Drew Angerer/Getty Images News

Investment Thesis

Palantir Technologies Inc. (NYSE:PLTR) has enjoyed a robust recovery since its FQ4 earnings card. We also discussed in our previous article and shared with readers why the stock could be bottoming (Buy rating). PLTR stock has outperformed the S&P 500 ETF (SPY) since our article was published (+25% Vs. +4.3%).

Therefore, we think the stock is no longer significantly undervalued due to the remarkable recovery. However, we believe Palantir stock still represents a solid opportunity for investors who have an appetite for speculative positions.

We discuss why PLTR stock is still in the Buy zone.

PLTR stock key metrics

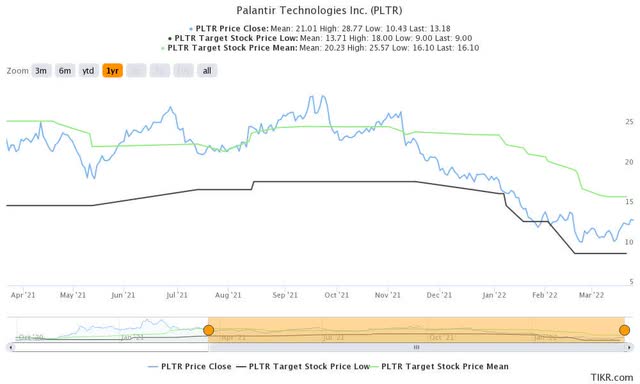

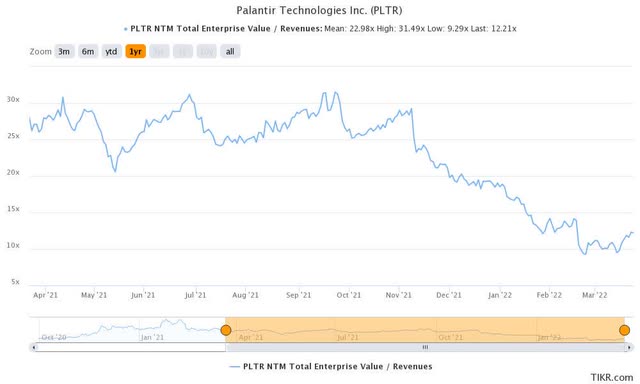

PLTR stock consensus price targets Vs. stock performance (TIKR) PLTR stock NTM Revenue trend (TIKR)

PLTR stock has moved closer to the average consensus price targets (PTs). Investors should note that the average PTs have often been strong resistance levels previously. Nevertheless, there’s still an implied upside of more than 50% to its average PTs. In addition, we also observed that PLTR stock has also moved convincingly away from its most conservative PTs.

Therefore, despite its recent recovery, the Street has not been in a hurry to re-rate PLTR stock.

Furthermore, PLTR stock’s NTM revenue multiple has recovered from its all-time lows to 12.4x. As a result, it’s also broadly in line with its high-growth SaaS peers (12.6x) that we track.

Hence, considering the above factors, we think PLTR stock looks fairly valued now.

Where is Palantir Heading in 2022?

We consider PLTR as a speculative stock. Therefore, we would usually not encourage investors to add at a fair valuation. Even though CEO Alex Karp has committed to GAAP profitability moving forward, Palantir still has much to convince. But, the commitment towards GAAP profitability is critical to assuaging investors of Palantir’s incremental operating leverage moving forward.

Furthermore, COO Shyam Sankar emphasized that he expects its adjusted operating margins to remain relatively stable in a recent conference. Therefore, we consider it a crucial factor in modeling Palantir’s valuation accurately. The Street also highlighted the criticality of projecting relatively stable margins. Morgan Stanley (MS) emphasized (edited):

We are wondering about the company’s long-term operating margin. We saw ‘wild swings’-from 17% in 2020, to 31% in 2021, and a projecting 27% for 2022. Confidence in the steady-state margin profile is key to understanding EPS growth longer-term. – Barron’s

In addition, we were also concerned about Palantir’s government segment growth deceleration. Its commercial segment has certainly accelerated remarkably, but its adjusted profitability has also taken a marked impact.

