Justin Sullivan/Getty Images News

Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) stock has continued to baffle investors. In March, the company reported pretty “solid” FQ4 results and beat its guidance. Then, it guided up for an optimistic FY22, which initially saw its stock react positively. However, the momentum has since dissipated as it continued to consolidate near its March lows.

We were investors in SOFI but have since gotten out. We took advantage of the Q4 earnings spike to sell and reallocated our exposure. It was a speculative position, to begin with, so our exposure was appropriate. Therefore, the impact on our portfolio was not material. While we concur that SOFI stock’s valuation has collapsed markedly, it still traded at a premium.

Furthermore, investors cheered its solid EBITDA margins and revenue growth but missed the critical point. SoFi is still deeply in the red. The student loan moratorium looks set to continue, but we think it has been priced in. Nonetheless, we don’t suggest investors consider adding exposure in the hope of the resumption of student loan payments.

Given the recent tech market bottom, we had plenty of solidly profitable players to choose from. We have also been adding more exposure to profitable stocks in the recent bottom than non-profitable or speculative ones. Given the current macro environment, it’s advisable to focus on earnings than just topline growth.

As such, we revise our rating from Buy to Hold.

What You Should Focus On From Its Q4 Earnings Card

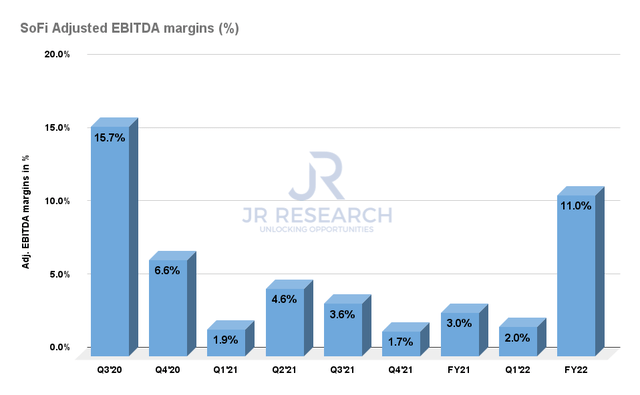

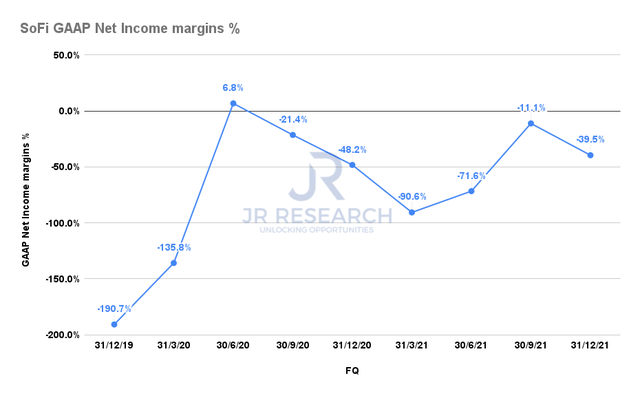

SoFi adjusted EBITDA margins % (Company filings) SoFi GAAP net income margins % (S&P Capital IQ)

We believe that SoFi investors can hardly see from the above charts that they belong to the same company but are represented differently. The first chart focuses on SoFi’s adjusted EBITDA margins, the company’s preferred guidance. The second chart focuses on its GAAP net income margins, which we think is critical. Why? Berkshire’s (BRK.A) (BRK.B) Warren Buffett reminded investors again in his recent letter to shareholders of the danger of over-relying on adjusted earnings. He emphasized (edited):

Here, it should be noted, we are talking about the old-fashioned sort of earnings that we favor: a figure calculated after interest, taxes, depreciation, amortization and all forms of compensation.

Our definition suggests a warning: Deceptive “adjustments” to earnings – to use a polite description – have become both more frequent and more fanciful as stocks have risen. Speaking less politely, I would say that bull markets breed bloviated bulls. (Berkshire 2021 Annual Report)

So, what can we glean from SoFi’s charts above? It’s clear. The adjusted metrics belie a clearly unprofitable business.

Of course, SoFi’s robust FY22 guide assumes operating leverage. It guided for revenue to increase by 55% YoY to $1.57B. Notably, its adjusted EBITDA margin is estimated to accelerate to 11%, from 3% in FY21. That’s a solid guide nonetheless. But, the market has discounted that because it can’t make sense of the bifurcation between SoFi’s adjusted and GAAP numbers.

