niphon/iStock via Getty Images

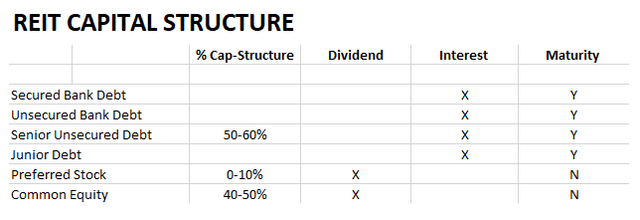

As I explain in The Intelligent REIT Investor Guide, “Preferred stock occupies a unique space between debt and equity, displaying certain attributes of both bonds and common stock.”

Many investors seeking higher yields have become interested in preferred stocks, particularly in those issued by real estate investment trusts (“REITs”).

Almost all REIT preferred stocks are senior to the issuer’s common stock and offer a fixed quarterly dividend. Unlike bonds, these shares are not guaranteed by the issuer to repay a specific amount on a specified date, and most are perpetual securities like common stock.

Further, in the event of liquidation or bankruptcy, preferred shareholders’ rights are subordinated to those of the issuer’s creditors. However, preferred stock does have seniority over common stock, and common dividends cannot be paid unless preferred dividends are current.

The Intelligent REIT Investor Guide (Wiley)

While the allocation to preferred stocks within a traditional diversified portfolio remains low, we believe that preferred stocks are an attractive asset class for what they are: securities characterized by high yields and low relative volatility.

Preferred stocks occupy a unique space in a company’s capital structure, sitting beneath debt and above common equity with respect to liquidation rights and dividend payments.

In normal market conditions, the volatility of preferreds (as measured by both standard deviation and beta to the S&P 500) is less than common stocks. After accounting for the much higher yields, we believe that preferred stocks adequately compensate investors with income and lower volatility, since preferred are senior to common equity.

Types of Preferred Stock

The most common type of preferred stock is a fixed-rate cumulative redeemable preferred stock. Breaking that down further, a fixed-rate preferred stock issue will pay a fixed coupon amount as a dividend, similar to that of a bond.

On the other hand, a floating rate issue will pay a variable coupon amount that’s typically linked to LIBOR plus some spread amount.

Cumulative implies that in the event of a missed dividend payment, the issuer will have to make it whole in the future once they resume paying common dividends.

Keep in mind, preferreds remain senior to common equity and the issuer will not be able to pay common dividends until they pay preferred dividends. This acts as a heavy incentive for issuers to keep preferred dividends current.

Lastly, redeemable issues give the issuer an option to call back securities at a pre-determined future date. An issue’s call date is typically five years after the issuance date.

Yield-to-Call (YTC)

An oft-overlooked feature of preferreds is yield-to-call, especially compared to current yield. Since most preferred stocks are callable, it’s important to review the call provisions of the securities as they will dramatically influence the potential payoffs.

For example, consider two identical 7% fixed preferred trading at $26 with a $25 par value – however, one preferred is callable in 6 months while the other is callable in 5 years.

The current yield will be the same on both, however, one security can be called away at $25 in 6 months while the 7% payment on the other is protected for the next 5 years.

Consequently, it’s critical to evaluate the relative yield-to-call of the security, a feature that is often overlooked by investors and index funds.

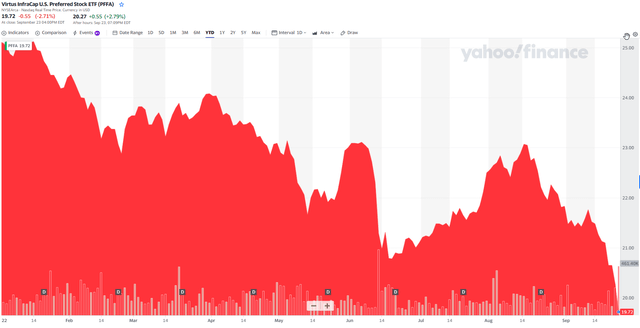

Virtus InfraCap U.S. Preferred Stock ETF

Presently, uncertain macroeconomic conditions have created liquidity and credit driven dislocations in the preferred market.

Additionally, index funds often overlook yield-to-call provisions and naively apply weightings based on issue size. We therefore favor active management with proven track records.

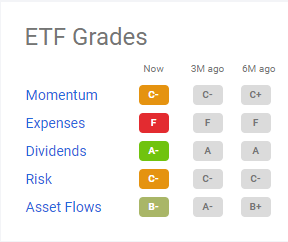

What about the Virtus InfraCap U.S. Preferred Stock ETF (NYSEARCA:PFFA) – an actively-managed preferred stock fund – for investors seeking stable-income in an environment characterized by instability?

Seeking Alpha

When evaluating active managers, we believe that historical performance and insider holdings are important indicators of both capability and conviction to the underlying strategy.

On the performance side of the coin, since PFFA’s inception (05/16/2018 – 9/16/2022), it has a total return of 24.32%, 12.69% higher than iShares Preferred and Income Securities ETF (PFF), the largest preferred equity index fund.

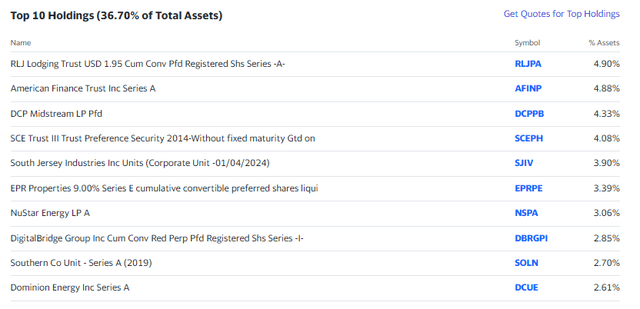

The InfraCap team actively screens for undervalued opportunities, and two of their highest-conviction picks have supported its outperformance.

For example, PFFA held an approximately 4% position in a convertible preferred security, South Jersey Industries (SJIV) on 02/24/2022 before the company announced an accepted takeover offer representing a 53% premium to SJIV’s prior day closing price.

More recently, DCP Midstream (DCP) announced a takeover offer from Phillips 66 (PSX) on 08/17/2022 – DCP’s preferred equity units made up approximately 5% of PFFA.

Since the takeover announcement, DCP’s preferred units have benefited from the improved credit quality and pricing certainty ($25 par price) related to the merger.

Following both events, the InfraCap team has slowly and opportunistically harvested gains in the positions and redeployed capital into other discounted issues.

Secondly, we feel that insider holdings are an indicator of management-level conviction in the strategy. It should be noted that the portfolio manager, Infrastructure Capital, remains PFFA’s largest holder and has shown to add to their position – especially in times of market uncertainty.

Opposed to passively-managed funds, the InfraCap team is able to take advantage of current market conditions and systemic dislocations that persist in the preferred stock universe.

As opposed to the bulk of preferred stock exchange-traded funds (“ETFs”), PFFA has: a lower exposure to mandatory convertible preferred stocks, fewer negative YTC securities, the ability to quickly adjust leverage, and a high yield that is less exposed to a rising interest rate environment.

In times of increasing rates and inflation, investors are cautioned away from fixed income as current yields become less and less appealing. However, PFFA’s high yield (9.9%) provides income-focused investors a comfortable buffer when rates increase.

Investors in preferred stocks with a floating-rate coupon are generally positioned to benefit from an increase in interest rates, credit spreads (i.e., risk premiums), or both.

However, because preferred stocks are typically callable and perpetual, redemption timing is uncertain. Accordingly, InfraCap’s team actively screens to take advantage of this timing and opportunistically add value.

In addition to sector-specific concerns, idiosyncratic credit-related evaluations remain critical.

In 2022, we’ve seen preferred stock performance diverge on credit differences. Lower-rated, higher-yielding credits outperformed, while higher-rated lower-yielding credits underperformed due to their correlation to treasury yields.

High investment-grade issues with low coupons underperformed their higher-coupon counterparts with a larger spread versus interest rates.

PFFA maintains exposure to higher-yielding securities that offer less interest-rate exposure while maintaining internal financial models to evaluate and forecast company cash flows and leverage profiles.

Investing in preferred stocks using active managers is an attractive opportunity at this time, given that:

(1) yield-to-call market dislocations persist,

(2) interest rate sensitivities are of increasing importance,

(3) fixed-to-float features are often overlooked and,

(4) credit-driven considerations remain.

PFFA currently takes advantage of all these opportunities.

We must also provide a few risks here, such as the 1.2% expense ratio, and while active management is an important advantage for this strategy, there are many cheaper alternatives (.55% according to Yahoo Finance).

In addition, PFFA has around 30% leverage and while that does provide yield enhancement, it also adds risk that investors should be aware of.

PFFA’s dividend yield is getting close to 10% as shares have dropped by over 21% year-to-date.

Remember, PFFA also pays monthly dividends…

So, riddle me this, who’s buying?

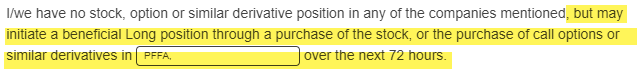

While I don’t normally invest in preferreds of some of the equity REITs that I don’t recommend (like EPR and GNL), I’m considering an entry allocation in PFFA. See my disclosure below:

Seeking Alpha

Be the first to comment