Morsa Images

Amazon (NASDAQ:AMZN) advertising has become an increasing threat to Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) core advertising business, which was evident in the latest quarterly earnings. Google services revenue only grew 2% year-over-year, compared to 25% growth in Amazon advertising revenue. Amazon benefits from a recurring stream of purchase-minded web visitors to its platform, augmenting the appeal of its advertising solutions. Consequently, Google has been trying to undercut Amazon’s e-commerce platform for two decades now, and has only intensified its efforts in recent years, with the aim of undermining the allure of Amazon advertising solutions.

Google Shopping

Google Shopping launched in 2002, as an additional Google tab where web surfers can find products to buy. Observing Amazon’s success in charging sellers fees to list products on its website, Google initiated paid listings in 2012, whereby “Google took a free search vertical, which previously ranked results by relevance only, and turned it into a service where advertisers pay to play”. Almost a decade later, Google Shopping failed to take off as an alluring shopping destination, failing to replicate Amazon’s lucrative marketplace.

As a result, amid the onset of the pandemic in April 2020, Google scrapped its ‘paid listings’ strategy and switched to free listings. This allows merchants to list their products for free to appear on the Google Shopping tab, and doesn’t require them to pay Google any commissions for sales through the platform (although it is worth noting that paid advertising has not been completely abolished, as advertisers can still pay to have their products listed at the top of the Shopping search results pages).

This strategy is aimed at expanding the range of products listed on Google, giving more choices to consumers, hence striving to attract more shoppers to the Google Shopping tab, over Amazon’s marketplace. Commission-free listings indeed induced “an 80% increase in merchants on Google, with the ‘vast majority’ being small to medium-sized businesses” in one year.

Nevertheless, while Google has been successful at attracting more merchants to list on Google Shopping, it is still failing to meaningfully attract purchase-minded web visitors compared to Amazon, which could be testament to how difficult it is for competitors to crack Amazon’s network effect.

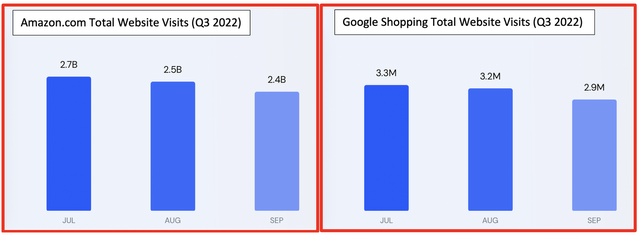

Amazon.com’s monthly web visits trounce those of Google Shopping, reflecting Google’s failure to competently attract shoppers despite its broadening product listings.

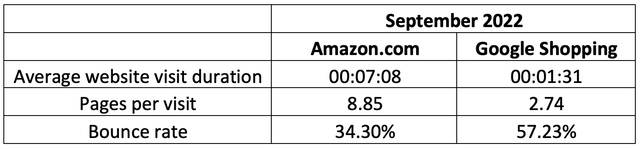

In fact, not only is Google Shopping failing to attract a comparative volume of web visitors, but those that do visit the website spend far less time on it compared to Amazon.com. The bounce rate reflects the proportion of visitors that only visit one web page before leaving the website altogether, which is significantly higher for Google Shopping (57.23%) than Amazon.com (34.30%). While Google is attempting to direct Google Search users towards Google Shopping when surfers search for a product, by listing products from Google Shopping on top of search result pages, it is failing to keep web visitors engaged within the marketplace. In fact, because Google Shopping product listings are an aggregation of products from numerous digital D2C merchants with their own websites, even if web visitors find something they like on Google Shopping, they are likely to be induced towards that specific merchant’s website as opposed to spending more time on Google Shopping.

The point is, Google has so far failed to break online consumers’ habits of searching for products on Amazon. Based on a JungleScout study of 1000 US consumers in Q3 2022, shoppers are more likely to search for products on Amazon (63%) than search engines (49%) like Google, Bing and Yahoo.

Over the years, penetrating Amazon’s network effect has become increasingly challenging, with around 200 million prime subscribers globally who almost by default would be looking for products on Amazon.com as opposed to elsewhere to reap as much value as they can out of their prime memberships. Amazon also offers various services in addition to its marketplace, including Prime Video, Prime Music and grocery services, creating multiple reasons for web surfers to visit Amazon.com, making the platform (and Prime membership) stickier.

Google’s shift towards free listings inevitably comes at the expense of lower advertising revenue (as well as lost sales commissions), with the long-term goal being to develop a full-fledged marketplace benefitting from a recurring, lucrative flow of purchase-minded web visitors, which would in turn amplify demand for Google’s advertising solutions on Google Shopping search results pages, ultimately increasing advertising revenue over the long-run, and thereby effectively compete against Amazon’s advertising solutions.

Bill Ready’s short tenure

The company’s push towards e-commerce really started to intensify amid the hiring of Bill Ready in January 2020. According to The New York Times:

Around the time of his [Bill Ready’s] hiring, Sundar Pichai, Google’s chief executive, warned senior executives that the new approach could mean a short-term crimp in advertising revenue… He asked teams to support the e-commerce push because it was a company priority.

