24K-Production/iStock via Getty Images

The stock market and economy are currently in concerning territory. I’m usually positive, but I have to be realistic based on the facts that we are facing. The fundamental and technical facts that I will highlight in this article point to a negative scenario for the economy and the stock market over approximately the next year.

We are now in an official bear market as the S&P 500 (SPY) declined more than 20% so far this year. If inflation was running at normal levels (about 2%) and we weren’t in an aggressive interest rate increase environment, I would say this could be a buying opportunity. However, my thesis is that continued aggressive interest rate hikes by the Federal Reserve is likely to slow down mortgages and the real estate market. This is likely to have a negative ripple effect on most of the economy.

The Fed’s Effect on the Housing Market

With the inflation rate over 8%, the Federal Reserve stated that they will continue to increase the Federal Funds rate in efforts to lower inflation. Fed Chairman, Jerome Powell, stated that the Fed is likely to increase rates by 50 or 75 basis points in the July 26-27 meeting.

Continued interest rate hikes are likely to lead to a slowdown in the mortgage and real estate market. Many 30-year mortgages are now being offered at over 5% after being at historic lows for many years. Continued rate hikes will make mortgages even more expensive. This can lower the demand for mortgages and home purchases and lead to lower house prices.

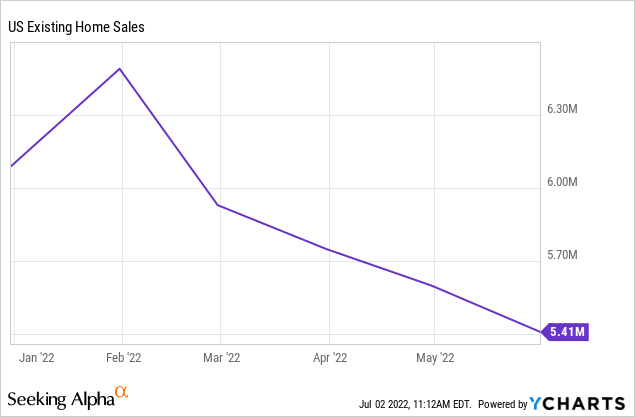

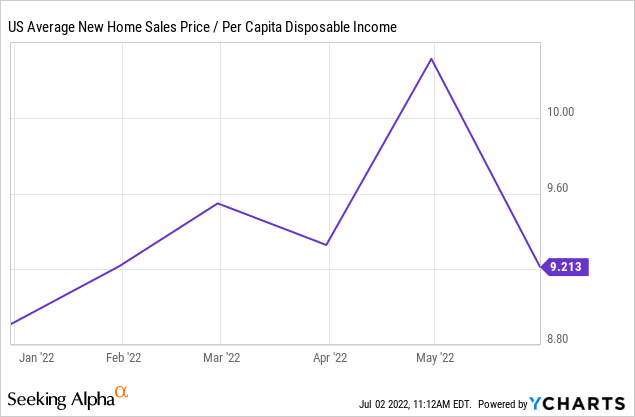

Existing home sales experienced four straight months of declines from February to May. The June report will be released on July 20. New home sales declined 5.9% in May 2022 as compared to May 2021. I expect more declines for most future reports this year as mortgages get more expensive.

The charts above illustrate the recent declines in the housing market. Lower demand for home sales is likely to continue for the remainder of the year as higher mortgage rates significantly increase the total cost of homes. The cost of houses are becoming out of reach for many families in the U.S. with the average price of a new home at $511,400 and median existing home price at over $400,000. With these high costs combined with higher mortgage rates, the housing market is likely to decline for the remainder of the year.

Housing Market Spillover Effect

The potential decline of the housing market tends to spillover to other areas of the economy. Sales of other large items such as appliances, furniture, and other home accessories are also likely to decline. Less demand for new homes leads to less demand for construction materials and related jobs.

Declines in the housing market can also spillover into other large interest-rate sensitive markets such as the auto industry. Automakers had the benefit of offering low interest loans for more than a decade as a result of the low-interest environment. The zero percent to 1.9% financing deals are probably going to end as interest rates continue to increase this year. Buyers may have to pay within a smaller time window (such as a 3 or 4-year payment plan) to get no interest loans going forward. Many consumers may not be able to afford to do that due to the higher monthly payments.

Auto sales already plunged by 30% in May 2022 over May 2021. Of course, the decline may not all be due to higher auto loans. Supply chain issues (shortages of semiconductor chips and other parts) have contributed to higher auto prices. Increased auto loans going forward will add to the higher prices, increasing the overall cost of purchasing new vehicles. This could price many consumers out of the auto market. The average monthly auto payment for new vehicles increased 13% to $700 in June 2022. Many consumers might not be able to buy new vehicles at those costs.

Declining sales in these major markets as interest rates go higher is likely to lead to an eventual recession as total GDP is at risk of turning negative for multiple quarters.

