nensuria/iStock via Getty Images

Investment Thesis

At the price of around $270 per share at the time of writing, many investors may see Align Technology (NASDAQ:NASDAQ:ALGN) as an absolute bargain. Down over 60% from its all-time highs, it seems like things cannot get much worst for an innovative medical equipment company dominating its niche in orthodontics. However, after in-depth research and analysis of the company’s latest performance, I would advise investors to think twice before buying in straight away.

Align Technology’s financial performance has been shaky lately as the company reported its Q1 2022 non-GAAP income at $2.13 per share (-14.5% YoY, -24.7% QoQ), missing analyst estimates by -$0.10 per share. Although Q1 2022 revenue grew 8.8% YoY, the company recorded the worst operating margin since Q2 2020 when the Covid-19 pandemic was disrupting business activities all over the globe. Increasing costs from inflation, a weakening global economy, unfavorable foreign exchange rates, and lockdowns in China are the main external factors to blame for the decline in margins. Going forward, I believe many of these pressures are going to sustain throughout 2022, potentially creating a large dent in the company’s growth.

Besides the poor mid-term outlook, there is increasing uncertainty in the long-term fundamentals of the company due to increasing competition. What was once a blue ocean is turning red as numerous competitors are now offering identical clear aligner products after Align Technology’s key patents had expired.

Taking the aforementioned factors into our 5-years Discounted Cash Flow valuation, we reached a fair value of $239 per share which is below where the stock is trading (as of June 8th, 2022). As a result, I would rate Align Technology stock as a “Hold” and wait for a better price with more margin of safety.

Company Overview

Align Technology is a global dental equipment company that designs, manufactures, and markets the renowned “Invisalign” clear aligners along with related tools and software for orthodontics. The company was founded after two Stanford students, Zia Chishti and Kelsey Worth, invented the clear plastic aligners back in 1997.

For those who have worn braces, most will agree that traditional metal wired braces are no fun to have on as they often irritate gums, collect food pieces, limit choices of diet, have long treatment periods, and can be aesthetically unpleasant. Align Technology’s Invisalign addresses all these problems astoundingly, making them a much more desirable option for people looking to align their teeth.

In addition to its flagship Invisalign device, Align Technology also provides intraoral scanners called “iTero” and a software platform for restorative dental treatments known as Exocad’s CAD/CAM. These tools and services supplement the company’s Invisalign treatment as 3D imagery of the patient’s teeth and CAD software are required for the prescription and design of the clear aligners and other orthodontic treatments.

The revenue structure for the company is outlined in the tables below.

Align Technology’s 2021 Revenue Breakdown

| Revenue Source | Revenue Generated (mil. $) | % of Total Revenue |

| Invisalign | 3247.1 | 82.2% |

| System and Services | 705.5 | 17.8% |

* System and Services income consists of revenue from 3D scanning (iTero) and CAD/CAM software services.

Align Technology’s 2021 Invisalign Revenue by Segment

| Region | Revenue Generated (mil. $) | % of Total Revenue |

| Americas | 1544.8 | 47.6% |

| International | 1498.7 | 46.2% |

| Non-Case* | 203.7 | 6.2% |

* Non-case includes revenue from retention products, Invisalign training for enrolled doctors/orthodontists, and other non-core products.

Source: Investor Relations

Company Past Performance

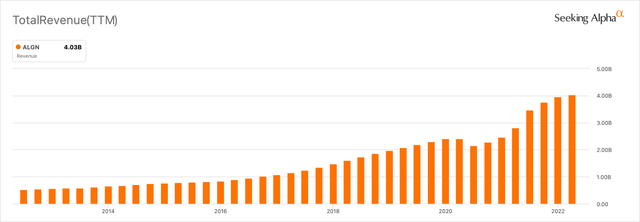

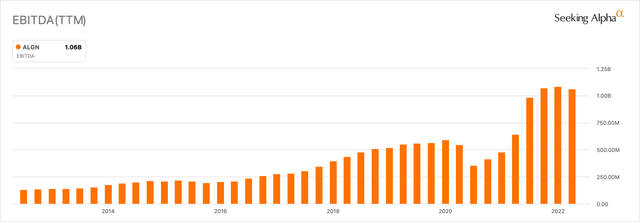

Over the past decade, the adoption of Align Technology’s clear aligners has been growing exponentially. Due to various advantages over traditional braces, the volume of Invisalign case shipments grew from 365.5 thousand in 2012 to over 2.5 million in 2021. As a result, Align Technology’s revenue and net profits increased by over 24% and 33% CAGR respectively between 2012 and 2021.

