hapabapa

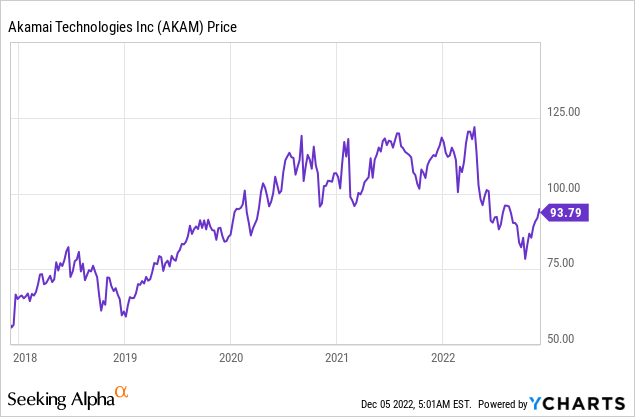

Akamai (NASDAQ:AKAM) owns the world’s largest and most established content delivery network (CDN) with over 4,000 locations globally. The business is currently expanded its business to focus on the trillion-dollar cybersecurity market and the growing cloud computing business. So far results have been promising with its “Compute” business growing revenue by a blistering 72% year over year. The company still has a long way to go as it is facing revenue declines in its core business. But in this post, I’m going to break down its evolving business model, financials, and valuation, let’s dive in.

Evolving Business Model

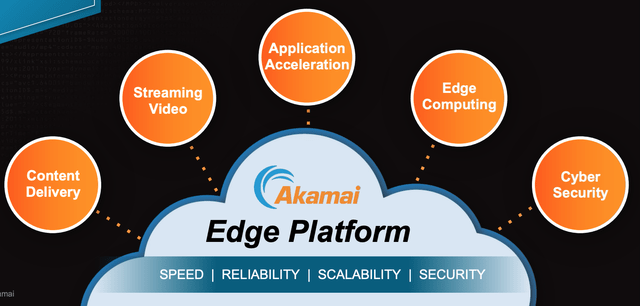

Akamai’s mission is to “power and protect life online”. The company has its roots as the world’s largest and oldest content delivery network [CDN]. A CDN basically uses a footprint of global data centers to store a cached version of a website in order to increase website performance/speed and security. For example, let’s say you are in Los Angeles, California and you are accessing a website that is hosted in Sydney, Australia. Rather than your “HTTP GET Request” for the webpage going to the server in Sydney, it can be derived from the LA data center close to you, if the website provider uses a CDN.

The CDN is a great business and competes with companies such as Cloudflare (NET), Fastly (FSLY), and Amazon’s CloudFront by AWS. However, Akamai believes it can leverage its vast “edge network” as a platform for edge computing, Video Streaming, fast application delivery and even cybersecurity.

Akamai Edge Platform (Analyst Day Presentation)

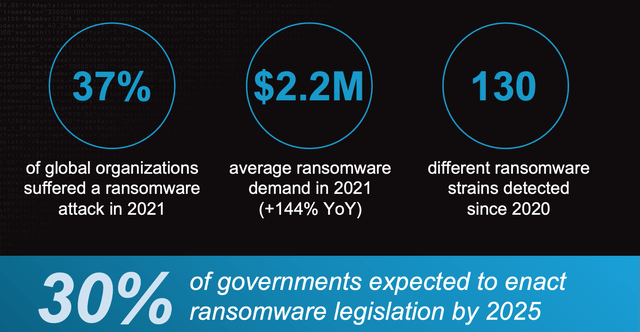

Akamai’s three main pillars now include Compute, Security, and Delivery. Cybersecurity is huge growth market, given 37% of global organizations suffered some type of ransomware attack in 2021, according to a Verizon Data Breach Investigations Report, cited by Akamai. This attack usually involves a hacker hijacking sensitive customer information and then planning to release it on the dark web and in the press unless a hefty ransom is paid. The average demand is $2.2 million (usually asked for in Bitcoin). This is one of the biggest fears organizations have, and as there is a direct cost of inaction it can easily be quantified to urge the buying of a solution.

Ransomware attack (Analyst Day Presentation)

Akamai’s cybersecurity platform consists of a multitude of solutions. Guardicore enables the “micro-segmentation” of individual users. This basically means users or employees on a corporate network are only given access to the applications they need and thus prevents “lateral movement” via a hacker. Then we have a Secure Web Gateway [SWG] which helps to stop DDoS attacks. In addition, multi-factor authentication is one of the easiest ways to prevent breaches.

Cybersecurity Akamai (Analyst Day Presentation)

Damage from cyberattacks will equate to ~$10.5 trillion by 2025, up an eye-watering 300% from 2015. Therefore, a study by McKinsey indicates the $150 billion organizations spent on cybersecurity solutions in 2021 is insufficient, and thus the market will likely grow to between $1.5 trillion and $2 trillion.

