Vincenzo Pace/iStock Editorial via Getty Images

On the first of July, Airbus (OTCPK:EADSY) (OTCPK:EADSF) sent a ripple through the aerospace industry by confirming that the Big Three from China had ordered Airbus aircraft in big quantities. Given the current state of Boeing Commercial Airplanes, there is little doubt that this deal is a major blow to Boeing (NYSE:BA). In this report, I have a look at the order, why this is significant and under what circumstances this could truly become pivotal.

Big Order from the Big Three

Airbus A320neo China Southern Airlines (Airbus)

The three airlines that placed orders with Airbus are Air China (OTCPK:AICAF), China Eastern Airlines (CEA), and China Southern Airlines (ZNH). The first thing that is interesting to do is to look at the order composition and put a realistic value on the order.

The order of roughly 300 aircraft was disclosed separately:

- Air China disclosed that it had purchased 96 Airbus A320neo family aircraft with a list price of $12.2 billion. A third of the aircraft has been allocated to subsidiary Shenzhen Airlines with deliveries of all aircraft on order to take place between 2023 and 2027.

- China Eastern Airlines disclosed that it had purchased 100 Airbus A320neo family aircraft with a list price of $12.8 billion with deliveries scheduled between 2024 and 2027.

- China Southern Airlines disclosed that it had purchased 96 Airbus A320neo family aircraft with a list price of $12.2 billion with deliveries scheduled between 2024 and 2027.

The combined list price for the 292 aircraft is $37.3 billion. The filings did not contain an exact order mix, but from the quoted list prices it was possible to construct an order mix which subsequently can be used to calculate the market value of the aircraft, which is always a lot lower than the catalog price. By doing so, we found an order mix that is unsurprisingly skewed towards the Airbus A320neo and Airbus A321neo with an estimated market value of $15.45 billion to $16.25 billion.

While the market value of the aircraft is a lot smaller than what catalog values suggest, it doesn’t make the win for Airbus smaller. Airbus is aiming to increase production rates for the Airbus A320neo to 70 aircraft per month by 2025 with incremental increases expected from the current production levels of around 45 aircraft per month. The order from the Big Three in China nicely layers into the aspiration of Airbus to increase production in the coming years and it is highly likely that the order also was a major reason for Airbus to eye further production rate increased beyond what had previously been announced.

Boeing is the Big Loser in Political Play

Boeing 737 MAX render China Southern Airlines (Boeing)

Whereas Airbus can be seen as the big winner, Boeing without doubt is considered the big loser in this endless quest for aircraft orders. Many Boeing critics have adopted the unrealistic view that this is a result of the Boeing 737 MAX problems that Boeing had, and those views could not be further away from the truth. For that small, but very vocal group it is important to consider the simple fact that the Boeing 737 MAX has become the playball in geopolitical tension between the US and China.

Earlier this year, Boeing delivered the bad news to investors that it was no longer anticipating a further production rate increase later this year for the Boeing 737 MAX program. This decision was likely driven by lower near-term demand for air travel in China due to new lockdowns, but also has a big political element to it. Fighting a political battle using aircraft orders is possible in China because the big airlines in China are state owned and the country is an important end-market for commercial aircraft.

After the second crash of the Boeing 737 MAX, China was the first country to ground the Boeing 737 MAX. That is a move that in hindsight can count on wide support, but it also marked a moment where China exerted political pressure via a regulatory agency. China did make a big step last year to put the Boeing 737 MAX back in service in China, but since then progress on rebuilding the MAX presence in China has slowed down significantly. China Southern Airlines conducted a test flight with the Boeing 737 MAX in mid-June, but that was a month after it had removed the Boeing 737 MAX from delivery plans due to the uncertainty regarding deliveries. Weeks later, China sends a strong signal by ordering additional Airbus A320neo family aircraft.

