Paul Morigi

Introduction

Note: This article is an update of my article published on September 12, 20022.

On September 28, 2022, Reuters announced that:

Warren Buffett’s Berkshire Hathaway Inc (BRKa.N) bought another 5.99 million shares of Occidental Petroleum Corp (OXY.N), boosting its stake to 20.9% after the oil company’s shares lost about a fifth of their value in less than a month.

This article is meant to reply to a few questions and readers’ divergent arising from my preceding article and update on the ever-changing Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) sizeable ownership in Occidental Petroleum (NYSE:OXY).

1 – A thorough look at the new Form 4

I have indicated below a transaction table from the latest Form 4 filed yesterday. In this table, you can see when and how many shares were bought by Warren Buffett’s Berkshire Hathaway, resulting in an increase of ownership from 20.1% to 20.7%.

| Date | Shares bought | Weighted Stock Price | Price range | $ Cost | Shares owned |

| 9/26/22 | 1,542,076 | 57.9116 | $57.52 to $58.18 | 89,304,088 | 189,908,536 |

| 9/27/22 | 2,705,798 | 58.2857 | $57.67 to $58.53 | 157,709,330 | 192,614,334 |

| 9/28/22* | 496,285 | 59.1951 | $58.63 to $59.50 | 29,377,640 | 193,110,619 |

| 9/28/22* | 49,114 | 59.9743 | $59.90 to $60.00 | 2,945,578 | 193,159,733 |

| 9/28/22* | 1,191,917 | 61.3765 | $60.755 to $61.595 | 73,155,694 | 194,351,650 |

| 5,985,190 | 58.8941 | 352,492,331 |

194,351,650 20.7% |

Following the purchases, Berkshire Hathaway Inc. owns about 194,351,650 million Occidental shares worth approximately $11.933 billion, based on Occidental’s price of $61.40. This amount is not including the warrants.

Note*: In form 4 above, the last three transactions have been made on the same day, and I do not see why BRK is presenting Form 4 this way. I find it quite strange. It may have been a way to send a message.

However, if we combine the three transactions done on the same trading day, we have 1,737,316 shares purchased at an average price of $60.7137. This stock price is clearly above the warrants’ strike price of $59.624.

To determine the percentage owned by Warren Buffett’s Berkshire Hathaway, we will have to look at the OXY’s shares outstanding basic average.

The shares outstanding can be indicated as either basic or fully diluted. According to GuruFocus, the shares outstanding basic average is 939.2 million shares. Also, the shares outstanding fully diluted is 1,018.3 million. The fully diluted shares outstanding number includes diluting securities, such as options, warrants, or convertibles.

Thus, Warren Buffett’s Berkshire Hathaway owned 20.7% of the shares outstanding (basic average) on June 30, 2022, or 19.1% of the shares outstanding (fully diluted average).

However, if the warrants are exercised, the total ownership, in this case, could go as high as 27.2%, with the shares outstanding rising to 1,023.06 million, while Occidental will receive $5 billion. Not included in the theoretical 27.2% is the redemption of the $10 billion series A preferred, which could increase BRK ownership close to 45%-50% if a share deal can be struck.

A swap share for debt is an attractive deal that both parties could eventually accept. OXY could reduce its debt by up to $5 billion and issue nearly 84 million shares or more to BRK (OXY will have to pay 5% extra in this case or even 10% potentially).

The Corporation, at its option, may redeem, in whole at any time or in part from time to time, the shares of Series A at the time outstanding, upon notice given as provided in Section 6 D below, at a redemption price equal to the sum of 1 – $105,000 per share and 2 – the accrued and unpaid dividends thereon (including, if applicable as provided in Section 4 A above, dividends on such amount), whether or not declared, to the redemption date.

Finally, there is a slight discrepancy in the article mentioned regarding Buffett’s ownership which is indicated at 20.9% in the Reuters article without justifying the result.

Also, Form 4 on September 28, 2022 indicates that BRK owns 83,858,849 “Warrants to Purchase Shares of Common Stock” at an exercise price of $59.624 (unchanged). The warrants were initially 80 million shares with an exercise price of $62.50 but were subsequently adjusted.

The warrants contain provisions that adjust the exercise price and the number of shares of the issuer’s common stock issuable on exercise upon the occurrence of certain events. As such, the exercise price and the number of shares of the issuer’s common stock issuable on exercise as reported on this form are subject to change upon the occurrence of future events in accordance with the terms of the warrants.

The warrants were initially for 80,000,000 shares with an initial exercise price of $62.50 per share. On June 26, 2020, the issuer’s board of directors declared a distribution to its common shareholders of warrants to purchase additional shares of common stock, which distribution resulted in an anti-dilution adjustment to the warrants, which lowered the exercise price to $59.624 and increased the number of shares issuable on exercise of the warrants to 83,858,848.81.

