zazamaza/iStock via Getty Images

Elevator Pitch

My investment rating for Alta Equipment Group Inc.’s (NYSE:ALTG) shares is a Buy.

ALTG’s shares rose by +57% from $11.08 at idea initiation in early-March last year to $17.38 during intraday trading on November 15, 2021, following the publication of my earlier initiation article for Alta Equipment on March 4, 2021. The company’s stock price has subsequently pulled back to close at $11.23 as of September 23, 2022 in line with broad market weakness, and this has prompted me to write an update for Alta Equipment.

An improvement in supply chain issues, expansion into Canada, and a new shareholder capital return program are among the key tailwinds for Alta Equipment. This explains why I remain Bullish on ALTG and maintain my Buy rating for the name.

Supply Chain Constraints

Alta Equipment’s actual quarterly non-GAAP adjusted earnings per share fell short of the market’s expectations for three consecutive quarters between Q3 2021 and Q1 2022. This was the major factor which led to ALTG’ share price dropping off after reaching a peak in mid-November 2021.

But there are now signs of a turnaround for Alta Equipment.

Alta Equipment released its most recent Q2 2022 financial results last month, and surprised investors in a positive way with better-than-expected earnings and an upward revision in full-year operating income guidance.

Prior to the second-quarter earnings announcement, the market had anticipated that ALTG will be marginally profitable with a non-GAAP EPS of $0.01, but Alta Equipment managed to generated a much higher adjusted EPS of $0.22 for the recent quarter. At the same time, ALTG increased the mid-point of the company’s full-year fiscal EBITDA guidance from $139.5 million to $149.5 million.

The key reason for ALTG’s above-expectations bottom line and optimism with respect to full-year financial performance is that supply chain constraints have shown signs of improvement.

ALTG highlighted at its Q2 2022 results briefing that the company “recorded sales in Q2 2022 that frankly, could have occurred had we had the supply earlier.” Looking ahead, Alta Equipment stressed that “the backlog is there for new equipment”, and emphasized that assuming that “we can get supply that we’ll be able to convert that into sales quickly.”

A recent September 22, 2022 Bloomberg article citing research from Morgan Stanley (MS) noted that MS’ “supply-chain stress index fell again” with improvements in areas like “cheaper costs for shipping raw materials, lower delivery times, and fewer logistics backlogs.”

In a nutshell, the easing of supply chain constraints is a key tailwind for Alta Equipment in the near term. Wall Street analysts share the company management optimism as seen with the change to consensus financial projections for ALTG. In the past three months, the market’s consensus FY 2022 and FY 2023 normalized EPS estimate for Alta Equipment has been increased by +6.5% and +5.8%, respectively.

Geographic Expansion

On July 6, 2022, Alta Equipment disclosed that it “entered into a definitive agreement to acquire Yale Industrial Trucks, Inc., a privately held Yale lift truck dealer with five locations in southeastern Canada.” Notably, ALTG mentioned that this deal “extends our operations into an international market for the first time.”

ALTG quantified the growth opportunity associated with the company’s venture into southeastern Canada at its Q2 2022 investor call. Alta Equipment revealed at the company’s most recent quarterly earnings briefing that the geographic expansion relating to Yale Industrial Trucks “is adding about 40% to our addressable market” in terms of industrial truck deliveries. The company also added that Yale Industrial Trucks’ current share of the markets it operates in, specially Quebec and Ontario, is rather low, implying that there is substantial room for market share gains.

Based on my calculations, Yale Industrial Trucks’ trailing twelve months’ revenue is only about 3% that of Alta Equipment. As such, it isn’t the revenue accretion from the acquisition that is significant. Instead, this acquisition is meaningful, because it will extend ALTG’s growth runway in the long run as the company includes Canada as part of its target markets.

Inorganic Growth

ALTG has executed well on the company’s inorganic or M&A strategy in the past few years.

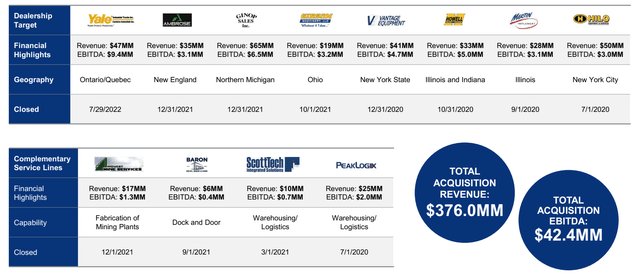

Alta Equipment’s Prior Acquisitions

ALTG’s Q2 2022 Earnings Presentation

As highlighted in the chart presented above, Alta Equipment has completed multiple acquisitions in the past three years, and these inorganic growth initiatives have contributed $376.0 million of top line and $42.4 million of EBITDA for ALTG. As a comparison, ALTA currently boasts trailing twelve months’ revenue and EBITDA of $1,389.5 million and $128.1 million, respectively. In other words, acquired companies have accounted for about a third of Alta Equipment’s top line and operating earnings.

Moving forward, it is reasonable to assume that Alta Equipment’s M&A growth momentum will continue. This is largely because ALTG typically targets small, private companies where the owners of these businesses are receptive to selling. At its Q2 2022 earnings briefing, Alta Equipment highlighted that “there’s a demographic tailwind to our (acquisition) strategy where there are more family businesses in need of succession than there are buyers like Alta.”

Shareholder Capital Return

Shareholder capital return in the form of dividends and share repurchases has always been an important consideration for investors in sizing up potential investment candidates. In the current bear market, investors pay even greater attention to shareholder capital returns. For example, dividends are a source of positive returns that help to offset temporary mark-to-market losses associated with share price declines.

As such, I have a positive opinion on Alta Equipment’s recent decision to embark on key shareholder capital return initiatives. ALTG published a press release on July 12, 2022 noting that it “initiated a regular quarterly common stock dividend of $0.057 per share” and “a $12.5 million share repurchase program.”

The $12.5 million share buyback program is equivalent to a meaningful 3.5% of ALTG’s current market capitalization; while Alta Equipment offers a decent annualized 2.1% dividend yield based on its most recent quarterly dividend. This could help Alta Equipment attract a new group of investors who didn’t previously consider ALTG as a potential investment candidate because of the absence of capital returns.

Bottom Line

I continue to assign a Buy rating to Alta Equipment. ALTG currently trades at an undemanding consensus forward next twelve months’ EV/EBITDA multiple of 6.9 times as per S&P Capital IQ, and there are multiple tailwinds (as detailed in the article) that could play a part in re-rating its shares.

Be the first to comment