Andrii Atanov/iStock via Getty Images

Investment thesis

With strong recent trading, Fixstars’ (OTCPK:FXSRF) shares have performed strongly YTD. However, its consultancy business model is inherently challenging to scale, and with our expectation of a downturn in the semiconductor market in the next 12 months, we believe the risk profile is high. With the shares trading on an estimate PER FY9/2023 43.0x, we rate the shares a sell.

Quick primer

Established in 2002, Fixstars is a specialist Japanese consultancy serving domestic semiconductor manufacturers. Its largest clients in FY9/21 were Kioxia (unlisted, previously called Toshiba Memory specializing in NAND flash memory), NEXTY Electronics (unlisted, a semiconductor components trading company affiliated to the Toyota (TM) group), and Hitachi (OTCPK:HTHIY).

Fixstars’ key competitive edge is its team of engineers skilled in both hardware architecture and software development, allowing for performance acceleration in various types of semiconductors. These include parallel processing technology in multi-core environments, optimal programming technology for various hardware architectures (such as GPUs and FPGAs), and controller development that utilizes the technical characteristics of NAND flash memory.

Its core activity is providing consultancy services under the Solution business (98% of total FY9/2021 revenues) which includes some specialist hardware sales, and a minor business in niche SaaS covering cloud products for Ising machines, online medical services, and AI-based code review. It also has a joint venture with NEXTY Electronics to develop software for autonomous driving.

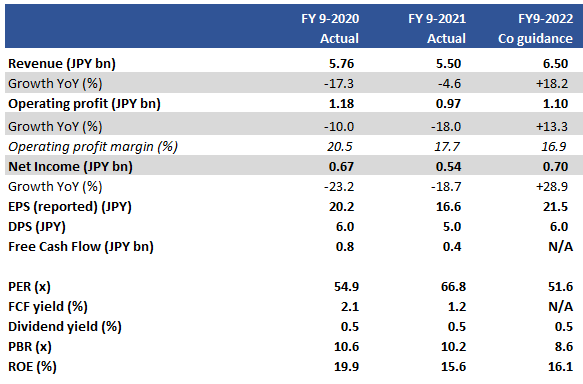

Key financials

There is no sell-side coverage and no earnings estimates available; we have put in company guidance for the current financial year.

Key financials (Company)

Our objectives

With recent earnings peaking back in FY9/2019, we want to assess whether this niche business can maintain a steady growth profile with its exposure to the semiconductor cycle.

A difficult business model to scale

As a consultancy service, Fixstars can grow its sales and drive earnings by increasing engineer headcount, raising charge-out rates, and maintaining high staff utilization. The company has been successful at increasing its staff numbers, increasing from 133 in FY9/2016 to 258 in FY9/2021, nearly doubling in the last 5 years. However, the company admits that hiring has become very competitive, resulting in only 5 net hires during FY9/2021.

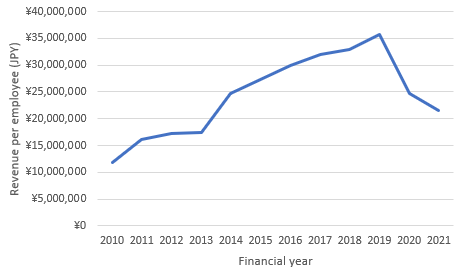

Increasing staff inevitably involves hiring junior staff, essential to investing in future growth. Although Fixstars has its fair share of hiring mid-career engineers, if we see the trend in FY revenue per employee, the recent peak was in FY9/2019. We believe this is partly due to the growing proportion of less experienced staff on the books. The other key factor appears to be Kioxia (formerly Toshiba Memory). In 2017, Toshiba (OTCPK:TOSBF) was forced to sell off its flash memory business to stave off bankruptcy following a financial scandal involving its Westinghouse nuclear unit. The memory business was spun off and sold for $18 billion to a consortium led by Bain Capital after a high-stakes bidding war. Following deal completion in June 2018, under new stewardship we believe Kioxia has been cutting back on operating costs to ready itself for an IPO, resulting in less business and falling utilization for suppliers such as Fixstars.

Trend in revenue per employee

Trend in revenue per employee (Company, Refinitiv)

With its key customer under some pressure, Fixstars has limited capacity to grow its business although efforts to develop a SaaS business tie in with its aim to develop a sustainable earnings model. On the other hand, we believe the majority of consultancy work carried out are longer-term contracts and hence earnings visibility tends to be high. Consequently, actual reported results often beat company guidance.

Company guidance for FY9/2022 is punchy with 18.2% sales growth YoY. H1 FY9/2022 results have been steady, with sales growth at 9.2% YoY and operating profit rising 86.2%. Despite the official stance of investing in new hires and new business development (particularly in SaaS), with the current run-rate achieving 79% of FY operating profit in H1 FY9/2022 Fixstars appears comfortably ahead of guidance. This also appears reflected in the share price performance YTD (up 25%).

Despite upside risk from earnings into H2 FY9/2022, we believe that unless the company sees reinvigorated demand from Kioxia or can gather high-end engineers in abundance, maintaining a sustainable earnings profile will be difficult to achieve.

Semiconductor cycle

Deutsche Bank Research believes that the current semiconductor cycle is said to be longer than usual (page 8), having peaked in CY2021 post-COVID and expected to continue into CY2023. Current supply bottlenecks and increase in manufacturing capacity could result in a negative scenario in the medium term where there is a risk of demand normalizing, together with excess manufacturing capacity resulting in a dramatic decline in pricing. Such a scenario will mean semiconductor manufacturers would cut back on R&D to weather the storm, with suppliers such as Fixstars in a position to win less lucrative long-term contracts for the medium term.

Valuation

The shares are trading on PER FY9/2022 51.6x, and assuming an optimistic 20% EPS growth YoY for FY9/2023 the resultant PER is 43.0x. This is not a cheap multiple and highlights to us that the market is valuing the company perhaps a little too high for its status as a specialist technology business.

With limited indications that new hires are recovering (the company is said to be aiming for around 10 new hires in FY9/2022 (page 10 of presentation)) and a potential downturn in the cycle within the next 12 months, we do not believe the shares should be trading at a high premium.

Risks

Upside risk comes from key customer Kioxia and a material upturn in demand for long-term consultancy work – a new plant is being built in Japan, and there may be more work forthcoming to support new product development.

Fixstars may also be able to obtain skilled engineers from new recruitment channels, particularly for its new SaaS operations. SaaS could provide a sustainable high margin earnings stream that is easier to scale than consultancy.

Downside risk comes from limited headcount growth, inherently limiting growth capacity as a consultancy service.

A downturn in the semiconductor cycle will result in a secular decline in semiconductor product development.

Conclusion

Fixstars has proven itself to be a valuable resource for Japanese semiconductor manufacturers, who prefer to outsource development work to limit fixed costs within their organizations. Gathering engineering expertise has been Fixstars’ core competitive edge, but this does not mean it is immune to customer discretionary spending cuts and the semiconductor cycle downturn. Weighing up what appears to be formidable challenges in the industry, we are negative on the shares and rate Fixstars as a sell.

Be the first to comment