Scott Olson/Getty Images News

Thesis

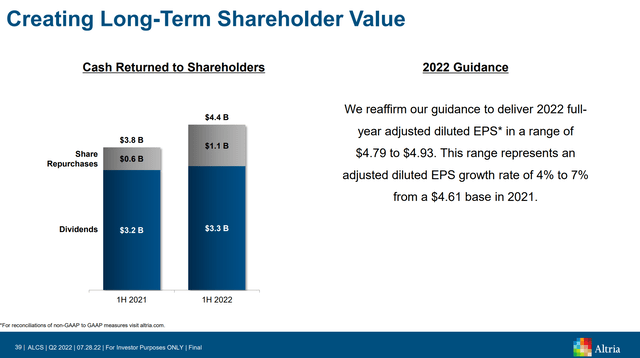

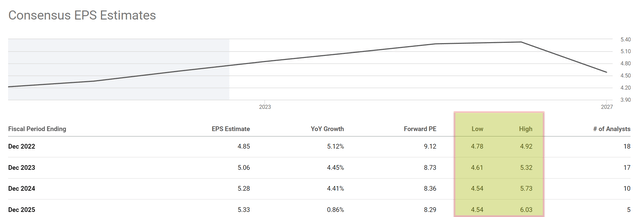

Altria (NYSE:MO) reported its Q2 earnings last week with mixed results. On the positive side, it reaffirmed its full-year EPS guidance of $4.79-$4.93, representing a healthy 4% to 7% growth from its 2021 level. On the negative side, the company continues to report the chronicle decline of its smokeable products segment. Smokeable product sales declined by 0.7% YoY. The business kept demonstrating its pricing power, and the decline was primarily driven by shipment volume.

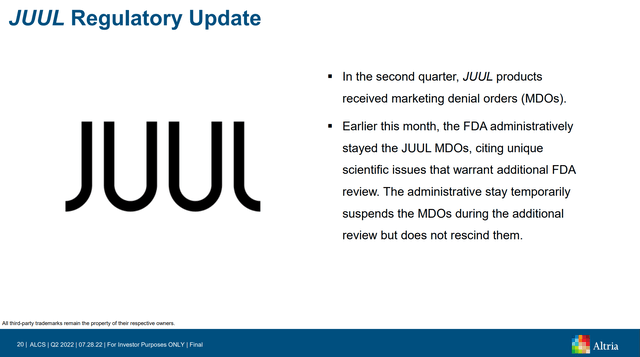

To me, the update of long-term fundamental relevance is the following announcement involving JUUL. The company started writing off its JUUL shortly after the $13B acquisition, and I feel that management has finally made up its mind to exit the JUUL venture. As you can see from the following comments from CEO Billy Gifford (abridged and emphases added by me), management is thinking about exit options.

Regarding our investment in JUUL… as of June 30, our estimated valuation is $450 million, which reflects a range of regulatory, liquidity and market outcomes. Under the terms of our relationship agreement with JUUL, we have the option to be released from our non-compete obligation under several conditions including the fair value of our investments, if the fair value of our investment is not more than 10% of the initial carrying value of $12.8 billion.

I feel sorry for MO, an otherwise shrewd business, for making this bad decision. It adds another case study to illustrate it is never a good idea to chase the hype. I also feel sorry for the investors who bought MO shares right after the JUUL acquisition. It’s a speculative investment that unfortunately did not work out.

However, at this point, with the JUUL valuation nearly completely removed from MO’s stock price, I think it is actually a good time to consider a MO position for several reasons to be elaborated on below.

Dividends and dividend safety

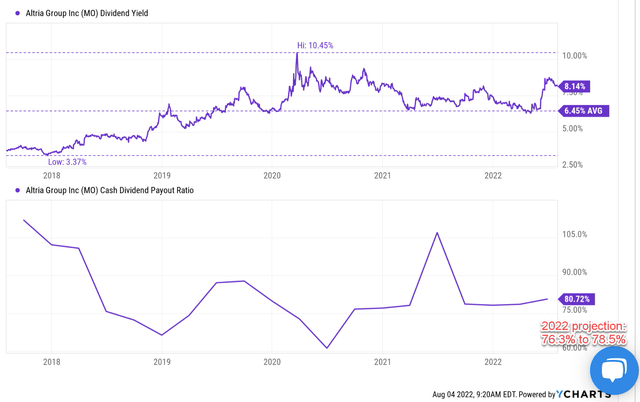

Let’s first address the elephant in the room: dividends. The dividends are high enough to rouse suspicions. The dividend yield for MO has fluctuated in a range between about 3.3% and as high as 10% with an average of 6.45% as you can see from the following chart. Currently, the yield stands at 8.14%, more than 26% above the historical average.

