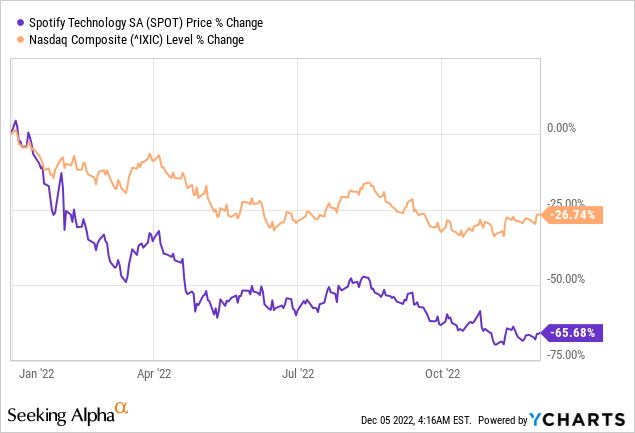

Sergi Alexander

Investing in Spotify (NYSE:SPOT) provides an opportunity to capitalize on the growth of the streaming music industry and exposure to the potential upside of the company’s innovations in the music streaming space. As the leading music streaming service, Spotify boasts a large user base that is highly engaged with the platform. The company is investing heavily in technology to improve the user experience and expand its offerings. Additionally, the company is pursuing international expansion opportunities and new partnerships that could further drive revenue growth. With a solid competitive position, a loyal user base, and long-term growth potential, Spotify offers an attractive investment opportunity for investors.

Q3 Earnings

Spotify reported solid Q3 2022 financial results, with total revenues of €3.04 billion, representing a 21% increase year-over-year. Operating cash flow came in at €40 million, with free cash flow at €35 million. Additionally, the company added 23 million new subscribers, bringing its total active user base to 456 million.

Market

The music streaming industry has experienced remarkable growth over the past few years. In 2020, music streaming accounted for more than half of all music industry revenue. Spotify, Apple Music (AAPL), and YouTube Music (GOOG) (GOOGL) are leading the charge and have become the world’s most extensive music streaming services. Spotify is the biggest, with over 286 million users and over 35 million songs. Apple Music has over 60 million users and is the second-biggest music streaming service, while YouTube Music has over 20 million users and is the third-largest music streaming service. The future of music streaming looks very promising. Analysts predict that streaming will continue to drive overall music industry growth, reaching nearly 80% of all music industry revenue by 2024. Spotify, Apple Music, and YouTube Music will continue to dominate the streaming landscape, with each service offering unique features and advantages. Spotify will focus on curation and personalized playlists, Apple Music will focus on exclusive content and offline listening, and YouTube Music will focus on video content. Streaming mostly is and, soon, will become the primary way people access and enjoy music.

Spotify Marketplace (Spotify Shareholder Deck )

Unique Selling Proposition

Spotify’s unique selling proposition is to provide users with a personalized music streaming experience. Spotify offers users access to a vast music library with customized playlists tailored to their tastes and preferences. It also provides exclusive content, such as live performances, artist interviews, and podcasts. Additionally, Spotify provides users with innovative features such as its Discover Weekly playlist, which curates new music based on the user’s past listening habits.

While I perceive YouTube Music’s discovery solution to be superior to Spotify overall in terms of user experience, breadth of content, and new innovative features, I perceive Spotify to outperform its peers by quite a bit.

TAM Expansion

To extend its total addressable market (TAM), Spotify aims to leverage two major growth drivers, technology and expanding partnerships. First, Spotify plans to continue investing in technology to stay ahead of the competition and meet customer needs. A particular focus has been and continuously will be on artificial intelligence and machine learning to improve their user experience and develop new features. Among these features are the following:

- Improved playlist curation and personalization tools: Spotify is looking to develop new tools to help users create and organize their playlists more efficiently and personally.

- Improved podcasting capabilities: Spotify is looking to expand its podcasting capabilities to make it easier for users to discover, subscribe, and listen to podcasts.

- Improved social features: Spotify is looking to add features that will make it easier for users to interact, such as creating shared playlists, messaging, and following each other.

- Augmented reality: Spotify is looking to leverage its music streaming platform to create interactive and immersive experiences using augmented reality.

- Enhanced video streaming capabilities: Spotify is looking to improve its streaming capabilities to make it easier for users to watch and enjoy music videos and other visual content.

Besides further investments in technology, Spotify plans to continue developing partnerships to expand its reach and increase its market share. This includes collaborations with record labels, artists, and other streaming platforms. Expanding partnerships include expanding its presence to new markets; most prominently here is the growth in the Indian market, which could act as a massive growth driver for the years to come. Spotify is reportedly exploring partnerships with Indian telecommunications companies to create bundled subscription offers for their customers.

New Features (Spotify Shareholder Deck)

Valuation

Spotify’s fair valuation is at 131.52, with an upside to today’s price of 63.8% for various reasons:

- Spotify’s future revenue growth is substantial. The company is well-positioned to benefit from the continuous massive global shift to streaming music services and has already seen impressive revenue growth over the past few years. This growth is expected to continue as Spotify expands its user base and launches new products and services.

- Spotify’s margins are also likely to improve in the future. This is driven by the company’s focus on cost-cutting initiatives such as reducing marketing costs, improving platform efficiency, and leveraging its economies of scale. This will help Spotify to increase its profitability, leading to a higher fair valuation.

- Spotify’s competitive advantages are another reason its fair value is higher than 80.31.

Spotify has a strong market position thanks to its significant user base and strong brand recognition. This gives the company a competitive edge over its rivals, allowing it to capture a more substantial portion of the streaming music market. These factors, combined with the company’s competitive advantages, make it an attractive investment and justify its higher valuation.

Spotify – 5 Year DCF (Personal Source )

Risks

Spotify is a rapidly growing streaming music service that has revolutionized how people listen to music. While the company has seen tremendous growth in subscribers and revenue, several risks are associated with investing in the company. One of the most significant risks is the company’s low operating margins, which stem primarily from not own any rights to the content they are offering. When a company does not own the range it provides, it must pay royalties to the content owners. This is a high cost for Spotify, as the royalties for streaming music are pretty high. As a result, the company’s profits are limited by the revenue it can generate from subscriptions and advertising. If the company’s expenses exceed the revenue, which has been the case, the company’s operating margins will suffer. A testament to this is Spotify’s Q3 earnings results.

Furthermore, the music industry is constantly changing, and this can create uncertainty for investors. As new artists emerge and different genres of music become popular, Spotify must continuously adjust its content selection to meet customer demands. This can be costly, as Spotify must pay royalties to the content owners each time it adds a new song or album to its lineup. Additionally, new streaming services are constantly emerging, creating competition for Spotify. This competition can put downward pressure on the company’s subscription prices and advertising rates, further reducing the company’s profits. Finally, there is the risk that the company’s current business model will become obsolete. If a new technology or business model emerges that makes streaming music more accessible or more cost-effective, Spotify could find itself at a competitive disadvantage. This could lead to a decrease in subscribers and profits, reducing the company’s stock price. In conclusion, investing in Spotify carries some risks, particularly regarding its low operating margins, which stem primarily from not own any rights to the content it offers. Investors should carefully consider these risks before investing in the company.

Conclusion

In conclusion, Spotify is a buy for investors looking for long-term growth. The company’s focus on increasing its market size and strong revenue growth make it a sound investment for those looking for solid risk/reward profiles. With its massive growth potential and ability to rapidly expand its user base, Spotify’s stock is an excellent addition to a balanced portfolio.

Be the first to comment