Align Technology 10-Year Revenue (Seeking Alpha Charting) Align Technology 10-Year EBITDA (Seeking Alpha Charting)

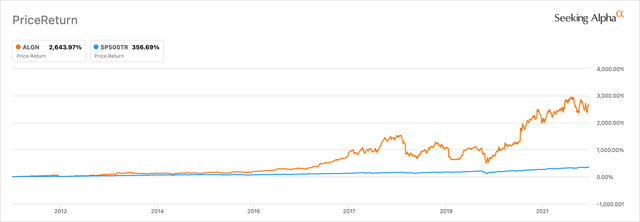

On par with the revenue and profits growth, Align Technology’s stock performed exceptionally well during the period. Share prices appreciated by 39% CAGR from 2012 to the end of 2021, outperforming the S&P 500 by more than 7 times. Truly an alpha in the market.

Align Technology (ALGN) vs S&P500 (Seeking Alpha Charting)

Industry Outlook

Despite the phenomenal growth in the adoption of orthodontic clear aligners over the past two decades, the market is still very young and full of potential. According to Grand View Research, the global clear aligner market has the potential to expand to $32.3 billion by 2030 (from $4.0 billion in 2022), which means a compounding growth rate of around 29.5% per year. On the more conservative side, other researchers are expecting the market to become $10.04 billion by 2028, growing at 19.7% CAGR from 2021.

Factors expected to drive the clear aligner market are the increasing demand for orthodontic treatments among the general population as people become more conscious about their oral aesthetics and health. This is further amplified by the improving availability and accessibility of orthodontic treatment centers, advances in medical technology, and increasing consumer spending power across the globe.

Align Technology estimates that up to 60-75% of the global population are affected by malocclusions to at least some extent, and up to 90% of the 21 million treatment cases in 2021 can be treated using the company’s Invisalign device.

Furthermore, the adoption of clear aligners over traditional braces is also likely to increase significantly in the future as the general public becomes more informed of their advantages. This is thanks to the aggressive marketing efforts by clear aligner providers, positive reviews from patients who have received treatment, and the increasing network of trained orthodontists.

Q1 2022 Results Indicate More Obstacles Ahead

Although the long-term future seems very bright, Align Technology’s Q1 2022 financial results are raising alarms as operating income has fallen by 12.1% YoY and 10.3% QoQ.

Below is an overview of the company’s Q1 2022 financial results.

| Financial Figures | Q1 2022 ($ mil.) | YoY Change | QoQ Change |

| Revenue | 973.2 | 8.8% | -5.6% |

| Gross Profit | 709.3 | 4.8% | -4.7% |

| Operating Income | 198.1 | -12.1% | -10.3% |

| Net Income (GAAP) | 134.3 | -33.0% | -29.7% |

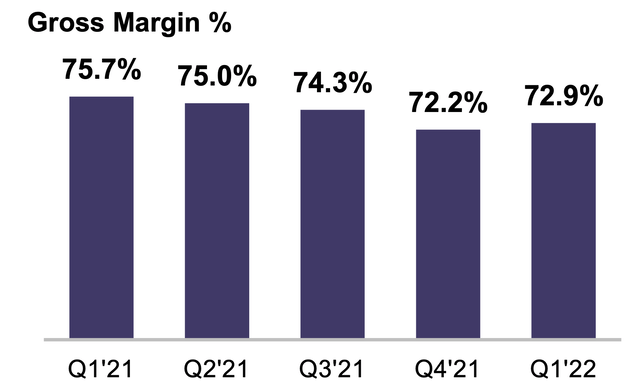

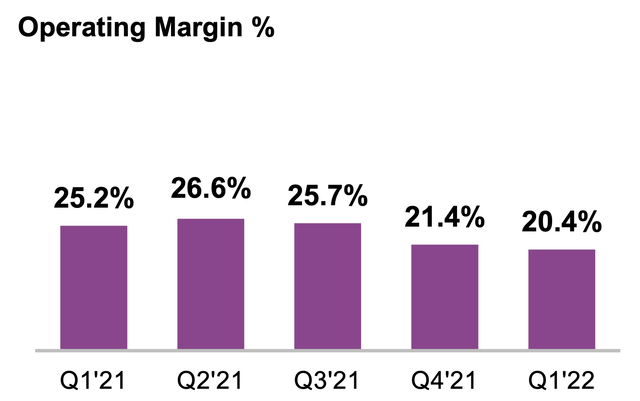

Furthermore, Align Technology’s profit margins are also declining in a downtrend since Q2 2021.