Bill Ready left his position at Google after just two and a half years in the role, to become the CEO of Pinterest (PINS) in June 2022. He was a key player in envisioning and devising a long-term strategy to eventually turn Google Shopping into a successful e-commerce platform and effectively rival Amazon. His abrupt departure just as Google was stepping up its e-commerce ambitions is disappointing for investors.

Furthermore, Pinterest’s recent third-quarter results revealed that their e-commerce initiatives are successfully boosting advertising revenue, while Google delivered a significant slowdown in ad revenue growth over the same quarter. While we don’t know how much of a role Bill Ready played in Pinterest’s recent success given that he only joined the firm at the end of Q2 2022, the recent turn of events does suggest a significant loss of talent for Google, and emboldens investors to believe that Bill Ready pursued the Pinterest opportunity not only to fulfill C-suite ambitions, but that he may have potentially seen better e-commerce potential at Pinterest than Google.

Whether Ready’s replacement Nick Fox can successfully execute Google’s new e-commerce vision will be determined over time, but given that the short-term advertising revenue sacrifice through free listings has not resulted in meaningfully higher e-commerce activity, it undermines the company’s potential to robustly grow ad revenue through Google Shopping and impede Amazon’s penetration of the advertising market.

YouTube Shopping

While Google is struggling to find success through Google Shopping initiatives, it is not the only avenue through which it is advancing its e-commerce ambitions. YouTube has been advancing its push into live-stream shopping to leverage YouTube influencers’ popularity and trust among content consumers, and thereby attract more purchase-minded web visitors. Furthermore, YouTube is also rolling out a new Shopping tab under its Explore section, which will offer an aggregation of products from the stores of YouTube influencers and digital merchants that want to sell through popular content creators on the platform.

The same JungleScout study referenced earlier found that 32% of online shoppers would search for products on YouTube in Q3 2022, which is an increase from 27% in Q3 2021 (based on 1100 US consumers).

According to similarweb, YouTube has the second highest volume of web visitors (behind only google.com).

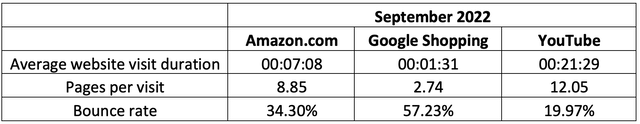

An extension of our web statistics analysis to incorporate YouTube finds that the video-streaming platform is ‘stickier’ and more engaging than both Google Shopping and Amazon.com, given its significantly lower bounce rate and longer duration of visits, creating more opportunities for advancing advertising solutions.

Therefore, while Alphabet is struggling to rival Amazon through Google Shopping, Amazon investors should not underestimate YouTube’s augmenting e-commerce potential. YouTube’s shopping features, particularly through the endorsement of influencers, could offer advertisers more opportunities for product differentiation compared to Amazon.com, where adjacent competitor product comparisons are inevitable even for merchants using Amazon’s ‘sponsored products’ and ‘sponsored brands’ advertising solutions.

In fact, despite YouTube’s recent advertising woes, management proclaimed the continued growth in YouTube Premium subscribers on the Q3 2022 earnings call, despite the dire macroeconomic backdrop of high inflation and a potential recession on the horizon. Moreover, the stickiness of YouTube Premium, offering subscribers ad-free access to both music and videos, could offer a gateway to encourage users to engage with both YouTube Shopping, as well as Google Shopping. Similar to how Amazon Prime offers a bundle of services to make the platform stickier and dissuade consumers from exploring alternative avenues, Alphabet could leverage its YouTube Premium subscriber base by bundling in shopping benefits, such as exclusive discounts and deals on YouTube/Google Shopping, thereby encouraging better engagement on its Shopping pages, and in turn offering more opportunities to advance advertising solutions. That being said, Alphabet would need to significantly advance its e-commerce solutions, particularly fulfilment, to effectively challenge Amazon at its own game.

Summary

While worsening economic conditions ahead are likely to undermine the performances of both tech giants over the near-term, inducing a ‘hold’ rating, Google’s failure to effectively challenge Amazon through Google Shopping should not take away from its e-commerce advancements through YouTube. While the company has a long way to go to adequately compete with Amazon on the e-commerce front, YouTube’s shopping and marketing solutions could indeed become a noteworthy challenger to Amazon’s advertising growth going forward.

Amazon has successfully erected a competitive moat through a self-reinforcing network effect, which is proving difficult for competitors to penetrate. Though it is worth noting an excerpt from Wiley’s ‘Why Moats Matter’; “corporations evolve and …moats grow, mature, and eventually die. In other words, economic moats have a life cycle”. Hence, while Amazon’s moat may seem invincible today, nothing lasts forever. New innovative solutions from existing competitors like Google, or new rising competitors in the e-commerce space could transform industry dynamics to create new industry leaders. Even disruptors can get disrupted.

Be the first to comment