Petmal

Investment Thesis

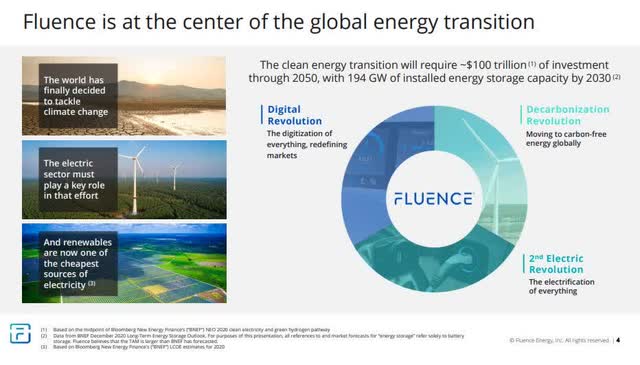

Fluence Energy, Inc. (NASDAQ:FLNC) operates in a market that will experience significant growth in the coming years: energy storage. With Siemens (OTCPK:SIEGY, OTCPK:SMAWF) and The AES Corporation (AES) present as major shareholders, the company looks fated to succeed. Unprofitable tech-growth companies are currently not so “sexy” due to market and macro conditions, yet Fluence presents both qualitative and quantitative characteristics that could change one’s mind. Fluence is significantly undervalued and should be considered a buying opportunity at current or lower levels, with a long-term perspective to 2030.

Fluence Q4 2021 ER presentation

A brief company overview

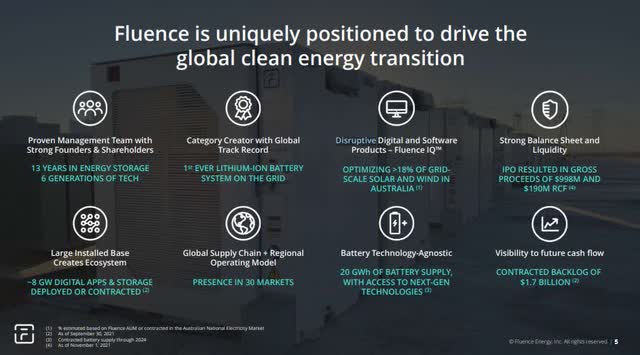

For those not fully aware of the company, Siemens and AES joined forces to launch Fluence in early 2018. The multi-awarded company carries 14 years of experience in the field, 4.8 GW of energy storage capacity, 185 projects in 30 markets, and 7.8 GW of AI-optimized bidding of renewables and storage. Thus, it should be considered among the leaders of the sector.

Fluence Q4 2021 ER presentation

In December 2020, Qatar Investment Authority (QIA) invested $125M in Fluence at a ~$1B valuation (resulting in a share price of ~$6.76). The company is publicly traded on NASDAQ since 06-21-2021. Its IPO at a ~$4.8B valuation ($28 price per share) helped raise gross proceeds of ~$1B. From a total of 171,316,665 stocks, only the 54,143,275 class A stocks are publicly traded. Another 117,173,390 class B-1 stocks, with x5 voting rights than class A, are held by the founders (50% Siemens – 50% AES). QIA holds 18,493,275 shares.

Corporate headquarters are located in Arlington, Virginia in the Washington D.C. metro area, with 2 additional offices in the USA, and another 7 worldwide.

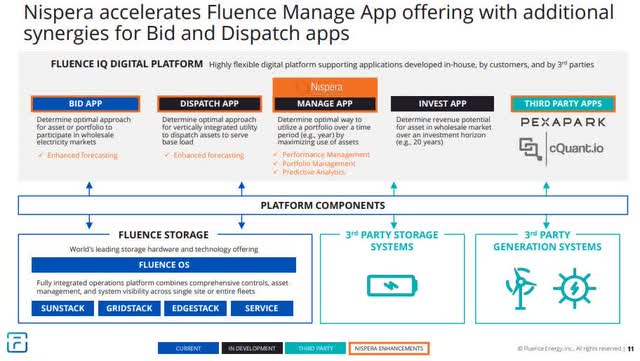

Energy storage products (based on lithium-ion batteries) and services, as well as digital applications for renewables and storage, constitute Fluence’s solution portfolio:

- Fluence Cube is the core of Fluence’s products. A tailored approach gives Gridstack, Sunstack, and Edgestack as final products.

- Fluence OS is a fully integrated controls software for managing and dispatching the storage system.

- Fluence IQ is Fluence’s AI platform that helps customers increase revenue and reduce risk with automated AI-powered bidding.

- Fluence offers four levels of Operational Services Packages and full turnkey Delivery Services.

