ko_orn

Introduction

Last Thursday, before the markets opened, Datadog (NASDAQ:DDOG) reported its Q2 2022 earnings results. If I had to use one word to label them, it would be ‘great’, but the stock nevertheless fell on guidance. Datadog is a very conservative guidance issuer, though, and over the medium to longer term, a recession might benefit the company, as it saves companies money. We also look at what makes Datadog exceptional.

If you want to get to know the company better first, I think this article might help you.

The Headline Numbers

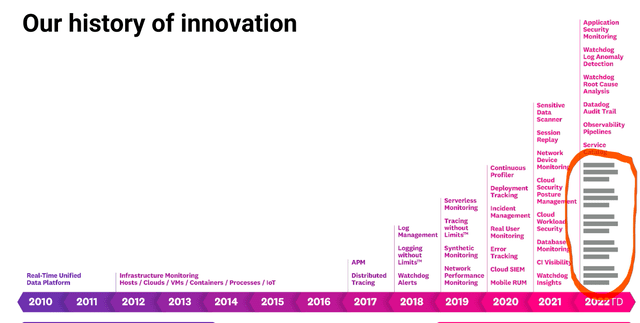

Revenue surged 73.9% YoY to $406.14M, beating the consensus by $24.86M or about 6.5%. For revenue, that’s a lot, especially in these challenging times. But it was a mediocre quarter for Datadog, which averages about a 10% beat on average.

It also meant a QoQ growth of 11.9%. Both results were much stronger than the guidance Datadog had provided in the last quarterly earnings release. For YoY, it had guided between $376M and $380M, 61.8% YoY growth at the midpoint. Management beat its own guidance by 7.4%. For QoQ growth, guidance implied a 4.1% growth at the midpoint. Also quite a difference with that 11.9% that Datadog was able to put in the books in reality.

Non-GAAP EPS of $0.24 were also much higher than the consensus, surpassing it by $0.09.

Guidance

Like many other companies, Datadog commented that they saw weakness in June, but it stabilized in July. Nevertheless, the company likely guided extremely conservative, as it’s otherwise already such a conservative guidance issuer. That’s important to keep in mind.

For Q3, the company guides for revenue coming in at $412M at the midpoint ($410M-$414M) or about 52% growth YoY. QoQ, this would mean growth of just 1.5%. That may be one of the reasons the stock initially dove 8%.

I’m telling you not to trust this management regarding guidance, though. And I like that. I prefer companies that under-promise and overdeliver and Datadog has a consistent history of doing this.

I think it’s not a big leap of faith to say revenue can grow by 60% YoY or even a bit higher. That’s a growth deceleration, but still very impressive growth for a company of Datadog’s size. Also, you shouldn’t make the mistake of thinking Datadog can’t accelerate again once the tide turns. It has done that before:

Guiding for 52% growth, as a very conservative guidance issuer, in this macroeconomic environment, that’s still an incredible accomplishment. Some will point out the soft QoQ growth but might underestimate the company’s guidance conservatism.

What probably concerned the market most and hence the initial sell-off, is that Datadog has upped its yearly guidance but in such a way that it actually lowered it. What I mean is that they raised their guidance by $1M, from $1.61B to $1.62B, which means up 56% YoY. But because this quarter was such a beat, by $24.86M, raising by $1M actually means lowering guidance by $23.86M. The reason is again the macroeconomic environment and Datadog’s prudence.

More Insight

Datadog’s large customers number, more than $100K in annual recurring revenue (‘ARR’), came in strong: 2,420, up 54% YoY from 1,570. They now represent more than 85% of the total ARR. The total number of customers grew 29% to 21,200, up 1,400 and that would have been 1,600 if Russian customers were not given the boot.

79% of customers use 2 products or more, 37% 4 products or more and 14% use 6 products. All of these numbers are up from last year by mid to high single digits.

For the 20th consecutive quarter (!) DNBRR or dollar-based net retention rate was higher than 130%. That’s extremely impressive. It means that if all last year’s customers spent $1B, that same group, including those who fell off, spent $1.3B now. That’s a fantastic driver of revenue growth for both the short and the long term. For the short term, I think it’s obvious. 30% revenue growth from existing customers is easier than convincing new customers. But in the long run, it also means that new customers will replace the existing customers by spending more and more on Datadog.