Align Technology Gross Margins (Q1 2021 – Q2 2022) (Investor Relations) Align Technology Operating Margins (Q1 2021 – Q2 2022) (Investor Relations)

The slowing revenue growth and decline in margins are attributed to various external factors occurring since late 2021 and the start of 2022, including the Covid-19 Omicron variant concerns, weakening consumer confidence, increasing costs (e.g. raw materials and shipping) from high inflation, unfavorable foreign exchange rates, and lockdowns in China. While concerns on the Covid-19 pandemic have largely faded in most parts of the world (except China), I believe many other pressures are likely to persist throughout 2022.

The Pressures from High Inflation are Increasing

The world has been experiencing high inflation since the start of 2022 due to supply-chain disruptions from the Covid-19 pandemic and more recently, the Russia-Ukraine war. In late April, IMF has raised 2022 inflation projections by 1.8 percent for developed countries and 2.8 percent for developing countries after the impacts of the Russia-Ukraine war are being increasingly felt. As a result, inflation is expected to be at 5.7% for developed countries and a whopping 8.7% for developing countries. As the Russia-Ukraine conflict still shows no signs of peaceful resolution, oil prices nearing record highs and China still locking down its cities, there is a high chance that the peak of inflation has yet to arrive.

The increasing price of necessities (e.g. food, fuel, housing, and consumer products) leads to reduced consumer spending power, and reduced consumption overall. Due to these financial pressures, many people who are planning to receive their costly Invisalign treatments may rethink or postpone their plans.

Furthermore, consumer sentiment is likely to get worse as the World Bank has recently revised its 2022 global economic growth forecast down to 2.9% from 4.1% at the start of the year, as a result of the increasing inflation. Regions such as the US, Europe, and China where Align Technology is operating are all expected to achieve only half the economic growth seen in 2021.

Back in Q1 2022 when inflation was just getting started, Align Technology’s revenue and operating income already dropped by 5% QoQ and -10.3% QoQ respectively. As the effects of the Russia-Ukraine war and China lockdowns are being more pronounced in Q2 2022, it is likely that the company’s Q2 and possibly Q3 revenue and margins will be even lower.

Unfavorable Foreign Exchange Rates

As seen in the revenue segment table earlier, about half of Align Technology’s revenue is from countries outside the US, notably in Europe, the Middle East, Africa, and the Asia Pacific. The foreign revenue generated will have to be converted back to US Dollars which is subject to the fluctuating foreign exchange rates.

It is apparent that the US Central Bank (the FED) is planning to aggressively increase interest rates this year to combat the high inflation, contrary to many other countries still reluctant to increase their rates due to the fragile economy. The mismatch in global interest rates is likely to boost the value of the dollar further against other currencies.

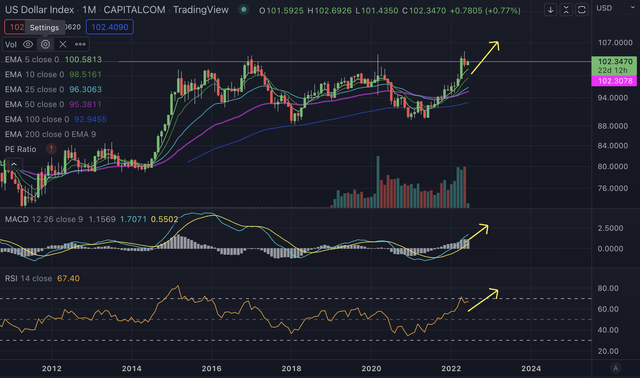

The Dollar Index Technical Chart (Image created by author using Trading View)

If we look at the long-term technical chart of the Dollar Index in the monthly timeframe, we will see that the index is testing the previous high back in 2017. Given the very strong momentum from the MACD and the RSI yet to reach the overbought territory, it is just a matter of time before the index breaks the resistance. Therefore, I expect that the dollar will continue to appreciate against other currencies in the coming months and further reduce the value of Align Technology’s international revenue and profit margins.

Increasing Competition May Impact Long-term Outlook

A large factor that has allowed Align Technology to grow tremendously in the past was the lack of competition. After inventing the clear aligners back in 1997, Align Technology was able to secure patents for its revolutionary product which prohibited any other players from copying. As a result, Align Technology was virtually the sole provider of Invisalign for almost two decades, enjoying rapid revenue growth since its product release.

