dogayusufdokdok/E+ via Getty Images

One of my favourite video games as a kid growing up was Sim Farm. While other kids enjoyed playing sports and shooting games, I liked playing business simulators. From my recollection, one of the best crops to grow within Sim Farm was oranges. Not only are orange groves perennial (they do not require replanting after every harvest), the crop also stores well and can be sold during the winter months when the price usually skyrockets (early stock trader training!).

Imagine my level of curiosity when I came across Alico, Inc. (NASDAQ:ALCO), one of the largest growers of citrus in the United States.

I believe Alico is an undervalued asset play. Its holdings in Florida citrus groves and ranch lands gives the company over $46 / share in real estate value. The operating business can also generate substantial operating income during good years. However, the biggest near-term risk is Hurricane Ian’s impact on the upcoming crop and fiscal year. While I like the asset value, I think investors should wait until we get more details on how bad F2023 will get.

Company Overview

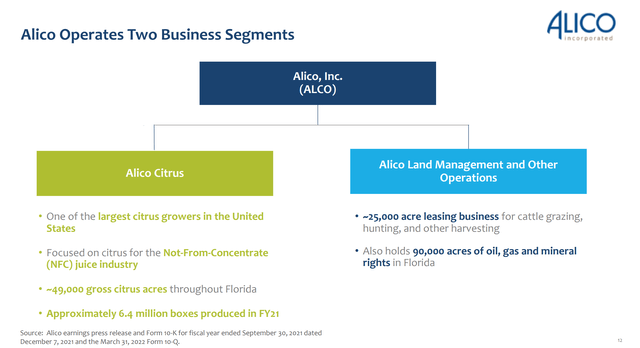

Alico, Inc. is an agribusiness based out of Florida. The company owns and/or manages 83,000 acres of land in eight Florida Counties (Charlotte, Collier, DeSoto, Glades, Hardee, Hendry, Highlands and Polk), and approximately 90,000 acres of mineral rights throughout Florida.

Alico’s principal business is tending citrus groves. The company is one of the largest citrus growers in the U.S. with ~49,000 acres of owned citrus groves throughout Florida. The company also manages ~7,000 acres of citrus groves for affiliated third parties and leases out ~25,000 acres of land for cattle grazing, hunting, and other harvesting activities (Figure 1).

Figure 1 – Alico Overview (ALCO Investor Presentation)

Citrus Is The Main Value Driver

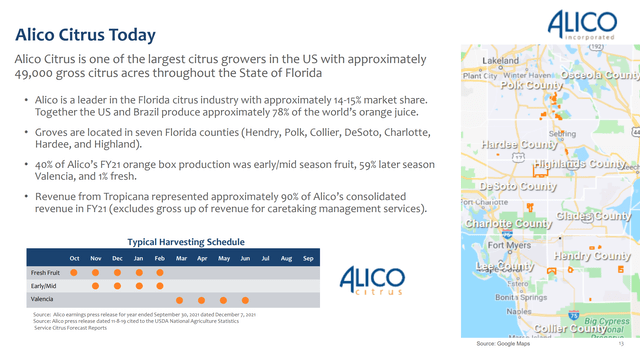

Alico’s citrus business accounts for over 97% of the company’s revenues and is the main value driver for the company. Alico has ~14-15% of the Florida citrus market and primarily produces citrus fruit for processing, as only 1% of Alico’s crop is fresh fruit for sale. Tropicana, PepsiCo’s (PEP) fruit juice brand, represents approximately 90% of Alico’s revenues (Figure 2).

Figure 2 – Alico Citrus Overview (ALCO Investor Presentation)

Citrus Industry Has Been Hard Hit By Disease And Weather

In the past few years, the Florida citrus industry has been hit hard by a variety of issues. First, Florida citrus growers have been fighting a bacterial disease called ‘Citrus Greening’ for the past decade. Huanglongbing (“HLB”) or citrus greening, was first documented in the early 1900s in southern China. HLB causes citrus trees to develop sickly yellow leaves and small, lopsided green fruits that drop early and have poor taste.

