ThomasSaupe/E+ via Getty Images

German equities, and the New Germany Fund (NYSE:GF) by extension, is currently negatively impacted by a raging energy crisis due to the Russia/Ukraine war. The German economy is expected to slip into recession in 2023. Until the energy crisis is resolve and Germany exits the coming recession, investors should stay on the sidelines.

Fund Overview

The New Germany Fund is a closed-end fund (“CEF”) offered by DWS Group, a German asset management company. If gives investors exposure to middle-market German companies. The GF Fund has $135 million in assets as of September 30, 2022.

Strategy

Germany, the fourth largest economy in the world and the largest in Europe, is home to many global giants such as Volkswagen AG (OTCPK:VWAGY) and adidas AG (OTCQX:ADDYY). However, what really sets the German economy apart from its peers is the Mittlestand – small and medium-sized companies that are world leaders in their respective fields.

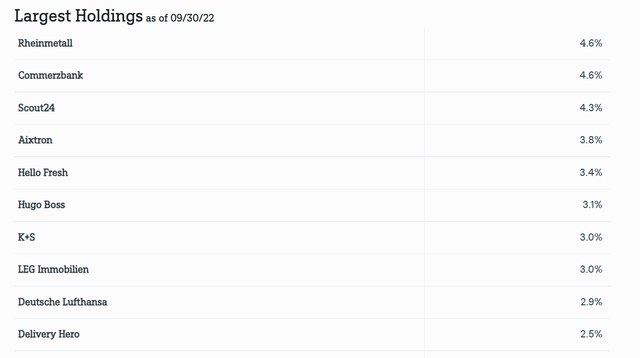

The New Germany Fund’s focus on middle-market companies gives investors exposure to some of the most dynamic companies in the world such as Rheinmetall (OTCPK:RNMBF), a leading European defense manufacturer, and Hugo Boss (OTCQX:BOSSY), a leading menswear retailer.

Portfolio Holdings

As mentioned above, the GF fund’s holdings are primarily middle-market German companies that U.S. investors typically do not have access to. The fund’s top 10 holdings are shown in Figure 1 below.

Figure 1 – GF Fund Top 10 Holdings (dws.com)

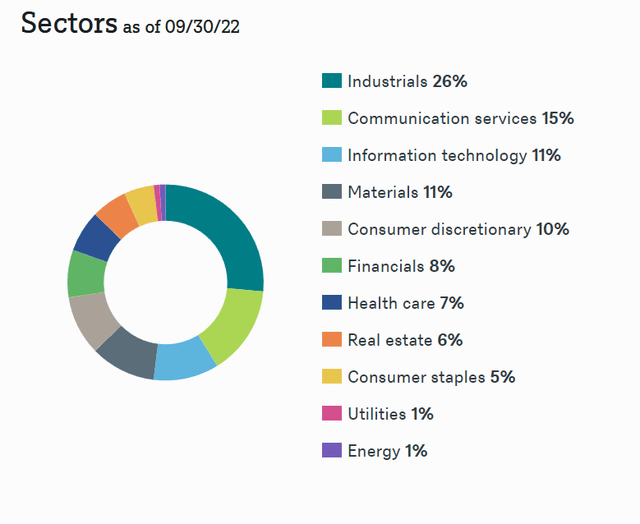

Figure 2 shows the GF fund’s sector allocation.

Figure 2 – GF Fund Sector Allocation (dws.com)

Returns

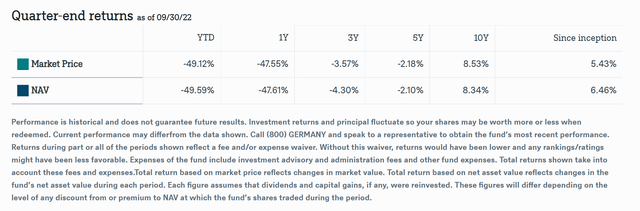

At first glance, the GF fund’s returns have been poor, with 3/5/10Yr average annual returns of -3.6%/-2.2%/8.5% respectively (Figure 3).

