Dimensions/E+ via Getty Images

Opendoor Technologies (NASDAQ:OPEN) is a digital native tech company that buys and sells residential real estate. By purchasing real estate and holding it on their balance sheet, Opendoor is able to rehab the property before they re-sell it.

Over the past several years, the company has significantly benefited from a strong U.S. housing market, fueled by low mortgage rates and a healthy consumer. Add on the flexibility with work-from-anywhere policies allowing consumers to move anywhere, rather than concentrate in large cities, it’s no surprise Opendoor has posted their fourth consecutive quarter of adjusted EBITDA profitability.

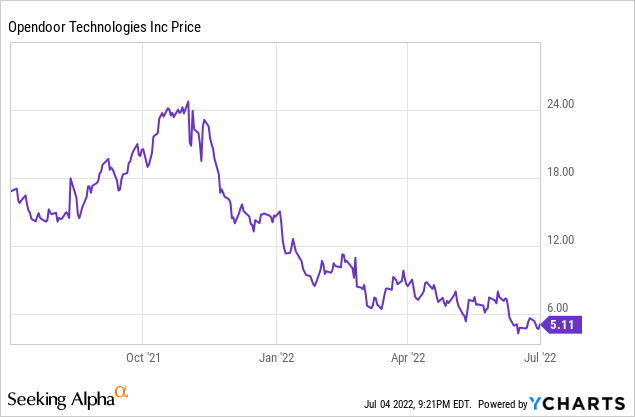

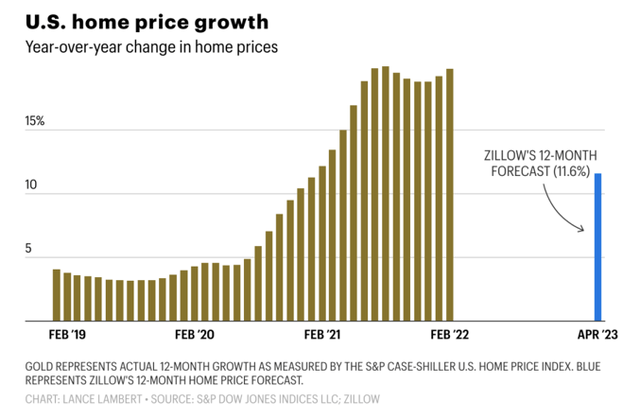

However, the stock has been down almost 70% so far this year as mortgage rates have more than doubled to over 5%, consumers are starting to normalize their spending patterns, and housing prices continuing to rise, making affordability an issue.

On top of that, the Federal Reserve may continue to raise rates over the coming months, which would ultimately flow through to higher mortgage rates. While the housing market does not come to a stop as rates rise, it does make affordability more of a challenge, especially when housing prices continue to move higher.

For now, I believe the macro environment remains challenged and makes it difficult to believe the housing market will remain this hot. Even with the stock down this much so far this year, there continues to be downside risk.

Financial Review and Guidance

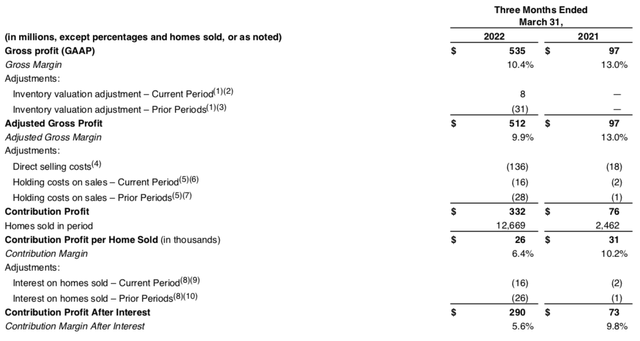

During Q1, Opendoor saw their revenue reach $5.2 billion, which was well above expectations for just $4.3 billion and up significantly from the $747 million in the year-ago period. The company also sold 12,669 total homes which was over five times the volume sold in the year-ago period.

