BlackJack3D/iStock via Getty Images

Investment Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is a stock that made sense at one point in time, in a markedly different market environment. What’s more, I’ll be honest, I had my doubts about this stock for a while. Indeed, the ”diamond hands” in this name gave me pause for thought.

All the while, the value investor in me struggled to find the positive risk-reward to be compelling enough. So on the fence, I largely remained.

Nevertheless, the crux of this argument has now shifted. Today, in this higher interest rate environment, the thesis is now a lot simpler: avoid this name.

A Moment of Honesty

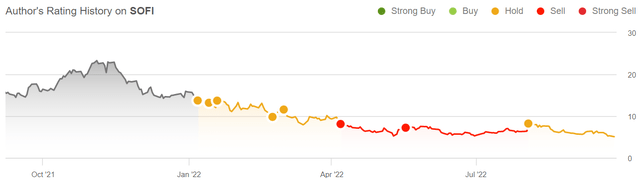

As you can see above, I was never outright bearish on SoFi. Yes, I had my doubts, and I was outspoken about them at the time. Even as I received backlash from the community that I didn’t “get it.”

Nevertheless, I was never truly bearish on this name, at least not for a persistent period of time. And there’s a reason that. As I mentioned already I had my doubts. Ultimately, when it comes down to it, SoFi was executing superbly.

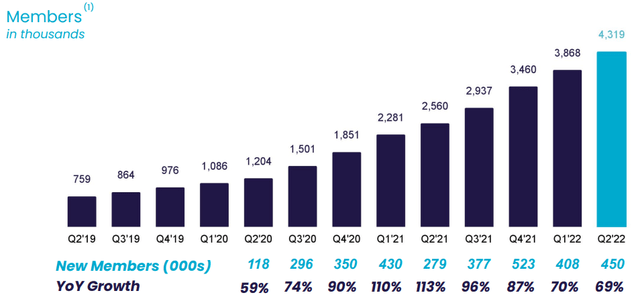

You simply don’t get this level of member growth into the millions unless you are doing something right. I look at countless businesses, and the fact is that getting to 1 million customers on your platform is a commendable feat, but nothing that interesting. While getting to 4 million customers and still growing at 69% y/y, is a whole different story.

SoFi’s ambition to design and deploy financial products that help customers stay in control of their finances is clearly working. There’s no other reason for this virality in its adoption curve. Customers are so readily adopting SoFi’s digital wallet because there’s value in its platform. There’s no point in over-intellectualizing what’s relatively straightforward.

These customers use the product. They recommend it to a friend. They would miss the product if it were to go. But above all, perhaps importantly they trust the brand.

Accordingly, deposit figures were up 135% y/y to $2.7 billion, driven by its lower cost of funding.

Essentially this is where the core of the bull thesis came from. Once SoFi got its bank charter, its ability to fund lower-cost loans would allow its business to thrive.

Furthermore, SoFi’s Lending business is incredibly profitable. As of Q2 2022, its contribution profit margins stood at is eye-popping 57% of adjusted net revenues.

Again, there’s a lot more to like here than immediately meets the eye.

A Moment of Clarity

Up until very recently investors were more than willing to embrace SoFi’s growth vision, particularly given that was already reporting positive EBITDA numbers.

Realistically, it simply didn’t matter what kind of adjustments were being made to its EBITDA figures.

And let’s be clear, SoFi is not the worst offender in this practice. But the thing with EBITDA projections is that nobody asks difficult questions until the stock moves lower.

And here, the fact remains that its two biggest add-backs are stock-based compensation and depreciation and amortization.

And both of these costs are not considered “real costs,” at least in a bull market. Yes, depreciation is a cost that goes out the door first and gets ”recognized” on the income statement over time. And yes, management will only stick around if they are sufficiently incentivized to do so with attractive SBC packages.

So again, these costs aren’t really “costs,” at least not something that investors get unduly concerned with while the stock is going up.

But then, when interest rates rise so quickly, investors start to think, when I can get a ”nearly risk-free” government bond with a 4% coupon for 2 years, maybe there is an alternative?

Put another way, investors posit, do I really want to underwrite paying 45x EBITDA for a business with a such questionable EBITDA profile?

SoFi’s Shorts Are Leaving

I recognize that the stock is down more than 70% from its highs.

I also understand that if the stock did get back to $10 investors would get an easy double on this name. Indeed, if the stock was simply to return to the price back in August, investors would clear a quick 50%. And that could happen.

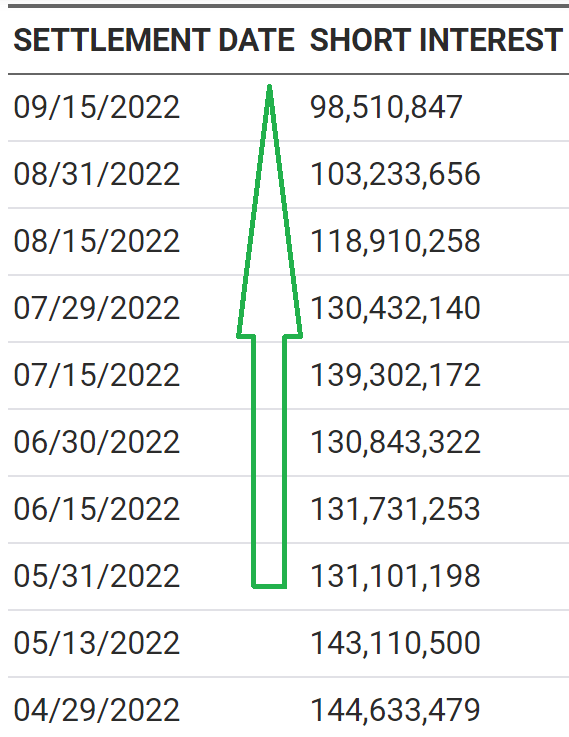

SOFI short interest

But there again, as you can see from the table above, shorts are slowly covering their position in this stock, and yet the stock continues to migrate lower.

In practical terms, that means that it’s not so much that shorts are out crowding this stock, rather it’s the shareholders themselves calling it a day on this name.

Hence, that means that short squeezes are less likely to drive the share price higher.

The Bottom Line

As you can see there’s a lot of nuance to SoFi. It’s much more than just a digital wallet. It’s a one-stop shop for higher earners that are seeing customer adoption curves that are astounding.

But the problem here is that investing is about figuring out the risk-reward of an investment and position-sizing it accordingly. If one wants to speculate some capital on SoFi, that’s fine. It could work out.

I believe that it’s OK to change one’s mind when the facts change. And that this investment thesis has become considerably less compelling in the light of rapidly rising rates. When investors can get 2-year government bonds with 4% coupons, and know (nearly) beyond doubt that they’ll get that coupon from the U.S. government, it makes very little sense to chase growth stocks at high valuations. So I don’t believe that the risk-reward for SoFi is compelling enough.

Be the first to comment