But my view is that the JUUL acquisition never helped the dividends and its removal has no relevance to the dividend either. And you can clearly see this in the bottom panel of the chart, which shows MO’s payout ratio in terms of cash flow. MO has been doing a consistent job of managing its dividend payout in the past. The payout ratios have been fluctuating around an average of about 80% both before and after the JUUL acquisition.

Looking forward, my projection for its cash payout ratios is somewhere between 76% and 78%, well below its historical average. As aforementioned, it reaffirmed its full-year EPS guidance of $4.79-$4.93. And historically, it has been maintaining remarkably high earnings to cash conversion ratio (on average 96 to 97%). I’m projecting $3.65 of dividend payout per share for 2022-2023. If you put all the other above numbers together, you would see its cash payout ratio to be between 76% and 78%, not only consistent with the historical range but also lower than its historical average. I see no sign of concern here.

Capital allocation and share repurchase

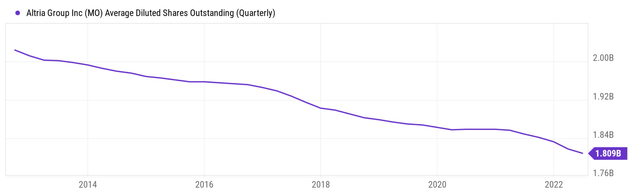

As a matter of fact, MO not only generates enough cash to comfortably cover its dividends, but it will also have plenty of capital allocation flexibility to boost shareholder returns through other avenues. Take share repurchase as an example, it has been consistently buying back its own shares as you can see from the following chart. Cumulatively, its net outstanding shares have shrunk from 2.01 billion 10 years ago to roughly 1.81 billion currently (an annual reduction rate of about 1%).

Going forward, the company will continue its buybacks as CFO Sal Mancuso commented (abridged and emphases added by me) during the Q2 ER. To me, such repurchase programs are a no-brainer and will be highly accreditive to shareholders for several reasons. MO’s return on capital is so much higher than its cost of capital. As detailed in my earlier articles, its ROCE (return on capital employed) is above 100% while its cost of capital should be no more than 10%. Second, its current valuation is quite compressed (at a single-digit FW PE of ~9x). And to top it off, the company will be able to maintain a strong balance sheet and a stable leverage ratio at the same time too.

We have approximately $750 million remaining under the currently authorized $3.5 billion share repurchase program, which we expect to complete by the end of this year. Our balance sheet remains strong. And as of the end of the second quarter, our debt-to-EBITDA ratio was 2.3x. In August, we expect to retire $1.1 billion of notes coming due with available cash.

Return projections

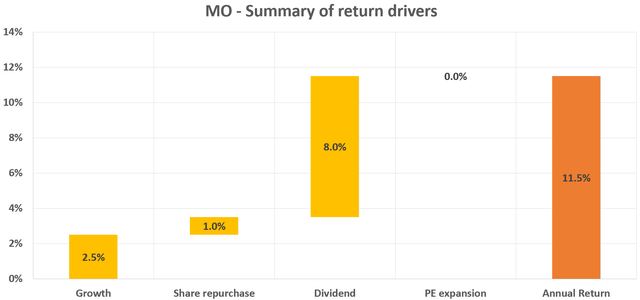

Based on the above analysis of the business fundamental, here, I will consider a conservative scenario as shown in the waterfall chart below. This scenario considers the following return drivers:

- 2.5% growth in total profit, essentially only adjusting for inflation.

- 1% share repurchases, consistent with its historical trend.

- Dividend of 8% on average (assuming dividend increase would keep the dividend yield approximately at the current level).

- No valuation expansion at all.

Based on the above conservative estimate, the annual return should be in the double-digits range (say 11.5%).

Final thoughts and risks

To summarize, the thesis here is that the removal of JUUL from its stock price has actually reduced the investment risk. The JUUL acquisition never helped its dividends (or earnings) and its removal has no relevance for its dividends or earnings either. At the same time, the removal of the JUUL valuation significantly reduced the valuation risks.

Looking forward, I am still seeing a cash-cow business with superb ROCE and capital allocation flexibility. And even a conservative estimate points to annual return potential in the double-digits range of around 11.5%. Moreover, most of the return (about 8%) will come from its current dividends, adding another layer of safety to the investment.

Finally, risks. The secular decline of its smokable products is a major risk here. Depending on how you model the rates of shipment volume decline, its pricing power, and inflation, you can arrive at a wide range of future earnings. These uncertainties are capsulated in the large variance in the consensus forecasts as shown below. The variance between the optimistic and pessimistic forecasts is more than a factor of 1.3x even 3 years out ($6.03 EPS vs. $4.54 EPS in 2025).

Be the first to comment