putilich/iStock via Getty Images

Lido Finance (LDO-USD) is a DeFi protocol that currently offers liquid staking on five well-known blockchains. For those not deep in the DeFi realm, liquid staking is the act of minting a derivative of an asset that is staked on a blockchain. When a user stakes an asset on a network like Ethereum (ETH-USD), it generally relegates that asset to be unusable until it is un-staked. While users can typically un-stake their assets if they want to use them for a different purpose, it isn’t always the case.

For Ethereum, staking for the purpose of securing the parallel Beacon Chain means the ETH that has been staked is locked up until after the Ethereum merge to Proof of Stake. I touched on this in my latest ETH article earlier this week. However, going a bit beyond the scope of that article there is a secondary problem with Ethereum staking that Lido Finance is currently addressing; staking minimum. To stake on Beacon as a validator, users have to have a minimum of 32 ETH. This is a rather high minimum threshold for a typical DeFi participant and it has led to staking pools through platforms like Lido Finance. Lido is essentially solving two issues; the democratization of ETH staking and staking into a lockup without a clear duration.

Through Lido Finance, holders of ETH who wish to stake on the Beacon Chain but who lack the bankroll to do so as a validator can get both access to ETH staking rewards and liquidity by minting the Lido Staked ETH derivative (stETH-USD). This proposition has led to a rather large inflow of Ethereum staked to Beacon through Lido Finance.

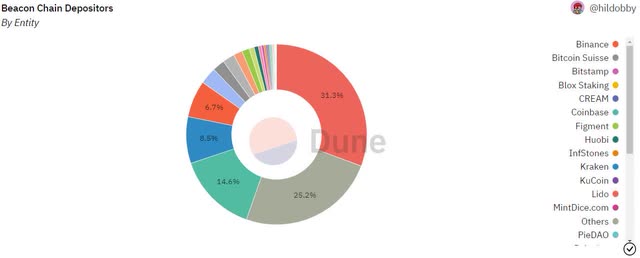

Currently, 31% of the ETH that is staked on Beacon has been staked through Lido Finance. This makes Lido the largest Beacon staker by far.

Network Data

While Lido accounts for an immense amount of Beacon’s staking, Ethereum isn’t the only chain where Lido users have assets. Lido offers staking on Solana (SOL-USD), Polygon (MATIC-USD), Polkadot (DOT-USD) through Moonbeam, Kusama (KSM-USD) through Moonriver, and previously Terra Classic (LUNC-USD). Currently, Ethereum makes up the overwhelming majority of that staking. But before the Terra collapse in early May, there was quite a bit of LUNA staked through Lido as well.

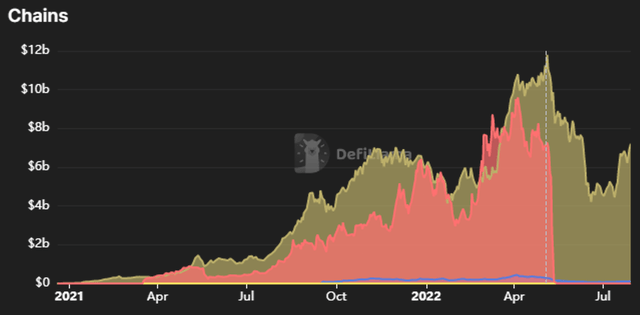

Staked Through Lido By Chain (DeFi Llama)

In the chart above, the yellow is Ethereum and the light orange is Terra. When Terra Classic collapsed in early May, the derivative coin “Lido Bonded Luna” (bLUNA-USD) collapsed right with it. As of now, Ethereum makes up almost 98% of the crypto that is currently staked through Lido Finance. While the DeFi space as a whole is also highly reliant on Ethereum for staking, it is worth noting that Lido Finance is reliant on ETH to a larger degree than the rest of the DeFi community.

| Lido Finance TVL | Broad Defi TVL | |||

|---|---|---|---|---|

| Chain | Millions | % of Total | Billions | % of Total |

| Ethereum | $7,131 | 97.84% | $57.7 | 92.17% |

| Solana | $117.30 | 1.61% | $2.7 | 4.31% |

| Polygon | $31.1 | 0.43% | $1.9 | 3.04% |

| Moonbeam | $6.5 | 0.09% | $0.2 | 0.32% |

| Moonriver | $2.5 | 0.03% | $0.1 | 0.16% |

Source: Lido Finance & DeFi Llama, as of 7/29/22

To be clear, the total DeFi footprint in the broad market is far larger than the $63 billion referenced in that table above. Those percentages in the far right column are adjusted to represent only the chains that Lido serves. So we’re looking at how reliant Lido is on Ethereum compared to the other four networks where it operates and comparing that to the TVL from those five networks only. To this point, there hasn’t been as much demand for Lido’s other DeFi products. How those figures change over time is something to pay attention to if you’re considering exposure to Lido’s token.