Figure 3 – GF Fund Returns (dws.com)

However, upon closer inspection, the GF fund does deserve some merit. For example, despite an abysmal 2022 with YTD drawdown of 49.1% to September 30, 2022, the fund still has a 8.5% 10Yr average return.

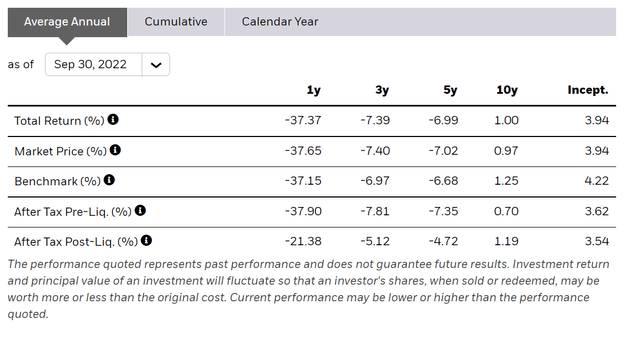

For context, if we compare the returns of the GF fund vs. the iShares MSCI Germany ETF (EWG), we can see that GF has substantially outperformed EWG on a 3/5/10 Yr basis.

Figure 4 – EWG Fund Returns (ishares.com)

So my conclusion is that the GF fund’s poor performance has more to do with an out-of-favor asset class (German equities) rather than poor manager skill.

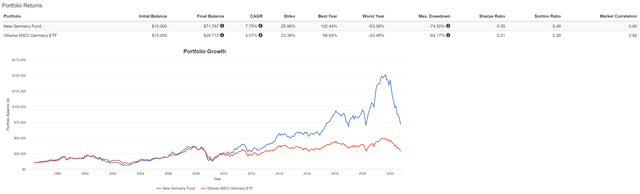

If we compare the GF fund vs. EWG using Portfolio Visualizer, we can see that GF has compounded at a far higher rate of 7.8% vs. 4.1% in the time period analyzed (May 1996 to September 2022). However, GF does have higher volatility (26.0% Stdev for GF vs. 23.4% for EWG) and a larger max drawdown (74.5% for GF from April 2000 to September 2002 vs. 64.2% for EWG from March 2000 to March 2003).

Figure 5 – GF vs. EWG (Author created using Portfolio Visualizer)

Distribution & Yield

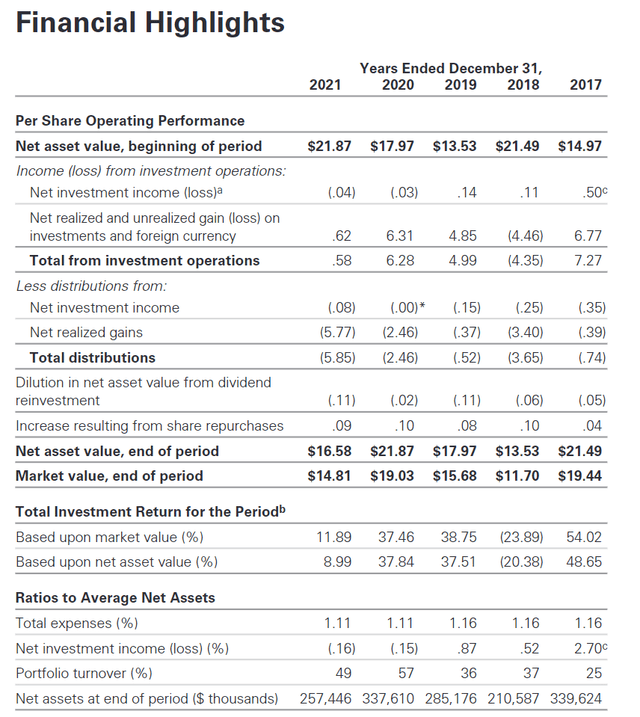

Historically, the GF fund has paid very substantial distributions, mostly funded from realized long-term gains (Figure 6). In 2021, the fund paid $5.85 in total distribution, which was equivalent to 26.7% of the fund’s beginning of year NAV. The fund’s most recent distribution of $0.7254 was paid on June 24, 2022, giving the GF fund a trailing distribution yield of 10.2%. This distribution was funded from realized long-term capital gains.

