Chip Somodevilla

The former undisputed social media giant Facebook, which just recently got rebranded into the “metaverse company,” is coming off of its arguably worst year since its inception all the way back in 2004. The sheer scope of the equity erosion that has taken place at Meta Platforms, Inc. (NASDAQ:META) since the beginning of the year remains both tragic and historic at the same time. It started the year by delivering a very troublesome earnings report which highlighted multiple fundamental issues within the business model. As a result, the then-$900 billion company saw more than $200 billion in equity erased in just a single after-hours trading session.

Given this has occurred at the onset of a long-overdue stock market decline, which only recently started to align itself with the broader macroeconomic trends, it was little more than an early sign of all the problems for Meta shareholders. After the floodgates were opened, the company generated a negative 62.28% year-to-date return, significantly underperforming the S&P 500 (SPY) for the first time in years. Meta is currently trading for a little more than $128.10 per share at the time of writing this article.

In this immensely difficult situation for the company, with an already damaged personal reputation being put on the line, Mark Zuckerberg, the founder, and CEO of Meta, took to the big stage to showcase the latest developments in his Metaverse project. The company’s abrupt and rather unexpected pivot into the space surprised many analysts and investors alike, as Mark poured billions of dollars into a pet project that investors see ranging from capital destruction at its worse, to just being naïvely decades early into an eventually solid business at best.

We have already had a chance to discuss the tragic story of Meta’s shareholder value destruction in our June article under the title: “Zuckerberg Might Be Right About The Metaverse After All.” Back then, we examined Mark’s pet project in order to attempt to position ourselves as the Devil’s Advocate portraying the other side of the story. Mr. Market’s treatment of Meta, and the way market sentiment shifted in little more than a couple of quarters, allowed for an interesting value proposition to present itself. This remains problematic in our view, and the interesting sequence of events only served to further reinforce our belief that Meta remains fundamentally undervalued and carries significant upside potential.

Meta vs S&P500 1-Year Return (Seeking Alpha)

Annual Developer Connect Event

On the 11th of October, Meta held its annual Meta Developer Connect event. Mark Zuckerberg, alongside other senior company executives and some high-profile guests, took to the stage to highlight their latest product innovations, technological breakthroughs, as well as some exciting and potentially lucrative new partnerships. Initial reception to the event has been mediocre at best, with Meta shares losing 2.3% of their value at Tuesday’s closing bell.

From a strictly technological perspective, the most exciting news of the event was the long-awaited reveal of “Project Cambria,” now simply titled the “Quest Pro”. The project was first teased almost a year ago and is supposed to be the next big step in Meta’s attempt to conquer the Augmented Reality and Virtual Reality space, significantly outpacing Quest 2.

Meta Quest Pro (Oculus Website)

The device stands two feet taller than both its predecessor and the competition, as it implements two new interesting features. The first feature is the newly implemented ability of the device to track the movement of a user’s face and eyes. This, for example, enables the user to transmit his basic emotional expressions onto the virtual world and allows for a much more convincing “virtual avatar” experience.

The second feature is that the company implemented a full-color passthrough video, which is supposed to represent a midpoint between VR and holographic augmented reality. It uses outward-facing high-resolution cameras to capture outside images that can be rendered live to the headset, allowing for an augmented reality experience.

Codec Advanced Virtual Avatars (Meta Connect 2022)

Quest Pro’s price tag definitely took away more than one headline, as charging $1,499 for an AR/VR Device seems quite distanced from reality in the current macroeconomic environment, unrelated to the impressive technological leap. Meta defends this price point, claiming they are still actively pursuing both lineups, with the $399 Quest 2 more intended for the average user, while the $1,499 Quest Pro is aimed towards businesses and professionals. The device is already available for pre-order, and early units should start shipping in late October, meaning we will see how all of this plays out.

Another notable point that Meta wanted to make is that their “Quest Store” is achieving steady growth. The store just surpassed $1.5 billion in sales, with products still mostly being games and interactive fitness apps. Most of the talk here is intended toward attracting more potential developers that are supposed to work on Metaverse-related projects, but this still remains a good sign for investors.

Of over 400 apps on the Quest store, roughly 1 in 3 are making revenue in the millions today. 33 titles have made over $10 million in gross revenue, which is up 11 since February, and the number of apps that have made over $5 million in gross revenue has doubled since last year, up to 55. Walking Dead is a great example. Walking Dead has surpassed $50 million in revenue on Quest alone, and that’s nearly double the revenue on all of the other platforms it ships on. And it’s not just that developers are finding success on our platform, they’re actually finding it really quickly. I can give you some examples, Resident Evil 4 and Zenith: The Last City. The first is a classic. It’s one of the best games ever made, it’s one of my personal favorites. It was completely rebuilt for VR. And the other is like a brand-new title from a small independent team. Both of these titles made their first $1 million of revenue on the Quest store in less than 24 hours.

Chris Pruett, Director of Content Ecosystem

From an investor standpoint, the main highlight of the event is without a doubt Mark revealing the impressive lineup of partnerships that Meta managed to secure, bringing several strong-sounding names into the Metaverse:

- NBC Universal / Comcast (CMCSA) with a content deal to deliver themed experiences in Horizon. The Peacock streaming app will also be coming to Quest headsets as part of the partnership.

- Accenture plc (ACN) in order to launch “Quest for Business” next year, providing metaverse bundles to businesses looking to expand their virtual work offerings.

