Getty Images

After a blockbuster year in 2020, the outlook for 2021 and 2022 was less exuberant as covid induced demand was expected to gradually taper off. The company demonstrated the ability to actually maintain sales levels by developing online sales. Moreover, with the CEO expecting consolidation in the wholesale sector, Ahold Delhaize (OTCQX:ADRNY) (OTCQX:AHODF) is well positioned to take advantage and grow the business through acquisitions as well. Given the current volatility in markets this stock presents an opportunity when the forward dividend yield surpasses 4%, implying a price target of US$25.

Company overview

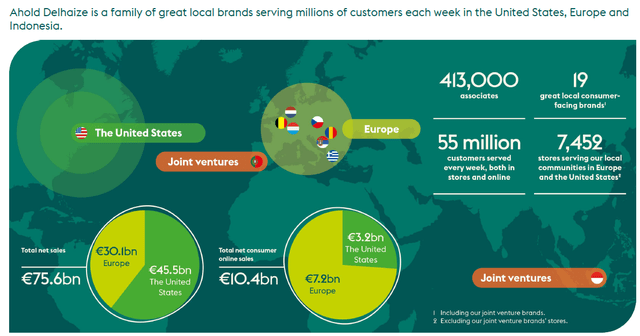

Ahold Delhaize is a multinational retail and wholesale company active mainly in the US and Europe, see figure 1. Well-known brands of the company are Food Lion, Stop&Shop, The Giant Company and Hannaford. The presence in the US is limited to the US East Coast whereas the presence in Europe is spread over the continent.

Figure 1 – AholdDelhaize markets and sales (aholddelhaize.com)

Performance

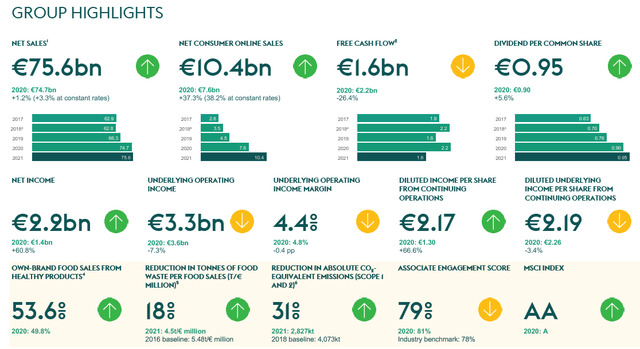

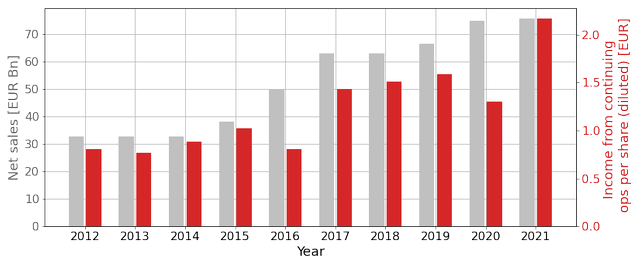

After a blockbuster year in 2020, as consumers increased grocery spending during the various lockdowns, the outlook for 2021 and 2022 was less exuberant as demand was expected to gradually taper off with societies opening up again. Yet 2021 turned out to be an exceptionally good year as well, see figure 2.

Figure 2 – 2021 Group highlights ( aholddelhaize.com)

In spite of 2021 being a year with less lockdowns, the company managed to increase sales by 1.2%. More interesting however is the massive increase in net consumer online sales. The company increased sales by 37.3% to a total of €10.4Bn (2020: €7.6Bn). Even without lockdowns, the online sales have shown tremendous growth.

Another number which showed a spectacular increase is the diluted income per share from continuing operations. This number gained by more than 66% to €2.17. The main reason for this jump has to do with the fact the 2020 number was depressed by a €1.4Bn pension charge. As explained here Ahold Delhaize took this charge to reduce its pension liabilities.

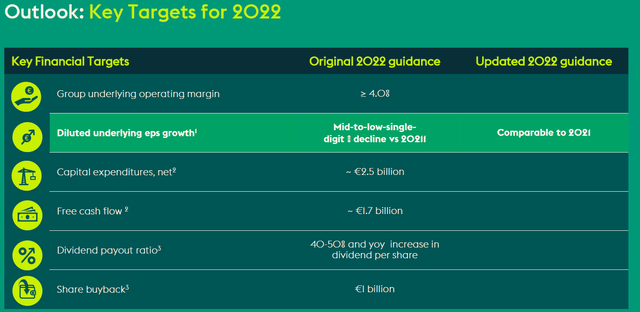

So, with 2021 coming in above expectation, the company expected a slight decline in EPS for 2022. Nevertheless during the Q1 presentation the company revised the outlook (figure 3) as:

‘Higher than expected Q1 earnings coupled with a more resilient consumer climate in the U.S. as well as a more favorable U.S. dollar are forecast to more than offset the challenging economic backdrop in Europe.’

Figure 3 – AholdDelhaize outlook as per Q1 ’22 (aholddelhaize.com)

Bol.com

The performance of Ahold Delhaize, and especially the growth in online sales, was not lost on investors. In November ’21 it became apparent Elliot had taken a US$1Bn stake. The news broke after the investor day where the company had announced it was looking into the options of an IPO for Bol.com.