Stable Financials

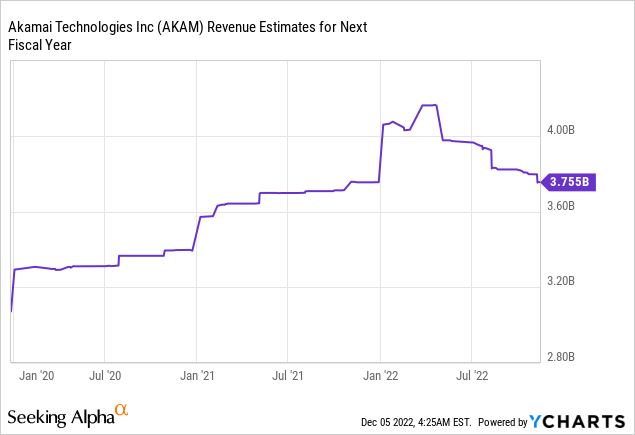

Akamai reported strong financial results for the third quarter of 2022. Revenue was $882 million, which beat analyst estimates by $5.9 million and increased by 3% year over year. The revenue growth rate isn’t exactly fast but on a constant currency basis, Akamai reported 7% growth which is slightly better.

The good news for Akamai is its two newer business segments (Security and Compute) are growing rapidly with a collective growth rate of 23% year over year or 28% on a constant currency basis. These two segments combined makeup 55% of total revenue and are poised to become a bigger part of overall revenue in the years to come.

Akamai’s Security segment increased revenue by 13% YoY (19% FX neutral) to $380 million. This was driven by strong growth in the Guardicore solution explained previously which contributed $14 million in Q3. Notable customers who adopted the solution in Q3 included one of the largest energy companies in the world, a major South American broadcaster, and a large dietary supplement provider. This range of customer industries means Akamai is well diversified and has a security product that appeals to a vast range of organizations. Security makes up 43% of total revenue and is the second major revenue pillar of the business.

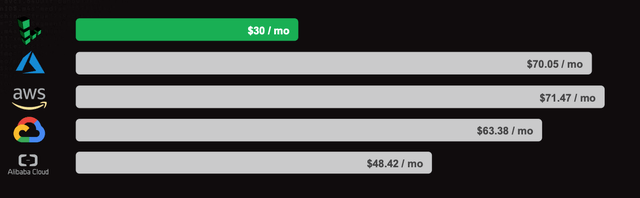

Akamai’s second major growth driver is the “Compute” business which generated $109 million in Q3,22 up a rapid 72% year over year. Akamai aims to position itself in the “sweet spot” between large cloud infrastructure providers such as AWS and Azure, and smaller cloud providers such as Digital Ocean. Its value proposition is simple, offering lower costs than the Cloud titans with greater flexibility for developers. To accelerate this part of its business Akamai acquired Linode in early 2022 for a staggering $900 million. Linode offers an easy-to-use platform for cloud computing. I have used the platform myself and found it very easy to “spin up” an “instance” of computing with the click of a button. This may sound complex but you can think of the “cloud” as just somebody else’s computer, which you are using to run an application. Of course, the beauty of it is you can scale easily with performance. Approximately 179,000 developers used Linode in April 2022 and as you can see from the chart below it is cheaper than the major cloud titans for an equivalent workload.

Cloud Providers Cost (Analyst Day Presentation)

Akamai has connected Linode’s 11 existing locations to its private backbone which enables lower latency, better economics, and higher throughput for customers.

Akamai’s traditional Delivery business reported revenue of $393 million which declined by 15% year over year or 11% on a constant currency basis. This declining growth wasn’t great to see, but its new business segments are gaining traction so should be able to offset this in the coming quarters.

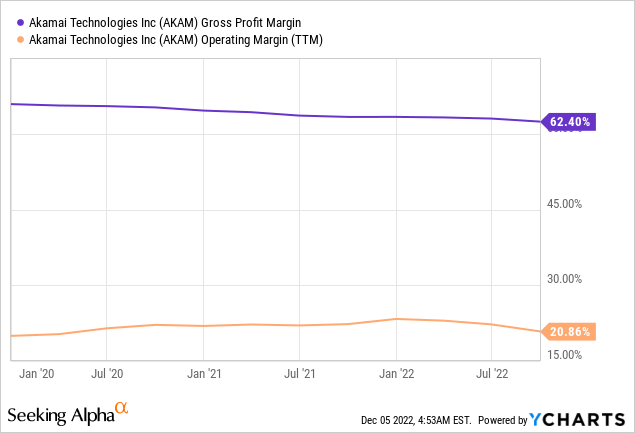

Profitability and Expenses

Akamai reported non-GAAP Earnings Per Share of $1.46, which beat analyst expectations by $0.04. However, non-GAAP net income did decline by 16% year over year to $200 million.

