Media Whalestock/iStock via Getty Images

Investment Thesis

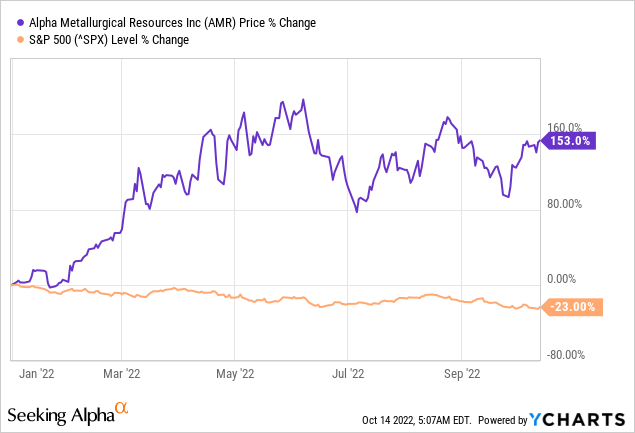

Alpha Metallurgical Resources, Inc. (NYSE:AMR) has rewarded its investors with a 5.8x price gain in the last 3 years and an over 1.5x gain in the previous year and YTD, outmatching the market by triple-digits.

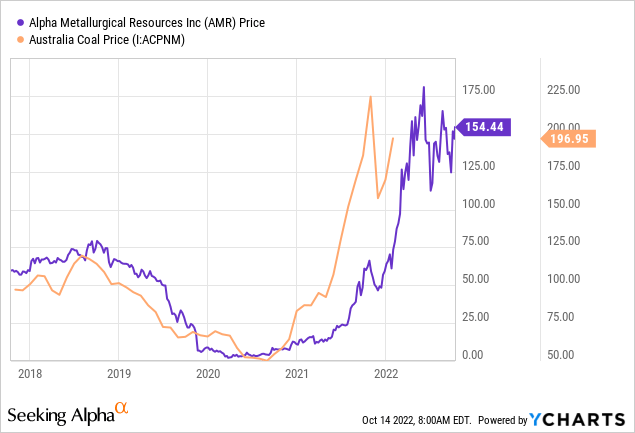

The stock is currently trading at great relative valuation metrics because of high revenues and profitability caused by a significant surge in the underlying commodity prices, which reached almost 5 times higher during their peak in 2022 than in 2020. The company has leveraged this upsurge to churn out augmented cash flows, initiate share repurchase transactions, and declare dividends.

The close correlation of AMR stock with the commodity price forecasts that the stock will likely dip in the short term and reemerge as a long-term winner due to its established moats and strong fundamentals.

The Company

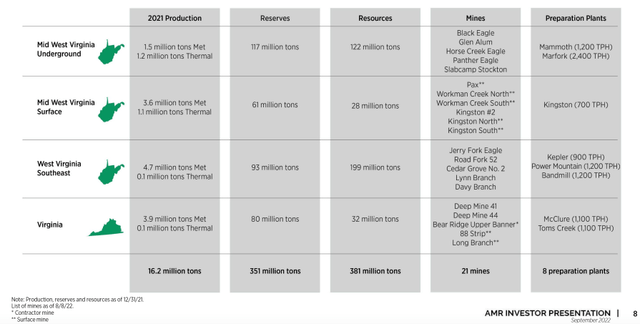

AMR mines, processes, and sells thermal and metallurgical coal from Virginia and West Virginia to a global steel-industry clientele. The company operates 20 mines and 8 coal preparation and load-out facilities, with about 351 million tons of proven and probable metallurgical and thermal reserves and about 381.7 million tons of in situ bituminous coal resources.

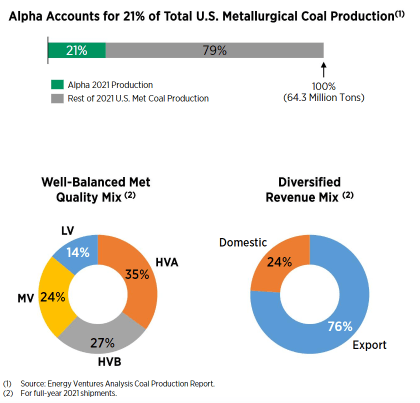

Alpha accounts for nearly a quarter of all the met coal produced in the U.S. and produced approximately 16.2 million tons of coal in 2021.