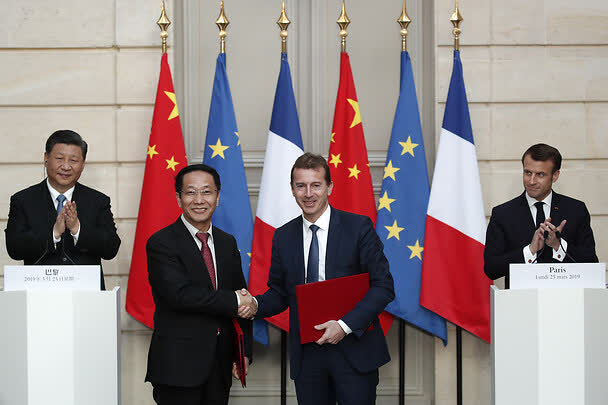

In some sense, things are going as one would have expected. In a report published in May 2019, a month after the second crash with the Boeing 737 MAX, I explained that the Boeing 737 MAX would potentially become the playball in a geopolitical tense situation between China and the US. We are now seeing that years after Trump initiated a trade war with China claiming trade wars are good and easy to win, the opposite is showing to be the truth costing Boeing an order for nearly 300 jets valued $15 billion. So much for trade wars being good.

Trump’s successor, President Biden has largely adopted anti-China politics which actually has been a key element for past administrations as well. His failure to seek a resolution to the China-US tension has now ultimately led to the order not falling Boeing’s way and we have seen that in previous sales campaigns the geopolitical tension rendered negotiations ineffectual. In 2019, Boeing and China had been in talks to secure a big wide body order but no order was agreed on.

The tension with China is quickly resulting in failed campaigns stacking. In 2018, China Eastern Airlines issued a Request for Proposal for 150 single aisle jets which also did not result in an order for Boeing and in 2017 then-President Trump touted a 300 unit aircraft order from China which actually mostly consisted of existing orders being reused and while that largely is seen as something that would fit President Trump it is actually something that President Xi of China is also known for doing. President Xi tends to create a buzz with airplane orders to get aerospace work transferred to China and built the industry out there. President Xi actively uses that buzz, often rehashing old orders, to achieve other goals in China’s interests.

However, this is not just about the trade war. There are certainly some other technological and geopolitical interests involved. In 2016, then-President Obama intensified ties with Vietnam by lifting the ban on lethal weapon sales to the country in a move that should strengthen the position of the United States as China increasingly tries to take control of the South Chinese Sea and a big F-16 sale in 2020 driving the defensive as well as offensive capabilities of Taiwan has also soured the relation between China and the US further and in 2021 remarks from the US about the situation in Hong Kong was seen by China as US interference.

So, solely pointing at the trade war and any deficit in the trade as the reason for Boeing losing orders is an oversimplification. Behind that goes an often-unrecognized effort from the US to increase its presence in China and bring the situation in the South Chinese Sea under its sphere of influence. All of that happens with commercial aircraft sales being put at stake and while Lockheed Martin got the big arms sale Boeing is suffering the sales on the commercial aircraft front. It is an underexposed reality that US foreign policy explicitly puts commercial sales prospects at risk for what it thinks is the greater good.

ASML EUV machine (ASML)

It is, however, not the case that Boeing gets nothing in return because when President Obama visited Vietnam to intensify relations Vietjet ordered 100 Boeing 737 MAX 200 aircraft but it is evident that the orders that Boeing is set to lose due to political tension exceed the number of orders it would win. The geopolitical tension also plays along a technological path as the US is trying to block sales of next generation semiconductor manufacturing equipment to the Chinese industry. Not having access to advanced equipment to manufacture chips harms the position of China as a supplier of chips, but also its technological advancement.

The result of the US trying to deny China access to advanced manufacturing equipment and its aim to strengthen its position in the South China Sea to counter China is a trade war that ultimately harms the position of Boeing, its workforce and the US economy.