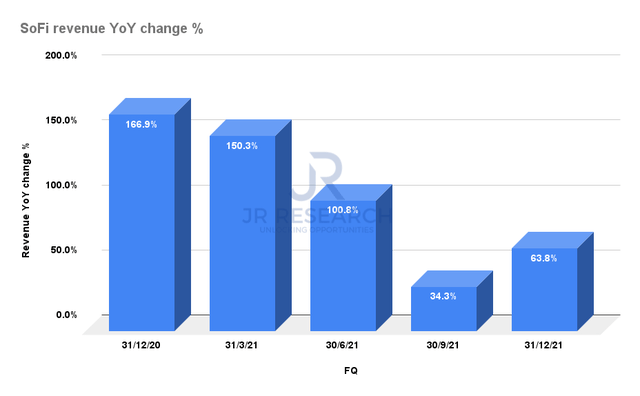

SoFi revenue YoY change % (S&P Capital IQ)

Furthermore, SoFi relied on pretty sublime revenue growth while notching its losses. So, we can surmise that SoFi has been investing significantly for growth.

However, we have always considered it speculative. There are several consumer finance apps available in the market. The common theme has also revolved around a “one-stop-shop” notion. Sounds familiar? It’s because that’s also SoFi’s strategy. So, investors need to ask themselves what makes SoFi’s business model so unique that they are ready to go heavy on SOFI stock?

Our speculative position was predicated on its story, which we think the Street also bought into. CEO Anthony Noto reiterated his strategy at a recent March conference. He articulated (edited):

We are trying to build the best-of-breed product that builds the best touch with people and at the best economics.

If we can do that, then we’re going to have much greater scale, much greater operating leverage, greater variable profit. It will allow us to reinvest at an even faster rate.

And so we look at each one of the businesses on a stand-alone basis to allocate, to drive the best returns for that business, and then think about how do we leverage the businesses together, so they’re more valuable together. (Bank of America’s Electronic Payments Symposium)

SoFi has made a series of acquisitions over the past year to further vertically integrate its stack. Noto considers these acquisitions critical to improving SoFi’s product and helping differentiate its offerings against the market.

But, we think SoFi’s bottom line hasn’t quite justified that it’s moving in the right direction. Until proven otherwise, investors should consider any position as speculative. Therefore, any exposure must be appropriately sized.

Is SOFI Stock A Buy, Sell, Or Hold?

Given that the Biden Administration is set to extend the student loan moratorium again, the near-term catalysts on SOFI stock are falling apart. Moreover, given the uncertain macro environment beset by surging inflation and rising rates, it could be a political disaster to reinstate payments now.

In addition, commentators have suggested that we could be looking at 2023 before any repayment could restart. But, given the cadence of the delays so far, that might even seem optimistic for now.

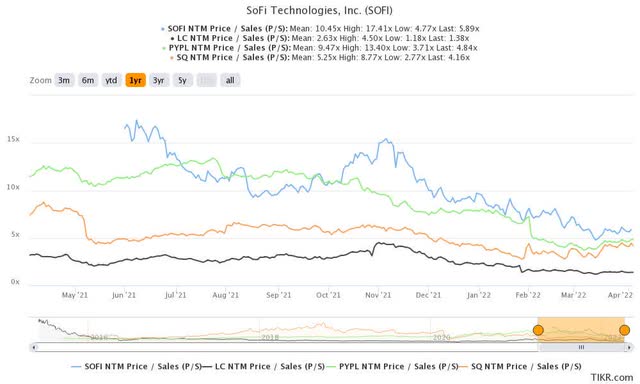

SOFI stock NTM P/S multiple (TIKR)

Moreover, SOFI stock is still priced at a premium against its FinTech peers. Investors cannot ignore peer multiples, no matter their confidence or optimism. SOFI stock’s valuation has justifiably collapsed but might not be low enough.

Therefore, given the above reasons, we have moved out of SOFI and are unlikely to return. However, we had sized our allocation appropriately and are out with no regrets.

As such, we revise our rating on SOFI stock from Buy to Hold.

Be the first to comment