Boarding1Now/iStock Editorial via Getty Images

Alaska Airlines (NYSE:ALK) was one of the first mainline carriers where the disruptions due to pilot shortages became evident as the company cancelled around 4% of its flights each day as the airline was 63 pilots short than what it had scheduled for. It eventually forced the CEO of Alaska Airlines to issue an apology video where he outlined plans to hire 150 pilots, 200 reservation agents and 1,100 flight attendants. The issues the airline is facing are not specific to Alaska Airlines, but make it extremely interesting to analyze the financial performance through the quarter.

As a starting point for this analysis, we go through the updated guidance for Q2 2022 to see how they stack against what Alaska Airlines actually realized. Then go through detailed P&L statements and the guidance for the third quarter.

Strong Demand Balances

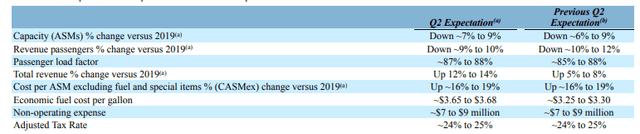

Q2 guidance Alaska Airlines (Alaska Airlines)

For the second quarter, capacity was brought down slightly in the updated guidance while strong demand was expected to drive higher load actors and passenger revenues on stable unit costs. Given that the capacity was expected to be marginally lower at the most positive bound, having CASM-Ex remain constant in the guidance was a positive. Less positive, but certainly realistic, was the increase in expected fuel costs per gallon.

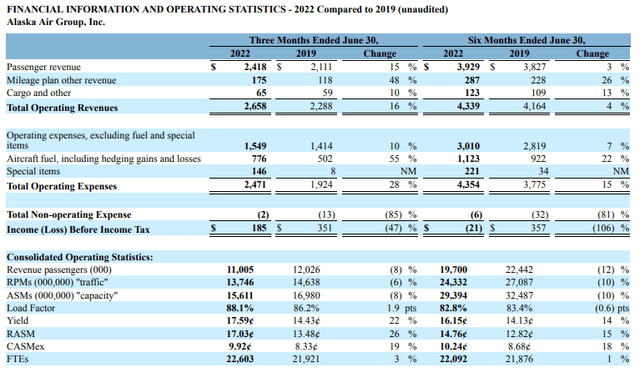

Year-over-three performance Alaska Airlines (Alaska Airlines)

Alaska Airlines ended up reporting revenues up 16%, whereas it previously guided in the 12%-14% range. So, Alaska Airlines significantly beat its own guidance helped by strong continued demand and pricing which set its June revenues on a record breaking $1 billion. Capacity was down 8% which was worse than the guidance and reflects the continued challenges that Alaska Airlines faces, but the company is saying it now has a better insight into its training pipeline and is more conservative with its scheduling, and while capacity was down passenger numbers were better than expected as load factors improved. CASM-ex Fuel was up 19%, which was at the high side that Alaska Airlines had guided for.

All with all, I believe that the results were strong where lower capacity was more than offset by strength in demand for air travel and pricing. An important item to discuss are fuel costs. Those were up 183% driven by higher fuel prices and higher flight activity. The economic fuel price per gallon ended up being $3.76 per gallon, which is higher than what Alaska Airlines had guided for. So, two recurring elements we see with airlines is that they haven’t really been able to get their fuel guide in the right range nor their capacity. To dampen the fuel bill, Alaska Airlines has fuel hedges in place which it expected to provide a $200 million relief on the fuel bill this year. In Q2 this was $90 million and in Q3 a relief of $50 million is expected.

When it comes to dealing with issues faced across the industry, we saw that Alaska Airlines is increasing its hiring, seeking for 150 pilots, and it’s more conservative in scheduling. That’s a set of measures that does not materially differ from actions competitors are taking. On the regional side of its business, I found that Alaska Airlines did not provide a thorough plan on how to recover capacity there. That might be disappointing, but I believe that at this time regional carriers cannot do a whole lot to retain pilots. They can improve their fleets, removing the smaller less efficient parts of their regional fleets and keep the training pipeline fluent. An additional step would be to bring pay in line with that of the mainline, but even for mid-tier airlines such as Alaska Airlines that might not stop the attrition.

Q3 Guidance: Revenue Growth Improves Further

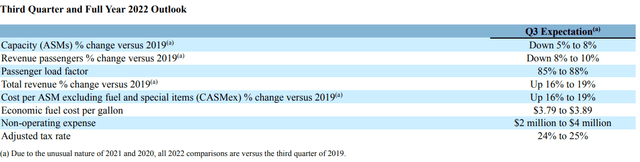

Q3 guidance Alaska Airlines (Alaska Airlines)

For the third quarter, Alaska Airlines expects capacity to be down 5% to 8% hinting at a modest capacity improvement as the output of the training pipeline improves. Revenue passengers is expected to be down 8 to 10 percent, also providing some improvement compared to the Q2 updated guidance, while passenger factors are expected to be in the 85 to 88 percent range, slightly lower than what the airline guided for in Q2, and that’s not really unexpected as a capacity improvement would somewhat dampen the load factors toward more normalized numbers. The revenue growth, however, is expected to accelerate so Alaska Airlines sees a strong pricing environment ahead, maybe not at the peak levels seen earlier but still extremely strong. The big question of course will be whether Alaska Airlines will be able to translate that into margin expansion as the economic fuel price per gallon is expected to be up to $3.79-$3.89 and CASM-Ex is growing in line with the total revenue.

So, there’s an expected top line improvement of $380 million to $455 million in the third quarter. Fuel costs could chip away $15 million to $40 million and labor costs are expected to chip away some of that top line growth as well. On a GAAP-level, I expect that there will be a significant improvement as the second quarter results included a $146 million fleet restructuring charge which I don’t expect to be that high in the second quarter though the write offs are subject to the fleet transition plans and execution from Alaska. Overall, while I do believe there’s some pressure from rising fuel prices and labor costs, there should be room for Alaska Airlines to realize sequential margin expansion.

Conclusion

Overall, earnings were not exciting in the sense that there wasn’t a lot of unexpected items. We saw solid demand and the unit fuel cost exceeding the guide resulting in double-digit adjusted operating margins. I would say that Alaska Airlines has more room to restore the margins, the third quarter will show even higher fuel costs but also higher revenues as the strong demand environment continues to exist. Obviously, demand can soften especially since there are fears of an economic slowdown but there are some areas where growth is still off by a wide margin compared to 2019 and some levers that Alaska Airlines could pull. Corporate travel is off by around 20 to 25 percent and even amidst a slowdown in economic growth I would expect that corporate travel demand will continue to recover while for the casual travelers we would likely see demand fall at current yield levels before yield falls. So, if needed Alaska Airlines could play with the pricing but realistically with demand expect to fall before yield there is no need for that at this point as the demand at current yield levels is still high and even if there is a quick drop in both Alaska Airlines can play around to find a sweet spot for the top-line.

Be the first to comment