Guang Niu

Thesis

Alibaba Group Holding Limited (NYSE:BABA) has continued to fall toward its March and May lows after our previous update urging investors to capitalize on its pullback.

Investors have been roiled by negative news across the global economy, with major currencies getting hammered by the Fed’s aggressive rate hikes. As a result, the yuan has also been hit markedly, as currency speculators piled on to bearish yuan bets, with the offshore USDCNH breaking above levels last seen in May 2020.

Consequently, it has also impeded further attempts at monetary policy easing by China’s central bank, as it could embolden bearish yuan bets to push further. Therefore, China’s attempt at closing the gap toward its initial 5.5% GDP growth rate looks increasingly challenging. Moreover, the World Bank also revised its forecast to 2.8%, projecting a highly underwhelming year for China.

Notwithstanding, we gleaned that Alibaba’s projections have not been revised markedly downward despite the battering BABA received in the hands of sellers since our previous update. Hence, we are increasingly confident of BABA’s reward-to-risk profile at the current levels as it closes in on its 2022 lows.

However, investors must note the potential for downside volatility remains, as the market could force a re-test of its May lows to trap bearish investors before reversing the selling momentum. Hence, it’s critical for investors to consider layering in their exposure to capitalize on the potential volatility.

We reiterate our Buy rating on BABA but rein in our medium-term price target (PT) to $95 (implying a potential upside of 19%).

De-risking BABA Ahead Of China’s CPC National Congress

China will hold its pivotal 20th CPC National Congress in mid-October as Chinese President Xi Jinping looks to secure his third term. Investors had hoped that Xi could loosen the zero COVID restrictions after the Congress, helping lift the malaise seen in China’s economy over the past year.

As China enters its Golden Week Holiday, consumer spending is expected to remain subdued. State governments continue to be vigilant in implementing COVID restrictions as China heads to its 20th CPC. As a result, the holiday is not expected to spur consumer spending, which could have provided a much-needed boost to the embattled Chinese economy. Bloomberg reported:

Passenger trips by road are expected to plunge by about 30% from a year ago during the National Day break, according to government data. Prices of air tickets for the period are lower compared to last year and travelers are taking shorter journeys, figures from hotel booking sites show. Cinema box office takings are expected to decline by more than 20%.

Notwithstanding, Chinese Premier Li Keqiang highlighted that the government would likely focus on Q4’s performance to assess the recovery cadence. He stressed in a recent meeting that China’s “economy was turned around and it recovered and stabilized in the third quarter.” Li accentuated that Q4 would be pivotal, as “the final three months of the year have the heaviest weight in annual economic activity and many already announced policies are expected to have [a] greater impact in that period.”

Therefore, we postulate that China remains on track toward an economic recovery through 2023, which should boost the recovery cadence of Alibaba, given its exposure to consumer discretionary spending.

Revisions On Alibaba Estimates Seem Relatively Muted

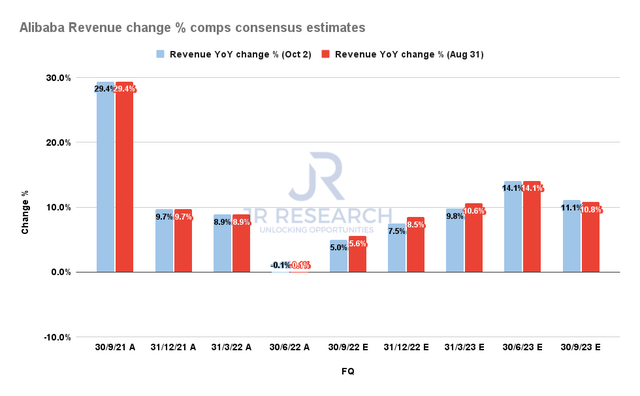

Alibaba Revenue change % comps consensus estimates (S&P Cap IQ)

We gleaned that the revised estimates of Alibaba’s revenue growth are not significant from our previous update. Therefore, we postulate that the Street consensus largely concurs that the worst impact on Alibaba’s recovery momentum is likely over.

Accordingly, the shape of the recovery through 2023 remains intact. Therefore, positive developments from the National Congress relating to further easing of China’s zero COVID restrictions could provide upside surprises to these estimates.

With China’s economy recovering from its malaise through Q4, we don’t expect BABA to suffer a significant de-rating to its valuations moving ahead.

Is BABA Stock A Buy, Sell, Or Hold?

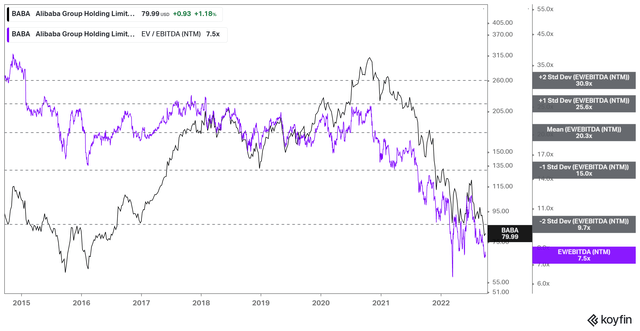

BABA NTM EBITDA multiples valuation trend (koyfin)

Enough has been said about BABA’s low valuation, as its NTM EBITDA multiples remain close to the two standard deviation zone under its 10Y mean. Therefore, we believe March lows in BABA’s valuation would continue to offer robust support.

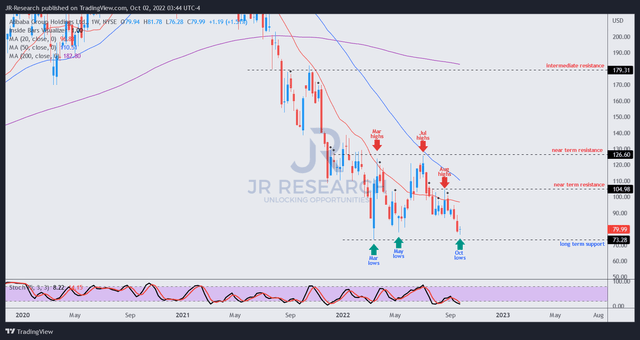

BABA price chart (weekly) (TradingView)

With the recent battering, BABA has fallen close to its March and May lows, as seen above. However, we are confident that BABA could remain within the consolidation range undergirded by its long-term support.

Coupled with an improving economy and potentially positive developments post-National Congress, we remain sanguine about Alibaba’s forward prospects through 2023.

Therefore, we reiterate our Buy rating but reduce our medium-term PT to $95 to reflect more conservative target multiples.

Be the first to comment