alvarez/E+ via Getty Images

Investment Thesis: While Air Canada has started to see an uptick in passenger revenue, potentially higher costs of operating cargo services across the Pacific region could derail the company’s recovery in the short to medium-term.

In a previous article back in February, I made the argument that while Air Canada (OTCQX:ACDVF) could see upside going forward, it is likely to be over a longer-term period as rising fuel costs along with lower revenue per passenger mile compared to pre-2020 could weigh on profitability.

The purpose of this article is to determine the potential trajectory of Air Canada for the remainder of this year, taking into account both the loosening of Covid restrictions as well as the effects of the ongoing situation in Ukraine on the broader airline industry.

Performance

When looking at Q4 2021 results, Air Canada’s balance sheet shows that while the company’s cash to total current liabilities ratio has risen (meaning the company is better placed to meet its short-term debt obligations), the company’s cash to long-term debt ratio has also decreased as Air Canada has had to continue expanding its long-term debt load over the past year to finance its business:

| Period | December 2020 | December 2021 |

| Cash and cash equivalents | 3658 | 4248 |

| Total current liabilities | 7139 | 6924 |

| Long-term debt and lease liabilities | 11201 | 15511 |

| Cash to total current liabilities ratio | 51.24% | 61.35% |

| Cash to long-term debt ratio | 32.66% | 27.39% |

Source: Figures sourced from Air Canada Q4 2021 Results: Financial Statements and Notes. Ratios calculated by author.

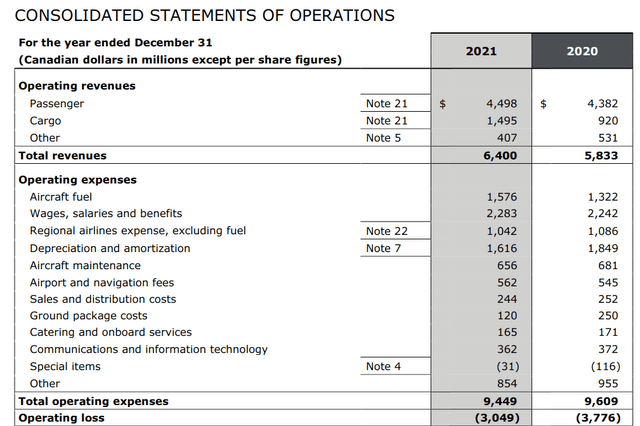

That said, while the company did see an increase in aircraft fuel costs over the past year, this was balanced out by a decrease in depreciation costs – with 12 new Airbus A220 and 7 new Boeing 737 MAX 8 fleet allowing the airline to retire older aircraft.

Air Canada Q4 Results: Financial Statements and Notes

In addition, an impairment charge of $46 million was incurred in 2021 as a result of the accelerated retirement of older fleet.

While the company did manage to grow revenue, operating expenses have simply continued to outpace such revenue growth. Air Canada reported a net loss per share of $10.25 for 2021 as compared to $16.47 for 2020.

Looking Forward

While the Government of Canada no longer has a blanket recommendation against all international travel, travelers returning to Canada are still advised not to return if displaying symptoms of Covid-19 or indeed if having caught the virus. This may be having a continued impact on the demand for international travel due to the ongoing uncertainty.

Aside from this, the ongoing situation in Ukraine could further delay the recovery of the airline industry as a whole, and this is not simply due to higher gas prices.

For one, the fact that Russian airspace is now off-limits to Canada, USA and Europe has significant implications for travel. For instance, Air Canada has had to suspend summer flights between Vancouver and Delhi because making the route is not possible without crossing into Russian airspace, or otherwise taking a much longer route that would significantly increase the cost of the flight.

This latter point is critical in understanding the current situation, as this means that Air Canada will need to increase prices on these flights (or even across all its flights to spread out the cost) to make them viable. Moreover, this puts Asian carriers that still have access to Russian airspace at an advantage on these routes, as they can be more price competitive due to the lower costs of operating such flights.

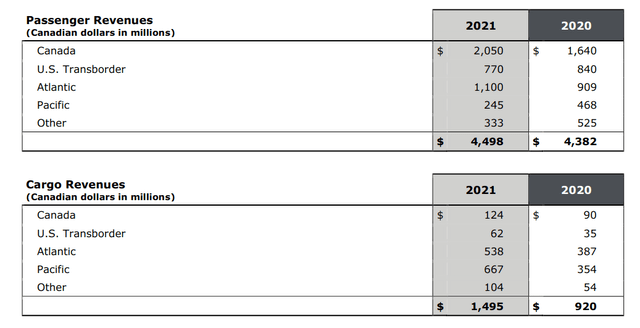

In the case of Air Canada specifically, while only a small segment of its revenue comes from flights to and from Asia, the company still derives nearly half of its cargo revenue from the Pacific region:

Air Canada Q4 Results: Financial Statements and Notes

During the pandemic, Air Canada had been significantly reliant on bolstering its cargo revenues to make up for the drop in passenger revenues. The fact that Air Canada is significantly dependent on the Pacific region in this regard will likely mean higher operating costs to continue operating its cargo service in this region.

From this standpoint, Air Canada seems to be facing growing challenges to its business. While the company has seen an uptick in revenue as air passenger revenue continues to rebound – revenue per passenger mile still remains significantly below pre-pandemic levels.

Additionally, the fact that costs of operating cargo services are likely to increase means that the company does not have as much of a buffer against lower revenue across the passenger segment.

Conclusion

The airline industry as a whole is facing challenges due to Covid, higher energy prices, and the ongoing geopolitical situation between Russia and Ukraine.

However, Air Canada could be significantly affected by rising costs of operating cargo services across the Pacific region. In this regard, investors might shy away from the stock until the broader situation starts to improve.

Be the first to comment