David Becker

Earlier on, I wrote a bullish article about Alibaba Group Holding Limited (NYSE:BABA, BABAF) and its cheap stock. I said there was a possibility for it to plunge further. Since then, the company’s shares have risen by almost 23%. It was near the time when BABA was trading at record lows.

Now, the company has declared its fiscal Q2 2023 earnings results. Earlier on, the market also watched the meeting of Xi and Biden. It was important since the relations between the two countries have been quite complicated for a while. But let me try to analyze what the future holds in store for Alibaba.

Earnings results

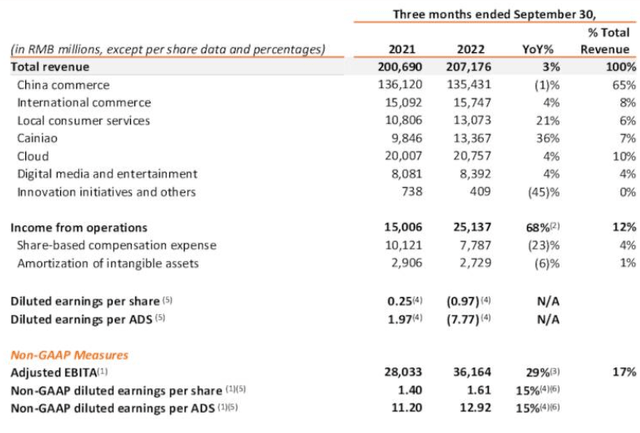

In some respects, Alibaba’s earnings results were somewhat better than they had been for the same period a year ago.

For example, the revenue figure rose by 3%. Most of the gains were due to the local consumer services (+21%) and the Cainiao division (+36%), BABA’s logistics company. Unfortunately, these two departments make only small parts of the total revenues BABA reports. A lion’s share (65%) of Alibaba’s sales is due to China commerce, the indicator that declined by 1% compared to the same period a year ago. In my view, there is nothing horrible, but at the same time, this is quite bad news for Alibaba. It is widely considered a high-growth business operating in the technology sector. That means that in order to meet its investors’ expectations, it should demonstrate reasonably high and stable growth.

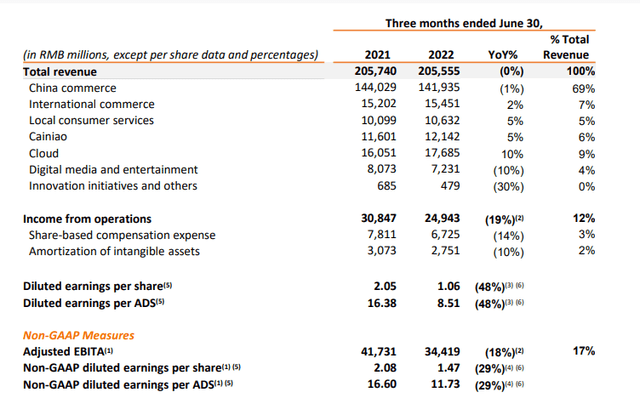

Source: Alibaba’s earnings presentation, slide 3.

I would also like to present another set of results, namely the one reported for the quarter that ended on 30 June 2022.

And in order to make the comparison easier, I also prepared a table with the two sets of results.

| in RMB millions, except per share data | Three months ended 30 September 2022 | Three months ended 30 June 2022 | ||||

| Total revenue | 207 176 | 205 555 | ||||

| China commerce | 135 431 | 141 935 | ||||

| International commerce | 15 747 | 15 451 | ||||

| Local consumer services | 13 073 | 10 632 | ||||

| Cainiao | 13 367 | 12 142 | ||||

| Cloud | 20 757 | 17 685 | ||||

| Digital media and entertainment | 8 392 | 7 231 | ||||

| Innovation initiatives and others | 409 | 479 | ||||

| Income from operations | 25 137 | 24 943 | ||||

| Share-based compensation expense | 7 787 | 6 725 | ||||

| Amortization of intangible assets | 2 729 | 2 751 | ||||

| Adjusted EBITA | 36 164 | 34 419 | ||||

Source: Prepared by the author based on Alibaba’s data.