A 2019 GTA Materializing

Airbus GTA 2019 and extensive collaboration agreement (Airbus)

While the big order announcements make for splashing headlines, it is always key to provide proper context and separate fact from fiction. Aircraft orders are often made part of big announcements, while some parts of the announcements are either not backed by a firm purchase contract, are already listed in the order books as unidentified orders or simply a rehash of previous agreements. Furthermore, one should keep in mind that at times tentative orders are placed and later firmed up. If you view both orders as firm orders, you are basically processing the same order twice and that might give a skewed view of reality.

The latest order from the Big Three in China indeed seems to be a firm order, it is not known whether any part of this order has already been present in the order book as unidentified orders but there is something else we should take note of. In 2019, Airbus announced a general terms agreement for the purchase of 300 jets with China. The agreement consisted of 290 Airbus A320neo family aircraft and 10 Airbus A350 aircraft and was presented as a new firm order by the media. In a report I published on the subject I pointed out that no order was placed according to our data analytics on Airbus order flows and that has remained the case since 2019. Until these orders were incrementally firmed or firmed in different quantities, the GTA did not lead to a firm order. That General Terms Agreement might actually be the basis on which the announcement from the Big Three is based. In other words, in 2019 the framework for the agreement was drafted and three years later that framework led to firm orders.

At this time there is no confirmation whether this is a completely new order or not, but the quantities of the 2019 GTA and the ordered quantities as well as the absence of the GTA being firmed according to our insights suggest that the new order was largely based on the 2019 GTA and does not stack on top of it.

A Dent to the Boeing Bull Thesis

Boeing 737 MAX China Southern Airlines (AerCap)

Whatever way you view it, one thing is clear and that is that this is a blow to Boeing. Earlier this year, it already became clear that due to the absence of a resumption of Boeing 737 MAX operations in China there would be no increase in production rate on the Boeing 737 MAX program. That was already a major disappointment as it make chances for Boeing to achieve a target of 500 commercial aircraft deliveries this year almost unreachable, which subsequently stalls the attempt to bolster cash flow, improve unit costs and deleverage the balance sheet.

While I largely anticipated that the 500 aircraft deliveries this year were out of reach due to the situation in China. While I saw the risk regarding China, a resumption of deliveries to China has been part of my bull case scenario and during the height of the trade war, I have also pointed at the buying power of China on the commercial aircraft market as a way to reduce the trade deficit. With the order for nearly 300 Airbus jets, it seems that a lot of that is falling apart and that the prospects are less bullish. Is that true? Perhaps.

However, these 300 deliveries are scheduled for the next 5 years and the commercial aircraft industry is an industry that has a 20-year horizon on forecasts. The 20-year market outlook suggests that there will be demand in China for nearly 6,500 aircraft. While the order for 300 aircraft is big, it covers less than 5% of the total 20-year demand. So, it is clear that not everything is lost for Boeing. Things could be more impactful for Boeing if the current order for 300 aircraft for Airbus is a pivot on its long-term practice of buying from both manufacturers in almost equal shares and instead support its plans of Airbus to push aircraft production to record levels and supporting the own aircraft manufacturing industry.

At this point, there is no strong indication that this is the case and for the foreseeable future China still needs Boeing and Boeing needs China. So, while the US might have harmed Boeing here if this stalemate is set to continue it will eventually harm the Chinese interests, as well as neither the Chinese industry or Airbus, have the capacity to provide what the Chinese airlines require.

Conclusion

The order that the three Chinese airlines announced is definitely a boost for Airbus, which will see its production plans supported to some extent by Chinese orders. However, it should be kept in mind that this order likely builds on the General Terms Agreement announced in 2019 and is not in addition to that agreement.

While it is easy to blame the Boeing 737 MAX for missing out on the order, I think what we are seeing clearly is how the Boeing 737 MAX has become the playball of politics where the US is risking aircraft sales in exchange for some form of influence on the Chinese semiconductor industry capabilities and the South China Sea. The Chinese answer has been clear with granting an order to Airbus instead of Boeing and you cannot blame Boeing for any of it. It’s the US administration that is now costing Boeing orders. What remains to be seen is whether this is a very strong warning from China or a long-term pivot at the cost of Boeing.

Be the first to comment