Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 28.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the last week of October.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

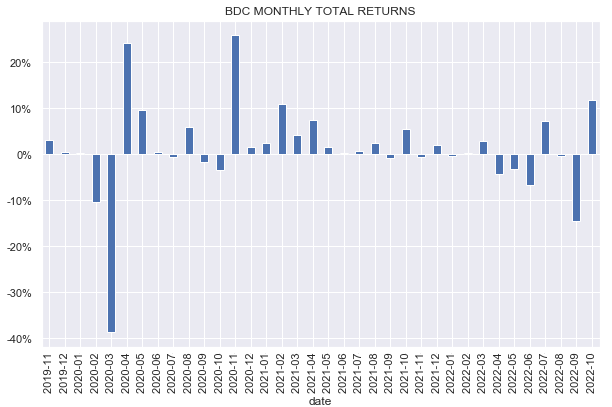

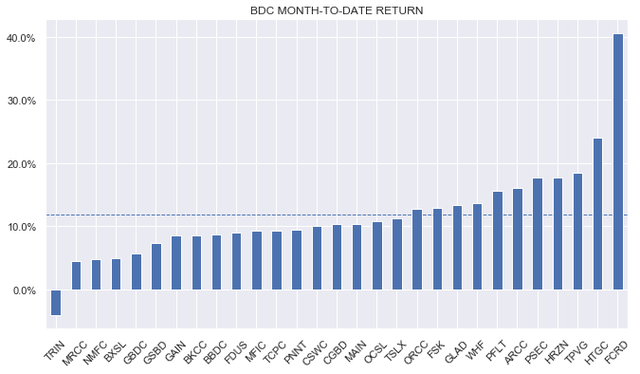

BDCs had a great week, outperforming nearly all other income sectors and generating a 5% return. ARCC was in the lead with a 10% jump on the back of strong earnings. In October the sector had a 12% return.

October didn’t quite reverse the drop over September but it came close.

Systematic Income

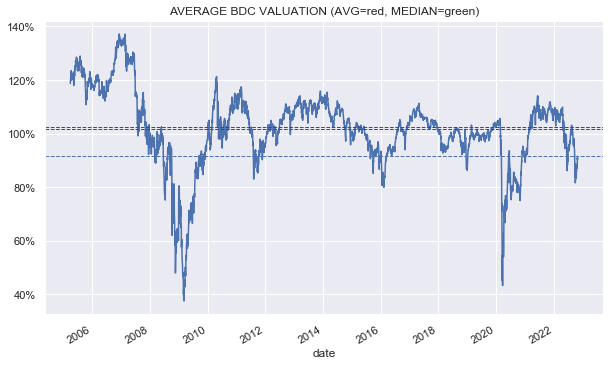

Sector valuation had a nice bounce, rising to 91% from a very depressed recent trough of around 80%. Recall that these figures are slightly overstated (i.e. actual valuations are likely 1-2% higher) as they are based on Q2 NAVs and we expect NAVs to tick lower marginally.

Systematic Income

As we highlighted in the last month or so the sector was well set up for a bounce on the back of strong earnings and relatively stable NAVs. The current valuation is still attractive in places but obviously less compelling than it was.

Market Themes

One of the things that’s interesting to track is the level of insider trading in the BDC sector. Insider trading is clearly not the be-all and and-all of BDC allocation since we don’t know what else these individuals are trading, that they are likely limited in what trades they can make due to the likely need to disclose their trades internally (i.e. it would look bad for a BDC manager to be buying a ton of another BDC’s shares) or the specific reasons for their trades.

That said, the information on what insiders are doing is clearly useful for income investors given insiders know more about their own companies than non-insiders, not just by virtue of their privileged position but also because of their deeper industry experience and familiarity with the asset class. It also matters because studies have shown that insiders tend to earn abnormal returns on their transactions.