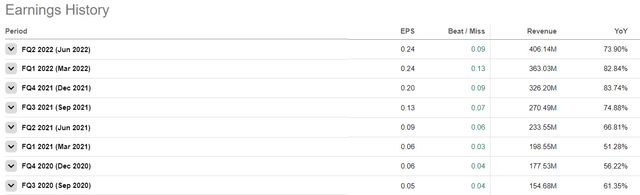

Of course, DBNRR comes from adding new products. I think it’s not highlighted enough that Datadog doesn’t spend as much on sales as many software companies do but chooses to invest in R&D, which the company has proven to be able to monetize quickly. There are 17 product modules now:

(Source)

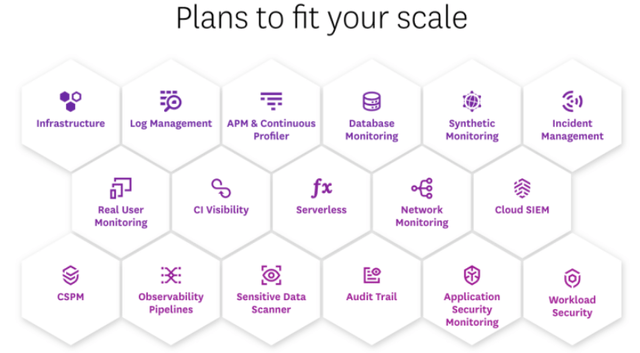

That’s up from just nine modules two years ago. That’s why I like it a lot that Datadog spends so much on R&D. The return is huge. And the company hinted at more to come in the earning call presentation:

Datadog’s Q2 2022 earnings call presentation

(Source, orange line by the author)

It looks like five more additional products might be released this year. That’s confidence-inspiring, as Datadog has shown that it knows what its customers want very well. Therefore, I applaud Datadog’s heavy investments in R&D. It makes the gap with its competitors bigger and bigger. It is the heavy R&D investing and the efficiency of these investments that make Datadog exceptional.

This quarter, R&D accounted for 43.8% of revenue, while sales & marketing was 28.4%. The trend continues, as R&D was up from 40.6% in Q2 2021 and sales and marketing were down from 30.1% in Q2 2021.

Another important thing to point out about Datadog is that they charge in dollars worldwide, which means there are no currency headwinds as with other companies. But of course, because of the strong dollar, for these foreign companies, Datadog’s products cost more and that might make them look at how to save money. Only 28% of sales come from outside the U.S., which shows that the impact will probably be limited and that there is still a vast opportunity internationally.

The Q2 free cash flow was $60.2M, which means an FCF margin of 14.8%. In Q1, this was 35.8%, extremely high for a company at this stage. This might make you think that this was a bad quarter for FCF, but there is a lot of seasonality, based on the time the invoices are paid. There are usage-based elements, but most of Datadog’s revenue comes from 1-year subscriptions. Looking at the first 6 months of this year compared to last year, you see an FCF margin of 25% versus 18% last year.

The Seekret Acquisition

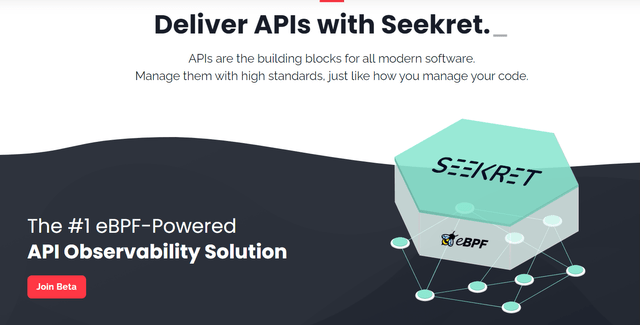

The acquisitions Datadog makes also are adding value. They buy when the companies are still relatively small and then integrate the products on their own platform. These are product-and-employees acquisitions, not customer acquisitions.

This quarter, another one of these was announced. The company is buying Seekret, which provides an observability platform for APIs. I think this is another great addition, as we see more and more APIs that take a central place in companies, internally and externally. Think of all the customers of Twilio (TWLO), WhatsApp (META), Google Maps (GOOGL) (GOOG), Slack (CRM) or Amazon’s (AMZN) Alexa, for example, and many others. These companies are all based on APIs.

I had not heard about Seekret before, but it looks like a typical Datadog acquisition. It’s still in beta, as you can see on its website.

The company is based in Israel and has three founders and as far as I could see these are the only 3 employees. Financial terms were not disclosed, but this will be another tuck-in acquisition that could generate a ton of money in the future, once the product is mature enough to be another Datadog module. I really like the acquisition.

How about a recession?

While the company was not completely immune from macroeconomic circumstances, especially in its very conservative guidance, it’s still firing on all cylinders. Over the short term, there might be a deceleration of growth, but I think it might be a boost for the long term.

After all, Datadog makes things easier and cheaper. Olivier Pomel, Datadog’s founder and CEO, gave an example of a 7-figure customer that replaced 9 different solutions with Datadog. That’s a cost-saving for a company. There are also lay-offs in the sector and many companies use open-source alternatives. But these open-source alternatives need people and are expensive in that way. Datadog can help there too, to be more efficient overall, with fewer people.

While over the short term, they might look at cutting some costs, over the long term, when economically things go 100% again, this will prove to be a boost for Datadog.

Conclusion

Datadog posted another outstanding quarter. While guidance looked relatively weak, I think the company is extremely conservative in its projections. There could be more volatility over the short term, but if you are a long-term investor, I think Datadog is one of the best stocks to own for the next decade.

In the meantime, keep growing!

Be the first to comment