AMR Q2 Presentation

Market Overview

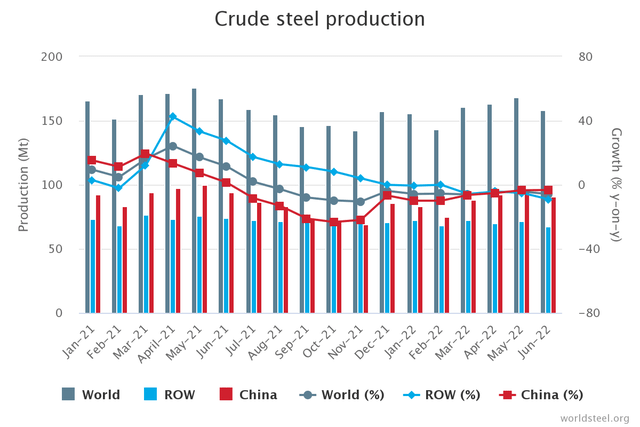

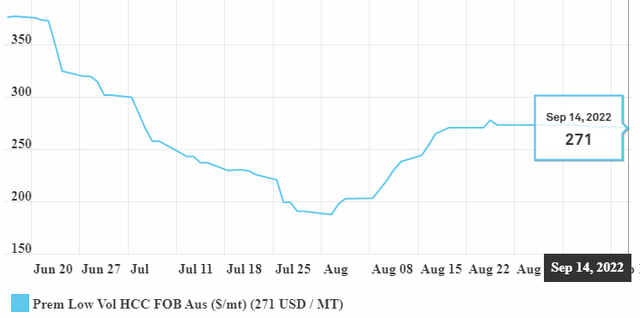

The metallurgical coal pricing market has been depressed since the start of Q2 2022, owing to the pre-recessionary slow economic growth indicators, lower crude steel production, and the overall macroeconomic and geopolitical instabilities.

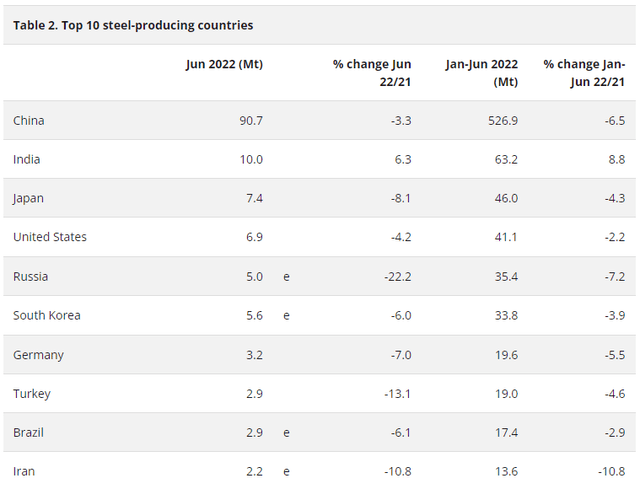

World Steel Association (“WSA”)

Australian Premium Low-Volatile (“PLV”) index pricing, an index tracking the spot price of physical premium hard coking coal, declined by 37% through Q2 2022 and has since dropped an additional 10%. In absolute terms, the underlying commodity prices have dropped from $480 to $271 per MT since the start of Q2 till mid-September, a cumulative fall of 43.5%. Similarly, the Chinese PLV CFR China was down 22% to $308/mt during Q3.

However, recent data shows that in response to stable demand from China and India due to increased restocking activities and an expected weather-related supply disruption from the Australian market, the Q4 prices are expected to be stable.

