Jae Young Ju/iStock via Getty Images

Investors tend to focus on the big semiconductor names such as Nvidia (NVDA), Micron (MU), Intel (INTC), Applied Materials (AMAT) etc. There is nothing wrong with that, but sometimes it’s good to consider some of the smaller players in the industry. Some small semiconductor companies might have more room for long-term growth. One of these potential companies is Alpha and Omega Semiconductor (NASDAQ:AOSL).

Alpha and Omega is a $1.5 billion small cap semiconductor company that produces products for numerous items such as vehicles, appliances, power supply solutions, PCs & notebooks, LCD TVs, battery packs & smart chargers, smart phones, etc. AOSL sells to many leading brands in most categories. The company’s products include: MOSFETs, IGBTs, Power ICs, intelligent power modules, TVS diodes, HVIC, and Wide Bandgap (SiC/GaN). These are the components in the products listed above that help make them operate as they do.

Positive Outlook for Semiconductors

I pointed out in my recent article regarding investing strategies for this year, that semiconductors are likely to perform well in this current phase of the economy. Semiconductors are facing high demand and the supply is still trying to catch up. This gives the semiconductor companies pricing power, which bodes well for revenue and earnings growth.

Deloitte is projecting 10% growth for semiconductor sales to over $600 billion in 2022. The growth could probably be higher without the supply constraints. It may take two or three years for new manufacturing facilities to be put in place to truly have supply meet demand. In the meantime, semiconductor companies will be able to sell whatever they can produce.

Alpha and Omega Semiconductor is poised to reap the benefits of 17% to 18% revenue growth and 57% earnings growth for FY 2022 (consensus). This growth should help drive the stock higher along with the other factors that I’ll discuss.

How Alpha and Omega is Responding to the Semiconductor Market Dynamics

AOSL has a 3-part strategy for the current semiconductor market dynamics. First, the company expanded production capacity and invested in R&D in its Oregon facility.

The second strategy is AOSL’s progression of its joint venture with Chongqing (completion of Phase I). The joint venture involves a state-of-the-art power semiconductor packaging, testing and wafer fabrication facility. The completion of Phase I marked an increase in capacity and the selling of 3.2% equity interest in the JV. The company previously had a 51% stake in the Chongqing JV. Lowering its stake below 50% allows the JV to raise more capital as a more independent company.

Future plans for the joint venture are for additional expansion and an IPO on the Shanghai STAR market. Phase 2 of the JV is in progress where $80 million was raised from outside investors. The Phase 2 expansion is expected to by completed during 2023.

Alpha and Omega’s third strategy is to increase capacity by expanding relationships with third-party foundry partners to meet the increased demand. The company’s efforts to increase overall capacity should set AOSL up for multiple years of strong gains. There are many products that need AOSL’s technology. Therefore, demand should remain high for the foreseeable future.

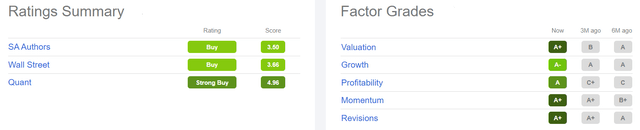

High SA Ratings

Seeking Alpha Ratings (seekingalpha.com)

Stocks with strong buy quant ratings on Seeking Alpha tend to outperform the S&P 500 (SPY). AOSL fits that criteria with strong ratings in each category. Although this stock may not be well-known, it has strong fundamental characteristics that more well-known and established companies have achieved.

Key Fundamentals

Alpha and Omega has a strong balance sheet with $269 million in total cash and $46 million in total debt. The company has 3.5x more total assets than total liabilities and 2.6x more current assets than current liabilities. This shows that AOSL has a strong ability to pay off its long and short-term debt.

The company had strong operating cash flow of $214 million for the trailing 12 months. AOSL is on track for a large y-o-y gain in operating cash flow of about 66% over FY21. The company doubled its operating cash flow in both FY20 and FY21. The strong balance sheet and cash flow growth gives the company good flexibility to expand the business, for stock repurchases, possible acquisitions, etc.

Alpha and Omega achieves strong profitability metrics which helps drive the strong cash flow growth. The company has a high net income margin of about 61%, which significantly outperforms the sector median of 5.6%. AOSL has an ROE of 79%, ROIC of 7.6%, and ROA of 40%. I would like to see the company improve the ROIC to the double-digit range, but 7.6% is acceptable.

Low Valuation

Alpha and Omega is trading with an attractive, low valuation. AOSL has a forward PE of 13, and price/sales of 2, and price to cash flow of 7.6. This is lower than the semiconductor industry’s forward PE of 18, price/sales of 6.8, and price to cash flow of 16.8. The low valuation gives the stock plenty of room to move higher.

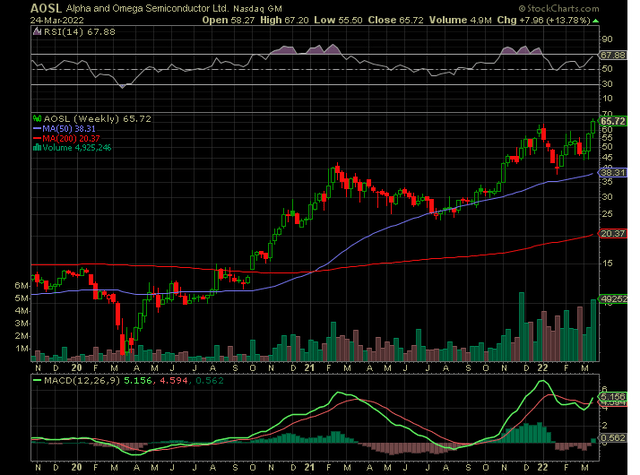

The weekly stock chart above shows that AOSL has some positive upward momentum as the price breaks higher above the 50-day moving average (blue line) with higher highs and higher lows. The RSI crossed above 50 to about 67. The green MACD line recently crossed above the red signal line, indicating positive upward momentum. This shows that the buying pressure is strong for the stock.

Alpha and Omega’s Long-Term Outlook

Alpha and Omega looks positive for 2022 and beyond. The company’s semiconductors are in high demand for use in numerous products. AOSL has a solid strategy in place to expand production capacity to help meet the strong demand. As vehicles, smartphones, PCs, and other products continue to become more advanced, the demand for AOSL’s technology is also likely to grow.

The stock’s valuation leaves room for more price appreciation. AOSL’s above-average revenue and earnings growth can drive the stock for strong double-digit annual gains from its low valuation.

Be the first to comment