However, since 2017 when Align Technology’s Invisalign patents expired, numerous competitors entered the market, offering identical clear aligners and treatment models. Many of the competitors are backed by large medical supplies companies with long operating history and the trust of the general public. Furthermore, new startups also emerged into the scene, introducing more affordable versions of the product and alternative treatment models that address certain pain points left by Invisalign. What was once a blue ocean is turning red and bloody.

Align Technology’s clear aligner competitors can be categorized into two groups: the In-Office model and the At-Home model.

In-Office Model Competitors

The In-Office Model is Align Technology’s business model where patients visit trained doctors/orthodontists for prescription of the clear aligners.

Key competitors using this model include:

- ClearCorrect – Institut Straumann AG

- SLX – Henry Schein (NASDAQ:HSIC)

- SureSmile – Dentsply Sirona (NASDAQ:XRAY)

- Clarity Aligners – 3M (NYSE:3M)

Regarding product quality, most competitors’ products are fairly similar to Invisalign according to the reviews I came across. All clear aligners do their job of aligning mild to moderately severe cases of malocclusion (misaligned teeth) within 6-18 months. Meanwhile, there are mixed opinions on the details such as comfort, visibility, and durability of each provider.

In terms of pricing, the product lines from most competitors are moderately cheaper than that of Invisalign. While not game-changing, a difference of $500 – $1,000 may be enough for certain groups of customers to consider the competing brands. Below is a comparison table of Align Technology’s Invisalign and its In-Office competitors.

| Invisalign | Clear Correct | SureSmile | 3M Clarity | |

| Material | SmartTrack thermoplastic material; FDA-approved, BPA, BPS, latex, and gluten-free | Polyurethane resin, FDA-approved, BPA and phthalate-free, thinner than Invisalign | Essix Plastics | Five Layers of Polymer Material |

| Treatments Available | Mild to Complex | Mild to Complex | Mild to Moderate | Mild to Complex |

| Treatment Duration | 12-18 months (depending on complexity) | 12-18 months (depending on complexity) | 6-18 months (depending on complexity) | 6-24 months (depending on complexity) |

| Cost | $3,500 – $8,500 | $2,000 – $8,000 | $3,000 – $6,000 | $3,000 – $8,000 |

Sources: Dentaly.org, Smile Prep, Journal Clinic of Orthodontics

At-Home Model Competitors

In contrast to the In-Office model, the At-Home model does not require patients to visit an orthodontist for prescription of the clear aligners. The process starts with the customer obtaining an impression of their teeth using an at-home kit given by the aligner company. The impression is sent back to the service provider to manufacture the clear aligners accordingly. Finally, the tailor-made set of clear aligners is then mailed to the customer with proper instructions for treatment.

Companies providing the At-Home model include:

One of the biggest advantages of the At-Home model is the lower prices. At-Home clear aligners only cost around half of a typical In-Office Invisalign treatment as no doctors are required for the prescription. Furthermore, customers can conveniently undertake the treatment at home without needing to visit the dentist. At-Home treatments also tend to take less time (typically within 6 months) due to the simpler treatment process. The table below compares key At-Home aligner providers to In-Office ones.

| Brand | Type of Treatment | Cost Range | Average Treatment Time | Treatment Complexity |

| Invisalign | Regular in-office visits | $3,500-$8,500 | 12 to 18 months | Mild to severe |

| ClearCorrect | Regular in-office visits | $2,000-$8,000 | 12 to 18 months | Mild to severe |

| Smile Direct Club | At-home, physical centers available | $1,950, or $89/month | 6 months | Mild to moderate |

| Byte | At-home | $1,895, or $83/month | 3 months | Mild to moderate |

| Candid | At-home and in-office | $1,895, or $65/month | 6 months | Mild to moderate |

| NewSmile | At-home | $1,395, or $83/month | 6 months | Mild to moderate |

| Dandy | At-home, in-office visits | $1,900-$2,600 | 8 to 14 months | Mild to severe |

| AlignerCo | At-home | $1,145, or $113/month | 6 months | Mild to moderate |

Source: Dentaly.org

Unsurprisingly, there are a lot of drawbacks to the At-Home model. Firstly, these clear aligner programs are only capable of treating mild cases of malocclusions. Secondly, the lack of proper consultation with trained doctors increases the risks of unsuccessful treatment and adverse effects on the patient’s oral health, which can end up costing more money in the end. In fact, the American Association of Orthodontists has cautioned the public against undertaking at-home clear aligner treatments due to the lack of proper supervision from professional doctors and numerous complaints from customers.

