PM Images

International Money Express, Inc. (NASDAQ:IMXI), also known as “Intermex”, is a leader in money transfer services between the U.S. and Latin America. The company’s omnichannel business model allows customers to initiate international remittances through agent retailers, and company-owned stores, as well as with digital payments. The attraction here is a strong growth profile, with Intermex capturing market share in its core operating countries of Central America. Indeed, IMXI has climbed more than 40% in 2022 as an outperformer through a string of better-than-expected earnings.

We like the stock with a sense that international remittances should be relatively resilient to slowing economic conditions as a defensive business in the current market. Simply put, a volatile global economy in combination with a historically strong U.S. Dollar should support demand for these types of cash transfers in support of friends and family. While IMXI has already been a big winner this year, we see more upside over the year ahead.

IMXI Key Stats

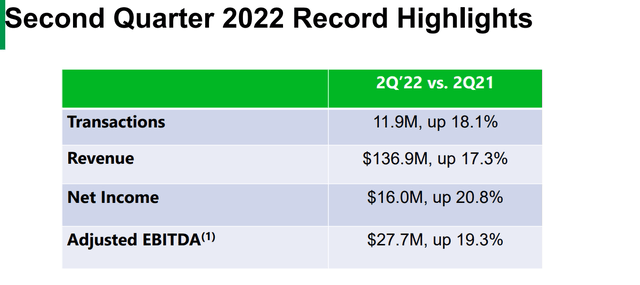

Intermex last reported its Q2 earnings in early August with EPS of $0.47, up from $0.39 in the period last year while beating expectations by 0.04. Revenue of $137 million increased by 17.3% year-over-year and was also ahead of estimates.

The story is the climbing number of transactions that reached 11.9 million, up 18.1% y/y. Within that figure, digitally originated transactions more than doubled and now represent 26% of the total. The number of active customers is up 15% from Q2 last year, which provides some runaway for continued growth between new and repeat customers.

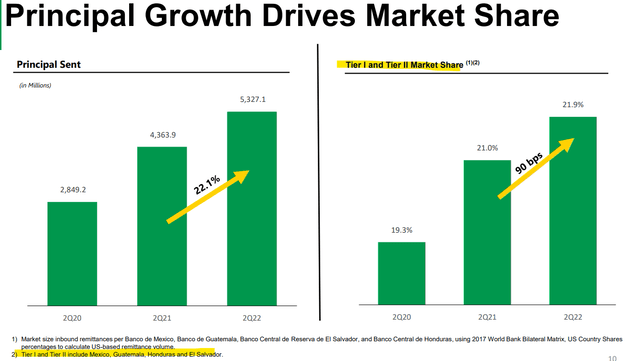

During the earnings conference call, management noted how its receiving customers, which often do not have traditional bank accounts, are increasingly utilizing mobile wallets which have added to transaction activity. The share of digital transactions as a percentage of the total is now 26.3%, up from 22.1% in the period last year. What’s also impressive is the principal value of transactions at $5.3 billion in Q2, up 22% over the past year. Intermex notes that its market share of inbound international remittances at 21.9% is up 90 basis points over the past year and from 19.3% in 2020.

While the company operates in 22 countries, the core business includes Mexico, Guatemala, Honduras, and El Salvador. On this point, IMXI is in the process of closing its acquisition of smaller remittance player “El Nacional” which will add to its distribution reach of local agents to new areas as well as open the door for Intermex to expand into Europe as a new growth driver.

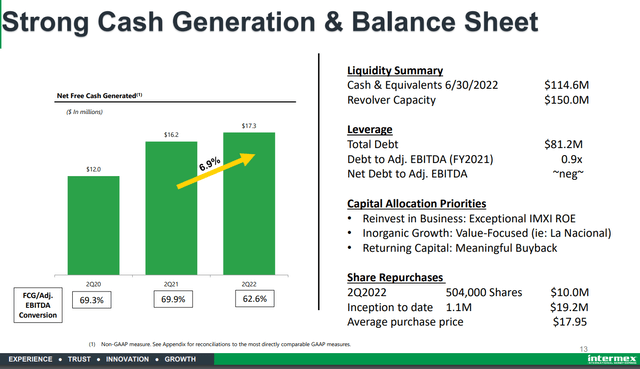

A solid balance sheet and positive free cash flow generation are strong points in the company’s investment profile. Intermex ended the quarter with $115 million in cash against $81 million in total debt. Considering adjusted EBITDA of 28 million during the quarter and $77 million over the past year, the leverage ratio is under 1x. Notably, the company has been active with share repurchases, buying back $10 million in Q2 with another $21 million remaining under the existing authorization.

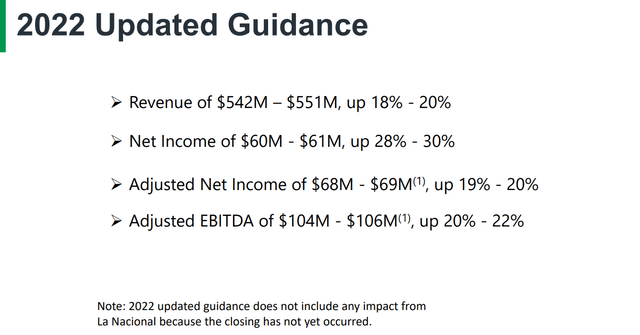

In terms of guidance, management projected some confidence that the trends can continue. For the full year, the company revenue was between $542 million to $551 million, up 19% at the midpoint. The expectation is that adjusted net income and adjusted EBITDA climb around 20% from 2021. These targets were revised higher compared to guidance back in Q1 highlighting the strength of the business.