The warrants were issued on August 8, 2019, and are exercisable at the applicable holder’s option, in whole or part, until the first anniversary of the date on which no shares of the issuer’s series A preferred stock remain outstanding, at which time the warrants expire.

However, the warrants do not represent immediate ownership of the OXY stock, only the right to purchase the company shares at a set price in the future. According to Forbes:

A stock warrant is a derivative contract between a public company and an investor. A warrant gives the holder the right to buy or sell shares of stock to or from the issuing public company at a specified price before a specified date. Holders of warrants are under no obligation to buy or sell the underlying stocks.

Warrant holders are at a disadvantage to shareholders because they don’t have voting rights or a right to dividends.

1.1 – What is the difference between a Form 4 Filing and a schedule 13G/A filing?

The controversy I covered in my preceding article was due to a misunderstanding related to the filing schedule 13G/A filed on August 31, 2022.

The form 13G/A purpose is to require large holders to report their entire ownership stake, including the warrants. The ownership did not change at the time and was 20.1% based on the shares outstanding basic average.

However, Form 4 must be filed within two business days following the transaction date (buy or sell). It is what was done yesterday.

1.2 – Why is Berkshire Hathaway buying more OXY shares above $59.624?

It is where facts and speculations clash due to a lack of crucial information. The truth is that Buffett’s Berkshire Hathaway can at any time exercise the warrants in whole or part; it is indicated above. We can only make conjectures after that.

BRK seems unwilling to exercise the warrants even though the Houston-based oil company’s share price peaked at $77.11 on August 29, 2020. I will not guess why because it is a futile exercise that serves no purpose for us.

However, the warrants to purchase the issuer’s common stock are held by Berkshire indirectly through the following Berkshire subsidiaries:

- Berkshire Hathaway Life Insurance Company of Nebraska (3,018,918.56),

- Berkshire Hathaway Specialty Insurance Company (1,677,176.98),

- Columbia Insurance Company (10,608,144.37),

- Government Employees Insurance Company (27,254,125.86),

- GEICO Indemnity Company (8,385,884.88),

- GEICO Casualty Company (3,270,495.10),

- BHG Life Insurance Company (5,870,119.42),

- And National Indemnity Company (23,773,983.64).

This complex ownership could complicate the process and partly explain why BRK chose not to exercise the warrants.

In my preceding article, I said that BRK was not likely to buy OXY shares above $59.624. This part is not valid anymore.

1.4 – Why is the sub-20% threshold meaningful for Berkshire Hathaway?

This part is unchanged. The 20% threshold is meaningful for Berkshire Hathaway because the company can incorporate a proportional amount of the OXY’s earnings in its financial results – valid to sub-20% holding – potentially raising its annual earnings by about $2 billion.

Conclusion

I still think Buffett’s Berkshire Hathaway has no desire to acquire Occidental Petroleum, and I’m afraid I have to disagree with the analyst at Truist and its “clear path” argument.

“We continue to believe an outright total purchase of OXY in the near-term could make logical sense for Berkshire Hathaway,” Neal Dingmann, analyst at Truist, said in a research note.

Still, the recent buying is very puzzling, considering that Berkshire Hathaway already owns a significant part of Occidental Petroleum. We are left with speculation as to why Buffett’s Berkshire Hathaway keeps buying shares, albeit at a smaller amount and mostly at or below $61.

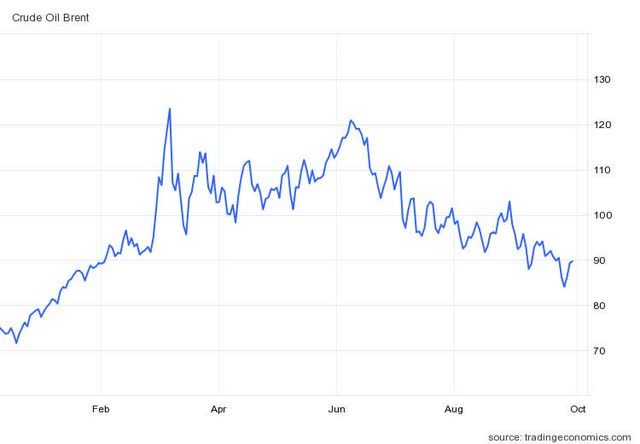

The energy sector has temporarily lost its shine recently as oil prices fell below $100 a barrel, impacting the stock prices of oil producers, including OXY.

But Buffett has hardly been discouraged by the recent relative weakness of oil prices. Occidental is one of Buffett’s two critical holdings in oil, the other being Chevron (CVX). Buffett’s holding in Chevron is about $29 billion.

