Solskin

Summary

I recommend a buy rating on Alignment Healthcare (NASDAQ:ALHC). Before going into the article, I strongly encourage readers to read up on the US healthcare industry, specifically on the Centers for Medicare and Medicaid [CMS], fee-for-service [FFS], and value-based care [VBC].

To me, ALHC is a noble cause to provide seniors with better healthcare services, and they are very intentional in their dealings, as structures like AVA have been put in place to deal with different types of customer needs. Ultimately, I believe investors can profit from the mispricing at the current valuation. I think ALHC brings a lot to the table and is well-positioned to keep growing its share of the market as the industry changes.

Company overview

At ALHC, their goal is to revamp the healthcare experience for seniors. They are the future generation, consumer-centric that delivers this revolutionary experience through their Medicare Advantage plans that are specially designed to satisfy the needs of individual seniors in the United States.

Rising cost of healthcare for seniors

As it is, there is already enough pressure on the already-cricked healthcare system because of the increasing senior population. The net Medicare spending was about $630 billion in 2019, and the Congressional Budget Office projects it to double to over $1.3 trillion by 2029. Although there has been a significant increase in healthcare spending, U.S. seniors have poor health outcomes compared to other developed nations. This is shown through the lower life expectancy rate, an increase in the levels of hospital utilization, and the common occurrence of chronic conditions. A major part of the nation’s unmanageable high healthcare costs is due to the fact that there is an increased number of high-risk and high-acuity seniors in the population.

Fragmentation in the US healthcare system is additional headache to seniors

For seniors, maneuvering the healthcare system is complicated and hard because their healthcare needs are serious and complex. As such, they experience a disorganized healthcare landscape.

ALHC S-1 reports that about 85% of the senior population in the US is living with at least one serious disease, and it has been deduced that about 60% of the senior population has at least two chronic diseases. It does not take a lot for a person who has cared for these seniors at some point in time to figure out that this poses a huge challenge to the healthcare system. AHLC also found out that 36% of the Medicare population that has four or more serious conditions represents 75% of total Medicare spending. A lot of these seniors would greatly benefit from well-coordinated clinical care and functional support. The models that are in place right now don’t do a good job of meeting the needs of these older people.

Medicare Advantage is a growth driver

The Medicare Advantage program encourages plans to develop innovative products that will better meet the needs of seniors than traditional medical care. CMS has adopted a broader definition of supplemental benefits, allowing Medicare Advantage plans to provide collaborative services aimed primarily at social determinants of health, which can have a significant impact on seniors’ health outcomes. As a result of this shift, Medicare Advantage plans now have more opportunities to provide more effective healthcare solutions while also achieving superior clinical outcomes for their members. CMS has made it possible for Medicare Advantage plans to give seniors more value by giving them access to healthcare through both traditional care delivery services and extra benefits.

These seniors desire and are asking for a change, and as such, the Medicare Advantage market continues to grow, and ALHC plans to continue to meet the unmet needs of these seniors.

ALHC’s product solution catered towards users’ needs

Various healthcare organizations have struggled for a long time to fully make use of the utilization of data and technology to further improve business operations, clinical outcomes, and customer satisfaction. A huge amount of digitized data that is mostly not used is produced in the industry. Because of this, integrated data management from start to finish has become a huge competitive advantage.

ALHC has a proprietary technology platform that is called AVA. AVA was primarily designed and created to tend to senior care needs and provide end-to-end coordination of the healthcare ecosystem. The technology’s complete suite of tools is built within an interconnected data architecture. ALHC’s abilities and position in the healthcare ecosystem allow them to ingest and turn around wide, longitudinal datasets into insights, analytics, and custom-built applications that were programmed to ensure premium care and service for Alignment’s members. AVA makes sure that their insights are correct, up-to-date, and useful so that they can give their customers better experiences.

AVA was purposely built to further ensure that ALHC provides superior healthcare for Alignments’ senior members. The technology aids ALHC’s internally employed care teams, operations teams, marketing teams, concierge personnel, and also local community-based healthcare providers and brokers. All of these afford ALHC the opportunity to reliably produce replicable outcomes and experiences for members even as they continue to rise in the markets they are presently in and in future ones.