HLB was first spotted in Florida in the mid 2000s, and since the first discovery, the disease has spread rapidly to almost every citrus producing county in the state. There’s no easy cure for the disease and many farmers have resorted to ripping up groves of citrus trees to prevent its spread.

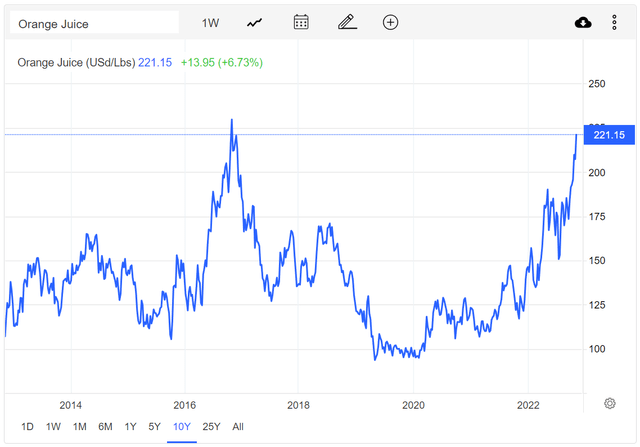

This year, the HLB disease issue was further compounded with frost in January and Hurricane Ian in September. Initial government estimates following the hurricane has orange production declining 32% or 28 million boxes from last season. The immediate impact of Hurricane Ian can be seen in the price of orange juice futures, which surged to multi-year highs in recent weeks.

Figure 3 – Orange juice futures prices (tradingeconomics.com)

For Alico specifically, although much of the company’s citrus groves were spared from the direct impact of Hurricane Ian (with the exception of a grove in Charlotte county), the company did experience significant drop of fruit from its citrus trees. Formal damage calculations are ongoing and we should learn more at the next earnings release in mid-November. Thankfully, this appears to be a one-season issue as most of Alico’s citrus trees remain intact.

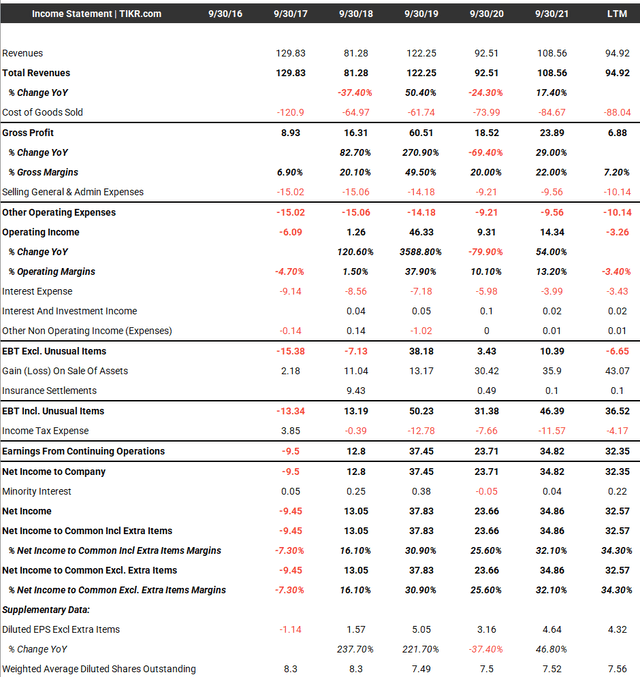

Financials Are Quite Volatile

Alico’s revenues can be quite volatile. Fiscal 2018 saw a large decline YoY as the company was recovering from the impact of Hurricane Irma in 2017 that damaged the F2018 citrus crop. (Figure 4).

