John Moore

Can The Good Times Last?

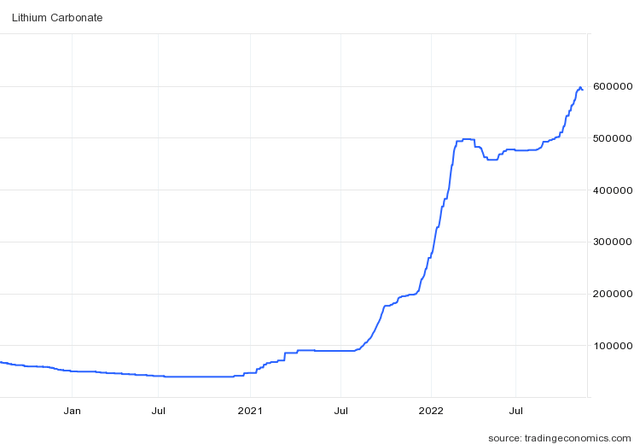

Specialty chemicals developer Albemarle Corporation (NYSE:ALB) has been the beneficiary of a surge in lithium prices that began last year. Lithium carbonate remains near a record high, over 10x where it traded in 2020. (Units on the chart are CNY/ton. 1 USD is currently equal to 7.16 CNY.)

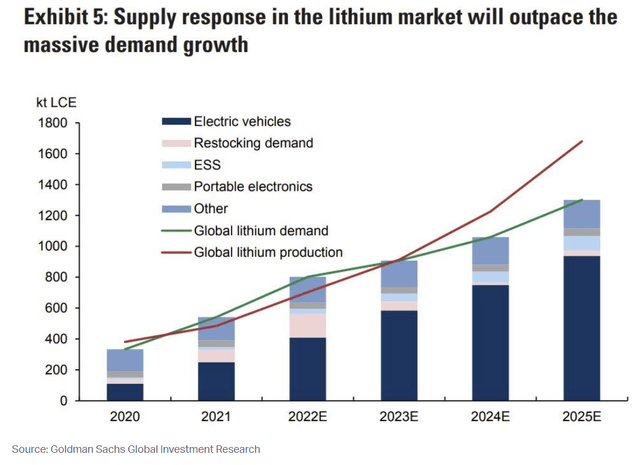

This surge in pricing will allow Albemarle to have positive free cash flow in 2022 despite heavy capital spending on plants that are only just now finishing construction and beginning start-up. After reporting earnings in early November, the stock spiked to an all-time high around $334 but began trading lower in the past week, giving up nearly all its post-earnings gain. This drop had been attributed to rumors of lower Chinese demand in 2023 as well as a forecast from Goldman Sachs (GS) that supply will exceed demand after 2023, widening further by 2025.

This gap looks scary to anyone who has followed the lithium market for more than the last couple years. Following a peak in late 2017, lithium carbonate prices fell by 70% over the next couple years even before the start of the pandemic as producers began adding capacity in response to that early demand spike.