IMXI Stock Price Forecast

There’s a lot to like about IMXI which benefits from several underlying secular tailwinds. First, data suggests that the pandemic in 2020 accelerated the use of international remittances globally, particularly from the United States and into Latin America. 2021 was a record year for these types of flows, with every indication the trends can continue as more and more migrants and second or third-generation family members regularly use these types of services.

The other important dynamic at play is the more widespread adoption of mobile devices and access to the internet, which is a key issue in some of the smaller countries of the region. Simply put, a new generation of customers are initiating digital transfers with ease and convenience, supporting more transactions. Intermex, through its brand recognition and customer loyalty, is well positioned to keep outpacing the industry and generate higher earnings, supporting a positive long-term outlook.

The reason we’re looking at IMXI today is a sense that the business of facilitating international cash transfers between the U.S. and Latin America may prove to be recession-proof. Our thinking here is that in a more challenging macro environment in both the U.S. and Latin America, the need for individual financial assistance is greater than ever. The remittances related to financial emergencies or recurring support of friends and family could see an uptick in a broader economic slowdown as a uniquely counter-cyclical segment of financial services.

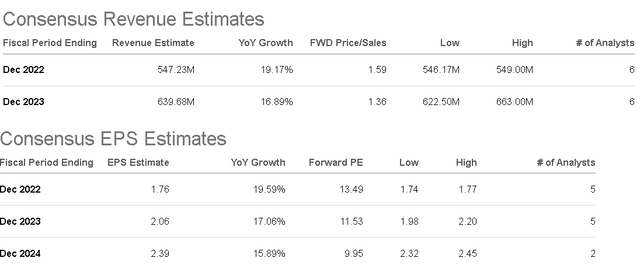

The bullish case here is simply that Intermex can maintain its growth strength with upside to earnings targets. According to consensus, the forecasts for full-year 2022 revenue and earnings, climbing near 20% from 2021 are in-line with management guidance. The market also expects continued momentum into 2023 with revenue and earnings climbing by 17%.

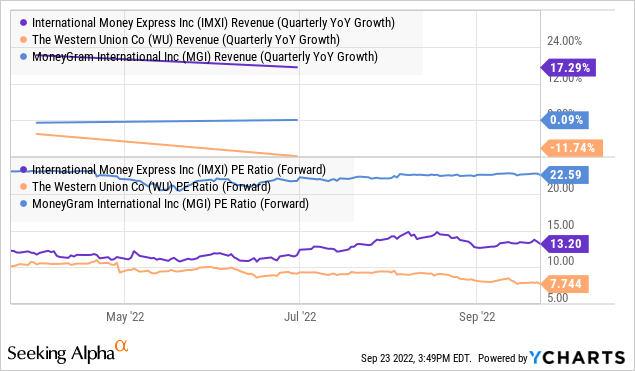

These estimates stand out among a group of larger competitors including The Western Union Co. (WU) and MoneyGram International, Inc. (MGI) with IMXI generating stronger growth. In the last quarter, for example, WU posted a sales decline of 12% while MGI was flat. As it relates to valuation, IMXI’s forward P/E of 13x is between MGI at 23x and WU at 8x. We believe IMXI deserves a higher multiple and growth premium given its more focused operating exposure to Latin America with the remittance trends in the region being driven by the transition to digital, which IMXI is capturing.

Final Thoughts

IMXI with a market cap of $855 million is a high-quality small cap considering its recurring profitability, positive free cash flow, and supported balance sheet. This is the type of stock that can perform well even during periods of macro volatility. Ultimately, we expect shares to trade higher over the next year.

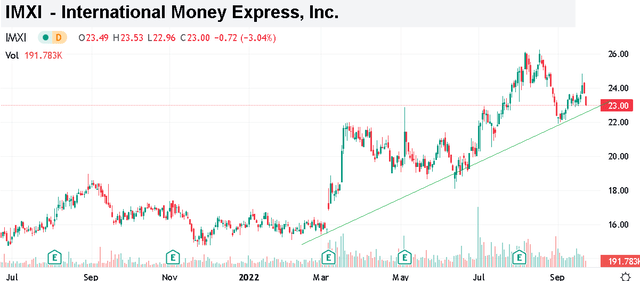

From the stock chart below, IMXI is hugging an upward trendline from Q1 this year. With the stock currently off around about 10% from its recent high, we believe this pullback is a new buying opportunity. We rate IMXI as a buy with a price target for the year ahead at $30.00 representing a 15x multiple on the current consensus 2023 EPS.

The upside here is that the company will continue to capture market shares with its climbing customer base initiating more transactions on the platform, driving earnings to outperform expectations. In terms of risks, one concern is that deeper financial market volatility can pressure the stock based on poor sentiment towards all risk assets. Weaker than expected results in the upcoming quarters can also open the door for a correction lower.

Be the first to comment