Kevin Frayer/Getty Images News

Earlier this month, I wrote two articles about Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF), which described the internal and external threats that the company faces. In them, I’ve argued that the weaker growth of the Chinese economy coupled with the inability of the regulators from both sides of the Pacific to reach an audit deal will make it hard for Alibaba’s stock to appreciate anytime soon. However, in the last week, a couple of developments happened, which create a possibility for a short-term rebound in Alibaba shares. While I continue to be skeptical about Alibaba’s ability to outperform in the long run, there’s nevertheless a chance that Alibaba could create additional shareholder value in the foreseeable future mostly thanks to the recent actions of Beijing.

Positive News From Beijing

Last week, Beijing announced a new stimulus package that aims at reviving the Chinese economy after the negative consequences as a result of lockdowns that have been implemented in major cities earlier this year. In the new package, Beijing aims to spend 1 trillion yuan ($146 billion) mostly on infrastructure projects, which could spur economic growth and uplift all the other industries. The latest successful results of Pinduoduo (PDD) and an announcement of a positive outlook could suggest that the consumer sentiment is recovering, in part thanks to the efforts of the People’s Bank of China, which trimmed interest rates earlier in August.

At the same time, the second positive development came out of nowhere when it was announced that the Chinese and American regulators agreed on an audit deal. It gives PCAOB the ability to fully inspect books of the Chinese-based companies such as Alibaba, to which Beijing denied access in the past. This is an important development, since it could help Alibaba and its peers to finally comply with the Holding Foreign Companies Accountable Act (HFCAA) and avoid a possible delisting from the American exchanges. The PCAOB inspectors are expected to be in China in the next few weeks in order to conduct inspections. In the following months, we’ll finally know whether Beijing has honored its part of the deal. At the same time, if Beijing delivers on its promises, then we would be able to say that one of Alibaba’s biggest external threats has been eliminated.

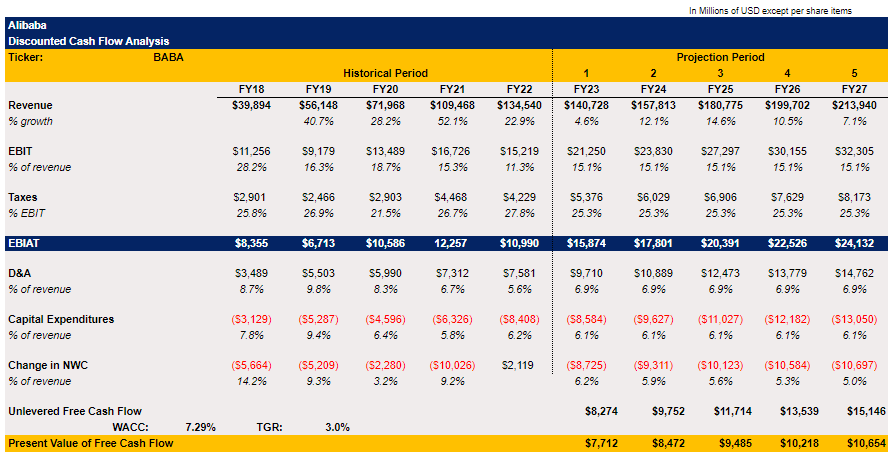

In the meantime, thanks to those positive developments, it’s safe to say that Alibaba has a short-term momentum going for it and there’s a possibility that its shares could appreciate in the foreseeable future. To figure out how much upside Alibaba’s stock has, I decided to create a discounted cash flow (“DCF”) model where my revenue assumptions are mostly in-line with the street estimates for the following years, while most of the other metrics are mostly averages of previous years. The terminal growth rate in the model stands at 3%.

Alibaba’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

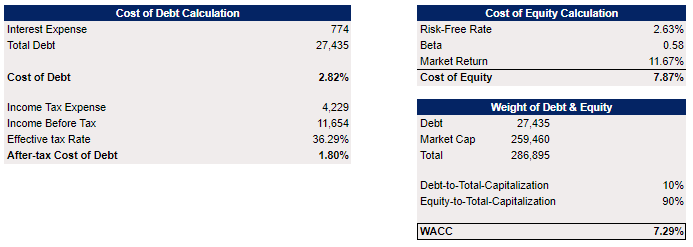

To calculate the cost of debt, I used the latest total debt, annual interest, and tax expenses data mostly from the previous fiscal year that’s provided by Seeking Alpha here. In the cost of equity calculation, the risk-free rate equals the yield of the Chinese 10-year government bond, the market return equals the average annual performance on the Hong Kong stock exchange in the last few decades, while Beta in the calculation stands at 0.58. My cost of debt and cost of equity calculations gave me a WACC of 7.29%.

Alibaba’s WACC Calculations (Historical Data: Seeking Alpha, Assumptions: Author)

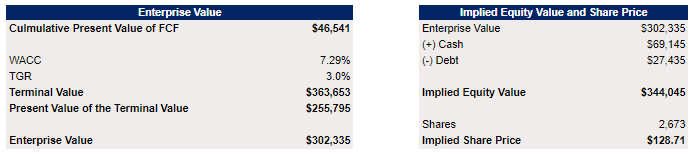

With all of that information, my model showed that Alibaba’s enterprise value is $302 billion, while the fair value of its stock is $128.71 per share, which represents an upside of ~33% from the current levels. As a result, we could see that Alibaba’s stock clearly has room for growth and could appreciate in value in the short term.

Alibaba’s Fair Value Calculations (Historical Data: Seeking Alpha, Assumptions: Author)

Major Concerns Still Remain

Despite all of those developments and the fact that Alibaba’s stock has more room for growth solely based on fundamentals, there are nevertheless several risks. I believe these are still making it impossible to justify a long-term long position in the company.

First of all, there’s a risk that Beijing’s latest stimulus package won’t be able to spur economic growth after all. Let’s not forget that China is currently in the midst of property and power crises, as home sales are down 40% this year, while severe droughts have led to power restrictions in manufacturing hubs. At the same time, 35% of China’s GDP comes from foreign trade. Considering the hawkish speech of Fed Chairman Jerome Powell, which also resulted in the depreciation of Alibaba’s shares a few days ago despite the announcement of an audit deal, there’s a possibility that there won’t be any soft landing and the global economy will enter a recession. If that’s going to be the case, then it’s likely that the latest stimulus package won’t help to revive the Chinese economy at all.

There’s already an indication that Beijing will fail to increase the country’s GDP by its official target of 5.5% this year due to the weak performance of the economy in the first two quarters of 2022. The major advisory firms already slashed their estimates and now expect the economy to grow only at ~3% this year, but there’s always a risk that the situation will deteriorate with each new quarter as China’s Western partners are in the midst of fighting rising inflation. Therefore, there’s a possibility that Alibaba could perform worse than expected, which could lead to downward revisions of its top-line performance for the following years. As a result, this would negatively affect its fair value as well.

At the same time, there’s no guarantee that the audit deal will work in the end. As I’ve already noted in my latest article on Alibaba, the PCAOB signed a memorandum of understanding with the Chinese side nearly a decade ago, but it didn’t help it to gain any access at all to the books of Chinese firms. In addition, just recently Beijing has once again failed to fully honor its trade commitments with the United States. This shows that there’s a possibility that the Chinese side will once again fail on its promise to allow PCAOB to receive full access to the books of Chinese companies later this year.

Last but not least, after the tech crackdown that began nearly two years ago, Alibaba’s stock has been constantly trading at relatively cheap levels despite being undervalued fundamentally. Considering that in recent quarters Beijing has also strengthened its grip over the private sector, there’s always a risk that additional interference from the state will follow. That’s one of the main reasons why in recent quarters we saw an exodus of institutional investors who sold their Alibaba shares en masse. It’s likely one of the main reasons why even Alibaba’s long-time holder SoftBank (OTCPK:SFTBY) recently trimmed its position in the company as well.

The Bottom Line

The announcement of a new stimulus package along with a signing of an audit deal last week should be viewed as positive developments for Alibaba, as it gives it a chance to improve its performance and eliminate a major external risk at the same time. As a result, there’s a possibility that the company’s shares could appreciate in the short term since the stock is currently trading at a significant discount to its fair value.

However, due to the risk of additional interference from Beijing along with the lack of guarantees that a new stimulus package will save China’s weakened economy, there’s a real chance that in the long-term Alibaba could continue to trade at distressed levels. Therefore, it makes it impossible to justify a long-term long position in the company at this stage.

Be the first to comment