Fluence’s solutions will be critical for the global transition to renewable energy, the stability of the energy networks, the reduction of fossil fuel use, and the management of the energy/storage systems.

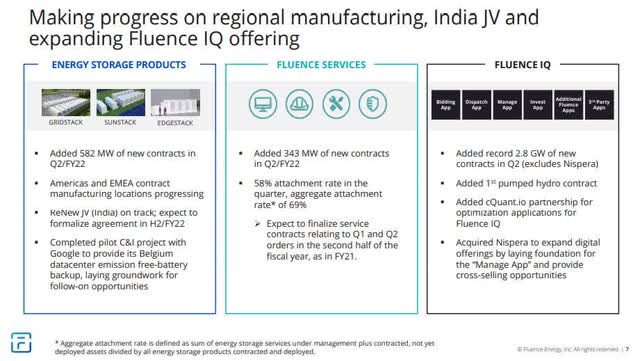

Q2 2022 ER and FY 2022 outlook

Fluence’s Fiscal Year starts on 10/01 and ends on 09/30. For the 2nd Quarter ended March 31, 2022, the company announced a strong set of results. Revenue of $343M is up 249% year-over-year. Net loss was $(61)M. Net cash position was ~$723M as of March 31, 2022.

Demand remains strong, as well as new orders and backlog conversion. Total backlog was ~$2.2B (~$1.8B from energy storage products, and ~$0.4B from energy storage services and Fluence IQ), increased by ~$0.3B compared to the previous quarter. Gross profit margin improved compared to Q1.

Fluence Q2 2022 ER presentation

Fluence IQ added 2.8 gigawatts of new digital contracts during Q2 resulting in a total of 7.8-gigawatt assets under management. As CEO Manuel Perez Dubuc mentioned during the Earnings Call “the significant growth in Fluence IQ is ahead of our business plan.” In that direction, Fluence acquired Nispera, a Zurich-based provider of AI and machine learning-enabled SaaS, which brings an additional 8 gigawatts under management. Nispera acquisition constitutes an interesting addition to the digital part of the business. The transaction includes a ~$30M full-cash buyout plus 530,471 restricted shares issued to Nispera management. Fluence will benefit both from integrating Fluence’s digital solutions and by geographical expansion as Nispera is present in markets that Fluence was previously not. This looks promising, as the company is doubling digital contracts which bring higher profit margin revenue.

Fluence Q2 2022 ER presentation

The company reaffirmed the previous fiscal year’s revenue guidance between $1.1B to $1.3B, highlighting the supply chain global issues and the possibility that a part of the expected revenue could shift into the next year. That would bring the expected revenue closer to the lower end of the guidance.

Therefore, things weren’t as bad as the market perceived on May 12th. A gradual normalization of the supply chain problems is expected during the 2nd half of the year. Furthermore, the company’s cash position ensures there is enough capital to execute the business plan until profitability is achieved. Break-even in terms of EBITDA is expected in 2024.

Macro/market environment

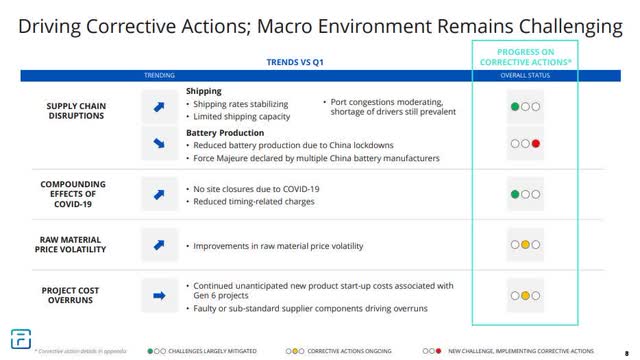

The new global environment now includes ingredients such as Coronavirus-related restrictions (especially in China), supply chain bottlenecks, raw materials increased prices, increased shipping costs and shipping time, a major energy crisis, a war in Ukraine, and inflation/recession concerns.

Raw materials and shipping costs increased during Q2. Shipping time from Asia to the U.S. West Coast almost tripled compared to pre-pandemic times. The company managed to increase prices by 15%-25% in new contracts passing the increased cost to the clients while pursuing diversification of battery suppliers. There were zero cancellations from clients due to price increases and there are also conversations with existing contracted clients to pay an increased price as there will be a longer-term relationship, with positive results. Battery manufacturers issued force majeure in some cases forcing the company to do the same to 3 clients in Q2.

Concerning production, Fluence has signed a contract for a manufacturing facility in the U.S. with an estimated start of production by the end of 2022 while the facility in Europe is estimated to start production in early 2023. This means that in a few months exposure to China will be significantly reduced. In 2023 non-Chinese battery suppliers will provide ~30% of Fluence’s product, in 2024 ~50%, and so on, aiming at a gradual diversification of production.

