huettenhoelscher

Aircraft leasing companies are in my view some of the most underappreciated companies by Wall Street. With solid long-term growth trajectories and strong value retention, I consider them to be extremely safe investments layering long-term orient portfolios. Shares of aircraft lessors have taken big hits during the pandemic over concerns on air travel demand recovery, but as pointed out back then those times were solid entry points.

Air Lease Corporation (NYSE:AL) is not my favorite aircraft leasing play, but I believe if you’re looking for a dividend paying aircraft lessor, this might be a name of interest. For my own portfolio, Air Lease Corporation is not yet on the radar as I have other investment priorities and management’s assessment on the situation in Russia was wrong, which led to false hope from investors. In this report, I will analyze the Q3 2022 results and apply a price target to shares of Air Lease Corporation.

Flat Earnings For Air Lease Corporation

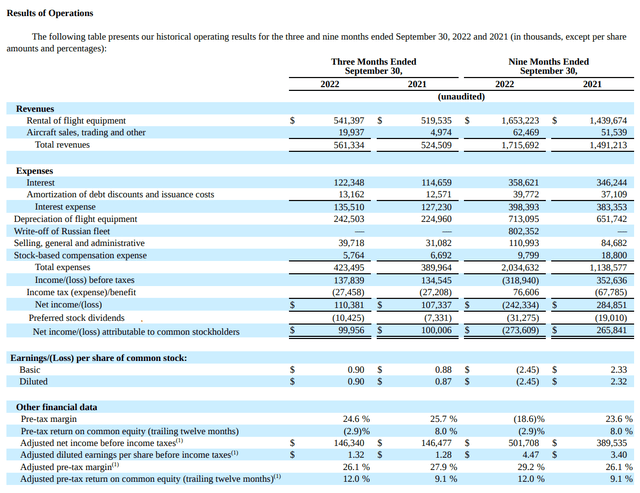

While air travel demand is booming, you don’t see it reflected as much in the earnings of Air Lease Corporation for the quarter. That’s also not odd given that on top line there has been some reductions related to missed revenues from Russia and new deliveries and leases at more attractive terms are somewhat constrained by supply chain challenges. During the third quarter, the missed revenues due to cash accounting was slightly higher at $6.2 million compared to $5.4 million in the comparable quarter last year.

Costs rose faster than revenues driven by higher depreciation and interest expenses as the fleet grew. Selling, general and administrative – SGA – expenses grew on increased business activities, higher insurance premiums and aircraft transitions. SGA grew from 5.9% last year in Q3 to 7.1% this year.

Going forward, eyeballing the cost development is of interest as inflation and higher interest levels lead to increased costs for Air Lease Corporation.

While third quarter results are not really anything to get excited about as can be seen in the decline in margins, the nine-month ended numbers do show that results are still significantly better on adjusted basis being 29% higher with a three percentage point increase in adjusted margins.

For the quarter, analysts had expected revenues of $561.3 million and earnings per share of $1.32. Air Lease Corporation revenues missed by $15.38 million but beat the consensus by 5 cents. I think that quite well demonstrates that on topline things are not extremely strong but altogether it was a fine quarter for Air Lease Corporation. Air Lease Corporation tends to load the sales of aircraft towards the fourth quarter. The company expects to have $150 million in aircraft sales this year. In the first and second quarter there were no sales of aircraft and there was one aircraft sold in the third quarter with a $11.6 million gain. That’s not indicative of $140 million of sales in the next quarter because there obviously is a difference between the gain on sale and the actual sale itself, but the reality is that sales have been low as Air Lease Corporation, like other lessors and airlines, suffers from delivery delays of new technology aircraft. As a result, the sales process has slowed down, but the company expects $700 million in sales for the first half of next year capitalizing on the strong market for second-hand aircraft.

Reasons To Buy Air Lease Corporation Stock

While results are not extremely spectacular for the quarter, the nine-month ended figures show strong improvement on adjusted basis. The company has left the drag of the Russia impact behind and it’s now focused on getting the proceeds from insurance claims. Not many details are shared on the subject as it’s a complex issue that will take years to flatten out. The slight positive regarding the situation in Russia is that one Boeing 737 MAX was recovered which will be added back to the company’s flight equipment in the next quarter. The company was, however, quick to note that this is an exceptional case and that comment is likely to be placed in order to keep the strength in the pending insurance claims.

AerCap is actually my favorite lessor to invest in, but there are reasons to consider investing in Air Lease Corporation as well. The first one is that next year we should see higher sales activity again which should bolster financial performance and we’re at the start of strengthening in the wide body market as well similar to what we have seen in the single aisle segment. Furthermore, Air Lease Corporation has a growing fleet and that should enable the company to unlock more scales of economy.

Air Lease Corporation also pays a dividend. It’s not huge, but as the company grows you’re paid basically getting paid a small sum. The company recently increased its quarterly dividend by 8.1% to $0.20 per share. With a forward dividend yield of slightly over 2% it’s not huge for anyone with a strong interest in dividend income, but 2% in passive income is nice as you watch the company grow its fleet, unlock cost savings and increase its book value.

What’s Air Lease Corporation Stock Worth?

The Aerospace Forum

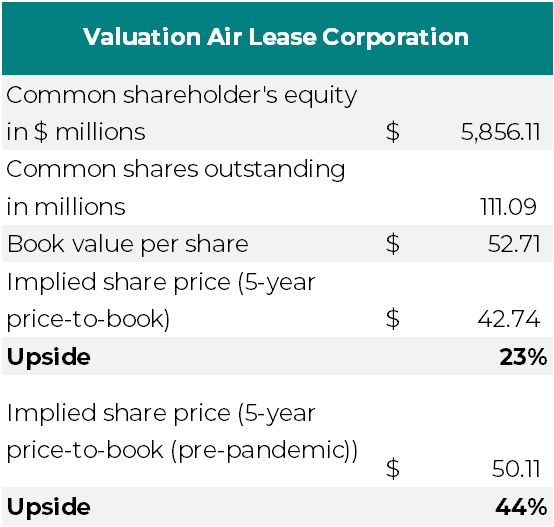

The big question is what Air Lease Corporation stock is worth at this moment. To answer that question, we calculate the book value per share by taking common shareholder equity divided by common stock to which we apply a typical price-to-book ratio for Air Lease Corporation. We get to a book value per share of $52.71. To that, a five-year historical price-to-book ratio has been applied, suggesting 23% upside and 44% upside when considering the pre-pandemic price-to-book ratio.

Wall Street price targets Air Lease Corporation (Seeking Alpha Premium)

Wall Street analysts have a strong buy rating on Air Lease Corporation with a price target of $54.86. Based on current shareholder’s equity I’m adopting a price target of $50 per share representing significant upside from current trading levels.

Conclusion: Air Lease Corporation Drives Value As It Grows

Air Lease Corporation is feeling some pain from the situation in Russia, both on top line and cost level but the company had a good quarter and with market demand strengthening both in the single aisle segment as well as the wide body segment things could get even better for Air Lease Corporation. A big plus is that as Air Lease Corporation increases its book value, justifying higher share prices, you’re paid a dividend for your waiting time.

Be the first to comment