While gross profit reached a record of $535 million, adjusted gross margin of 9.9% was down from the 13.0% margin in the year ago period. It’s not overly surprising to see some margin contraction as the company continues to invest in building out their network and asset base.

Nevertheless, contribution profit grew 337% yoy to $322 million, marking the 21st consecutive quarter of positive contribution margin. In addition, adjusted EBITDA reached $176 million, representing the fourth consecutive quarter of adjusted EBITDA profitability.

All else equal, I believe if the underlying housing market remains strong and growing, adjusted EBITDA margins will have room to expand. However, given the changing landscape, I am a little more cautious around long-term profitability potential.

At the end of the quarter, Opendoor had an inventory of 13,360 homes, representing $4.7 billion in value, with the company noting this is expected to be the low point of inventory for the year. Management also noted that only 7% of their homes were listed on the market for >120 days, compared to 24% of homes in the overall market, demonstrating the company’s ability to quickly sell their inventory, despite a low supply of housing.

We purchased 9,020 homes in the first quarter, up 151% versus 1Q21. As in prior years, our first quarter acquisition pace aligned with the spring selling season. We ramped our acquisition pace as we moved through the first quarter, acquiring 45% more homes in March than we did in January. We ended the quarter with 8,066 homes under contract to be purchased, representing $3.2 billion in value, double the number of homes under contract in 1Q21. This sets us up nicely to close on those homes in Q2, driving a solid uptick in acquisition volumes. While housing supply for the industry continues to remain at historical lows, that has not impacted our ability to acquire homes: we continue to see a record number of home sellers requesting an offer and real seller conversion well above 35%. These are an indication of our incredible product market fit, which will continue to fuel our acquisition growth for quarters and years to come.

Opendoor

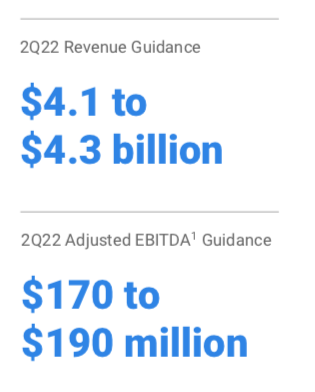

For the upcoming Q2, the company guided to revenue of $4.1-4.3 billion, or growth of 254% yoy at the midpoint. This would also reflect a slightly lower revenue compared to Q1 revenue of $5.2 billion.

When looking at adjusted EBITDA, guidance calls for $170-190 million, which compares to $176 million of adjusted EBITDA in Q1.

Viewpoint on Housing Market

While I am no expert on the housing market, I do believe the past few years have been some of the best years for housing. On top of mortgage rates largely remaining below 4% for the past 12-24 months, homeowners have experienced record appreciation in many parts of the country.

Even on Opendoor’s latest earnings call, the company talked about the current housing environment and their expectations for some moderation in the coming quarters.

Our expectation is that the housing industry may begin to experience a moderation in HPA [home price appreciation] and transaction volumes beyond what is normal from seasonal trends, beginning in the second half of the year – the pace of which should be gradual and consistent with a typical slowdown. While there is a reasonable chance of “stronger for longer” for housing, we have positioned ourselves to be more conservative in our home valuations in 2H22 given general macro uncertainty.

Yes, a moderating macro environment has already been included in the company’s outlook, but since the company reported, the Federal Reserve raised the benchmark interest rate by 75bps and there continues to be fears around more consistent 50-75bps rate hikes over the coming months.

As interest rates almost inevitably continue to rise, this typically results in housing prices to either moderate growth or actually stall, meaning inventory values don’t grow and consumers are less likely to purchase a new home. Add on fears around a potential recession, it paints a gloomier potential forecast for the housing market.

Yes, the consumer remains in very healthy economic shape given the past two years of stimulus benefits, though this has largely eased and it appears the labor market is normalizing.