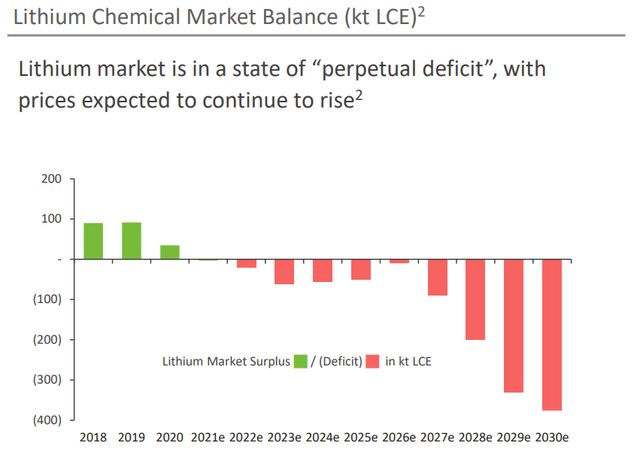

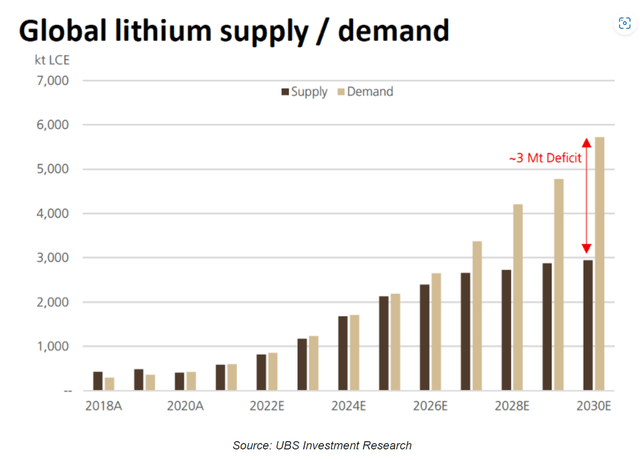

Looking further out, the surplus looks short-lived, as analysts predict widening supply shortages through 2030. A forecast last year from Macquarie calls for a 400 kt gap in 2030, while UBS predicts as much as 3 million tons.

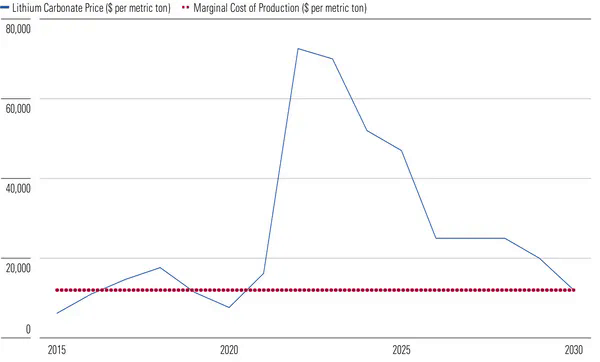

This variability in the supply and demand forecasts makes it difficult to predict the prices necessary to estimate Albemarle’s future cash flows. One thing I can say is that if the supply shortage is that large, then the price forecast I showed from Morningstar in my article last quarter is almost certainly too pessimistic. That forecast has prices coming all the way down to the marginal cost of production by 2030, which it estimates around $12,000/ton.

Morningstar

This cost of production could be outdated by 2030 due to inflation, as well as the fact that marginal production will come from increasingly harder to process resources, not the low-cost Chilean brine and Australian spodumene that make up Albemarle’s production base today.

With so much uncertainty in future pricing, when valuing the stock, I like to not only make my best estimate of the future, but also see what conditions would justify the current share price. Going through that exercise for Albemarle, the stock looks expensive even if lithium prices hold around $25,000/ton after 2025. However, the stock looks fairly valued with prices around $36,000/ton. Lower interest rates would also make the stock look more attractive since most of the cash flow is far in the future.

Extending The Volume And Price Assumptions

Last quarter, I modeled Albemarle’s earnings out to 2026. The company is wrapping up construction and going through the start-up phase at new facilities in Chile and Australia and will be producing sellable product from them in 2023. Also over the next couple years, the company will complete two more units at Kemerton and a new lithium hydroxide plant in Meishan, China, as well as expanding Silver Peak in Nevada.

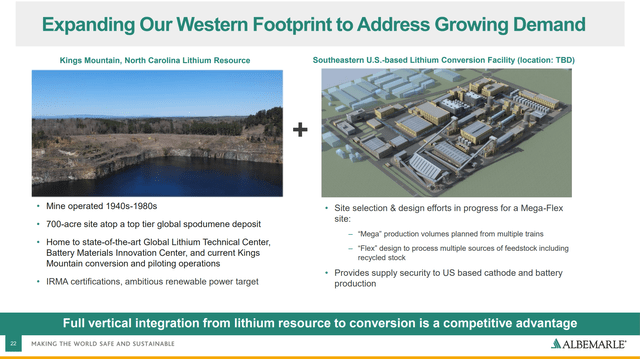

Looking out to 2030, additional units in Chile and Australia will be completed. The next big expansion will be in the US as Albemarle plans to reopen a mine in North Carolina and add conversion capacity in the Southeast U.S. to process flexible sources of feedstock including recycled material.