Evidently, China, which is the top steel-producing country in the world and accounted for almost 80% of the total spot market before the unofficial import ban on Australian coal, showed the least YoY production decline of 3.3% in June, and India, which is the 2nd largest steel producer worldwide and AMR’s largest importer, is the only country in the top 10 steel-producers list that showed a YoY increase, up 6.3%.

What Does This Mean For AMR In The Short-Term?

Despite the expected stability, the price levels are significantly lower than H1 2022 and, therefore, will likely result in sequential revenue declines despite the stable volumes. However, given the significant surge in prices, much higher than the historical averages, annual figures are expected to show a meteoritic YoY ascent in 2022 and then decline to a more stable state in 2023.

Since the commodity prices dictate the company’s revenues, AMR’s stock price is highly correlated with the Australian PLV coal prices. With the stock trading at a high point in its current cycle and the expected decline in the following year, short-term investors can benefit from selling their positions at a profit to grab it up at better prices in mid-2023. For reference, the recent $271/MT price is still about 3x higher than January 2020 prices.

The high prices and the FIFO-based inventory also mean that the company’s profit margins are likely to be unsustainably high, which will also settle down in 2023 as the prices descend to about $220/MT by 2024 as short-term supply constraints subside. This margin contraction is also likely to be reflected in the investor confidence that is already on its toes because of the recessionary pressures.

Assuming that the volume shows a marginal sequential improvement of about 5% each subsequent quarter and the prices settle at $240/MT in Q4 and $220/MT by Q4 2023, the company can be expected to generate $4.57 billion in 2022 and $4.52 billion in 2023, reporting a YoY growth of about 200% in 2022 despite almost a flat volumetric output and a YoY revenue decline of about 3.3% in 2023.

| 2022 | Million Tons of Met Coal | Realized Price Per Unit | Revenue from Met Coal | Other Revenues | Revenue | YoY Growth |

| Q1 | 3.50 | 1,056 | 16.28 | 1,072.28 | 2.8x | |

| Q2 | 3.80 | 1,320 | 16.47 | 1,336.47 | 3.4x | |

| Q3 | 3.99 | 270 | 1,077 | 16.67 | 1,093.97 | 1.7x |

| Q4 | 4.19 | 240 | 1,005 | 16.87 | 1,022.35 | 1.3x |

| 15.48 | 4,459 | 66.29 | 4,525.07 | 2x | ||

| 2023 | ||||||

| Q1 | 4.40 | 235 | 1,034 | 17.07 | 1,050.83 | -2.00% |

| Q2 | 4.62 | 230 | 1,062 | 17.28 | 1,079.63 | -19.22% |

| Q3 | 4.85 | 225 | 1,091 | 17.49 | 1,108.71 | 1.35% |

| Q4 | 5.09 | 220 | 1,120 | 17.70 | 1,138.02 | 11.31% |

| 18.96 | 4,308 | 69.54 | 4,377.19 | -3.27% |

These estimates appear significantly higher than the Wall Street consensus revenue of $4.2 billion in 2022 and $2.94 billion in 2023, which most likely account for a significant price dip associated with the impending recession. Forecasting the timing and the severity of the recession is next to impossible, but in either case, both estimates align on the fact that 2023 will very likely be a low point for AMR stock.

What Does The Long-Term Hold?

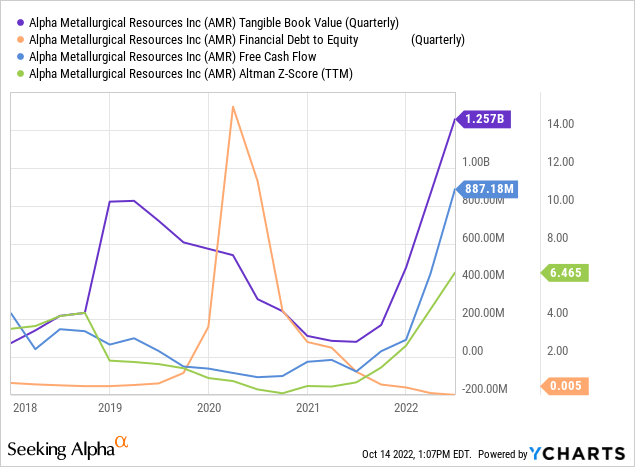

Despite the above, AMR’s long-term financial performance remains intact, with the company’s balance sheet experiencing significant improvements in the previous 2 years as it deleveraged itself and paid off about $600 million of total debt, augmenting its tangible book value from $13.26 per share to over $71 per share, an increase of over 5 times.