However, Alico was able to bounce back strongly in F2019, recording one of the best crops in years with 8.1 million boxes harvested vs. 4.8 million boxes in F2018 and 7.6 million boxes in F2017. Although F2020’s harvest was decent at 7.6 million boxes, realized prices were low, leading to weak financial performance. F2021 saw a weak harvest of only 6.4 million boxes, but prices rebounded strongly, so revenues were higher than F2020.

Figure 4 – Alico financials summary (tikr.com)

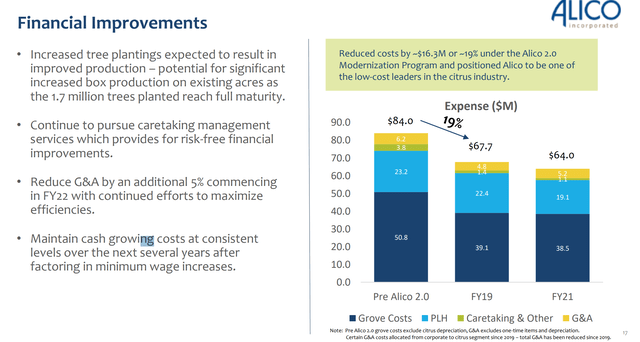

Alico’s operating income largely followed the ebb and flow of revenues, although beginning in late 2017, the company began implementing an ‘Alico 2.0’ modernization program that reduced operating costs and improved margins. As can be seen in Figure 5, Alico 2.0 has been successful in reducing operating costs significantly.

Figure 5 – Alico 2.0 modernization program (ALCO Investor Presentation)

F2022 Has Been Weak

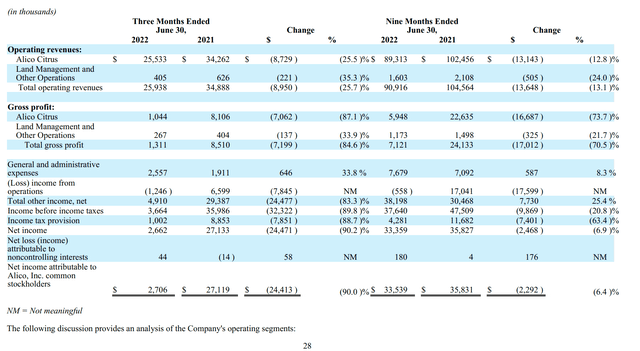

Looking at Alico’s YTD results, the harvest has been weak due to January’s frost, with Alico reporting YTD harvest of only 5.5 million boxes in the 9 months to June 30, 2022, 13% lower than the same point in F2021. This has led to a commensurate decline in YTD revenues. Alico’s margins are also noticeably weaker on higher fuel and fertilizer prices, with a gross margin of only 6.7% YTD in Alico Citrus, the lowest in years (Figure 6).

Figure 6 – Alico Q3/2022 Financial Summary (Alico Q3/2022 10Q Report)

F2023 Will Be A Write-off

With regards to the impact of Hurricane Ian, as the hurricane made landfall in the last days of September, Alico’s Q4/F22 results should be largely unaffected, as most of the harvesting would have been completed. However, there is likely significant damage to Alico’s current crop (early season crop harvests from November to February) that will negatively impact F2023’s revenues. Looking at Alico’s performance from F2017 to F2018, we can see revenues fell 37% as the fruit harvest was 37% lower (4.8 million boxes vs. 7.6 million boxes). If history is any guide, F2023 will likely be a write-off year.