Overall, we can see that the results for the September quarter were better than the ones reported for the June period. This is true of the EBITA and the revenue figures. But such a rise in revenue is not impressive for a growth-star company like BABA, I think.

But given the risk factors, which I will explain in some more detail later on in this article, the sales and EBITA were not horrible. Now, moving on to the net loss.

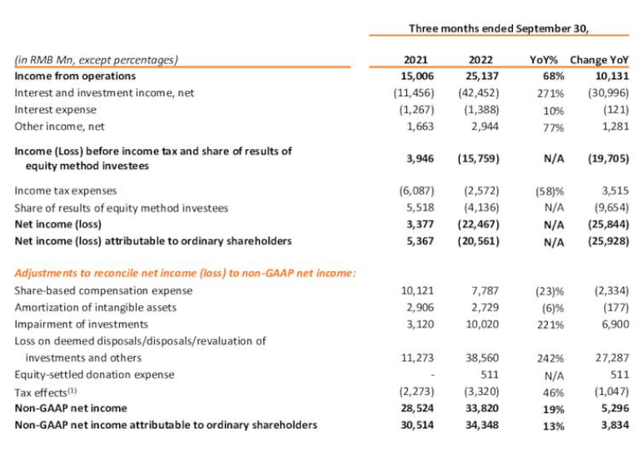

Source: slide 5.

According to the management’s statement, a rise in the company’s net loss was due to the fall in the market value of Alibaba’s equity investments in listed companies and a decrease in the share of results of equity method investees. In other words, the GAAP method ensures the value of investments is taken into account. The non-GAAP method, also used by Alibaba, excluded any gains or losses from the changes in the company’s investments. So, according to BABA’s non-GAAP, the net income totaled RMB33,820 million or US$4,754 million. This was a rise of 19% year-over-year. Not bad!

But overall, the results were neither particularly good nor awfully bad. The revenue growth has slowed down, whilst the company’s investments are not growing in value. At the same time, the net loss did not constitute an operating loss. BABA’s EBITA is positive. We should also bear in mind the company is suffering from a challenging environment. In my view, the market took this all into account when its stock price started rising after the results were published. Now I will talk about the environment the company operates in.

China-U.S. relations

Quite recently Joe Biden and China’s Xi Jinping had a meeting to discuss key issues with each other. This discussion was called “a baby step” in the two countries’ relations by analysts. No agreements on the key issues were reached.

At the same time, there are many potential areas of conflict between the U.S. and China. The situation around Taiwan is certainly one of the most significant ones. China’s relations with North Korea are also on the agenda but do not seem to be as pressing as Taiwan. But these are purely political issues. Economic problems have not disappeared since the U.S.-China trade war when Donald Trump served as the U.S. President. In October, the U.S. introduced unprecedented export bans on some semiconductor technologies. Earlier on it also sanctioned Chinese leading technology firms. These measures imposed against China explicitly target the country’s important technology sectors, including artificial intelligence and military modernization.

The point I am making is that there are many things to worry about on that front. This is particularly risky for Alibaba since it is one of the leading technology companies in China.

After the meeting between Xi and Biden took place, BABA’s stock appreciated because the market viewed this as a step towards stabilization. It might be so, but there are too many things Beijing and Washington can hardly agree on. So, it looks like investors are too optimistic in that respect.

Risks

Apart from the U.S.-China relations, there are other risks for Alibaba. One of these is the coronavirus pandemic and the Chinese authorities’ zero tolerance towards the spread of Covid-19. In other words, when there are several infections discovered in a large city, the whole city is shut for a lockdown. This is obviously not good for Chinese economic growth. Alibaba also faced very moderate revenue growth partly due to the lockdowns in China. Then, there is a global recession everyone expects nowadays due to monetary tightening in many countries around the world. This is certainly a real risk for Alibaba. At the same time, the company has been facing very high regulatory pressures from the Chinese authorities. The government of China decided to fight the largest high-tech companies’ monopolistic practices. Since the end of 2020, Alibaba’s stock started falling partly due to investors’ panic around Chinese authorities’ regulations. So, we can see there are plenty of things to worry about.