The company has continued to modularize Foundry for easier adoption by its commercial customers. For example, Sankar accentuated that Palantir has adopted consumption-based pricing for Foundry. We applaud Palantir’s approach, as we think it’s the correct move, given Snowflake’s (SNOW) success. In a recent Snowflake article, we discussed that CIOs highly favor the consumption-based pricing model. Such an approach has allowed Snowflake’s customers to move workloads and test Snowflake’s data cloud suitability without significant upfront commitments. Nonetheless, it could also lead to considerable volatility in revenue and profitability. In addition, consumption ramp also takes considerable time, and new logo wins are unlikely to be reflected in the P&L in the near term.

Nonetheless, it’s the right move for Palantir going forward. We think investors need to accord Karp & Team sufficient time to encourage wider adoption of its Foundry OS.

Notably, the Russia-Ukraine conflict has dramatically lifted our expectations over its government segment’s growth. Palantir had experienced weakness in growth momentum in Europe.

But the stakes in Europe have changed dramatically since the Russian invasion started a month ago. Germany has raised its defense spending dramatically from 1.53% to 2%. Furthermore, Palantir’s Gotham platform has been utilized by Western intelligence in the conflict. Therefore, the geopolitical stakes have risen significantly, and we believe the momentum will carry on.

And, there probably isn’t another defense contractor whose platform is on par with Palantir, given its success with the US government. Hence, we believe that Palantir is in an enviable position to leverage the increased defense spending. Sankar emphasized (edited):

The work that we’ve done with MetaConstellation, is being used by multiple Western allied services to really observe from an intelligence domain.

They are focusing on how can they can use this in a real-time decision-making sort of basis. Europe is not the same place it was 2 years ago.

You see that with the Germans committing EUR 100 billion to modernizing their force because they realized the threats are real. So, I think that’s also going to create a lot of market access. Not just because they need it, but they also are going to need it in the context of collaborating with Allied Forces. (Morgan Stanley TMT Conference 2022)

As if the emphasis by Sankar wasn’t sufficient, CEO Alex Karp followed up with an assertive letter, imploring European leaders to “step up and fight this battle alongside us in order to win.” Karp emphasized (edited):

The fantasy of an instinctively peaceful world may be comforting. But it is again coming to an end.

Europe has for the past two decades stood on the sidelines of the digital revolution, whose principal participants are still essentially all based in the United States.

The unrelenting innovation and disruption from American firms has reshaped industries and extinguished others. The need for Europe to become a leader in disruptive defense technology is clear.

An embrace of the relationship between technology and the state, between disruptive companies that seek to dislodge the grip of entrenched contractors and the federal government ministries with funding, will be required for Europe and its allies to remain strong enough to defeat the threat of foreign occupation. (Letter from Palantir CEO)

Therefore, Palantir is wasting no time pushing European governments that they need to move now. These leaders need to adopt Palantir’s platform to integrate their intelligence, surveillance, and sensors with the US government.

Hence, we believe it could even elevate Palantir’s commercial branding in Europe from the potential increased momentum in government spending. Therefore, the events unfolding in Europe could be a significant tailwind for Palantir moving forward.

Is PLTR Stock A Buy, Sell, Or Hold?

We discussed that PLTR stock seems fairly valued now. But, long-term speculative investors can still add exposure given these potential tailwinds.

Nevertheless, its stock could still be volatile in the near term, so investors are encouraged to add in phases. But, we think the stage has been set for Palantir to advance further in Europe.

Consequently, we could experience an upward inflection in government spending moving forward. Nevertheless, such momentum may not be reflected in the short term, so investors need to temper their expectations accordingly.

As such, we reiterate our Buy rating on PLTR stock.

Be the first to comment