But Reasons To Be Hopeful Further Out

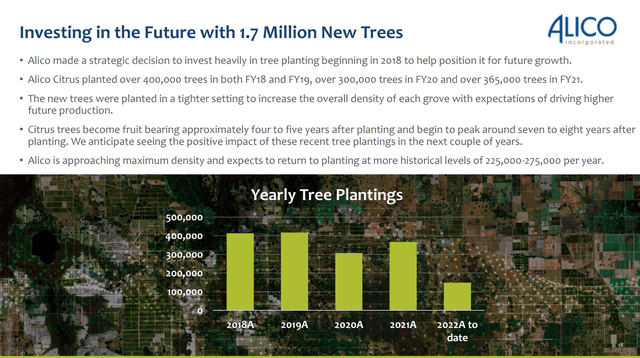

However, looking beyond F2023, there are reasons to be hopeful. First, as was mentioned above, Hurricane Ian largely spared Alico’s citrus trees from structural damage. So the decrease in harvest should only impact one season. Furthermore, after Hurricane Irma, Alico made a strategic decision to invest heavily in planting new citrus trees. In total, Alico planted over 1.7 million trees in the past four years, far above historical levels of ~250k trees per year (Figure 7).

Figure 7 – Alico has been investing for the future (Alico Investor Presentation)

Citrus trees typically bear fruit 4-5 years after planting and peak around 7-8 years after planting, so the positive impact of Alico’s new plantings should begin to show up in 2023.

Alico Has Significant Asset Value And Pays A Big Dividend

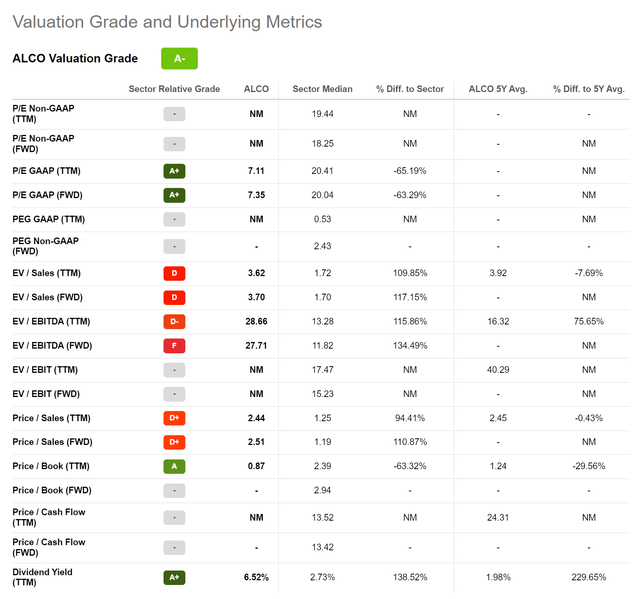

Alico is not forecasted to have earnings in F2022, so it is difficult to value Alico on traditional valuation metrics (Figure 8).

Figure 8 – Alico valuation (Seeking Alpha)

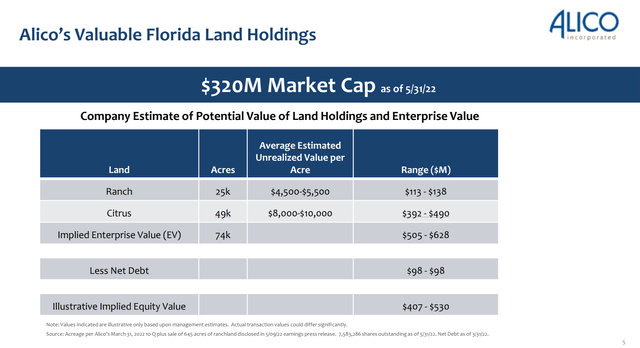

However, there are some positive attributes to Alico that investors should consider. First, although Alico’s financial performance is volatile, the company does hold a lot of valuable real estate assets. According to a recent company presentation, Alico has $500-600 million in real estate assets from its citrus groves and ranch land (Figure 9).

Figure 9 – Alico holds valuation real estate (Alico Investor Presentation)

Looking at a recent public transaction that Gladstone Land Corporation (LAND) made in Florida, Gladstone bought 617 acres of citrus groves for $5.2 million or $8.4k per acre. This largely substantiates Alico’s valuation range of $8-10k / acre for citrus lands.

