Andrzej Rostek

Alliance Resource Partners, L.P. (NASDAQ:ARLP) stock price has increased by more than 50% over the last six months as coal demand increased worldwide. Due to the high natural gas prices in the European Union and the United States, the demand outlook for coal should be strong for the rest of 2022 and 2023. I expect the company’s financial results in the second half of 2022 to be better than in 1H 2022. ARLP stock is a buy.

Quarterly highlights

In its 2Q 2022 financial results, ARLP reported total revenues of $617 million, compared with 2Q 2021 total revenues of $362 million, up 70.1%, driven by higher coal sales prices and volumes and higher oil & gas royalty prices and volumes. The company’s adjusted EBITDA increased by 95.7% YoY to $266 million in the second quarter of 2022.

“Segment Adjusted EBITDA at our coal operations climbed sharply to $222.6 million for the 2022 Quarter as increased coal sales volumes and prices more than offset continued inflationary cost pressures, supply chain challenges, and ongoing shipping delays due to poor rail performance. Our royalties businesses also continued to benefit from strong energy markets, once again posting record Segment Adjusted EBITDA during the 2022 Quarter,” the CEO commented.

“ARLP also continued to make progress during the 2022 Quarter on its energy transition strategy we outlined last quarter,” he continued.

The company produced 8878 thousand tons of coal in 2Q 2022, compared with 7481 thousand tons in 2Q 2021. Also, ARLP sold 8933 thousand tons of coal in the second quarter of 2022, compared with 7846 thousand tons in the same period last year. The company’s coal sales increased from $326 million in 2Q 2021 to $532 million in 2Q 2022. Its oil & gas royalties increased from 17 million in 2Q 2021 to $36 million in 2Q 2022. Finally, the company’s transportation revenues increased from $12 million in 2Q 2021 to $35 million in 2Q 2022. ARLP reported 2Q 2022 total operating expenses of $441 million in the second quarter of 2022, compared with 2Q 2021 operating revenues of $307 million in the same period last year, driven by increased coal sales volumes and inflationary cost pressures. The company’s net income (attributable to ARLP) increased from $44 million in 2Q 2021 to $161 million in 2Q 2022, up 266%.

The market outlook

In the second quarter of 2022, in Illinois Basin, ARLP sold 5.8 million tons of coal, up 7.5% YoY and down 0.9% QoQ. In Illinois Basin, the company’s coal sales price per ton increased by 28.5% YoY and 15.4% QoQ to $49.80. In 2Q 2022, in Appalachia, ARLP sold 3.1 million tons of coal, up 28.1% YoY and 36.1% QoQ. In Appalachia, the company’s coal sales price per ton increased by 62.7% YoY and 32.0% QoQ to $77.83. I expect ARLP’s coal sales in the second half of 2022 to be higher than in 1H 2022 as high natural gas prices in European Union and the United States caused the demand for coal to increase.

In the second quarter of 2022, in Central and Northern Appalachia employment increased. Meanwhile, employment in Illinois Basin increased. According to Figure 1, coal price per ton increased from $218 on 30 September 2021 to $436 on 28 September 2022. Also, we can see that coal prices in the third quarter of 2022 are higher than in 2Q 2022.