The healthcare platform is delivered through their Medicare Advantage offerings. They know that no two seniors are alike, and because of that, they are always looking for ways to meet the needs of these different seniors. This is done by using the different products that were made with different types of seniors in mind and also providing personalized healthcare that is easy to navigate to provide great experiences for their consumers.

Presently, their product portfolio includes Medicare Advantage products that have been specially made to look into factors like health condition, socioeconomic status, and ethnicity. All of these are to ensure that the products that are being created will meet the needs of the diverse senior population.

Not quite long ago, they began introducing the Preferred Provider Organization [PPO] offerings in some markets, which they strongly believe will catch the eye of seniors that prefer a more open design. ALHC has also launched a special virtual care plan that allows their members to choose a virtual provider such as their primary care physician, enjoy a number of benefits, and also have access to local, in-person healthcare resources when necessary.

They believe that looking at the social determinants of health will have a major and positive impact on the overall health of seniors because they have broadened their horizons beyond the traditional medical benefits to create products that will fully satisfy them.

Flywheel effect

ALHC’s model is based on a flywheel concept that is called the “virtuous cycle.” Thus, the model is specially designed to delight senior consumers. To start with, they listen and talk to the seniors in a bid to provide them with a top-notch experience in their healthcare and daily needs. AVA technology enables them to utilize data and predictive algorithms that have been specially designed to deliver personal care to each member. When information-enabled care is combined with member engagement, they are able to improve healthcare outcomes. They are also able to manage their healthcare expenditures and, at the same time, ensure that their consumers are thoroughly satisfied. This is a major advantage that they possess over others in the market. Because of the lower total healthcare expenditures, they are able to invest their savings in places that will increase their revenue. They also take note of feedback so that they can continue to further increase and improve on the benefits and produce strong clinical outcomes.

S-1

Valuation

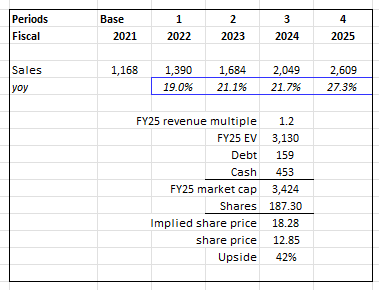

I believe the current valuation does not reflect ALHC’s intrinsic value. I expect ALHC to make $2.5 billion in sales in FY25, giving it a market cap of $3.4 billion and a stock price of $18.28 in FY24, assuming it trades at the same valuation multiple today (1.2x forward revenue).

Assumptions:

- Using consensus estimates, sales will continue to grow at a high rate, similar to historical levels, as ALHC continues to execute and capture more market share

- It is very unlikely that ALHC will ever trade back to its all-time-high valuation of 4.5x forward revenue. I assumed ALHC will remain trading at the current level (1.2x forward revenue) on the basis that the current market sentiment is significantly weaker than it was 12 months ago, and rates are also much higher (which affects discount rates)

Author’s valuation

Risk

Competitive industry

The healthcare industry is competitive. There are many healthcare service providers that basically do the same thing that ALHC does. A lot of these competitors have been in the industry for a longer period of time, and they have more resources at their disposal. All of these might have an adverse effect on ALHC’s business operations and finances.

Reduction in Medicare Advantage funding

ALHC’s major revenue comes from the government’s subsidized Medicare Advantage program. The program is purely financed by federal funds. Medicare Advantage spending has greatly increased over the years, and it is becoming a major part of the government’s budget. The slower state revenue growth has made the federal government put in place measures that are directed at controlling the growth of healthcare spending. As a result of this, they are open to the risks associated with contracting with the federal government and also to the fact that the federal government can end their contract with them at any point in time.

Conclusion

The current valuation presents an opportunity for investors to take advantage of the mispricing. I believe ALHC brings a lot of value to the table, and it is doing so from a position of strength, which enables it to continue capturing market share as the industry develops. However, regardless of whatever it is that they are offering, their major goal is to provide a better and well-improved healthcare system for seniors, which is a good cause that I support.

Be the first to comment