D. Lentz

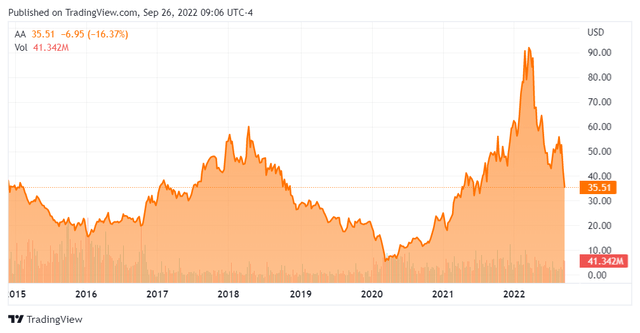

Alcoa (NYSE:AA) is a global $6.4 billion market cap producer of alumina and aluminum products. As a commodity producer, Alcoa is subject to global trends in the overall commodities markets. As shown below, Alcoa’s stock price action has been anything but boring over the last seven years. In particular, the swing from the bottom of COVID-19, at a little bit less than $6 a share, to the peak during Russia’s invasion of Ukraine during this year’s spring, at $92 per share is mindboggling. Since the 15x return was achieved the stock has cratered to today’s trading level at $35.5 per share. So what will happen in the future, will we see the stock going to $6 or $90+ or somewhere in between?

Alcoa stock price (Seeking Alpha)

Operating leverage

All commodity producers are impacted by operating leverage and deleverage. High commodities prices decrease fixed cost per unit sold which leads to operating margin expansion. The following cash flow increase in relation to a given producer’s fixed asset base increases Return on Invested Capital (“ROIC”), which in turn lures producers to expand operations. This supply expansion coupled with a macroeconomic downturn leads to collapsing industry-wide operating margins and sometimes negative cash flow and ROIC for individual producers (depending on the severity of the downturn). This then leads to mothballing and in extreme cases assets stranding, which in turn increases the price of a given commodity and the cycle starts anew.

Basically investing in a commodity producer, withstanding foreign currency effects, is a game of forecasting commodity prices.

Alcoa’s operating leverage

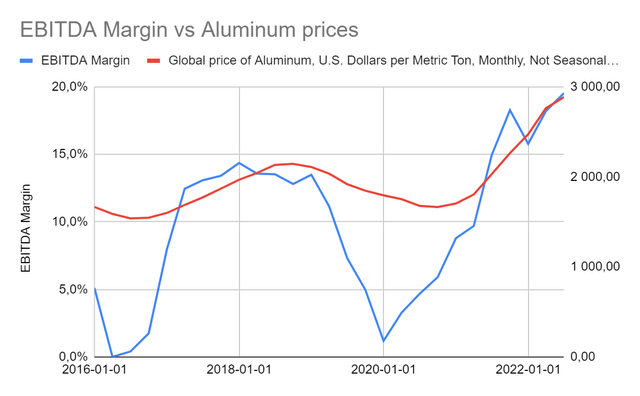

To clarify how dependent Alcoa is on operating leverage, I put together the chart below, contrasting the company’s EBITDA margin versus the global price of aluminum. From the chart, it is easy to see how dependent Alcoa’s is on aluminum price increases to generate healthy margins and cash flow.

When aluminum was trading at $1500-1600 per metric ton during 2016, Alcoa’s EBITDA margin was 0%, correspondingly when the price was trading at around $2000-2150 per metric ton during 2018 the EBITDA margin was 12-14%.

Hence any valuation effort should take into account this cyclicality and realize that high prices will not last forever, but neither will low prices.

Alcoa’s EBITDA versus Aluminum prices (Company financials and FRED)

Aluminum demand and supply in the future

The world is very much dependent on aluminum for both industrial needs and everyday consumption items. Demand drivers over the next coming years will most likely be the transportation, electrical, packaging, and construction industries. With growth across most geographies especially Asia.

Although these demand drivers are important, I would not imply from these that aluminum prices and subsequently Alcoa’s share price increase without bound. My view is that the industry dynamics are similar to the steel industry, where private companies compete with state-owned firms (especially in China) where attractive ROICs are not always the most important metric for business decisions.

Expressed in another way, aluminum production requires huge industrial facilities which require a lot of people to operate. So there is a risk that any demand increases will be met by at least the same amount of production increases driven by some players who want to create jobs for their local communities instead of maximizing the value of the business.

Furthermore, the demand outlook for China is very uncertain, as is well-known China has been struggling with its very important housing sector, which can restrain the overall economy from achieving the impressive GDP growth rates it has produced historically, which would dampen the demand outlook for aluminum.

Valuation

Looking specifically at Alcoa, the company has struggled to reach mediocre levels of profitability, regardless of the measure an analyst is using and I don’t forecast any substantial improvements over the coming business cycles.

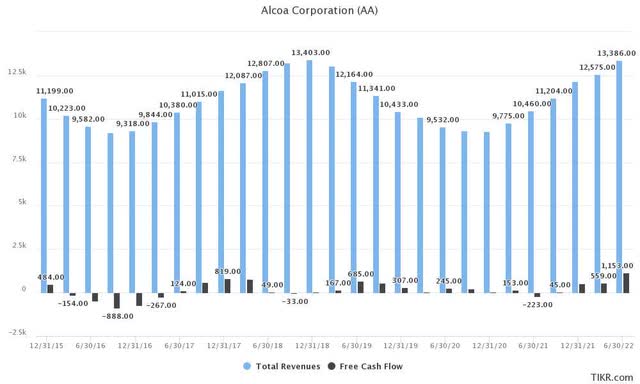

The sales and free cash flow generation cyclicality shown below, over the last seven years, will in my opinion continue over the next decade.

Alcoa sales development (TIKR)

Furthermore, assuming that the company can produce Free Cash Flow to Equity (FCFE) holders in the range of 1% – 5% of sales and discounting with an inflation adjusted discount rate of 8%, my fair value range is $7 to $44 per share with the most likely price level at around $20 per share, which is substantially below today’s trading levels. Hence, I suggest an investor to wait until the stock becomes cheaper.

Be the first to comment