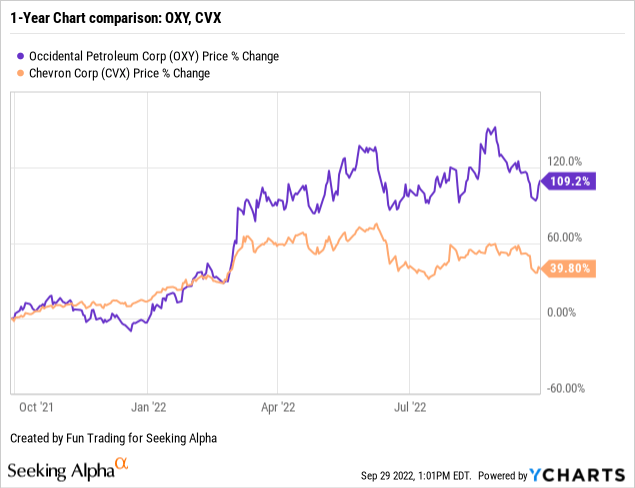

The fall in oil prices from a peak of $139/bbl to below $85/bbl is due to recession fears in Europe (and potentially in the USA) which is likely to reduce oil demand. However, OXY is still up 109% on a one-year basis and has significantly outperformed Chevron Corp. Will it continue? I doubt it, with the Fed turning more hawkish and ready to hike interest rates again in November.

The issue is that oil prices have significantly retraced in the past few months, and we may get some disappointing results for the third quarter. Furthermore, inflationary pressures will probably inflate CapEx and reduce free cash flow.

OXY Brent price history (Trading Economics)

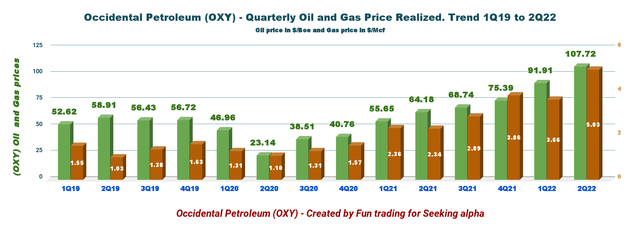

Realized oil prices in 2Q22 were $107.72 per barrel compared to $64.18 last year. Natural gas was $5.03 per Mcf, up from $2.34 in the previous year. NGL price was $42.04 per Boe, up from $25.06 last year.

It will be a sharp turnaround in 3Q22.

OXY Oil prices history (Fun Trading)

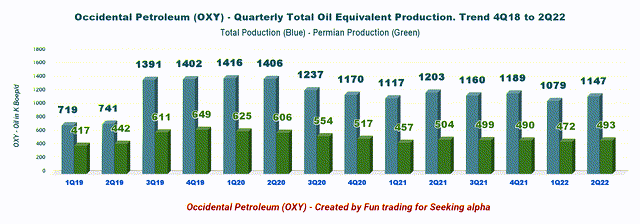

I expect oil prices to drop below $87 for Q3, reducing free cash flow significantly. Production should be above 1,100K Boepd, a bit down from 2Q22.

OXY Oil equivalent production history (Fun Trading)

TA Analysis and commentary

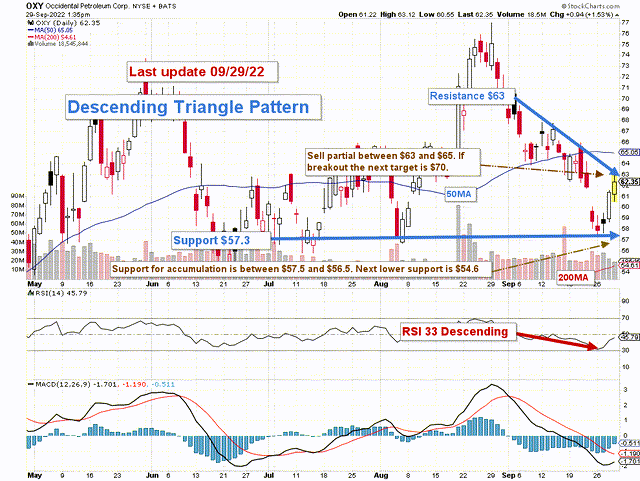

OXY TA Chart short-term (Fun Trading StockCharts)

Note: The chart is adjusted for the dividend.

OXY forms a descending triangle pattern with resistance at $63 and support at $57.3. Descending triangles are bullish formations that anticipate an upside breakout.

As indicated in my preceding article, the trading strategy is to take profits (25%-50% seems reasonable) between $63 and $65 with potential higher resistance at $70. Then, wait for a retracement below $57.3 with possible lower support at $54.6 (200MA) to consider adding again.

I recommend trading OXY LIFO, which lets you keep a core position for a much higher target while profiting from the fluctuations.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote of support. Thanks.

Be the first to comment