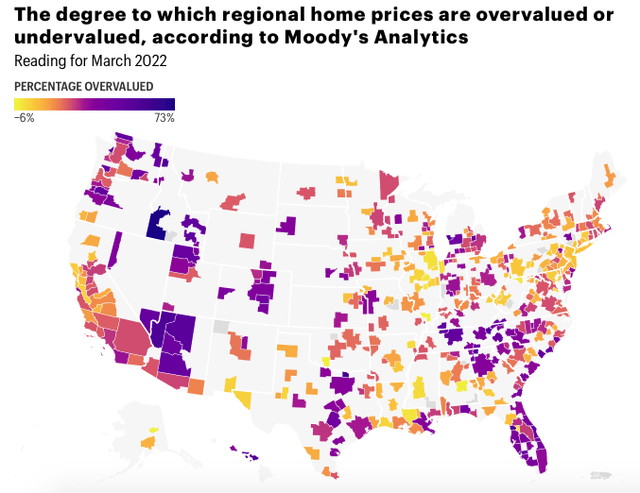

In a paper titled “Real-time market monitoring finds signs of brewing U.S. housing bubble,” Dallas Fed researchers say that for the first-time since the ’00s housing bubble we’re amid a housing market that has become detached from fundamentals.

The chart and quote above does a great job indicating which parts of the U.S. housing market are overvalued, with the darker colors indicating a higher percentage of overvalued housing. The article also found that U.S. home prices have risen almost 35% over the past two years and that 96% of regional housing markets are considered “overvalued” relative to local incomes.

This is the first time in many years where consumers are faced with rising mortgage rates and housing prices that have grown much quicker than household incomes. While this may take several months for rising rates to have a noticeable impact to the housing market, it does appear to be a challenging set-up.

Valuation

Valuation can be a little tricky for this company given they are highly exposed to the housing market, which tends to be cyclical over time. Over the past several years, we have experienced an incredible housing market, with low interest rates spurring significant demand. However, the macro factors have negatively shifted in recent months with mortgage rates moving above 5% and fears increasing around a potential recession.

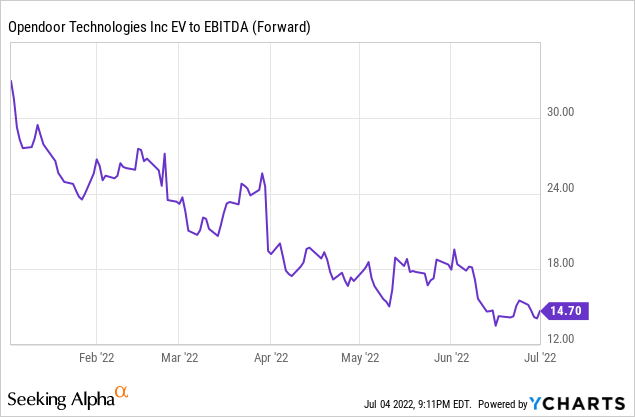

Even with the stock down almost 70% so far this year, a challenging macro environment makes timing the bottom quite difficult. The stock currently trades around 15x forward EBITDA, though this can be volatile given the big swings in profitability.

While there is no perfect way to value this company, looking at adjusted EBITDA multiples can be helpful. In very good times, the company likely generates significant amounts of adjusted EBITDA, as demonstrated in Q1 with adjusted EBITDA reaching $176 million, up from a $2 million loss in the year-ago period.

However, if the housing market were to slow and Opendoor were to be stuck with high-valued assets that are difficult to sell, adjusted EBITDA could quickly drop. Add on higher mortgage rates and consumer’s starting to feel potential impacts from a future recession, it remains a little difficult to believe the U.S. housing market remains this hot for the foreseeable future.

For now, I remain on the sidelines as it appears downside risk is at the forefront of investors. With many investors starting to focus more on profitability through a potential recession, a company tied to the housing market may be more challenged.

Be the first to comment