This was driven by a combination of declining growth in its core business and large non-GAAP operating expenses of $291 million. The company reported $111 million in capital expenditures which excludes stock-based compensation. Its effective tax rate was 17%, up 1% year over year, which also impacted results.

A positive is management showed confidence and authorized a $163 million share buyback program for 1.8 million shares. The company has a strong balance sheet with cash, cash equivalents, and marketable securities of $1.4 billion. Management’s plan is to buy back shares in order to offset dilution from the large stock-based compensation program for employees. Akamai does have fairly high total debt of $3.15 billion, but just ~$820 million of this is current debt, due within the next two years, and thus is manageable.

Advanced Valuation

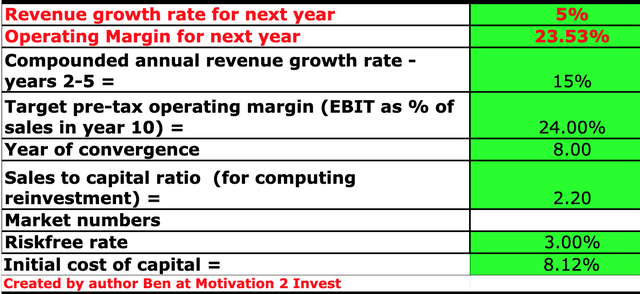

In order to value Akamai I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 5% revenue growth for next year. However, in years 2 to 5 I have forecasted revenue growth of 15% per year. I forecast this to be driven by the continued growth in Akamai’s Security and Compute, which should offset more stable revenue trends from Akamai’s legacy Delivery business.

Akamai stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted net income.

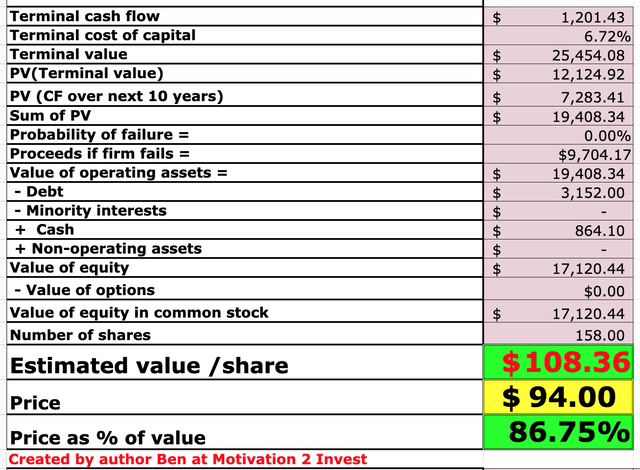

Akamai stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $108 per share, the stock is trading at ~$94 per share at the time of writing and is thus ~13% undervalued.

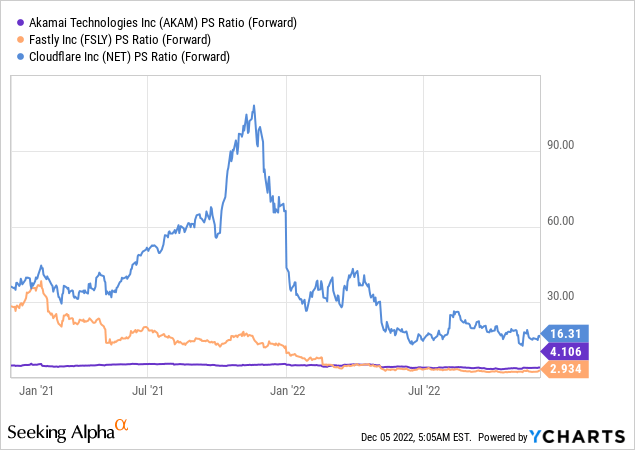

As an extra datapoint, Akamai trades a PS ratio = 4.1 which is 16% cheaper than historic levels. It is also much cheaper than competitor Cloudflare (NET) but slightly more expensive than Fastly (FSLY).

Risks

Longer Sales Cycles/Business Model Transition

On paper it sounds easy to attack a trillion-dollar cybersecurity market. However, Akamai will need to change its brand image from a legacy CDN to a trustworthy security provider. Entering the cloud computing market also has huge growth potential but again requires an immense amount of trust to be built especially with large enterprises. Given the forecasted recession, I also suspect sales cycles will lengthen.

Final Thoughts

Akamai is a great company which is evolving its business model to attack two huge growth markets, Cybersecurity and Cloud Computing. The initial traction has been strong but continued declines in its core business and FX headwinds have offset some of the results. Despite this the stock is undervalued at the time of writing and thus could be a great long-term investment. The company still has a long way to go, but the potential is huge with its new markets.

Be the first to comment