Drew Angerer

Back in 2019, I covered the sharp rise in short interest for plant-based meat company Beyond Meat (NASDAQ:BYND). With the stock trading at a ridiculous valuation then despite promising results, investors were placing large bets against the stock. As we are a couple of weeks away from the company’s next earnings report, sentiment for the name is quite bearish, with short interest for the name recently hitting a new high.

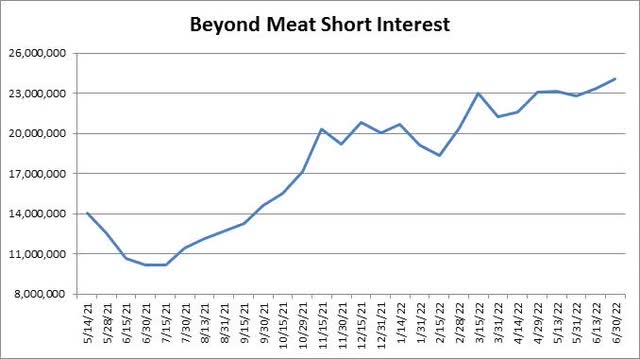

In 2019, we were talking about single digit millions for short interest in this stock. Of course, at that time, the float was around 34 million shares and it has risen about 22 million shares since then. Over the last year, short interest has been steadily increasing as the chart below shows. At the end of June update, more than 24 million shares were short, which is more than 40% of the current float. According to Finviz data, Beyond Meat currently has the highest percentage of float shorted in the US in terms of stocks with a market capitalization over $1 billion.

Beyond Meat Short Interest (NASDAQ)

The latest leg up in short interest basically started after the company’s Q1 earnings report, which was not very good. The company missed revenue expectations and announced a large loss for the quarter. Despite recording almost $110 million in total revenue, gross margin dollars were just $190 thousand. Net losses were over $100 million for the period, up dramatically from the $27 million reported in the year earlier quarter. Currently, the street is hoping for the company to reach profitability in 2025, but further significant losses are expected in the near term.

Back in May, management reaffirmed yearly guidance that net revenues were expected to be in a range of $560 million to $620 million, which was mostly in line with an analyst average of $588 million. This implied a very strong final three quarters of the year, but analysts have since been getting extremely skeptical. As of Thursday, the average street revenue estimate stands at just $566.6 million, implying analysts are basically looking for the company to lower guidance at its next report.

One of the other problem areas for the company right now is its cash flow situation. Last year, Beyond Meat burned through over $437 million in cash. That meant that for every dollar of revenue generated, the company burned 94 cents in cash. In Q1 of this year, the company burned through nearly $187 million, up significantly from the $54 million burned in Q1 2021. The company still had about $548 million in cash at the end of March, so it’s not going to run out of money in the near term. However, unless the cash burn slows down rather quickly, a capital raise will likely be needed sometime in the next 12-18 months. If the company has to go the debt route, adding interest expenses will only make it harder to get to profitability in the middle of this decade.

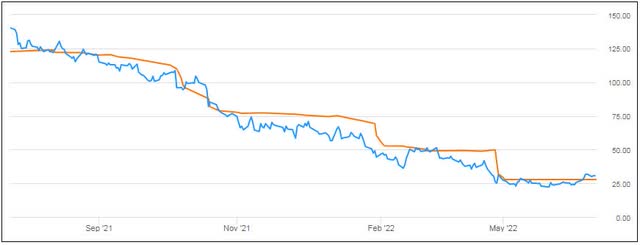

What’s surprised me in recent months is how well the stock has done. After that Q1 earnings release, shares initially fell below $20, but they’ve since jumped more than 50% and the recent high was a little above $33. At this point, the stock seems overvalued according to analysts, with the average price target of $27.82 implying more than $2 of downside from Thursday’s close. The last time shares were this much above the average price target (percentage wise) was last November, just before the stock crashed at its Q3 earnings report. The chart below shows the stock (in blue) against the average price target (in orange) over the past year.

Beyond Meat vs. Average Price Target (Seeking Alpha)

In the end, bearishness surrounding Beyond Meat has increased in recent months. Short interest topped 24 million shares at the end of June, up more than 137% over the past year, making it the most shorted billion dollar plus valuation name in today’s market. At the same time, analysts are expecting the company to reduce revenue guidance at some point this year. With the company’s year off to a bad start and cash burn piling up, investors should be very cautious given the stock’s surge from its lows.

Be the first to comment