schulzhattingen

Shares of Air Products and Chemicals (NYSE:APD) have lost about 14% of their value over the past year, pushing them back below levels reached pre-COVID in early 2020. Air Products is a capital-intensive company, which has led to concerns around how inflation will impact its business. However, these risks are manageable, and the secular outlook for Air Products is very positive. I view it as a core long-term holding and would be a buyer at current levels.

In the company’s fiscal third quarter, sales rose 22% with volumes up 5% and APD’s price increases were a 7% tailwind. There was a 15% boost to sales from energy cost-through while currency was a 5% drag. EBITDA rose 11% to 1.1 billion and net income rose 13% to $582 million, pushing EPS up 13% to $2.62. This energy cost-through item is something to highlight as I expect it will be a major contributor to sales growth when the company reports fiscal Q4 earnings on November 3rd.

APD takes no energy price risk. Whatever the energy input cost of running its gasification and hydrogen facilities is it passes on to consumers, meaning it makes or loses no money on energy price movements. When energy costs rise 10%, revenue goes up accordingly but profits are not impacted. This means that the company’s profit margin falls. In fact, last quarter EBITDA margins were 33.9%, down from a peak of 42.7% in Q2 2020 when oil prices briefly went negative. Energy was a 500bp margin drag year over year.

It is critical to emphasize that these margins swings should not be cause for alarm or joy because they are not representative of how the business is operating on its own. As investors, I view it as a positive that APD takes no energy price risk and is able to push that onto its end customers. That makes the economics of its projects more certain and cash flow more predictable. Noise on margins is well worth this certainty. Given European natural gas prices in particular have continued to rise, we are likely to see strong revenue growth in Q4, which creates the risk of a further decline in margins.

Looking deeper into results, we see trends that I expect to continue in coming quarters: namely US outperformance. Europe is facing a difficult winter of much higher energy prices while China’s COVID-zero policy is seemingly an unending source of uncertainty. That makes the US the best (or perhaps least bad) major economy, in my view. The Americas, which is just under half the business, had 4% volume growth and 8% price increases pushing operating income up 5% to $299 million. In Asia, volumes were up 2%. The company also received a dividend during the quarter from its Jazan mega-project in Saudi Arabia, which should be a growing source of cash flow and volumes in coming years.

The biggest concern is that Europe is one-quarter of the business. We are seeing signs the economy is starting to roll over. Volumes fell 3% in the quarter, and currency was a 15% headwind. Results were pretty resilient in the face of declining volumes as APD pushed up price 17%, leading to a 3% increase in operating income to $137 million. I would note there was a 24% energy cost pass-through. This pass-through is likely to move higher. My near-term concern is that faced with a shortage of natural gas this winter that there is a rationing of energy, which forces some industrial firms to shut-in production. This risk combined with a weakening economy point to near-term risk to Europe’s volumes and profitability. Fortunately, little of APD’s infrastructure is in Germany, which is most exposed to Russian gas imports of the major European economies.

Management guided for EPS of $2.68-$2.88 in Q4 leading to full year EPS of $10.20-$10.40. With some further deterioration in Europe and the fact that currency will likely be a $0.10 headwind, my bias is expecting EPS to be in the bottom-half of the stated range, though in Q3 management was able to manage these headwinds better than many feared.

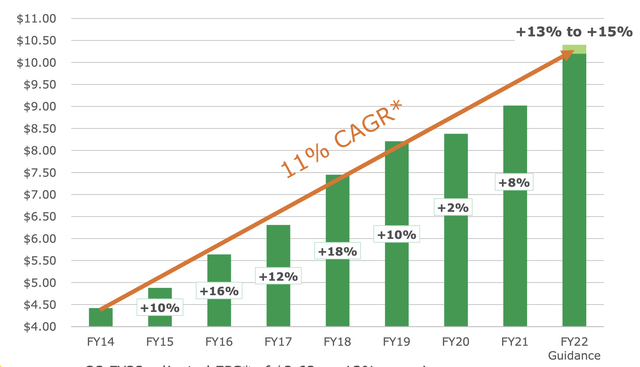

I do not think the potential for some weakness over the next two or three quarters in Europe should distract us from the long-term picture. This is a company with a dividend yield of 2.8%, an 11.4% 5-year growth rate, and 39 years of dividend growth. Last March, it increased its payout by 8%, and I expect another high-single digit increase in Q1 of this year. I would also note that distributable cash flow over the past year was $2.9 billion or $13.09 a year. It is only paying out 45% dividends, leaving $1.5 billion in its growth projects, and providing ample cushion to grow the dividend further. Importantly, this history of dividend growth has been matched by EPS growth.

Moreover, there is no sign that this growth is slowing. Governments and the private sector are trying to reduce carbon emissions to achieve climate targets. APD’s facilities providing gasification, green, and blue hydrogen are critical to reduce the carbon intensity of our energy supply. In fact, the Inflation Reduction Act increases the CO2 sequestration tax credit to $85 a ton from $50, which should be worth $175 million a year and growing to APD. Further, there is also a 10 year production tax credit for clean hydrogen. These measures should increase demand for APD’s services, providing the platform for long-term growth.

