David Becker

Investment Thesis

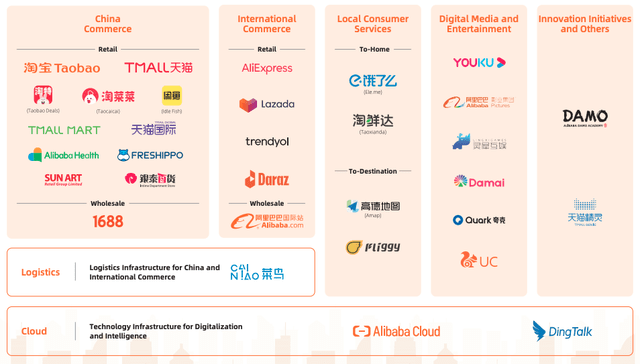

Alibaba Group (NYSE:BABA) is a Chinese multinational firm specializing in e-commerce solutions but has since branched out into software as a service (SaaS), logistics, and media.

Despite some macro headwinds and the extreme zero Covid policy in China that created stagnate traffic, overall revenue increased by 22% year over year in FY22. This was primarily driven by geographic expansion into rural areas of China and an increase in the order size per customer.

Cognizant of the geopolitical risks, we believe that Alibaba is a good speculative growth investment given the combination of low valuation, high growth and high risk. Alibaba has a tight grip on the domestic Chinese market, with 903 million active retail customers annually. Moreover, with the growing demand for cloud solutions and domestic logistics, Alibaba still has room to expand its market domestically and internationally. Should they capitalize on this, they could become a global powerhouse across e-commerce and logistics operations.

EFV= E2023 EPS times P/E (Price / Earnings Ratio)

EFV = $7.00 X 16.0 = $112.00

|

Alibaba (BABA) |

E2023 |

E2024 |

E2025 |

|

Price-to-Sales |

1.9 |

1.7 |

1.5 |

|

Price-to-Earnings |

11.9 |

10.3 |

9.1 |

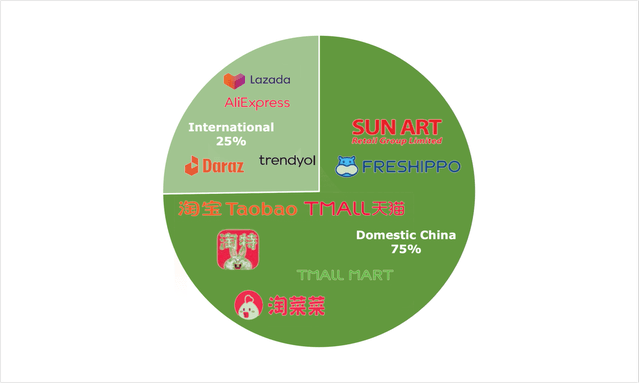

Domestic and International Commerce

COVID-19 restrictions in China are ongoing and incredibly strict. This has caused stagnant domestic revenue year over year and a decrease in customer engagement by 7%. However, consumer services including mapping and integrated commerce (Amap/Koubei), travel (Fliggy), and food delivery (Ele.me), had much stronger growth, with 21% year-over-year revenue growth. This was primarily driven by stricter lockdowns which caused much higher average order value per customer.

In FY22, Alibaba had 903 million active annual retail customers (AACs) across its various businesses. Alibaba had 98% retention of customers who spent at least $1,500 USD in FY21. These high-spending customers represent about 15% of AACs. With the addition of a more robust logistics network with Cainiao discussed below, 70% of new active annual customers were from less developed areas of China. More than 50% of Taocaicai, a direct-from-producer grocery and consumer staples provider were first-time buyers. Taobao, a hybrid of Etsy and eBay, had a 100% year-over-year increase in orders.

Cainiao is a primarily domestic, but expanding international, logistics and supply chain firm that offers delivery solutions. Year over year it had an increase of 36% in revenue (26%, excluding internal Alibaba transfers), equally driven by lockdowns forcing more domestic businesses to use e-commerce and virtual fulfillment solutions. International expansion has been ongoing. On average, 4.5 million parcels per day were moved internationally through the 9 parcel hubs globally. This figure is down approximately 500,000 from FY21, likely driven by a portion of the international air cargo fleet being Russian-registered and operated.

International e-commerce saw a 3% year-over-year increase in orders. Trendyol primarily drove this, a Turkish platform, 90% owned by Alibaba. In international wholesale markets, Alibaba had a 6% year-over-year increase in orders. In FY22, this amounted to 305 million annual active customers.

Data from Alibaba Group FY22 Presentation

Alibaba Cloud and Digital Media

Alibaba cloud operates as an infrastructure as a service (IaaS)/software as a service (SaaS) hybrid business, providing private and public cloud services to businesses. While this has seen some softening of demand, it still had a 4% year-over-year growth. In addition, while globally AWS and Azure still dominate, Chinese firms expressed a 70% preference for Chinese-owned providers.

Chinese internet infrastructure for companies is still largely dominated by traditional internal server architecture, with the SaaS market remaining tiny at just $5.2 billion. For reference, the US market for SaaS is over $120 billion. The total addressable market for cloud service providers is expected to grow to $30 to $70 billion by 2025 with public cloud accounting for 45% of this addressable market, and 55% being private cloud.

Alibaba operates a growing digital media operation, encompassing production operation Alibaba Pictures and video streaming service Youku. Combined these segments saw a 4% revenue growth.

Risk

Chinese equity listings on Western stock markets have seen a string of crackdowns by the Chinese government in FY21 with several high-profile delistings. These companies are traded through a complex series of loopholes, as foreigners are not permitted to own shares of internet companies and are prohibited from voting even by proxy. Frequently, the authoritarian regime has made harsh and arbitrary decisions regarding these companies. But from a practical perspective, it would be silly to cut off a mass of western money flowing into what amounts to a domestic company.

However, there has been some hope with the Biden-Xi talks taking place on November 15th as both countries have acknowledged that conflict (economically or otherwise) is not the goal of either country. Additionally, the two world leaders promised more open communications between the two superpowers.

Final Thoughts

In FY22, Alibaba reached the long-term strategic goal to serve 1 billion consumers in China and raised its goal to facilitate RMB10 trillion of annual consumption in China ($1.4 Trillion USD). In FY22 it facilitated RMB8 trillion ($1.3 Trillion USD). While geopolitical risk is always something to keep in mind, Alibaba is a dominant force in domestic Chinese retail and logistics.

Alibaba still has room to expand its market domestically and internationally, especially within the logistics and cloud spaces.

Be the first to comment