Figure 1 – Newcastle coal futures

tradingeconomics.com

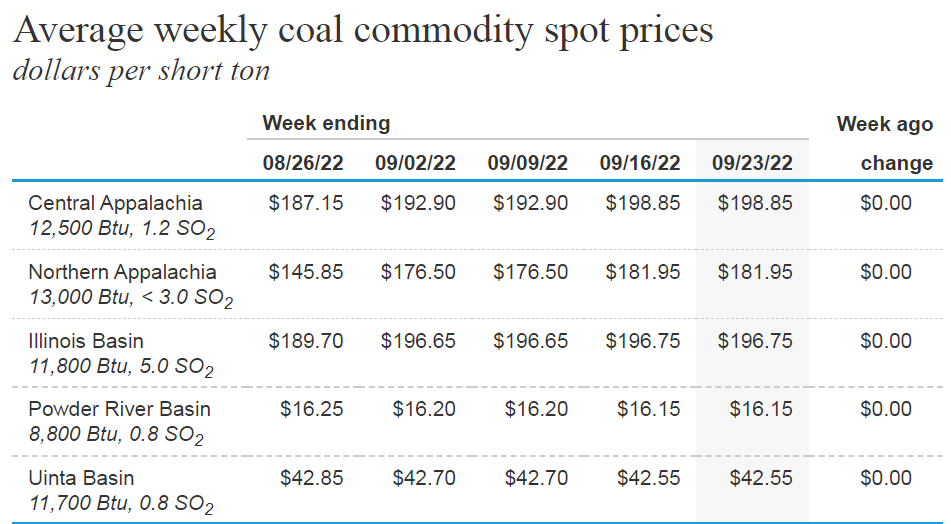

Figure 2 shows that the average weekly coal spot price in Central Appalachia increased from $187 per short ton on the week ending 26 August 2022 to $199 in the week ending 23 September 2022. The average weekly coal spot price in Northern Appalachia increased from $146 per short ton in the week ending 26 August 2022 to $182 in the week ending 23 September 2022. Moreover, the average weekly coal spot price in Illinois Basin increased from $190 per short ton in the week ending 26 August 2022 to $197 in the week ending 23 September 2022.

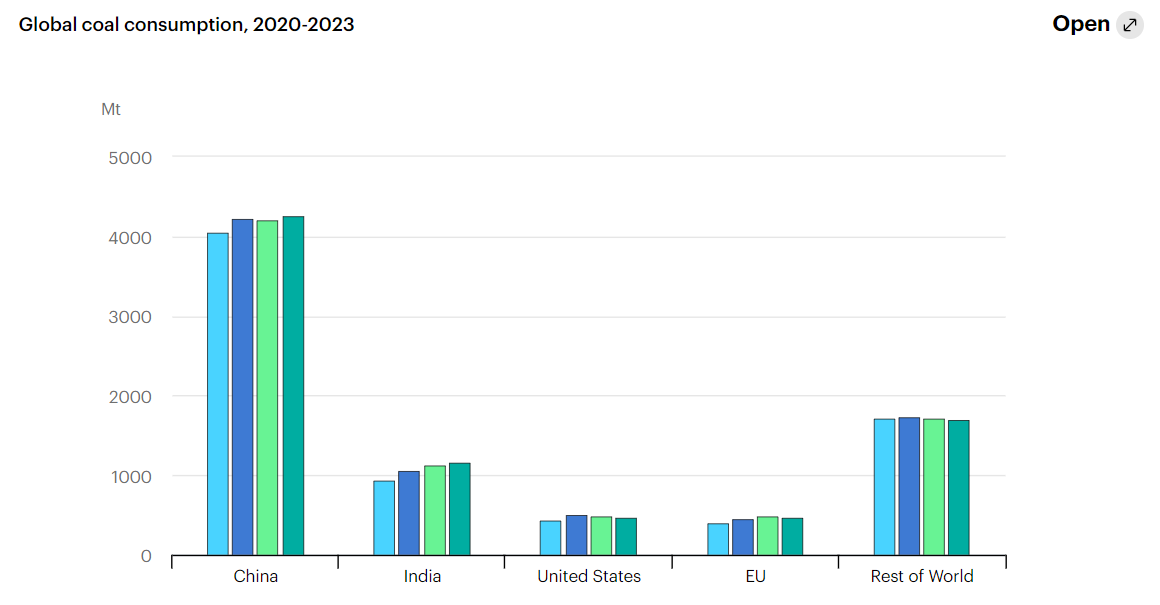

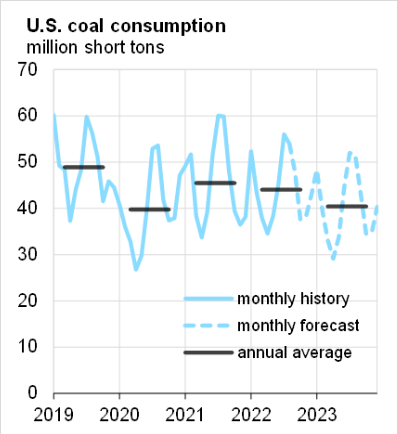

Furthermore, according to Figure 3, coal consumption in China and India in 2023 is expected to be higher than in 2022. On the other hand, coal consumption in the United States and Europe in 2023 is expected to be lower than in 2022. However, coal consumption in the United States and EU in 2022 is expected to be higher than in 2021. Figure 4 shows that U.S. coal production in 2022 is expected to be higher than in 2021. However, in 2023, U.S. coal production is expected to decrease. According to ARLP’s 2022 full-year guidance, the company expects its coal sales to be between 35.5 to 37.0 million short tons. Based on the current market condition, the company’s 2022 coal sales may be more than 37.0 million tons.