As a platform, Lido Finance has a very clear utility for DeFi participants who want to stake assets and use derivatives to generate more returns. In my view, a big test for Lido will be when the Shanghai update on Ethereum happens after “The Merge.” That update will enable redemption of stETH and a potential return of the ETH that is currently locked in the Beacon Chain to the redeemers. This doesn’t necessarily mean that the ability to unlock from Beacon will cause a flood of stETH mint redemptions. But it is something to keep in mind.

The LDO Token

As is often the case in crypto, a good project or platform for developers and users doesn’t necessarily equate to strong incentives for token holders. When determining if I go long any token, I generally like to see some sort of utility. For LDO, we have a very straightforward case of governance as a core reason for holding the coin. This is how LDO is described in Lido’s token launch announcement:

Our mission with the Lido DAO is to distribute all decision-making to create a trustless staking service built around community-growth and self-sustainability. This is achieved through the LDO governance token. The launch of LDO is a significant step towards achieving this goal, driving decentralised ownership and facilitating development of a distributed, independent governance structure to lead the Lido DAO.

As of writing, Lido Dao token has a market capitalization of $705 million and a cap rank of 66 according to CoinMarketCap. Here’s how the token was distributed following a 1 billion token pre-launch mint:

- DAO treasury – 36.32%

- Investors – 22.18%

- Validators and signature holders – 6.5%

- Initial Lido developers – 20%

- Founders and future employees – 15%

In my opinion, this is a fairly high level of concentration, with more than 70% of the LDO tokens going to investors, employees, and the DAO treasury. Still, that hasn’t stopped more adoption through the rest of the Lido community.

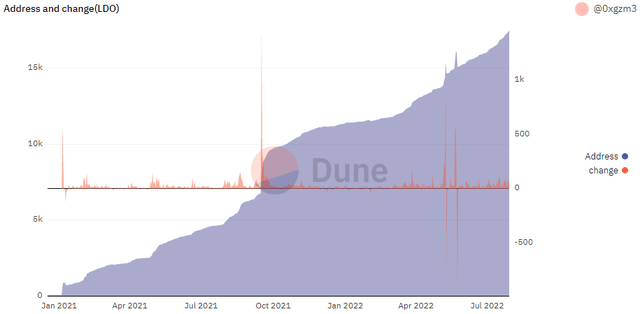

Address growth over the last year has been impressive with just 4,800 addresses at the end of July 2021 and over 15k addresses now. This community of LDO token holders appears to be taking the governance role very seriously as the DAO just shot down a proposal for LDO token sales to an outside investor with no lockup period. That proposal is now being adapted to better align with what the DAO members want.

This is a pretty interesting development because it’s proving the possibilities of DAO governance rather than more centralized corporate decision making. It’s something to keep an eye on and I think it’s generally very favorable for Lido Finance and the LDO token that there is a community this engaged with long term strategy.

Of Course, The Risks

Probably the biggest risk to Lido Finance at this point is confidence in the derivatives. One of the reasons why stETH has been making headlines lately is because it has lost its peg to ETH. As of writing, stETH is priced at a 2.5% discount to ETH.

Over the last three months there has been a bit of pressure on the stETH peg. While the Celsius (CEL-USD) collapse definitely exacerbated the issue in June, the peg problems really began after the collapse of Terra. As I explained in my ETH article earlier this week, there is actually an arbitrage opportunity that can be played here if you’re bullish ETH and trust Lido Finance. But the fundamental issue that makes these peg problems possible is that they often work well in good times but can be very problematic when there is a lot of pressure on the underlying assets.

Summary

I don’t currently have exposure to LDO. Furthermore, I don’t use Lido Finance for staking purposes. That said, there is actually quite a bit going on with this project and the token that I think it’s worth putting on a watch list. Only 31% of the token supply is circulating. That’s generally a level of dilution that gives me pause. But it’s not necessarily a deal-breaker if the release schedule doesn’t create a high level of inflation annually. Something else that’d I’d like to see from Lido Finance long term is more adoption of non-Ethereum networks. If you’re bullish DeFi, LDO is one to watch.

Be the first to comment