With all these expansions, Albemarle will be producing 400 kt/year by 2030.

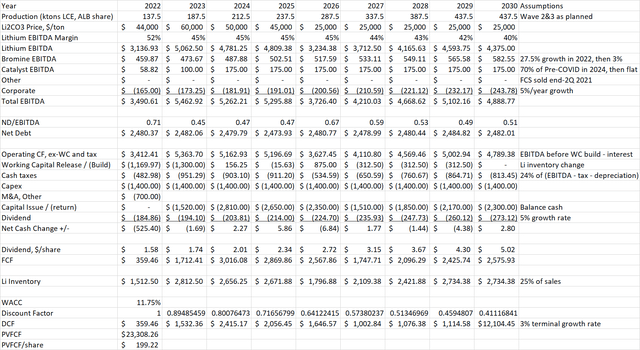

Updating the price assumptions, Albemarle provided guidance of $3.3 – 3.5 billion for 2022 in their last earnings release. This corresponds to a year average lithium price around $44,000/ton. This is just over half of the current spot price but factors in lower prices to start the year as well as Albemarle’s transitioning its customers from long-term negotiated prices to more index-based pricing. For 2023, I am using $60,000/ton, which is down $10,000 from the number used last quarter and the above Morningstar chart. This is meant to reflect the Chinese slowdown discussed above. 2024-26 then follows last quarter’s assumptions and the above Morningstar chart. Beyond 2026 however, I am leaving the price at $25,000/ton rather than letting it fall all the way back to $12,000. If the supply shortage is as large as some forecasts indicate, the higher price is justified.

Model Results

Given the back-end loaded growth, a discounted cash flow analysis is more useful than looking at current EBITDA or FCF multiples, so I am now using that technique for valuation. I am using a discount rate of 11.75%. You can see how this was calculated on Guru Focus. This is a higher WACC than you may be used to seeing, but don’t forget that the risk-free rate is now around 3.75%. ALB stock also has a fairly high beta around 1.5.

Besides the lithium price and production volumes discussed above, I also built in a decreasing EBITDA margin from 45% to 40% in the back half of the decade as Albemarle gets some of its new production from higher-cost sources. Bromine and catalysts remain a smaller but still significant part of the company. Bromine grows at 3% per year and catalysts recovers somewhat in 2023-24 and then stays flat. Finally, beyond 2030, the overall company’s cash flow grows at a terminal rate of 3%.

The discounted cash flow (“DCF”) valuation of Albemarle from these assumptions is $199/share, 28% below the price at the time of writing. I won’t necessarily call Albemarle a sell based on this valuation, because it can swing heavily depending on the lithium price assumption. Doing the sensitivity analysis, if I change the lithium price to $35,000/ton from 2026-2030, the DCF value increases to $276/share, about where the stock is now trading. Alternatively, if I leave lithium prices at $25,000 but lower the WACC by 2.5% to 9.25%, the DCF value increases to $277/share, also about where the stock is trading.

Conclusion

Albemarle can produce annual free cash flow in the $2- $3 billion range, based on my updated forecast for lithium prices which stabilize at $25,000/ton in the back half of the decade. This is enough free cash to buy back about half the outstanding stock by 2030 even while increasing the dividend by 5% per year. Still, applying a DCF model with a discount rate of 11.75%, the stock has around 30% downside to fair value.

I always caution against taking a DCF result uncritically without first considering how sensitivities affect the value. In this case, because Albemarle has so much production coming on in the future, a change in the long-term lithium price forecast can change the current valuation considerably. For example, changing the post-2026 lithium carbonate price to $36,000 from $25,000 takes the present value per share to $276, in-line with market prices. Using a 2.5% lower cost of capital also makes the stock look fairly valued.

I’m not selling my ALB based on this valuation, but I would not add here. Short term macroeconomic concerns could weigh further on the lithium price and cause significant pullbacks in Albemarle Corporation shares. As long as the forecasted supply shortage plays out relative to demand in 2030, higher lithium prices will reward buyers of future dips.

Be the first to comment