Figure 2 – Average weekly coal commodity spot prices

EIA

Figure 3 – Global coal consumption

EIA

Figure 4 – U.S. coal consumption

EIA

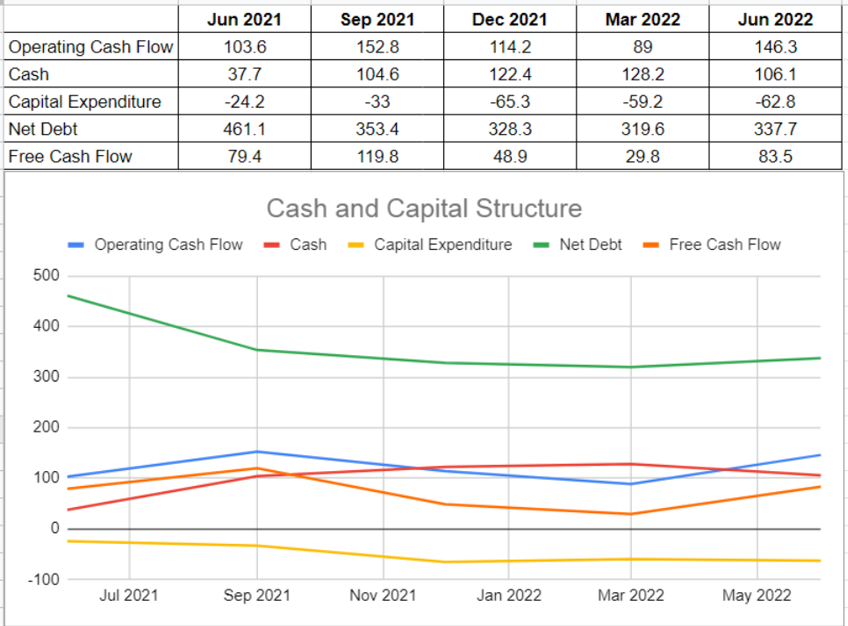

ARLP performance outlook

After the COVID-19 assault on the energy industry and the drop in energy prices, Alliance Resource Partners could recover in 2022 due to the Russian invasion of Ukraine and the following energy shortage. The company’s operating condition performed stronger than expectations in the recent quarter. ARLP’s cash flow performance represents that the company’s operating cash flow of $89 million during the first quarter of 2022 surged about 64% and sat at $146 million in the second quarter of 2022. Albeit a slight decline in the cash generation in 2Q 2022 compared with the previous quarter, ARLP’s $106 million cash balance surged amazingly year-over-year compared with its level of $37.7 million during the second quarter of 2021.

In short, in light of their up-to-now performance, we can expect stronger cash and capital structure outlook for the rest of 2022. Moreover, the company’s growth of 64% in operating cash in the 2Q2022, aligned with a 6% increase in capital expenditure to $62.8 million, resulted in $83.5 million free cash flow in 2Q2022, versus its previous level of $29.8 million at the end of 1Q2022.

Alliance Resource Partners’ net debt level of $337.7 million in the second quarter of 2022 shows an eye-catching decrease year-over-year versus its previous result of $461 million during the same quarter of 2021. Overall, ARLP’s cash and capital structure illustrates a well-performed condition that can assure future benefits for unitholders (see Figure 5).

Figure 5 – ARLP’s cash and capital structure

Author (based on SA data)