My Take on the Market Competition

Despite the high number of competitors offering identical clear aligners at lower prices and simpler treatment processes, I still believe Align Technology’s Invisalign should be able to maintain its dominance in the market. This is thanks to the very strong brand image, the largest network of doctors, long operation history, and trust from the general consumer established over the span of two decades. Align Technology also invests heavily in R&D which should allow its products to stay on top over the long term.

However, this is not to say that other competitors don’t stand a chance. As of 2021, Align Technology holds roughly 80-85% of the global clear aligner market share. I would expect this figure to decrease over time to somewhere between 60-70% as not everyone will be able to afford to pay $3,500-$8,500 for teeth alignment. Those with mild malocclusions and a limited budget may consider the wide range of at-home options available. Moreover, I have not mentioned the emerging competition from foreign countries like China (e.g. AngelAlign) and South Korea, which can potentially play a bigger role in the future.

Valuations

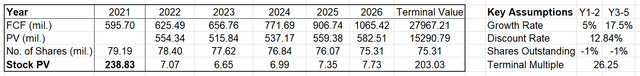

Due to the relatively predictable nature of the business, a suitable method for finding the valuation of Align Technology would be Discounted Cash Flow (DCF). For simplification, I will be forecasting the free cash flow 5 years ahead based on the conditions we have discussed earlier, before ending with a terminal value.

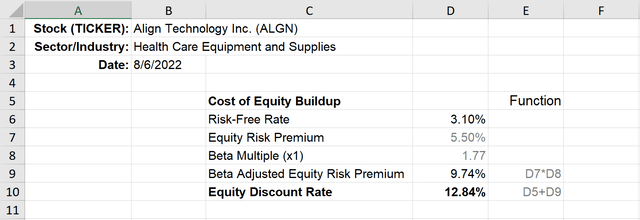

The Discount Rate

The discount rate will be calculated by finding the cost of equity of the company. As Align Technology has very little debt compared to its equity, the cost of debt will be ignored for simplicity. In the calculation table below, I am using the 10-year US bond yield of 3.10% as a rough figure for the risk-free rate, Equity Risk Premium at 5.50%, and Align Technology’s stock beta of 1.77 as of June 8th, 2022. This leads to a discount rate of 12.84%.

Growth Assumptions

For future free cash flow growth, I will split the assumption into two time periods: growth rate for the next two years (Y1-2) and growth rate for the third year onwards until year five (Y3-5). Ultimately, the fifth year’s free cash flow estimate will be multiplied by a terminal multiple which will be given as 1.5 times the latest growth rate (resembling a PEG ratio of 1.5), leading to our terminal value for the calculation.

As discussed earlier, it seems that the current high inflation, weakening global consumer confidence, and strong dollar value will continue to persist through most parts of 2022 before gradually stabilizing in 2023. Therefore, I forecast a modest free cash flow growth of only 5% CAGR during 2022-23. While this may sound very conservative, let’s not forget that Align Technology just reported a free cash flow of -$110.4 million for Q1 2022, a lot of making up to do in the upcoming quarters to achieve positive annual growth.

For the long-term growth rate (Y3-5), under the assumption that the global clear aligner market grows by approximately 25% CAGR (a middle ground between Grand View Research and Fortune Business’s figures) and Align Technology maintains roughly 70% market share in the increasingly competitive space, a 17.5% CAGR growth rate should be reasonable.

Multiplying the fifth-year growth rate by 1.5, we get a terminal multiple of 26.25 (17.5*1.5).

Lastly, as Align Technology still has plans to repurchase over $650 million worth of its shares, I roughly assume the number of outstanding shares will decrease by 1% each year in the forecast.

Below is our Discounted Cash Flow calculation table with all the assumptions in place:

2021 free cash flow figure from Seeking Alpha

According to our Discounted Cash Flow model, Align Technology has a fair value of roughly $239 per share which is below the stock price at the time of writing (approximately $270 on June 8th, 2022).

Conclusion

Align Technology was a true alpha in the past decade, yielding investors massive returns each year. The company’s long-term future is still very bright thanks to the large total addressable market and the huge potential demand across the globe. However, in the medium-term, it is facing various external pressures from high inflation, weakening economic outlook, unfavorable exchange rates, and lockdowns in China. Competition is also becoming more intense as numerous large corporations and new startups are trying to secure their piece of the pie. Taking all these factors into our Discounted Cash Flow calculation, we arrive at a fair value of $239 per share which indicates that there is still room for the stock price to fall further. Therefore, Align Technology is rated as a “Hold” for the time being.

Be the first to comment