Valuations

Alibaba’s valuations are really low and the stock should certainly trade much higher than it is trading now.

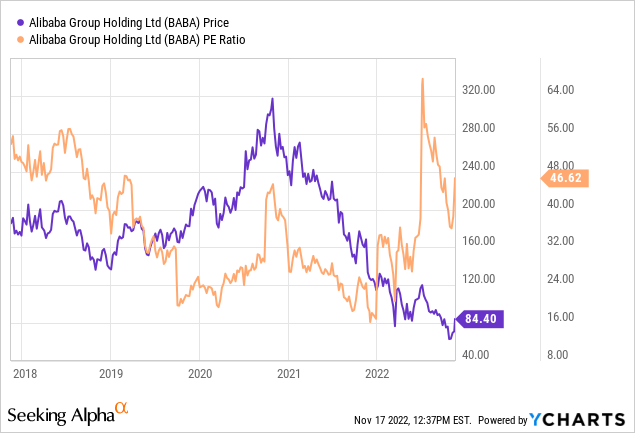

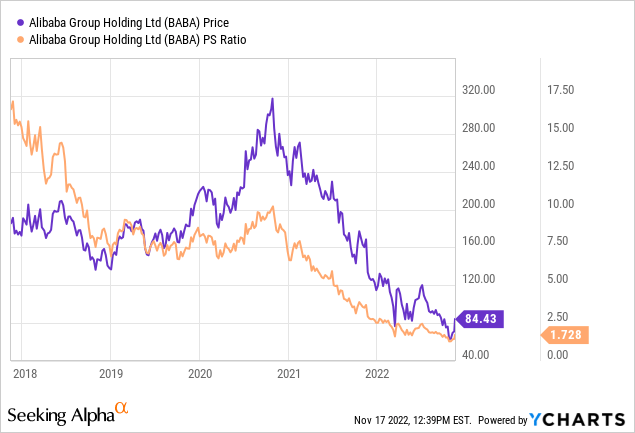

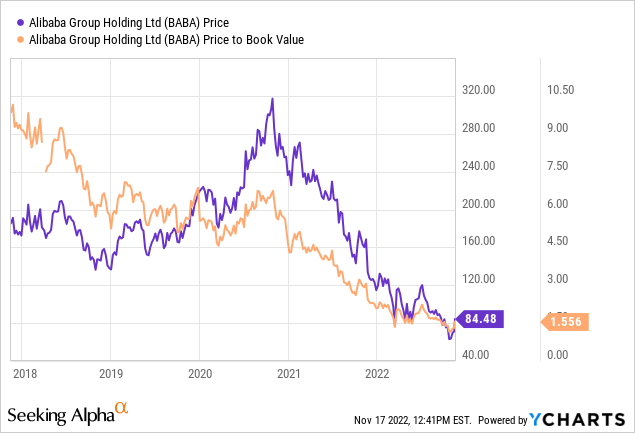

The company has been facing falling net profits but not declining revenues. I decided to use the price-to-earnings (P/E), the price-to-sales (P/S), and the price-to-book (P/B) ratios to judge the company’s value.

As I have mentioned above, the company’s profits have been declining. That is why it seems logical Alibaba’s P/E is not near all-time lows. As of the time of writing it is about 47, neither too high, nor too low for Alibaba but quite acceptable for a high-tech firm.

Alibaba’s P/S is low right now. As I have mentioned in my other articles, a reasonable P/S should be between 1 and 3. High-tech companies have been traditionally overvalued. So, an indicator of 1.7 as of the time of writing is very low for Alibaba, especially if you look at the company’s P/S ratio history.

The same is also true of Alibaba’s P/B ratio. As of the time of writing, it is lingering at just above 1.5, far below the company’s 5-year maximum of 10. Not to mention such an indicator is very low for one of the largest technology companies in the world.

Conclusion

Overall, I remain a cautious optimist. Alibaba published a reasonable set of results. But there are plenty of risks for Alibaba. At the same time, given the negative external factors, the company is doing pretty well. In my view, the market reacted too positively to the recently published earnings. But Alibaba has good long-term potential, provided there is no serious, prolonged crisis or shocking news in the near future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment