vchal

MGE Energy, Inc. (NASDAQ:MGEE) is investing heavily in the development of new solar, wind, and battery resources, which will likely bring further earnings from 2023. In my view, if management also continues to shift away from coal, and uses more natural gas, earnings will likely continue to trend higher. Under my own discounted cash flow model, I obtained a fair valuation, which appears higher than the current market price.

MGE Energy Reports A Diversified Customer Base, And Expects Massive Investments In the Renewable Industry

The diversified customer base is among the most appealing features of MGE Energy. MGE provides service to 159,000 customers in the city of Madison and adjacent areas, including 876 residences and 1369 industries and businesses. Management also claims to supply natural gas to 369k customers.

Source: MGE Energy Third-Quarter Financial Update

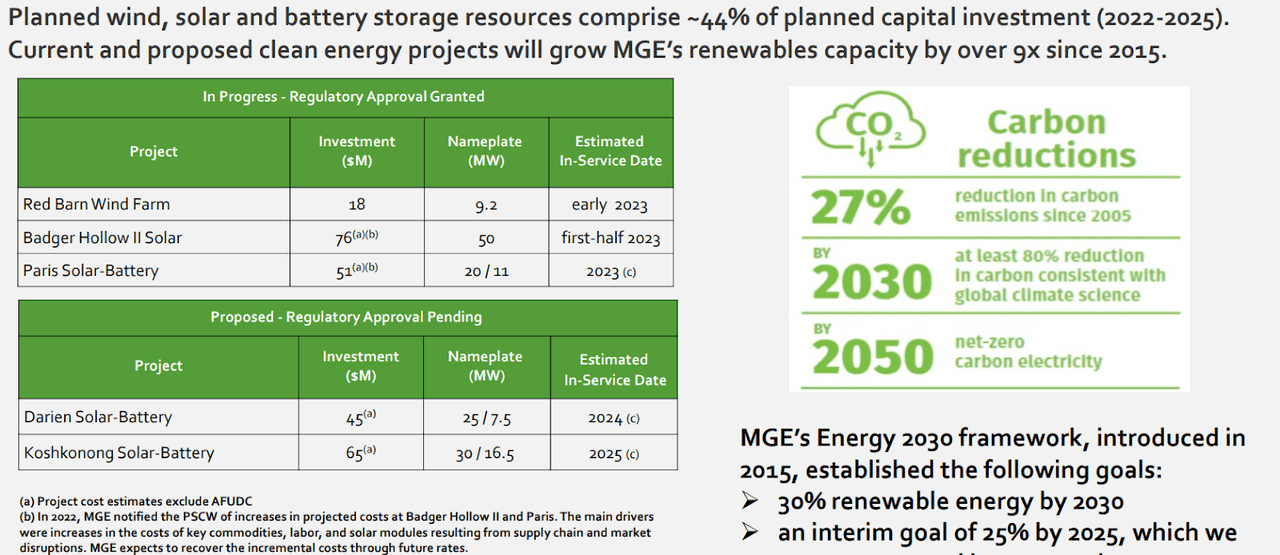

It is quite appealing that MGE expects to invest a lot of money in solar, wind, and battery resources. Investments in these industries are expected to comprise 44% of the total investment from 2022 to 2025. Considering the expected growth of the renewable industry, it appears very beneficial that management is investing heavily in these sectors. If more investors learn about the incoming projects, the demand for the stock will likely increase.

The Global Renewable Energy Market Size was valued at USD 881.70 billion in 2021 and is expected to reach USD 1930.60 billion by 2030, growing at a CAGR of 8.50 % during 2021-2030. Spherical Insights & Consulting

The Red Barn Wind Farm, with an investment of $18 million, 9.2 MW nameplate, and estimated for early 2023, is among the projects noted in a recent report. Besides, MGE noted that the Badger Hollow 2 Solar, with an investment of $76 million, is estimated for the first half of 2023. In my view, we could expect an increase in the free cash flow margin and revenue growth from 2023 because many projects are expected to be in-service around that year.

Source: MGE Energy Third-Quarter Financial Update

The Balance Sheet Appears Healthy, And The Cash Flow Statement Includes Positive CFO And FCF

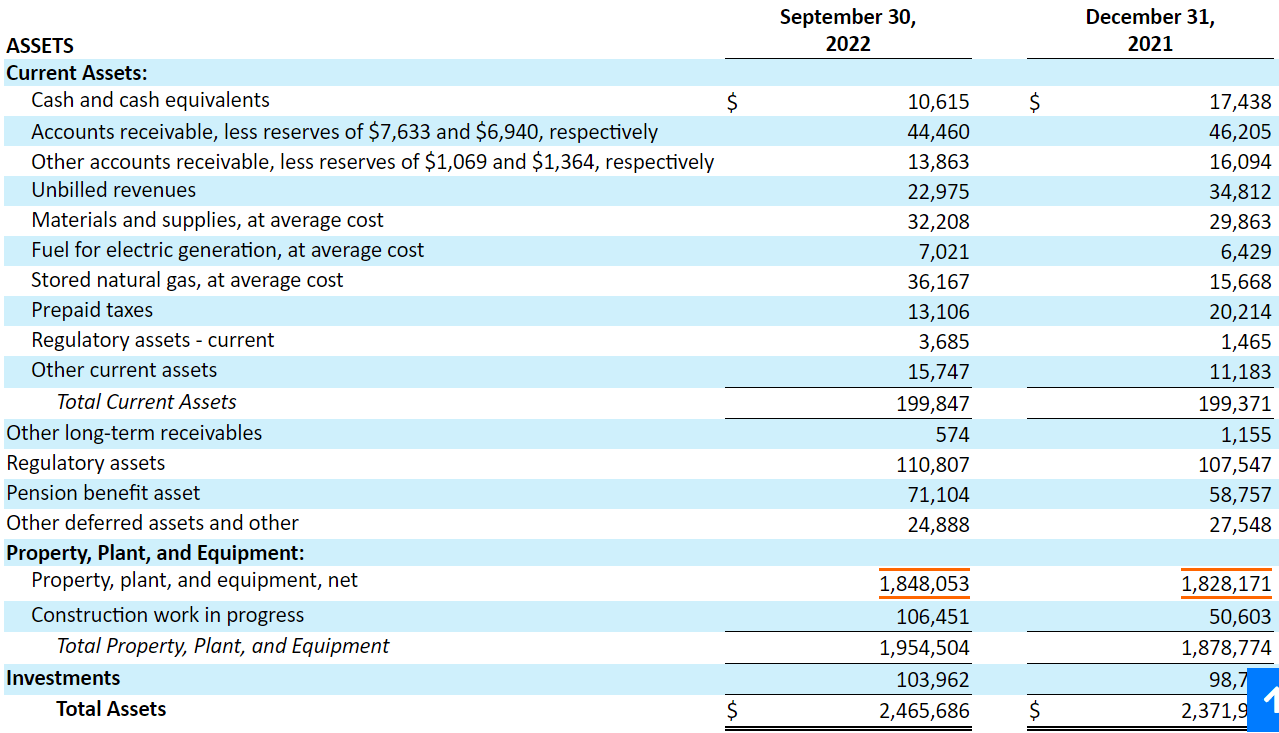

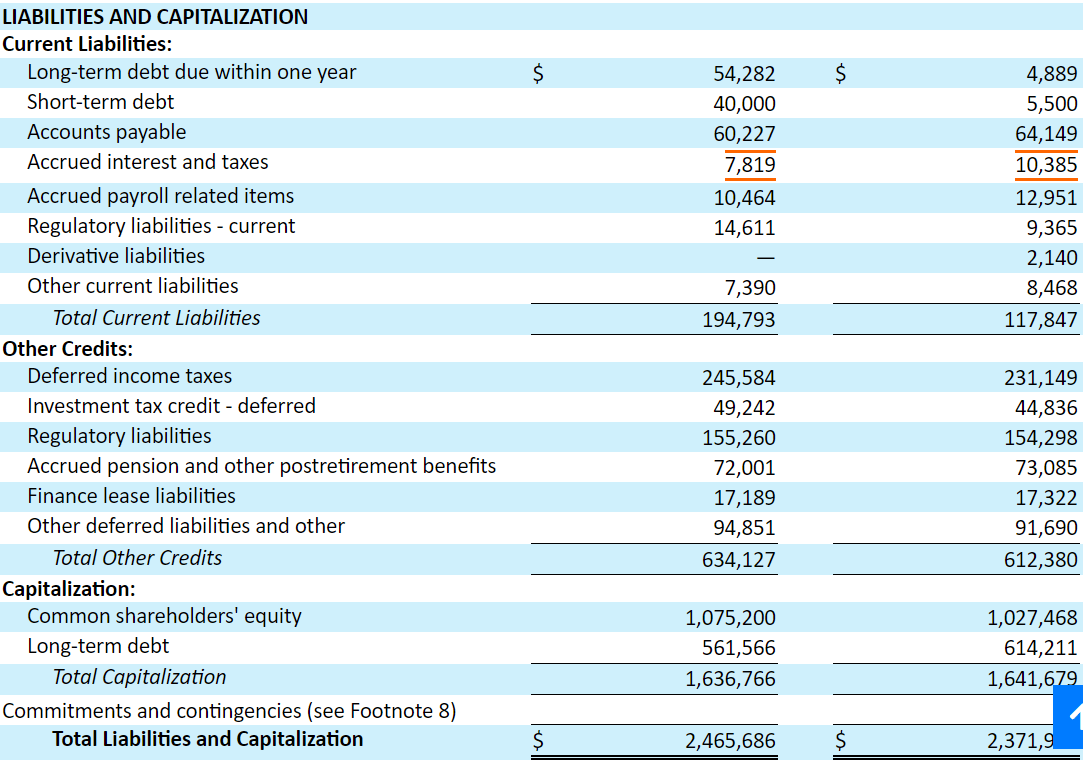

As of September 30, 2022, MGE reported cash and cash equivalents of $10.615 million, with accounts receivable of $44.460 million and unbilled revenues of $22.975 million. Total current assets also include materials and supplies of $32.208 million and $36.167 million in stored natural gas. The total current assets were worth $199.847 million, close to the total current liabilities. With this in mind, I wouldn’t expect a liquidity crisis any time soon.

With regards to non-current assets, MGE reported regulatory assets worth $110.807 million, pension benefit assets of $71.104 million, and other deferred assets of $24.888 million. One of the most valuable assets is property, plant and equipment, which is worth $1.848 billion. Together with construction work in progress worth $106.451 million, the total property, plant and equipment stands at $1.954 billion. In sum, total assets stand at $2.465 billion, implying an asset/liability ratio close to 1x. Considering these figures, I believe that the balance sheet appears in good health.

Source: 10-Q

The liabilities include long term debt of $54.282 million together with a short term debt of $40 million. The payable accounts were $60.227 million, and total current liabilities are equal to $194 million.

Non-current liabilities mainly consist of deferred income taxes of $245.584 million, investment tax credit worth $49.242 million, and an accrued pension of $72 million. Finally, long term debt stands at $561.566 million.

Source: 10-Q

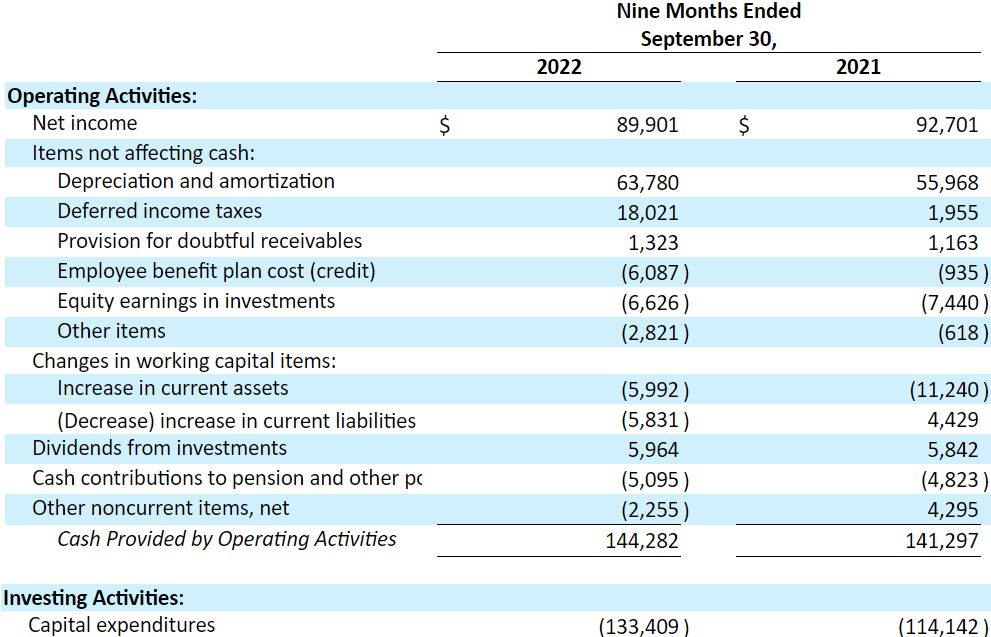

In the nine months ended September 2022, MGE reported net income of $89.901 million, with depreciation and amortization of $63.780 million and deferred income taxes of $18.021 million. The results included a positive CFO worth $144.282 million and capital expenditures worth $133.409 million. Thus, we are talking about a company reporting positive free cash flow.

Source: 10-Q

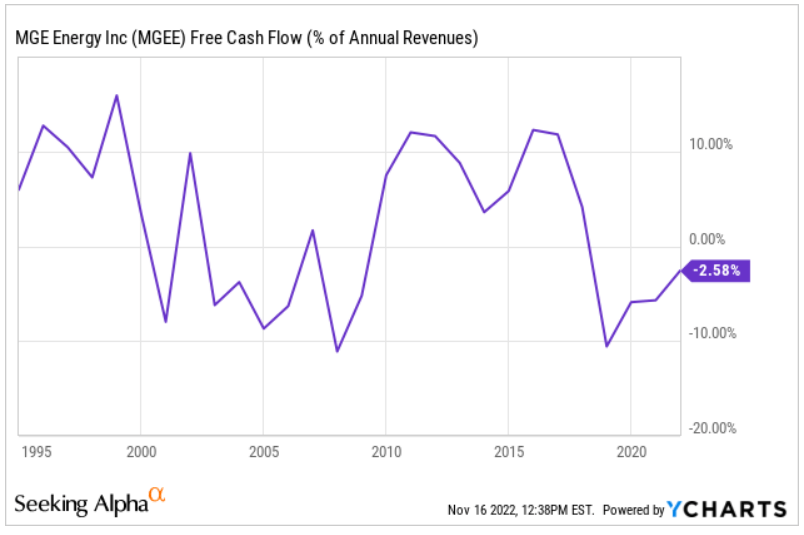

In line with the previous lines, MGE Energy reported free cash flow in the past. In 2010, management reported FCF/Sales close to 10%. I believe that assuming a FCF margin close to 3% makes a lot of sense.

Source: Ycharts

Forecasts Reported By Analysts And My Own Figures

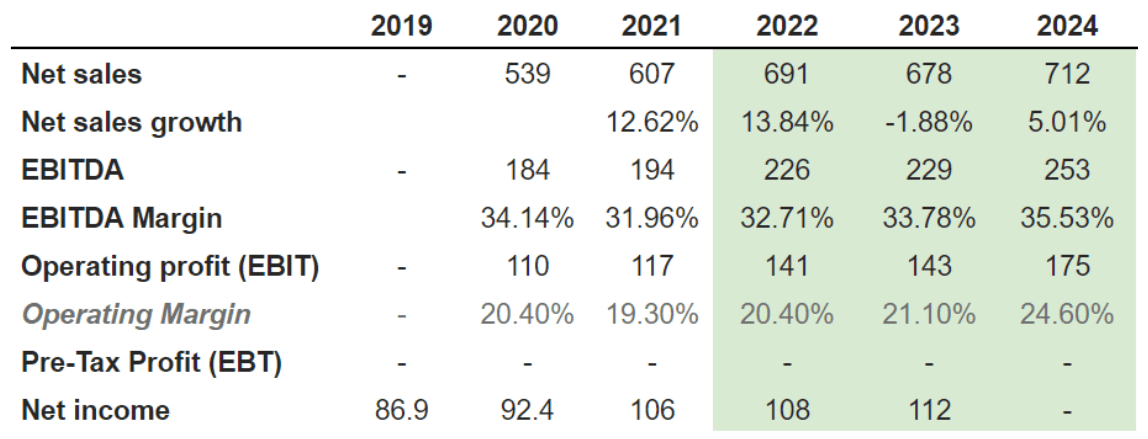

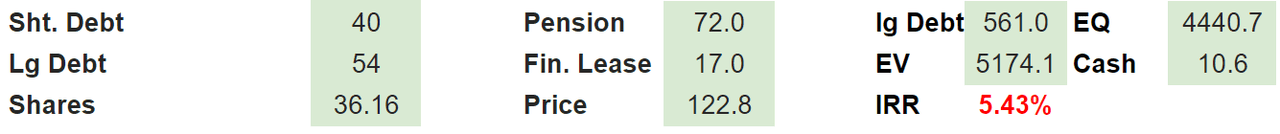

Analysts’ forecasts for 2024 include net sales of $712 million with a net sales growth of 5.01%, in addition to 2024 EBITDA of $253 million and 2024 EBITDA margin of $35.53%. The 2024 operating profit would be $175 million with an operating margin of 24.60%. Considering the figures, I assumed that designing a discounted cash flow model for MGE would make a lot of sense.

Source: Marketscreener.com

Under normal circumstances, I believe that investors in the market will likely be interested in MGE’s carbon reduction initiatives. I believe that less coal and more natural gas will likely have a beneficial effect on the company’s FCF margin. Besides, if MGE successfully obtains tax advantages or beneficial treatment from the government in the United States, net income would also be enhanced.

As we work toward achieving 80% carbon reduction by 2030 (from 2005 levels), MGE continues to examine and pursue opportunities to reduce the proportion that coal generation represents in its generation mix, as evidenced by its most recent announcements of the retirement of Columbia (a coal generation plant), the planned change in the Elm Road Units fuel source from coal to natural gas, and its growing ownership of renewable generation sources. Source: 10-Q

In line with my previous thoughts, let’s note that MGE expects to exercise further control on fuel costs as well as to enhance efficient operations. Management was quite explicit about these matters in the last quarterly report. Besides, MGE also noted that higher gas retail sales contributed to higher earnings in 2022.

MGE will continue to focus on growing earnings while controlling operating and fuel costs. MGE’s goal is to provide safe and efficient operations in addition to providing customer value.

Higher gas retail sales resulting from colder weather in the first half of 2022 contributed to higher earnings for the nine months ended September 30, 2022. Source: 10-Q

