloud) now control a dominant portion (62%) of the current cloud market, and we might see consolidation at some point in this space. But the investment AWS requires now is still hefty, especially while the business is bleeding a sizable amount of cash per quarter now. The business is also operating in a challenging environment currently. The cost to ship containers overseas persists at a high level. At the same time, inflation keeps pressure on its expenses and margin, especially with the high cost of fuel.

Be the first to comment