SDI Productions/E+ via Getty Images

Thesis highlight

I believe Privia Health (NASDAQ:PRVA) is currently undervalued. PRVA sees the struggle faced by the United States healthcare industry primarily due to the varying reimbursement models. With the Privia Platform, PRVA seeks to optimize healthcare practitioners’ management and overall performance. Despite the current risks, such as the existing stringent regulations, competitive market, and demand for competent healthcare professionals, the company is expected to sustain an optimal growth rate.

Company overview

Privia Health is a technology-driven, national physician-enablement company that collaborates with medical groups, health plans, and health systems to optimize physician practices, improve patient experiences, and reward healthcare professionals for delivering high-value care in both in-person and virtual care settings on the “Privia Platform.” PRVA enters markets, organizes providers, drives operational and clinical improvements, and transitions the market to value-based care (VBC).

Investments merits

US healthcare industry faces several challenges

As the healthcare industry moves toward VBC, the current care delivery platforms aren’t well-suited to work with different payment models.

I believe there’s a chance for primary care-led physician groups to deal with rising healthcare costs and bad outcomes and do well in different VBC models over the next several decades. Managing the entire cost of care for an underlying patient population and improving a variety of quality indicators are required for these models to achieve success and to be reimbursed for their use. It seems that the regional market, demographic cohort, and payer will all play a role in determining how these value-based models will develop in terms of program structure and growth pace.

Traditional physician groups find it hard to find ways to lower costs while also improving care quality and making it easier for more people in different regions to get care. As a result of the additional administrative work required to manage patients, medical practices have seen a drop in their profitability, had more difficulty gaining access to funding, and are experiencing cash flow difficulties. Physician burnout and hampered doctor-patient relationships are partly the result of complicated payment arrangements and outdated technology. Insurance companies for health care are putting more limits on their networks, which puts pressure on volume and especially hurts independent practitioners.

The U.S. healthcare system has a hard time improving health outcomes and keeping doctors and patients satisfied despite the country’s high spending levels. One clear piece of evidence is that according to the World Bank, life expectancy in the U.S. was 77.3 years in 2020, lower than in other developed countries.

Transition to VBC has its own pain as well

The U.S. healthcare system has significant obstacles and opportunities. Historically, the delivery of healthcare has been focused on providing reactive care in response to acute occurrences. This focus led to the development of a payment model known as fee-for-service (FFS). The FFS model does not reward prevention but rather inadvertently favors the treatment of acute care episodes as they occur by linking payments to the number of encounters and pricing more complex interventions.

The shift toward value-based payment systems has garnered support from patients as well as policymakers. I agree that there’s a demand for the technology-driven disruption that, if implemented, would move the healthcare system toward a model that’s focused on value. It’s feasible that PRVA’s integrated platform, which is powered by data and technology, will completely change the way the healthcare business operates. With PRVA’s experience working in all reimbursement settings, the company meets providers where they are on their transformative journey and enables them to accelerate and thrive in their transition as each geographic market shifts towards VBC.

The Privia Platform is the backbone of PRVA

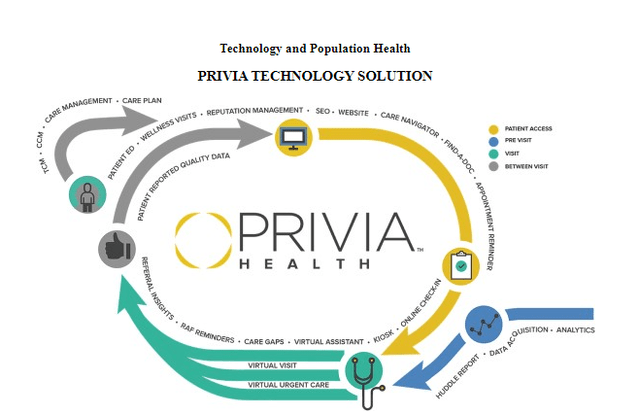

The workflows of the care team, the patient, and the provider are streamlined by Privia’s end-to-end, cloud-based platform, which focuses on:

- Diverse patient access (patient portal, mobile app, and search engine optimization)

- Pre-visit analytics and preparation

- In-person or virtual care delivery

- Post-visit analytics, care coordination, and reporting

More than these, PRVA’s technology-enabled platform:

- Scales operations across 3,250 providers in multiple markets;

- Improves multiple-payer contract performance

- Provides high-quality care to all patients;

- Supports providers reduce administrative burdens by using machine learning and AI;

- Helps the company itself scale operationally by collaborating closely with clinical and operational teams to optimize workflows as it enters new markets and payer contracts.

As we can see, PRVA’s platform is built on a modern cloud-based technology stack that uses agile development cycles and API standards to add new features and connect to systems outside of PRVA.

