Editor’s note: Seeking Alpha is proud to welcome OJRB Investment Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

gorodenkoff/iStock via Getty Images

Like most high-growth companies, Datadog (NASDAQ:DDOG) has gotten hammered in 2022. Although the company’s share price has been cut in half, at face value Datadog still appears expensive, trading at a P/S multiple of approximately 19x. While this seems high, the company is growing rapidly, is cash flow positive, and has a clear competitive advantage over its peers. Subsequently, I believe there is a strong long-term investment case for Datadog.

Business Model

At a high level, Datadog offers integrated data security and monitoring software for various enterprise cloud applications. Datadog’s SaaS platform enables internal developers and operations teams to collaborate effectively through real-time data integration. Datadog’s solutions include infrastructure and application performance monitoring, log management, user experience monitoring, network performance monitoring, database and security monitoring, incident management, developer testing, and pipeline monitoring.

What’s Datadog Trying to Solve?

Traditionally, the data sets used by software engineers (developers) and operations teams have been kept separate in depositories known as “data silos.” This separation is problematic as it makes collaboration, integration, and data monitoring between teams complicated, inefficient, and time-consuming. Datadog’s software solves this issue, allowing IT departments to integrate and monitor the performance, security, and functionality of multiple servers, databases, and apps in one unified dashboard. Ultimately, this helps to identify and fix problems when they arise.

Why I Like Datadog

Industry leader operating in a rapidly growing total addressable market

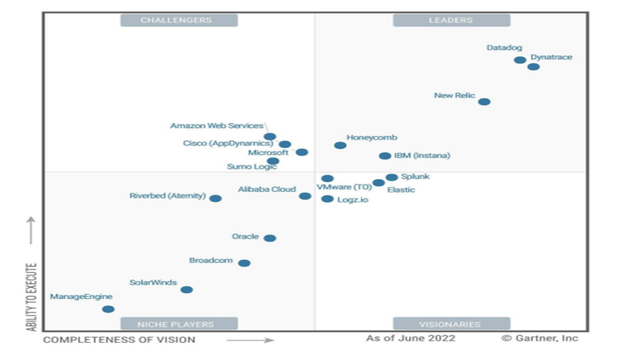

Today, data is becoming increasingly critical to the way businesses operate. The volume of data created and stored by organizations is growing exponentially – 90% of the world’s data was created in the last two years. Moreover, the infrastructure monitoring software market is expected to grow to US$53 billion by 2025 (up from US$38 billion in 2021). Operating in a fast-growing total addressable market is just one of the tailwinds for Datadog over the next five to 10 years. Importantly, Datadog is one of the – if not the – leading data monitoring and integration platforms currently operating. Highlighted in the company’s recent investor day presentation, a 2022 study by Gartner placed Datadog as one of the leading application performance, monitoring, and observability platforms.

Magic Quadrant for Application Performance Monitoring and Observability (Gartner)

Moreover, Datadog has one of the largest user bases in the industry, with over 21,000 customers. This compares to Dynatrace (DT), with only 3,300 customers. Additionally, over 2,400 customers annually pay Datadog more than US$100,000 in recurring revenue.

Clear value proposition

Organizations are rapidly re-platforming to cloud infrastructures. With the proliferation of data in business operations, effectively monitoring and managing databases, servers, and applications becomes ever more critical. As more data is stored, however, this process becomes more challenging. Managing and maintaining large sets of raw data is difficult due to the fragmented nature of data silos. For businesses, this makes managing data 1) time-consuming, 2) expensive, and 3) prone to human error.

Datadog’s integration software directly targets these issues, providing a pivotal solution to data maintenance, performance and security. Breaking down the silos between developers and operations teams, Datadog eliminates much of the manual monitoring and observability processes. Once data silos are removed, developers and operations teams can access shared, easy-to-use performance and monitoring tools. This allows teams to stay connected, share insights and develop a common understanding of application and infrastructure performance. In a business world reliant on data, this functionality is critical.

High switching costs

As previously stated, Datadog provides a critical business solution, creating high customer switching costs. Moreover, Datadog’s software integrates seamlessly into organizational databases, data logs and applications. This feature is a key source of its competitive advantage, making changes to a similar/competing integration provider disruptive, time-consuming, and inefficient. Therefore, without clear benefits, organizations have little incentive to switch platforms.

Subsequently, this translates into a sticky recurring revenue model for Datadog. Evidently, the company has a net dollar retention rate above 130% – meaning, on average, the company’s existing customers spend 30% more each year using Datadog’s services.

Impressive fundamentals and unit economics

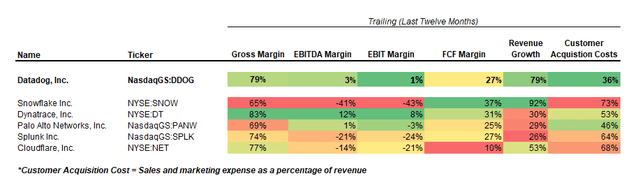

Quantitatively, Datadog’s unit economics and business fundamentals stand out in absolute terms and against its peers. Here’s a look at revenue growth and margins:

Revenue & Margins (Capital IQ)

While not yet optimized for accounting profit, given it is still early in its growth cycle, Datadog is cash flow positive and has almost an 80% gross margin. Datadog’s low cost of revenue (21% of sales) gives the company a large budget to invest in marketing and R&D to improve and iterate the functionality of its software. What’s also impressive is that the company has grown its top line by 79% over the last 12 months while remaining EBITDA positive.

While Dynatrace and Palo Alto (PANW) are also profitable on an EBITDA basis, these companies have been growing revenue at a significantly lower rate compared to Datadog. Comparatively, Snowflake (SNOW), which has been growing its revenue rapidly, has done so at the expense of lower gross and EBITDA margins and far higher customer acquisition costs. Datadog’s low customer acquisition costs vs. its competitors is another compelling metric I like about the company, and suggests it has an edge in attracting new users to its platform.

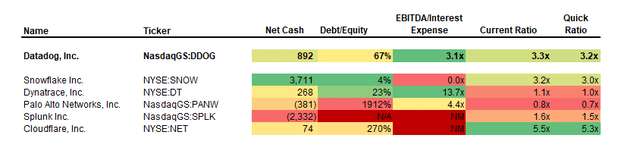

Here’s a look at the company’s financial health and balance sheet strength:

Balance Sheet Metrics (Capital IQ)

Financially, Datadog is in a relatively strong position, with a healthy net cash position of US$892 million. In addition, while the company’s debt-to-equity ratio is slightly higher than optimal, its EBITDA comfortably covers its interest expenses by approximately 3x. While Snowflake has a lower debt level relative to Datadog, this has come at the expense of shareholder dilution.

Shareholder Dilution

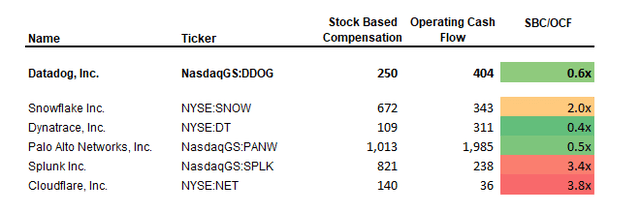

Another assessment I like to do when analyzing fast-growing technology companies is to measure how much the company is paying out in stock-based compensation to its employees relative to its operating cash flows. While stock-based compensation is a non-cash expense, it is dilutive to shareholders and will subsequently impact the value of share ownership over time.

As you can see from the chart below, Datadog has a low SBC/OCF multiple relative to most of its peers, indicating that dilution isn’t a significant threat to shareholders. Comparatively, Splunk (SPLK), Snowflake, and Cloudflare (NET) all have stock-based compensation expenses greater than 2x their total operating cash flow.