- Zoom Video Communications, Inc. (ZM) in order to implement newly designed avatars onto zoom calls.

- Microsoft Corporation (MSFT) with a two-sided partnership that without a doubt seems to be the most potentially lucrative out of the bunch. Microsoft’s CEO, Satya Nadella, tuned in and joined the presentation himself.

Mark Zuckerberg and Satya Nadella (Meta Connect 2022)

For business use, it is attempting to build up the “future of work” alongside Microsoft. The partnership would enable Quest users to conduct immersive team meetings where they would be able to interact with content from Microsoft apps such as Excel, Word, PowerPoint, Outlook, and SharePoint within virtual reality, alongside other benefits. If Meta remains serious about finding a proper business utilization for the metaverse, access to Office 365 alongside deep integration into other Microsoft resources will be a chance to take a huge step forward.

For entertainment use, Microsoft and Meta are exploring ways to bring Xbox Cloud Gaming to Meta Quest Store. Microsoft has made a huge leap already into the industry and is currently awaiting regulatory clearance to wrap up the $68.7 billion acquisition of Activision Blizzard (ATVI). Gaming remains the only currently available full-utilization of the “metaverse,” and as such, this part of the partnership could start creating value for both sides sooner than many would think.

Still attractively valued

Being down more than 60% year-to-date and having almost $600 billion of market cap erased from the markets places the average Meta long-term investor in a very difficult situation. The investor has lost slightly more than 4 years of gains, with the last time the social media giant traded at these prices being in early 2018.

However, Meta is not the same company it was back in 2018, with it having essentially doubled both the top and the bottom line since. In the second quarter of 2018, the company generated $13.12 billion in revenue and $2.83 billion in free cash flow. Even after the two troublesome quarters, Meta ended the second quarter of this year with $28.82 billion in revenue and $4.62 billion in free cash flow.

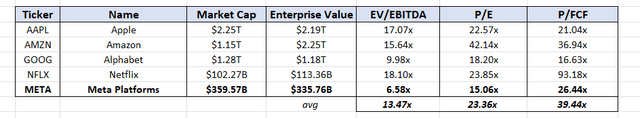

FAANG Valuation (Author Spreadsheet IQ Capital Data)

This led the way to what we consider to be an immensely attractive valuation, with the company currently selling for 6.58x FWD EV/EBITDA, 15.05x FWD P/E, and 26.44x FWD P/FCF. This places Meta far below the average of the “FAANG” group and companies such as Amazon.com (AMZN) or Netflix (NFLX), indicating that Mr. Market has slowly downgraded the company and no longer considers it a high-growth tech stock and the associated valuations.

It remains fair to a certain point, as growth is going to come under severe pressure in the current economic environment and is likely going to be limited to low double-digits at best. Ultimately, it comes down to the majority of investors questioning the efficiency of the current capital allocation and the depth of the company’s moat, which seems to have all but melted down recently. Either way, it remains a fact that Meta proved to be highly vulnerable to the likes of Apple (AAPL) and Alphabet (GOOGL, GOOG). We are not trying to argue that Meta didn’t deserve to be downgraded in this sense, nor that it deserves a premium valuation to some of the other high-quality companies, but simply that the market swung too far to the other side.

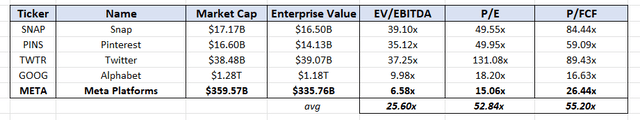

Social Media Companies Valuation (Author Spreadsheet IQ Capital Data)

This becomes more evident once Meta is compared to other giants in the social media space. The companies in this list find themselves in a relatively similar situation and are expected to largely suffer due to the macroeconomic environment that is poised to see discretionary spending limited and companies reigning in on their marketing expenses. We are discussing the likes of Snap (SNAP), Pinterest (PINS), and Twitter (TWTR). The ladder here might not be the best example, as the stock price has been influenced recently by the merger arbitrage opportunity, but it was never truly profitable or solid-looking financially in the first place. Such a direct comparison would make the company look significantly undervalued.

Closing thoughts

This year’s annual Meta Connect event served an important purpose for Zuckerberg, as he was given a chance to mount a proper defense of his “Pet Project” which has managed to attract much criticism as of late. Judging solely by the immediate market reaction, he failed to achieve a lot. Still, we would argue that the event marks a long-needed win for Mark, as he desperately needed to display a more practical use of the Metaverse, or at least the very beginnings of it. In other words, he needed to show that the $10 billion investment isn’t simply capital that was flushed down the drain.

The roughly two-hour-long affair left us impressed with the level of technological achievement that Meta has been able to deliver, and in our view remains a must-see as a point of due diligence for any investor seriously thinking about investing in the company. The announced partnerships also serve to reinforce the point that Meta isn’t really standing alone in the field, as many others have an interest and hope for the project to succeed, even though they didn’t carry the same level of commitment as Meta did.

We still remain cautious about the project. However, as stated in our previous article, we just recognize the difficulty of the position Meta found itself in and ultimately the decision-making process that led them to allocate that much capital into a high-risk, high-reward gamble such as the Metaverse. We also recognize that it is highly likely the company will continue to suffer in terms of both the top and bottom line given the situation they find themselves in. However, we remain committed to the idea that the king of social media is fundamentally undervalued and is one of the best investment opportunities in this bear market.

Be the first to comment