Privia platform built with a physician-first mindset

The goal of Privia is to redefine the way physician organizations are managed and to develop a system that’s tailored to the specific requirements of these organizations to optimize their overall performance. This is accomplished by the company through the following five critical elements of its platform:

- Emphasizing technology and the health of the population.

- Creating a single-TIN Medical Group and establishing a governance model in individual geographic markets.

- Owning and running a management services organization in each target market.

- Developing Accountable Care Organizations (ACOs) to take advantage of VBC potential.

- Offering a high-quality, low-cost provider network for purchasers and payers.

Too often, technology pains providers and patients instead of helping them. To improve workflows in both FFS and VBC settings, the Privia Technology Solution was developed with the input of both the practice’s physicians and patients. This increased patient participation at all stages of a visit, including pre-visit, point of care (in person and virtually), and post-visit. PRVA wants to improve its Privia Providers’ technology and marketing so patients may find a provider online, make an appointment, and receive reminders. These three actions have been shown to increase patient retention and decrease the number of costly no-shows.

Ability to scale across markets sets it apart from competitors

PRVA’s capital-efficient model is easily replicable in new markets. This is fantastic because they employ a low-asset business model as well as a methodical, consistent approach to market structure and development. Anchor relationships are formed in a new market between PRVA and market-leading provider groups and health systems, and they consist of a single-TIN Medical Group to which all other providers (whether employed by PRVA or not) are aligned. PRVA differs from its competitors in that its business model does not rely on large investments in things like purchasing existing medical practices or building brand-new clinics. PRVA’s predictions for new markets are based on data from previous provider cohorts, which show that they consistently improve practice performance in both FFS and VBC metrics over time.

As a result, with each new market added to PRVA’s portfolio, the company’s path to profitability and free cash flow contribution accelerates. Furthermore, PRVA’s business model allows the company to grow gradually by acquiring minority or majority stakes in existing practices and launching brand-new, wholly-owned Medicare Advantage and direct contracting sites of care.

Valuation

Price target

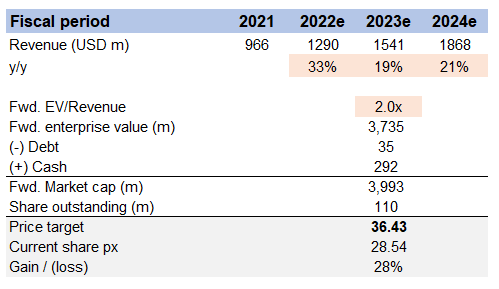

My model suggests a price target of $41.54 or ~28% upside in FY23 from today’s share price of $28.54. This assumes that revenue will continue growing at a high rate (high teens to low 20s) until 2024e, and the forward EV/revenue multiple will be 2.3x in FY23e.

Author estimates

My model is based on consensus estimates, which is also relatively in line with management’s long-term guidance of 20% top-line growth (mentioned in the 2Q22 earnings call). As for valuation, PRVA currently trades at 2x 1-year forward revenue. So long as PRVA can sustain its revenue growth at this level, I don’t expect any changes to its revenue multiple, especially since it has already pulled back a few weeks ago.

Risks

Regulation

Authorities at all levels-federal, state, and local-keep a close eye on the medical care industry in the U.S., which is subject to stringent regulations. The breadth of these regulations and the scope of the statutory exceptions and safe harbors that are available make it possible that some of PRVA’s business activities, notwithstanding the company’s efforts to comply with these laws, could be challenged under one or more of these laws. If PRVA fails to accurately anticipate how these laws and regulations will affect its business, the business may be held liable, and its operations may suffer.

Physicians are the critical asset

The success of PRVA’s business strategy is heavily dependent on the company’s ability to recruit a sufficient number of Privia Physicians for each of its Medical Groups. The number of Privia Physicians working in a certain market affects the company’s ability to negotiate competitive reimbursement rates with commercial payers, as well as the number of lives that can be attributed to the company for VBC calculations and the unit cost of providing its services in different geographic markets.

Competitive market

PRVA is in direct competition with national, regional, and local healthcare service providers for patients, physicians, and non-physician clinicians. There are presently a large number of other businesses and individuals offering healthcare services, including several with technology-enabled business models that are focused on the national market in a manner that’s similar to Privia’s. A lot of these competitors have been in business longer than PRVA and/or have a lot more money and resources than Privia.

Conclusion

I believe PRVA is undervalued as of today. The technology solutions provided by PRVA have a direct significance and impact on the healthcare industry. As reviewed, PRVA has shown market potential in the industry’s transition to VCB and overall U.S. healthcare management optimization. Come what may in terms of risks such as strict regulations and stiff competition, I expect PRVA’s market share to grow in FY23 and have strong potential to continue growing revenue.

Be the first to comment