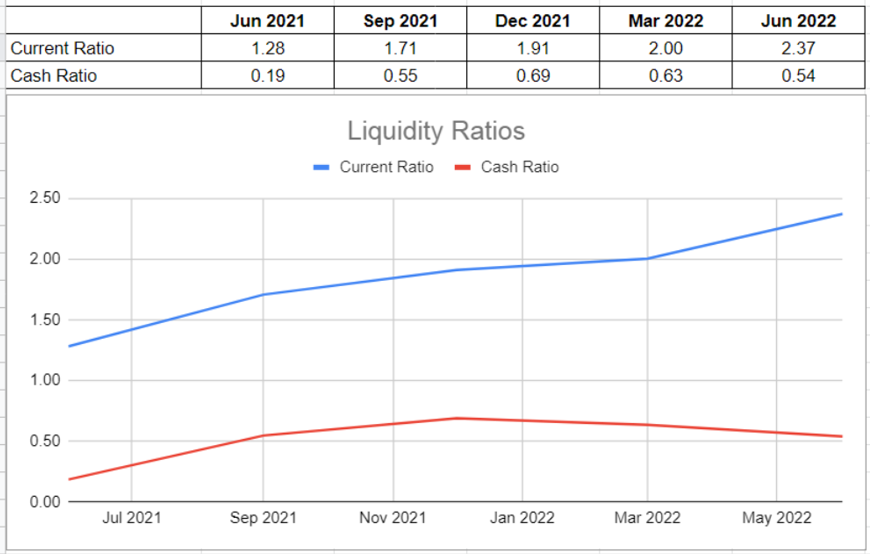

Following its strong cash and capital performance, it is not surprising to observe increases in its liquidity ratios. The company’s current ratio of 2.37x in 2Q 2022 is 18% higher than its result of 2.00x at the end of the first quarter. Notwithstanding a slight decline in the cash ratio of 0.54x compared with the previous level of 0.63x, it is much higher than its amount of only 0.19x at the same time in 2021. Thus, Alliance Resource Partners’ healthy liquidity position is observable from its liquidity ratios (see Figure 6).

Figure 6 – ARLP’s liquidity ratios

Author (based on SA data)

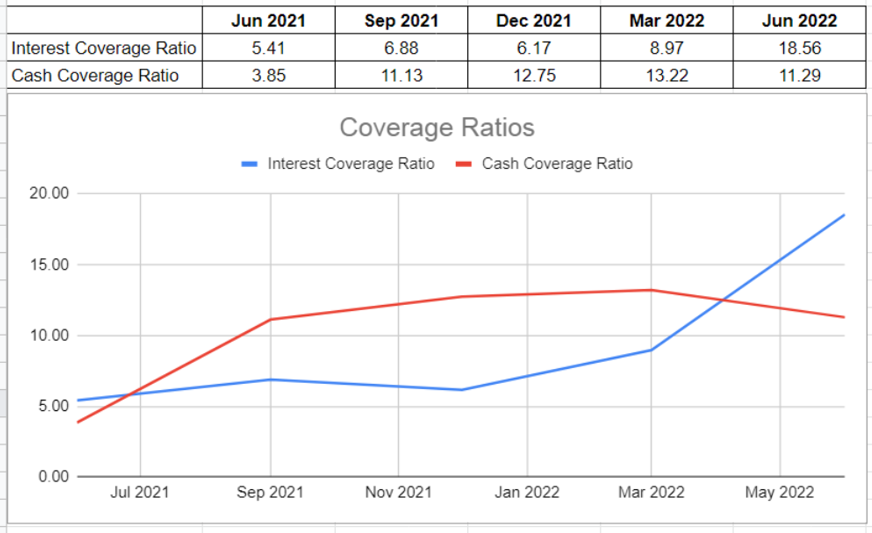

Moreover, we can analyze ARLP’s coverage ability across the board of its Interest Coverage Ratio (ICR) and cash-coverage ratio. Currently, its ICR indicates that 18.5 times the company can pay its interest expenses on its debt with its operating income. On the other hand, as a conservative metric to compare the company’s cash balance to its annual interest expense, ARLP’s cash-coverage ratio had a wee decline to 11.3x versus its previous level of 13.2x in the first quarter of 2022. Ultimately, when all was said and done, Alliance Resource Partners’ performance outlook represents its ability to generate profit for its unitholders in the condition of any risks of lower energy prices in the future (see Figure 7).

Figure 7 – ARLP’s coverage ratios

Author (based on SA data)

Summary

Coal prices in the third quarter of 2022 should be higher than in the second quarter of the year. Thus, ARLP can benefit from the market condition more than it did in the first half of 2022. Also, Alliance Resource Partners’ performance outlook represents its ability to generate profit for its unitholders even with lower coal prices. I am bullish on the stock as long as natural gas prices in the European Union and the United States boost the demand for coal.

Be the first to comment