Fluence Q2 2022 ER presentation

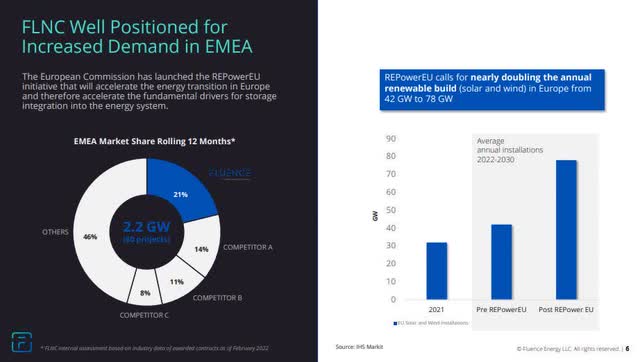

On the other hand, The European Commission launched the REPowerEU Plan last May. This plan aims at reducing dependency on Russian fossil fuels and fast-forward the green transition. Fluence will benefit from that plan as the company is the leader in Europe, with proven work, making Fluence the first name coming in potential clients’ minds when they are thinking of a solution in context with the REPowerEU Plan.

Fluence Q2 2022 ER presentation

To sum up, according to the company’s CFO, Dennis Fehr, “This new normal has us completing a contract and recognizing the majority of that revenue within 15 to 18 months on average, as compared to 12 months previously. This elongated timing for revenue recognition reduces our expectation for revenue progression and fiscal year 2023 and fiscal year 2024 by 10% to 15% as we expect this new normal will continue for the foreseeable future.” It is obvious that while the company takes every necessary action, both the top and the bottom line will be negatively affected for the next couple of years.

Valuation

Fluence’s EV currently is ~$1.46B. This should be considered low for a growth company and especially for a company of Fluence’s caliber. An EV/S (TTM) ratio of ~1.29 currently is significantly lower even than the sector’s median of ~1.78. Therefore, a fairer valuation for Fluence would be at ~$17.43 price per share. Not to mention the digital segment of the business which is not taken well into account when compared to the data of the Industrials sector and helps significantly increase profit margins.

Taking a deeper look into the future, energy storage is expected to grow significantly through the decade’s end. According to a Bloomberg NEF report, and assuming that the company follows a sector CAGR of 30% to 2030, Fluence could be producing ~$7.2B revenue in 2030 (Fluence FY 2021 revenue was ~$681M). The sector median P/S (FWD) ratio is currently ~1.29. Based on that, Fluence could present a fair value of ~$9.29B in 2030 and a share price of ~$53.82.

More conservative assumptions could have been made, yet, Fluence’s leadership believes that Bloomberg NEF assumptions are already conservative and the climate-change-related developments prove them right so far.

Even though Fluence could prove a hot investment there are certain risks that investors should have in mind.

- Fluence is operating at a loss and will continue to do so for the next fiscal year at least.

- Supply chain bottlenecks, energy crisis, and higher freight and raw materials costs could increase operating costs and production costs and reduce revenue and profit margins.

- An inflation/recession macro environment could push back orders, cause a loss of existing clients, or difficulty in attracting new ones.

- Rising rates could bring problems to potential clients’ financing plans.

- Existing competitors may claim a larger than expected market share and new ones may come up along the way.

Conclusion

On May 12, 2022, after the Q2 earnings release, Fluence’s stock experienced a heavy-volume sell-off. The reasons?

- Lowered revenue guidance

- Potentially slower increase in profit margins

- Increased raw materials and shipping prices

- Bearish market conditions

- Production and supply chain headwinds.

Despite these concerns being real, that sell-off was an overreaction, and providing that Fluence was on my radar for some time, I decided to initiate a position.

On July 28, 2022, Senate Majority Leader Chuck Schumer, and Sen. Joe Manchin unveiled a package for inflation reduction that includes $369B for fighting climate change. After the news hit, FLNC stock skyrocketed a +26%, signaling that the company will benefit from the Act if passed and signed into law.

To cut a long story short, even now that Fluence’s market cap has doubled, the company seems poorly valued. An already established growth company of this caliber, among the leaders of the booming Energy Storage industry, would not have remained at these levels for long despite short-term turbulence. In addition, there are signs of inflation peaking and a gradual normalization of the market/macro conditions. The green transition will not stop until decarbonization is achieved. The U.S., the EU, and other governments that share their view will continue to help and fund green investments. Hence, the forward-thinking, long-term investor should seek momentum to build up a position at current or lower levels and will probably multiply the invested capital in the long run.

Be the first to comment