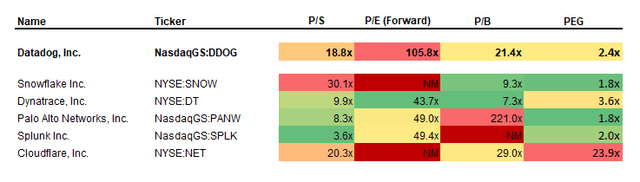

Valuation

Valuation Multiples (Capital IQ)

While the company’s quality is evident, from a valuation perspective Datadog appears expensive in absolute terms and against its peers. Although the company is growing fast, its PEG ratio remains high at 2.4x. Additionally, even after falling close to 50%, the company still trades at 19x sales.

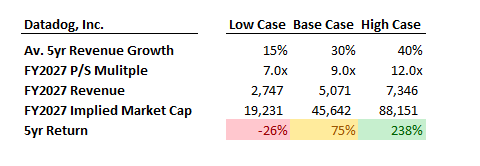

Return Scenarios (OJRB Investment Research)

Based on my back-of-the-envelope calculations, the base case scenario implies Datadog should generate a 75% return by 2027 at its current US$26 billion market capitalization. Bear in mind this assumes the company will maintain a 30% annualized revenue growth rate and a 2027 exit price-to-sales multiple of 9x.

While compelling, I would like to see the company’s P/S multiple pull back to below 15x before I consider entering an initial position. Given the company’s rapid growth and high gross margin, I believe 15x sales has an appropriate margin of safety built in, which should allow for robust investor returns over the next three to five years.

Investment Risks

Datadog operates in a fast-growing and dynamic industry subject to fierce competition. Subsequently, there are several risk factors that might impact my investment thesis.

Increased Competition

By far, the biggest threat I see impacting the future growth and market share of Datadog is increased competition in the data monitoring and observability sector. While Datadog has a robust customer base, its future growth depends on being able to attract and retain new customers to its platform. Datadog’s competitors include Dynatrace and Snowflake and incumbent cloud operators such as Amazon Web Services, Google Cloud, and Microsoft Azure. These competitors, especially the larger cloud computing businesses mentioned, have the financial and intellectual capacity to offer similar products at competitive prices. Ultimately, this might impact the price at which Datadog sells its products to its customers and Datadog’s total market share.

Failure to achieve sustainable profitability in the future

While Datadog is cash flow positive, the company has yet to reach profitability on a net income basis. Datadog continues to invest heavily in research and development and marketing to improve the functionality of its products and increase its total customer base. So far, this strategy has led to high revenue growth. However, it has also resulted in yearly net income losses for the past three years. Given the company’s limited operating history, it remains unclear whether it will be able to successfully reduce its operating expenses enough to achieve sustained profitability on a net income basis. If Datadog cannot reach and maintain profitability, the company’s Class A common stock value may significantly decrease.

Failure to innovate

Datadog’s competitive advantages stem from its innovative data monitoring and integration solutions. As stated by Datadog’s management, the company’s competitive positioning relies on a combination of trademarks, trade secret laws, patents, copyrights, and service marks. Any of these may be challenged or circumvented in the future. Despite having several pending U.S. patents, there is high uncertainty that these applications will result in issued patents. Even if Datadog continues to seek patent protection in the future, the company might be unable to obtain or maintain patent protection for its technology.

Conclusion

Based on my analysis, I believe there is a lot to like about Datadog. The company is clearly executing its high-growth strategy and offers innovative, easy-to-use data monitoring and integration software unmatched by its competitors. Moreover, with the data monitoring, management, and security industry growing exponentially, Datadog has a long growth runway ahead if it can continue to deliver as it has done in the past. While the company’s valuation appears rich at 19x sales, strong and sustained future revenue growth should create positive returns for investors over the next five years. While I’d like to see the stock pull back another 5%-10%, I still believe the company offers good value at approximately $US82 per share.

Be the first to comment