Technical Stock Market Perspective

S&P 500 price chart with RSI and MACD (tradingview.com)

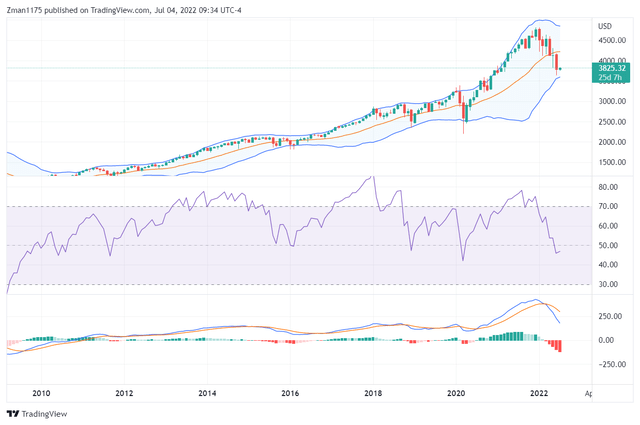

I zoomed all the way out with a monthly chart of the S&P 500 with each candle stick bar representing an entire month. We can see that the price action is currently bearish. This is confirmed by the declining purple RSI and blue MACD lines below the price chart.

We can see that the RSI is not too far away from where it was at the bottom of the market in 2020. However, the market had immediate positive catalysts to recover in 2020 with low fuel prices, businesses opening back up and large stimulus plans. Now we are faced with high fuel prices and other inflation on most items and no stimulus plan for recovery. In fact, we have the opposite of stimulus with the Federal Reserve aggressively increasing interest rates. The Fed’s actions are likely to lead to a slowdown in lending and economic activity as mortgages and other loans become more expensive. With that said, the stock market is likely to head lower.

S&P 500 Price Chart from 1997 to 2009 (tradingview.com)

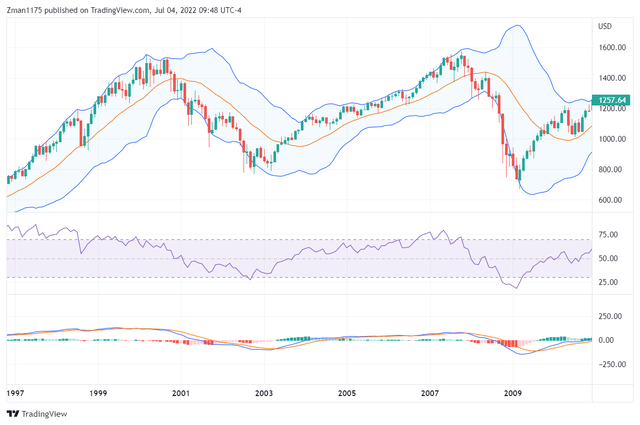

The monthly chart above shows the S&P 500 during the dot com boom and bust (late 90s to 2003) and the real estate boom and bust (2008 financial crisis). Both of these incidents were the result of heated economic activity, high valuations, and interest rate increase cycles. In both of these incidents, the S&P 500 declined to an oversold condition on the RSI monthly chart (purple line), which were driven by recessions. My opinion is that the current interest rate increase situation will lead the market to an oversold condition according to the RSI indicator on the monthly chart (level below 30). That means that there is more downside to go in my opinion.

We know that the Federal Reserve is aggressively increasing interest rates and will continue to do so until inflation gets to a level that they consider acceptable. What will it take to get to those levels? Probably a significant economic slowdown leading to many layoffs, which will lessen demand for fuel, houses, vehicles, and other products. That’s what the effect of higher interest rates tends to do to an economy. The higher financing costs brings the total cost of many items to a level where many consumers can no longer afford them. Then, demand drops off significantly.

Economic Outlook for the Second Half of 2022

As interest rates increase this year (the next increase is July 26 or 27), demand for mortgages and homes are likely to decline. The demand for vehicles is also likely to decline as financing them becomes more expensive. Layoffs will probably occur in these industries, which has a domino effect on other industries as consumers cut back on discretionary spending.

While a recession is typically defined as 2 consecutive quarters of negative GDP growth, it is possible that we could experience more than 2 quarters of negative growth. However, the Federal Reserve would probably stop the interest rate increases and perhaps begin lowering them again if inflation is at or below their target.

The recession is expected to hit in the first half of 2023 according to a survey of CFOs. None of the CFOs surveyed thinks that a recession can be avoided. That makes sense as it would give time for higher interest rates to have a significant negative effect on the economy.

Currently we have high inflation with expectations of higher interest rates for the remainder of the year. This is likely to act as a negative catalyst for the stock market, keeping us in a bear market. The market could decline another 10% to 30% from current levels depending on how severe the recession gets. Of course, there is likely to be some bear market rallies in between as traders take advantage of short-term oversold levels. These rallies will probably be sold, leading to lower market levels as the inevitability of a recession gets closer.

Be the first to comment