Jonathan Kitchen

The iShares MSCI EAFE Growth ETF (BATS:EFG) gives exposure to Japan and Europe mostly, which are markets that for various reasons are being beaten down. In fact, broader ETFs trade at lower multiples, reflecting this in the face of higher risk-free rates incoming. Growth in Europe isn’t the same profile as in the US, which boasts the best tech sector in the world. Sectoral exposures end up being pretty iffy, even given an already onset recession in Europe, a geography much worse placed than the US with the Ukraine invasion. While there are some points of resilience, the multiple doesn’t appear easy to justify. Pass.

EFG Breakdown

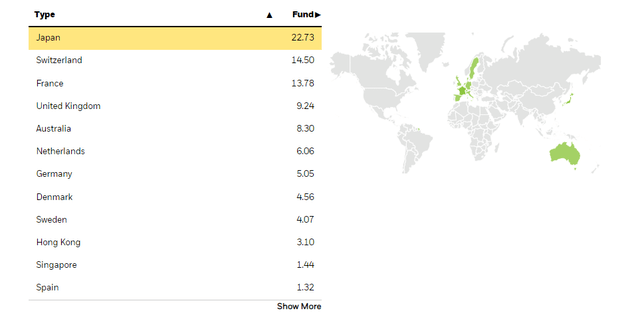

Let’s start as broad as possible with the geographical breakdown.

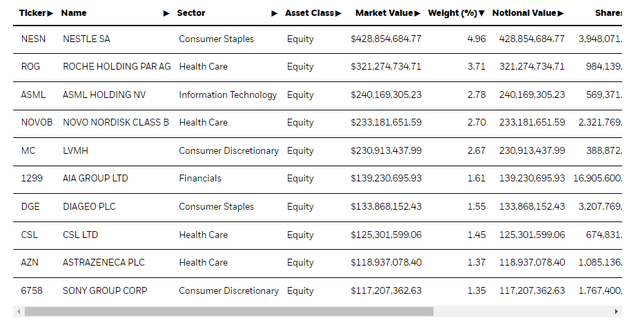

There’s a good amount of Japan exposures at 23% that accounts for the FE in the EAFE of this ETF. The rest is essentially just Europe. Certainly, when looking at the top holdings, European exposures are pretty clearly front and centre with some very well-known blue chip names.

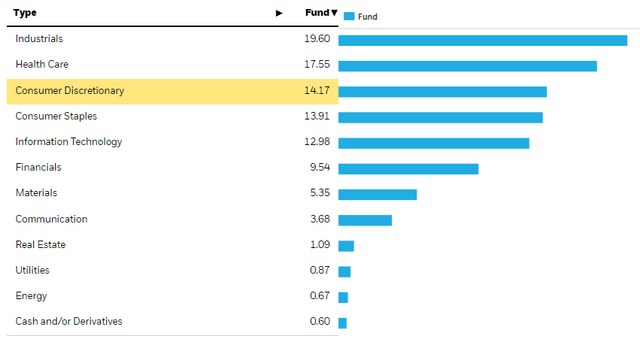

The sectoral breakdown is the following, and this is where we begin to have some issues.

Remarks

The problem with the sectoral breakdown is primarily how it stacks with some other ETFs at very similar valuations. The PE of this ETF is 10x, and that means a 10% earnings yield, the same as the iShares Core MSCI Europe ETF (IEUR). However, much like the SPDR EURO STOXX 50 ETF (FEZ) which we also took issue with, there are less resilient exposures within.

Industrials can be good, but it is a mixed picture because of supply chain issues and inflation exposure. Healthcare really is solid. But then there’s a lot of consumer discretionary. While not as much as FEZ, there’s still a lot, and FEZ at least had a solid financial exposure to compensate. This is coming from automotive and fashion exposures in Europe, which we don’t like in a recession and are unlikely to produce the resilient earnings or earnings growth that one would like when trying to stay ahead of rapidly rising rates.

Again, the IEUR and even FEZ trade at similar valuations. It’s possible that EFG is more exposed to a downturn than even FEZ, and it’s certainly more exposed than IEUR which has major financial exposures to support it as interest rates rise while also having a very similar PE, just at a very slight premium. We just don’t think EFG should be chosen over IEUR at any point given current market factors.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment