monsitj

Investment Thesis

Fortune Brands Home & Security (NYSE:FBHS) has approximately 65% of North American sales coming from the repair and rebuild industry, which is less cyclical compared to the new construction industry. This should help the company navigate the slowdown in the housing industry. The concerns related to the slowdown have led to the destocking of inventories at FBHS’s channel partners. The company is proactively working with its channel partners to maintain the inventory levels as the demand at the point of sale (POS) is still strong. FBHS is also managing its expenses and capex to prepare itself for a downturn in the economy. The long-term housing and R&R fundamentals look strong due to favourable demographics, record-high home equity levels, and lower housing inventory levels. Valuations are attractive for long-term investors who can look beyond the current cyclical slowdown.

FBHS’s Q2 FY22 Earnings

FBHS recently reported better-than-expected second quarter FY22 financial results. Net sales in the quarter were up 9% Y/Y to $2.1 bn (vs. the consensus estimate of $2.05 bn). The adjusted EPS in the quarter was up 7% Y/Y to $1.67 (vs. the consensus estimate of $1.59). The sales growth benefited from the easing labour and supply chain constraints and higher price realization. The adjusted operating margin was down 30 bps Y/Y to 15.1% due to the investments in digital transformation, partially offset by pricing actions. The lower share count in the quarter compared to Q2 FY21 and good sales growth led to an increase in the adjusted EPS Y/Y.

Revenue Prospects

The Water Innovations segment sales were down 6.4% Y/Y in Q2 2022 due to the impact of COVID shutdowns in China. Excluding China, the sales growth was up 4% Y/Y driven by solid point of sale for both Moen and House of ROHL in the U.S. The total backlog and service rates were near pre-Covid levels in the quarter. The sales in the Outdoor & Security segment grew 13% Y/Y due to higher price realization and volume growth in its Therma-Tru brand. The sales in the decking and security grew high single digit and mid-single digit. The cabinets segment’s sales grew 21% Y/Y with strong double-digit growth in stock cabinets and low teen growth in make-to-order cabinets as supply chain constraints and labour availability improved.

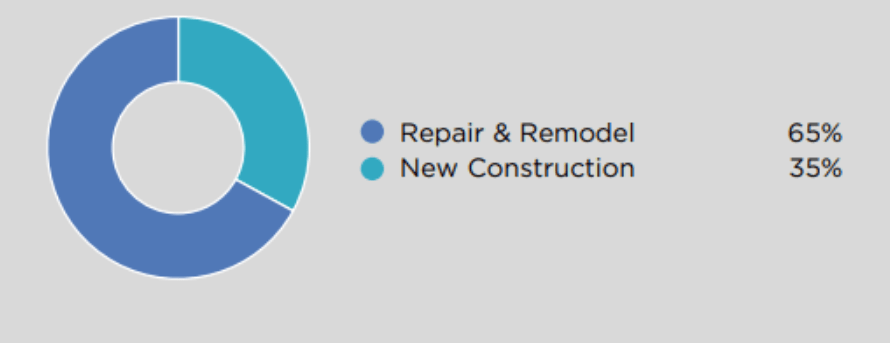

FBHS End Market Exposure (Company’s Investor Presentation)

While the concerns regarding the slowdown in the housing industry have dragged the stock price of FBHS down, I believe the company’s high repair and remodel exposure should provide some downside support. About 65% of the company’s residential sales in North America come from the repair and rebuild industry. The R&R industry is less cyclical compared to the new construction market, which should benefit the company during the slowdown. Given the concerns of a recession and higher inventory costs, most of the company’s channel partners are ordering below the point of sale level inventory. However, FBHS is not seeing any slowdown at the point of sales. So, to maintain the right level of inventory with its channel partners, the company is proactively working with them by providing them with the best service levels and assuring adequate inventory remains in the channels to address demand. FBHS has also been using its insights gained at the point of sale to work with its customers.

The company is placing its products in the market by understanding its customers’ needs and making sure that they have the right product. This kind of flexibility benefited the company when it saw millennials buying entry-level homes and shifted its product portfolio to match the demand. Additionally, FBHS is taking internal measures such as managing its expenses, CapEx, and capacity to prepare itself in the event of a downturn. The company has raised the midpoint of its guidance and tightened its sales guidance range to 6.5% to 7.5% from its previous range of 5.5% to 7.5% which is encouraging as it shows that end-market demand is still healthy.

The long-term housing fundamentals are supported by favourable demographics, lower housing inventory levels, and record high home equity levels. The R&R industry looks strong as the total U.S. home equity was $27.8 trillion with more than $11 trillion tappable home equity in June 2022. This should provide tailwinds to the company’s repair and remodel business in the long term as higher home equity usually results in homeowners being more comfortable with repair and remodel spending.

Margins

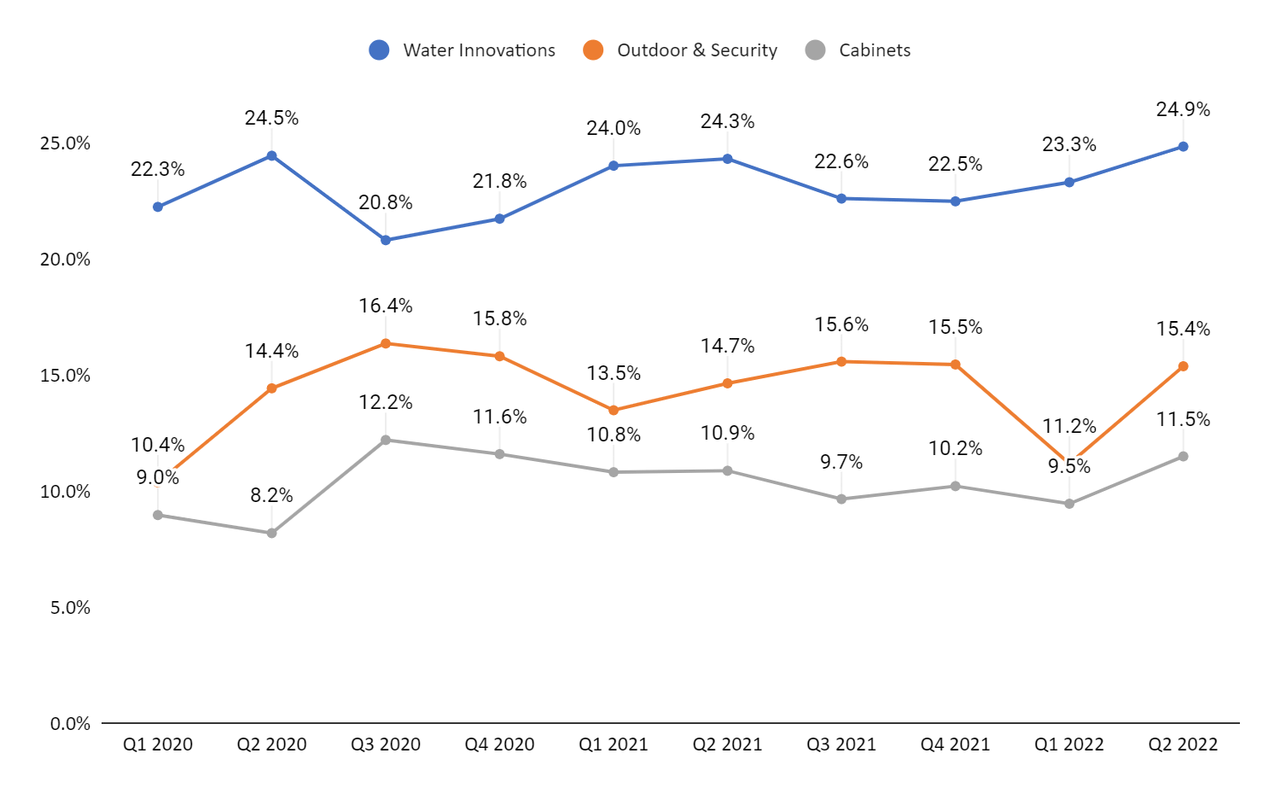

As we had predicted in our previous article, the adjusted operating margin of the company improved sequentially due to the pricing actions taken by the company. The adjusted operating margin of the company improved 20 bps sequentially to 15.1%. The adjusted operating margin in the Water Innovations segment improved by 60 bps Y/Y and 160 bps sequentially to 24.9%, driven by pricing actions and proactive expense management. The margins in the Outdoor & Security and Cabinets segments improved 70 bps and 60 bps Y/Y to 15.4% and 11.5% due to pricing actions and improvements in labour availability and supply chain constraints.

FBHS’s segmentwise adjusted operating margins (Company data, GS Analytics Research)

Looking forward, the company is taking measures to position itself during the recessionary environment, such as managing its expenses as we discussed above, benefiting its margins. The company is also investing in digital transformation to drive its future outperformance. In the near term, I believe the company’s margin should improve as higher input costs stabilize. The decline in commodity prices such as copper should start benefiting the margins in early FY23 due to the 6-month lag. The company is targeting a 70 bps margin expansion in FY22 from 14.2% in FY21.

Valuation & Conclusion

The stock is currently trading at a 10.88x P/E FY22 consensus EPS estimate of $6.28 and a 10.67x P/E FY23 consensus EPS estimate of $6.40, which is at a significant discount to its five-year average forward P/E of 16.60x. The company is taking proactive measures to navigate the recessionary environment by managing its expenses and working with its channel partners to maintain inventory levels. The company’s exposure to the less cyclical R&R market should help it offset the softness in the new housing industry to some extent. Also, the long-term housing fundamentals look strong due to lower housing inventory levels, record high home equity, and favourable demographics. Hence, I have a buy rating on the stock.

Be the first to comment