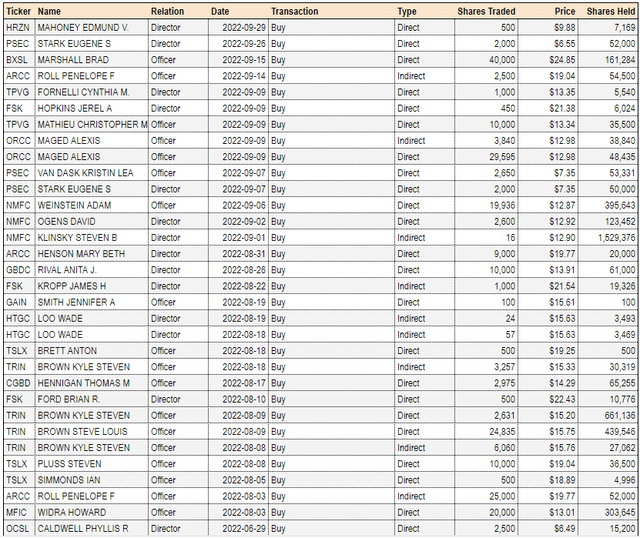

The table below is an extract from our service BDC Tool and lists open-market insider trades over Q3 for the BDCs in our coverage universe. What’s interesting is that there were no open-market Sale transactions. And two, the majority of BDCs in our coverage had at least some Buys.

Insiders are clearly seeing value in current valuations. Of course, it doesn’t tell us that the trough is behind us or that NAVs won’t move lower but it is still a positive signal for income investors.

Market Commentary

Ares Capital Corp (ARCC) released Q3 numbers which we highlighted recently in greater depth. Overall, the results fall very nearly along the lines of previously discussed expectations for the sector. NAV came in 1.3% lower – in the meaty part of the 0-2% drop we expected. Core net income rose by 9% – this is pretty healthy and less than the strictly quantitative figures disclosed by the company but certainly better than the goose egg that some skeptics predicted. Credit quality is also holding up well – non-accruals were unchanged for last quarter and net realized losses were low at -0.2%.

Trinity Capital (TRIN) had a tumble due to the Compass Point price target change to $12.75 from $18 as well as further stress in the bitcoin mining sector to which it lends. TRIN has exposure to 3 publicly traded miners with loans out to 2024-2025 totaling about $70 which is 15% of its Q2 Equity.

With a very conservative assumption that all of these loans are written down to zero – the company’s valuation will still be around 97%. In other words, there is a large margin that is already baked into the current price.

Earlier TRIN said that its bitcoin miner LTV in Q2 was below 90% LTV which is actually fairly aggressive, however, that was at a time when bitcoin was trading at a slightly lower price than it is now. Arguably, the cost of mining equipment has depreciated further since then but the depreciation path is taken into account at the outset.

The most concerning loan is to Core Scientific (CORZ) which just said it could run out of money by the end of the year and that it is unlikely to continue making payments on its equipment financing. It is very likely that TRIN will take a loss on this position (which is about 5% of its NAV) – we will know more once the results come out.

We should also add that the common shares of the other two borrowers look fine – one is up since the end of Q2 and the other is down by single digits. The combination of a rise in energy prices and a low bitcoin price is putting pressure on the sector.

Stance & Takeaways

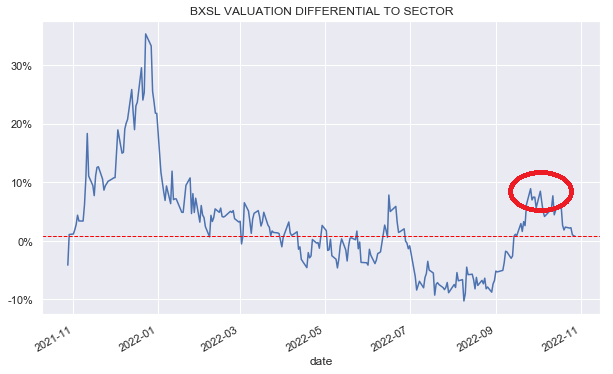

The BDC sector has continued to grind higher, leaving fewer obvious opportunities on offer. A few weeks ago we highlighted that BXSL looked somewhat expensive when it approached a 10% valuation premium relative to the sector. This has now reversed, making it cheap in our view once again.

Systematic Income

Be the first to comment