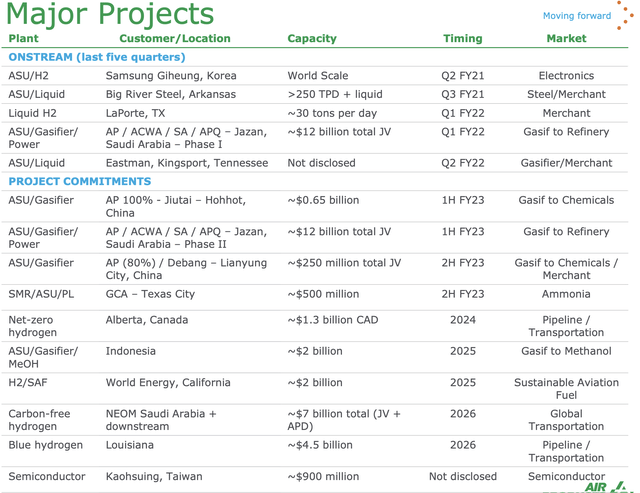

As a result, 2022 cap-ex is going to be about $4.5 billion, up from $2.6 billion last year. As you can see below, the company has had several major projects come online this year (most notably Jazan in Saudi Arabia) with a host of large projects to come over the next five years.

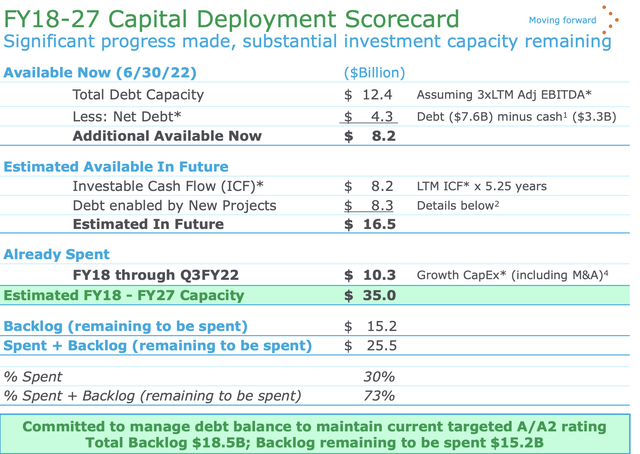

As these projects come online, the company’s cash flow potential will rise, providing the foundation for ongoing dividend growth. Importantly, APD has the capacity to do these projects. The company can run leverage at up to 3x EBITDA and meet its credit rating targets, but right now, its net leverage is about 1x, providing $8 billion of capacity today. On top of this, APD is retaining about $1.5 billion a year in cash flow to deploy into growth projects. Plus, each project that comes online increases EBITDA, enabling incremental debt. These provide a combined $24.7 billion in project capacity from 2022-2027. That is in excess of its remaining $15.2 billion backlog. APD can not only complete its existing slate of projects but launch new ones to take advantage of demand sparked by this favorable tax and regulatory changes.

A headwind for the stock in my view has been concerns about the cost of this backlog. Construction costs, like seemingly everything else, have risen over the past two years. If this continues, these projects may cost well over $15 billion. On the last earnings call, CEO Seifi Ghasemi said, “inflation will impact the capital cost of some of the projects that we are doing,” but most of these projects do not have committed prices on the products they sell, so higher project costs will mean higher product prices as the company expects to maintain the same margin.

If these projects cost $16.7 billion instead of $15.2 (i.e. up 10%), the price it sells its products will be similarly higher. APD’s profit economics should be largely immune (indeed the large price increases it pushed last quarter points to significant pricing power), but its ability to do projects beyond these shrinks. There are $3 billion in projects left that do have prices locked in, so at a 10% budget surprise, it’s a $300 million overrun. That is about a total $1.50 per share risk, which I think it is quite manageable and is not commensurate to how much the stock has fallen over the past year.

Air Products is a premier growth company with a stellar, under-levered balance sheet that sits at the center of our efforts to clean energy supplies, capturing carbon, gassifying, and producing clean hydrogen. As a consequence, it should be able to continue the steady growth of the past decade well over the next decade. If anything, I see the potential for faster growth with government policies incentivizing clean energy and APD’s cap-ex increasing.

As the company gives guidance for next year, Europe and currency may be a bit of a headwind, but I am looking for low double-digit growth to about $11.30-$11.50 in EPS and up to $15 in distributable cash flow (DCF) for a DCF yield of 6.5%, which is quite compelling given its growth prospects. I would be a buyer down to an implied DCF yield of 5% or up to $300, or nearly 30% in upside. At the same time, investors can enjoy an ongoing period of dividend income growth. This decline in APD is an opportunity to buy into a great company at a very attractive price.

Be the first to comment