Figure 6 – GF Fund Financial Summary (dws.com)

Note, following poor performance during the early 2000s drawdown, the GF fund stopped paying a distribution in 2001 and 2002. So investors looking for distribution yield may be disappointed in the coming quarters/years given the large drawdown YTD.

Fees

The GF fund charges a modest 1.11% expense ratio.

Risk

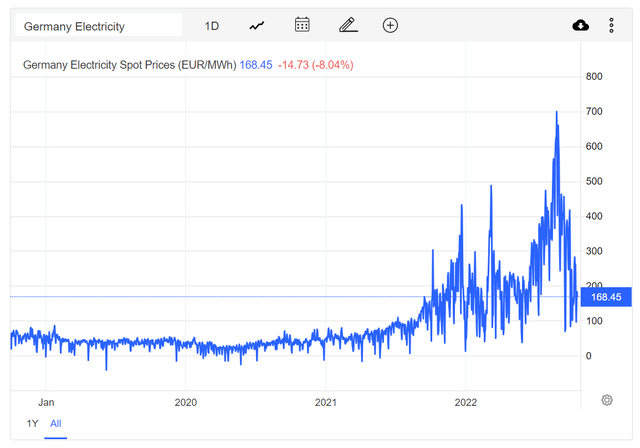

The biggest risk to German equities, and the GF fund by extension, is Russia’s continued invasion of Ukraine and the enormous stress it has placed on the German economy through surging energy prices. At one point in August, German spot electricity prices were 700 Euros / MWh, which is more than 10x the price of electricity from 2021.

Figure 7 – German Electricity Prices (tradingeconomics.com)

In response, the German government recently unveiled a 200 billion Euro spending package designed to shield consumers and businesses from the crippling energy prices. While the ‘defensive shield’ should alleviate pressures somewhat, the German economy is still reeling from the effects of the energy crisis and is expected to fall into recession in 2023.

Until the energy crisis is resolved, it is difficult to get constructive on the New Germany Fund.

New Germany Fund Outperforms In Bull Markets

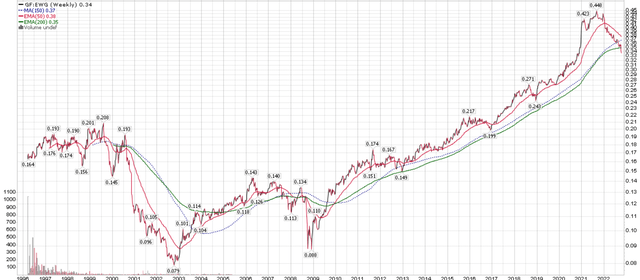

As a concluding thought, I would like to highlight the ratio chart between the GF fund and the EWG ETF (Figure 8).

Figure 8 – GF vs. EWG Ratio (Author created with price chart from stockcharts.com)

As we can see, the GF fund underperforms the EWG ETF during equity bear markets, from 2000 to 2003, from 2007 to 2009, and currently. This is because EWG tends to hold blue chip large caps which tend to hold value better than the dynamic middle-market companies held by GF.

However, the GF fund also vastly outperforms over the long run, especially during the bull market from 2009 to 2021, where it outperformed EWG by 5x.

I believe if and when the European energy crisis is resolved and Germany exits the coming recession, the GF fund will be an excellent buy. Until then, investors should stay on the sidelines.

Be the first to comment