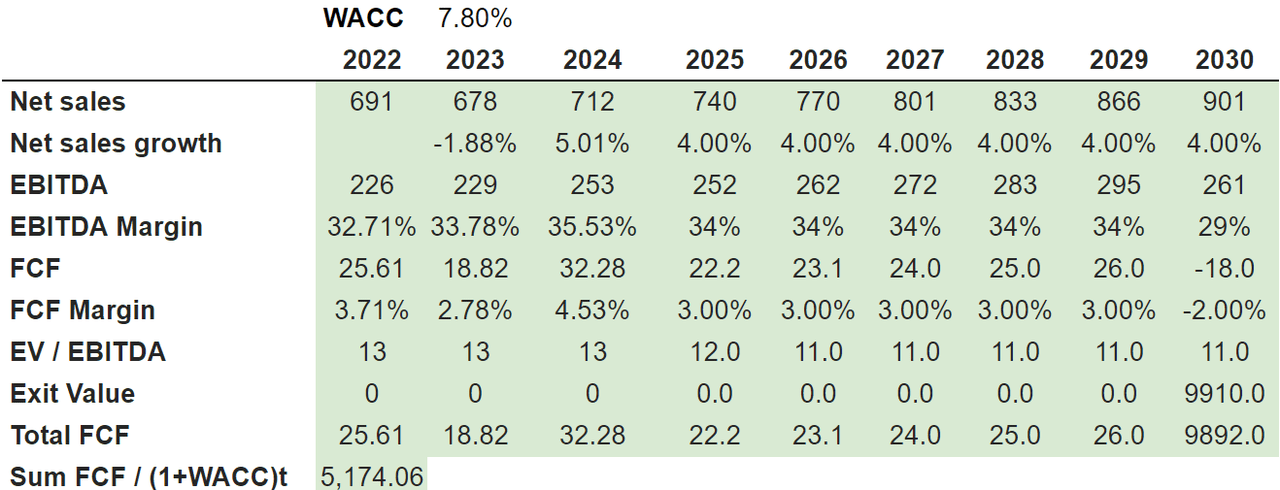

Under my own assumptions, I included 2030 net sales of $901 million with a net sales growth of 4%, in addition to 2030 EBITDA of $261 million with an EBITDA margin of 29%. I also used an EV/EBITDA of 11x, which implied 2030 exit value of $9.910 million. Finally, the sum of future FCF would be $5,174.06 million.

Source: Bersit’s DCF Model

If we include short term and long term debt, pension, financial leases, and the cash in hand, the implied enterprise value would be $5.17 billion. The implied equity valuation would stand at $4.4 billion, and the fair price would be $122.8 per share.

Source: Bersit’s DCF Model

Changes In The Regulatory Framework Could Imply A Valuation Of $37 Per Share

I believe that there are some risks, which may damage the company’s future revenue line. For instance, MGE has to respect certain regulations with respect to infrastructure protection and emergency preparedness. If management fails to design its systems, the company may suffer fines or even infrastructure damages. As a result, I believe that the company’s financial accounts would most likely suffer.

MGE must adhere in its electric distribution system to mandatory reliability standards established by NERC. These standards cover areas such as critical infrastructure protection, emergency preparedness, facility design, and transmission operations, among others. The critical infrastructure protection standards focus on physical and access security of cyber assets, as well as incident response and recovery planning. Source: 10-k

MGE will likely suffer from changes in regulatory laws against fossil-fueled generation and the transportation of natural gas. Management was very clear about these risks in the last annual report. I believe that changing regulations may reduce future free cash flow. Uncertainty about the future state of the law may also lower the demand for the stock.

While it is difficult to know the extent of possible legislation or regulatory activity, it is expected there will be an increase in the number and scope of environmental laws and regulations aimed at fossil-fueled generation and the transportation of natural gas. These possible changes, as well as evolving consumer sentiment, have affected and may continue to affect our business plans, make them more costly, or expose us to liabilities for past, present, or future operations. Source: 10-k

Besides, MGE may suffer a significant number of operating risks like failed delivery of fuel, supply chain issues, or tensions with the labor force. Management offered a list of inconvenient things in the last annual report.

Disruption in the delivery of fuel, including disruptions as a result of transportation delays, weather, labor relations, force majeure events, or environmental regulations affecting any of our fuel suppliers, could limit our ability to generate electricity at our facilities at the desired level. Should counterparties fail to perform, or other unplanned disruptions occur, we may be forced to fulfill the underlying obligation at higher prices. Source: 10-k

Under the previous conditions, I assumed net sales of $612 million with growth of -2.50%. I also included 2030 EBITDA of $177 million with an EBITDA margin of 29%. If we also assume an EV/EBITDA multiple of 7.6x, the implied exit value would be $4.618 million, and the sum FCF would be $2,059 billion. Finally, the results would also include an enterprise value of $2.0 billion, equity of $1.326 billion, and a fair price of $37 per share.

Source: Bersit’s DCF Model

Conclusion

MGE Energy is betting on the development of solar, wind, and other projects related to the renewable energy industry. Considering the expected growth of renewable energy, in my view, the corporate decision is smart. I would expect more demand for the stock as more investors notice the incoming projects from MGE. It is also worth considering that MGE is shifting away from coal to natural gas, which appears to benefit the earnings in 2022. My discounted cash flow model included a valuation that is higher than the current stock price. Yes, I see risks from new regulations, failed supply of fuel, or tension with the labor force. With that, in my view, the stock appears undervalued.

Be the first to comment