Similarly, the company’s cash position improved significantly as its levered and unlevered FCF yield surged to over % 14 and 30%. The company has decided to return a significant portion of this cash to shareholders through share buybacks and dividends.

Accordingly, it authorized a $600 million share repurchase program, of which it had already executed $326 million by the end of August. It also declared a $1.5 annual dividend per share, payable as $0.375 per quarter in May. In August, this was increased to $0.392 per share per quarter, adding up to an annual amount of $1.568 per share per annum.

The dividend currently forms a small portion of its earnings, yielding about 1%, but the share repurchase program could have been timed better as a recession looms at the front door. The cash would be better spent ramping up the CapEx and ensuring future economic benefits. The management could easily leverage the cash for buybacks when the price is much more beneficial to the investors.

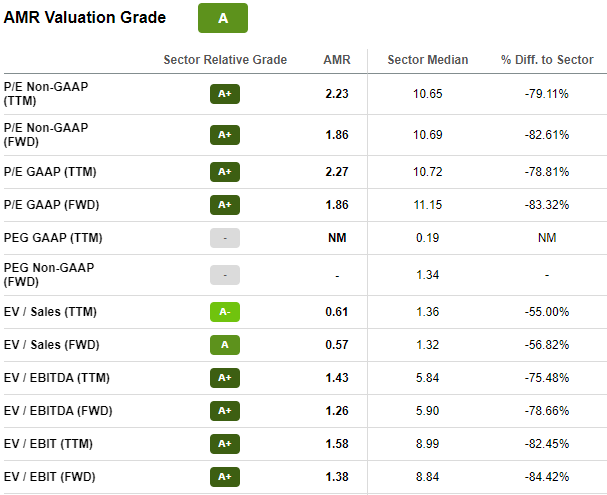

Valuation

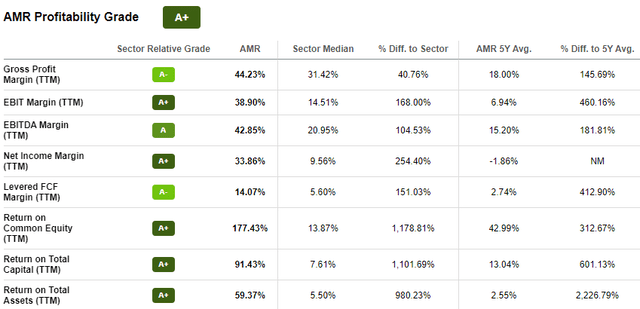

The inflated prices and revenues have turned the company’s TTM and forward valuation metrics into an oasis of green, with all its relative valuation multiples significantly lower than the sector median and 5-year averages. For long-term investors, the stock definitely offers an attractive opportunity to buy into a stock that is trading this cheaply at a high point of its cycle.

Seeking Alpha

However, if one prefers timing the market, I expect the price to decline in the short term because of the volatility in the underlying commodity price, which would be a much more opportune time to open a position in AMR.

Conclusion

Alpha Metallurgical Resources offers a great opportunity for investors to open a position in a commodity stock that can weather recessionary threats because of its optimized, debt-free balance sheet.

Despite the upcoming short-term commodity pricing decline, the “new normal” has been set at exceptionally higher rates than the pre-pandemic levels. Given AMR’s strong position in the export market, it will likely generate exceptional revenues and profits in the long run as commodity prices stabilize.

I am bullish on the stock in the long term and rate it as a long term buy. However, as I previously mentioned, mid-2023 is likely to be a more suitable time to buy the stock.

Be the first to comment