Bennett Raglin/Getty Images Entertainment

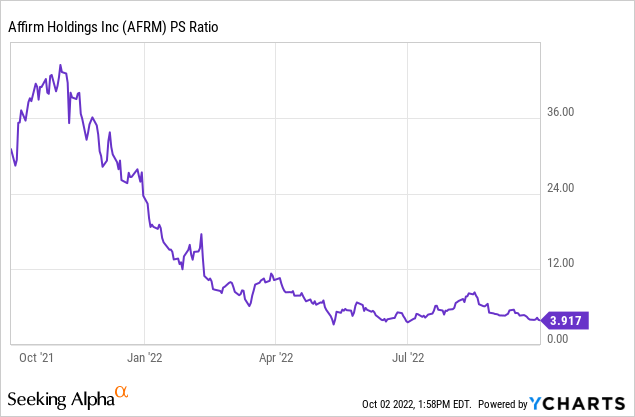

Affirm (NASDAQ:AFRM) is in trouble. The San Francisco-based BNPL firm like many fintech companies including SoFi (SOFI), Upstart (UPST), and Block (SQ) has seen its stock price collapse over the last year. This has been a vicious unending retracement that shows no sign of abatement in the short term. Inflation continues to remain sticky and has brought a combative Fed willing to oversee one of the most significant collapses of American wealth in a generation. Affirm just happens to be stuck in this crossfire but is not totally absolved of blame. At the previous high of $176, the company had a PS multiple north of 40x and was marching higher on boundless enthusiasm around the rapid growth of eCommerce. Indeed, eCommerce as a share of total retail sales continues to increase and is set to become half of total retail sales by the end of the decade. This has placed the company in a great position and it stands to ride the structural tailwinds of this growth with its partnerships and diversified range of financial products.

The pivotal partnership with Amazon (AMZN) has been expanded to Canada as tie-ups with small online boutiques continue to mount. At the current PS ratio of 3.9x, bulls could be somewhat right to state the collapse has gone too far. The company’s current PS ratio is discounting what remains strong growth and a push by management towards profitability. Revenue for Affirm’s fiscal 2023 is set to increase by at least 27% at the lower end of its revenue range. This would pull down its forward PS multiple down to 3.28x with scope for this to be lower on the back of the company reaching the higher end of guidance for revenue between $1.625 billion and $1.725 billion.

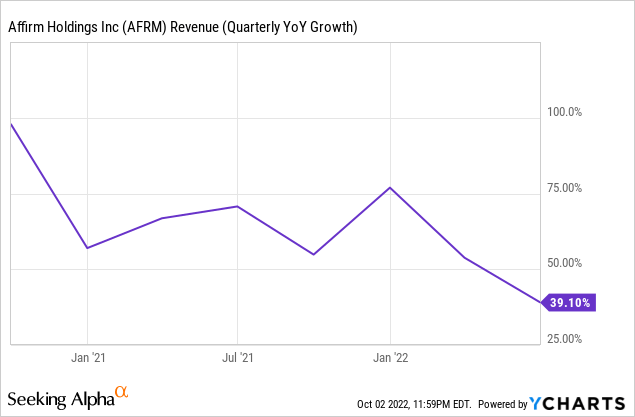

However, even at the high end of this range, Affirm’s fiscal 2023 revenue is expected to be lower than the consensus of $1.9 billion. This could either point to Affirm’s historically prudent management giving allowance for the uncertain economic period ahead or just a continuation of the normal slowdown of comparative revenue growth as businesses grow.

Macro conditions are already deteriorating with consumer confidence falling and an erosion of real disposable incomes well underway. When combined with continued unprofitability, this poor economic backdrop could point to more dread ahead. The spectre of a severe recession could cause the company to underperform on guidance.

Don’t Fight The Trend

Affirm last reported earnings for its fiscal 2022 fourth quarter which saw revenue come in at $364.13 million, an increase of 39% from the year-ago quarter and a beat of $9.27 million on consensus estimates. This growth was built on continued GMV growth and higher interest and servicing income as Affirm’s loan portfolio grew. Active merchants reached 235,000, increasing by 29,000 during the quarter on the back of a 96% year-over-year growth in active consumers to 14 million.

Growth was widespread with total transactions growing to reach 12 million during the quarter, an increase of 139% over the year-ago period. Transactions per active consumer increased by 31% to 3 with 85% of total transactions from repeat consumers. GMV grew by 77% year-over-year to reach $4.4 billion underscoring an all-around strong quarter for the BNPL firm. However, net losses continued to come in strong.

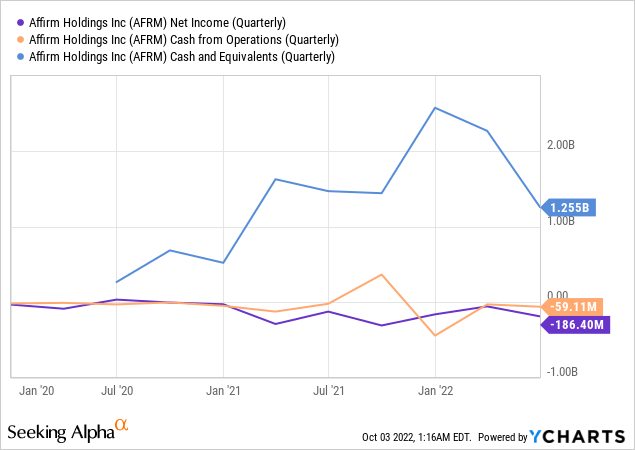

The company recorded an operating loss of $277.2 million, up from $114.3 million in the year-ago quarter with a net loss of $186.4 million versus $123.4 million in the comparable year-ago period. Cash from operations came in at $59.11 million, continuing a trend that has led to its cash and equivalents to dwindle from a high of $2.56 billion to $1.25 billion as of the end of the last reported quarter.

The uncertain macro backdrop combined with continued cash burn could point to more pressure on Affirm’s commons in the short term, especially if consumer credit performance deteriorates. However, Affirm has been managing this risk somewhat well. The company constantly monitors the credit performance of its portfolio and had to partially pull back from low credit segment consumers during the quarter to reduce potential charge-offs. This is at the core of its management strategy to achieve a sustained profitability run rate on an adjusted operating income basis by the end of its fiscal 2023.

The Antithesis Of Deferred Gratification

Affirm’s business model is straightforward. The company allows its users to finance internet purchases with easy-to-access credit that can then be paid back as periodic instalments over a specified time period. This is great when times are good and credit is cheap. But the next few months look set to bring negative economic growth and higher interest rates which will test the resiliency of BNPL. Against a full-blown recession, Affirm might find itself pulling back materially from underwriting for a currently large segment of its active customer base.

The company is yet to be fully tested with a real economic crisis that could bring higher charge-off rates and heavier losses. With the previous animal spirits all but dead, Affirm faces a future set to be characterised by more dread and uncertainty. Shares could have an even better entry point in the near future.

Be the first to comment