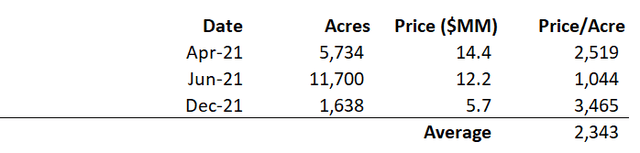

However, looking at recent transactions involving Alico’s ranch lands, I believe the ~$5k / acre value ascribed by the company may be high. According to data from the Alico’s F2021 10-K report, Alico’s ranch lands only fetched ~$2,300 / acre across 3 transactions in 2021.

Figure 10 – Alico ranch lands 2021 transactions (Author created with data from Alico 2021 10K Report)

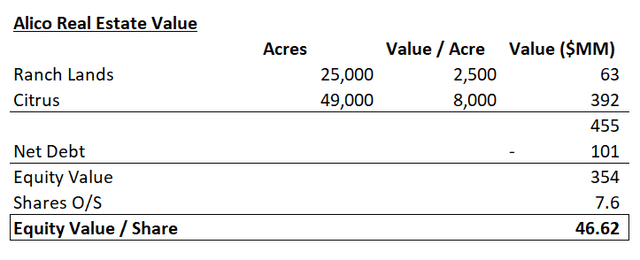

Using more realistic ranch values of $2,500 / acre and $8,000 / acre for citrus groves, I come up with real estate value of over $46 / share for Alico (Figure 11).

Figure 11 – Alico real estate value (Author created)

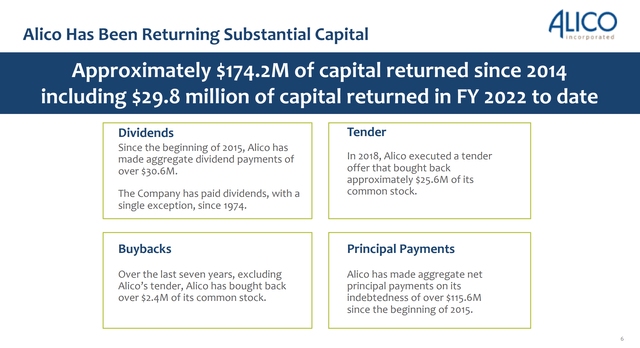

In addition to having significant real estate value, Alico has also been returning significant amounts of capital to shareholders. Since 2014, the company has paid over $30 million in dividends and bought back $28 million in shares. The company have also reduced debt by $116 million in the past few years, reducing balance sheet risk (Figure 12).

Figure 12 – Alico has returned $174 million in capital (Alico Investor Presentation)

Finally, Alico is currently paying a $0.50 / quarter dividend, which translates to a 6.3% forward dividend yield. The dividend was recently increased in June 2021 from $0.18 / quarter.

Risks

The biggest near-term risk to Alico is Hurricane Ian’s impact to the upcoming fiscal year. If the upcoming season is as bad as F2018 (37% decline YoY), then Alico could be looking at significant operating losses. Furthermore, elevated fuel and fertilizer costs appear to be here to stay, which could pressure operating margins.

Looking further out, climate change appears to be changing weather patterns, with tropical storms becoming more damaging, if not more frequent. According to NOAA, 9 of the 10 costliest tropical storms have occurred since 2000, and 4 of the top 5 have occurred since 2010. Hurricane Ian is estimated to cost private insurers $63 billion dollars and will be remembered as the costliest storm in Florida’s history. Clearly, changing weather patterns, especially the severity of tropical storms, will have a negative impact to Alico’s business since a single storm can ruin a whole season’s harvest.

Conclusion

In summary, Alico is an undervalued asset play. Its holdings in citrus groves and ranch lands gives the company over $46 / share in real estate value. The operating business can also generate substantial operating income during good years like in 2019. However, the biggest near-term risk is Hurricane Ian’s impact on the upcoming season and fiscal year. While I like the asset value, I think investors should wait until we get more details on how bad F2023 will get.

Be the first to comment