Bol.com is an e-commerce platform, akin to Amazon, albeit much smaller as it focuses on Belgium and the Netherlands only. At the time of the announcement the IPO was estimated to raise as much as €5Bn.

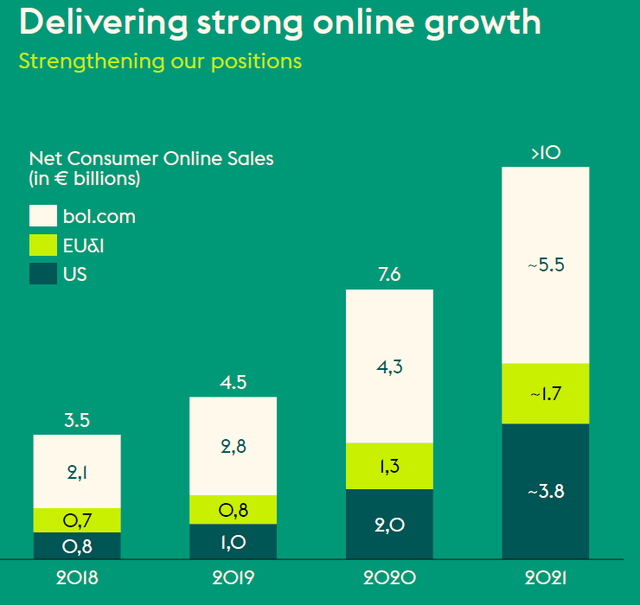

Ahold Delhaize has always been rather secretive about the finances of this online subsidiary it acquired in 2012, but at the investor day it was shared the platform accounts for €5.5Bn of net online sales and generates an EBITDA of €150 to 170 million. Out of the total net sales of ADRNY (€75.6Bn), €10.4Bn is accounted for by net online sales, of which more than half is accounted for by Bol.com, see figure 4.

Figure 4 – Distribution of net online sales per segment/geography (aholddelhaize)

The importance of Bol.com for the company is further highlighted if one realizes total net sales in Europe are ‘merely’ €30.1Bn as Ahold Delhaize generates the majority of revenue in the US. Narrowing the focus to Europe, Bol.com actually generates more than 18% of total sales.

It remains unclear whether Elliot proposed the listing, or if the company already had such plans, but evidently the Bol.com e-commerce platform is of big importance. This is further highlighted by the 2025 outlook. For 2025 Ahold Delhaize intends to grow sales by €10Bn compared to 2022, while focusing on doubling the sales from Bol.com. In other words, more than half the €10Bn total sales growth is expected to be generated by the e-commerce platform.

Given the current macro-economic environment it is doubtful whether Ahold Delhaize will pursue an IPO of Bol.com this year. Furthermore, at the investor day the company hinted on merging the customer journeys of its online platform and brick-and-mortar stores. It seems contradictory to prepare an IPO for the online platform while simultaneously integrating the same platform further into your business. The 10th of August Ahold Delhaize will present the Q2 2022 results and more news may be shared on this subject.

2025 Outlook

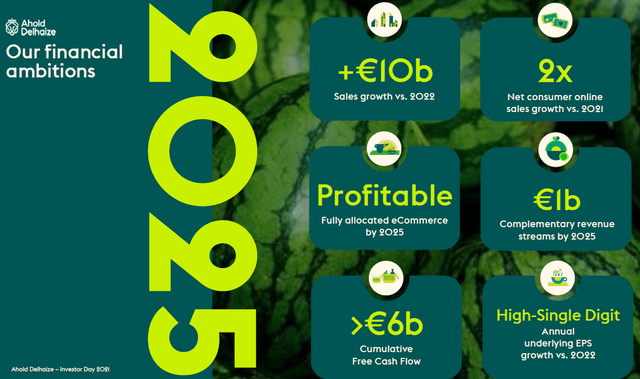

At the 2021 investor day Ahold Delhaize shared its 2025 outlook, see figure 5. The company intends to grow sales mainly by leveraging online sales growth. Considering sales growth over the past decade, the target is somewhat uninspiring.

Figure 5 – 2025 outlook (aholddelhaize.com)

In 2016 Ahold Delhaize was created after a merger of Dutch Ahold and Belgian Delhaize. As seen in figure 6 the sales showed a steep increase between 2015 and 2017 due to the merger. However, after the merger the company managed to achieve a compound annual growth rate of 4.7% in the period 2017 to 2022. Assuming this rate of growth can be maintained, the company will achieve €86Bn of sales by 2025 (2021: €76Bn), meaning the sales growth target is not overly ambitious.

Figure 6 – Development of sales and EPS (aholddelhaize.com; chart by author)

The very same holds for underlying EPS growth. Since 2017 the CAGR of income from operations was 11.0%, with earnings per share showing the same growth. Considering cumulative free cash flow the story is not different. Current free cash flow is approximately €1.5 – 2Bn per year, implying the cumulative target of €6Bn is well within reach.

A more interesting outlook however is CEO Frans Muller hinting at consolidation in the retail and wholesale sector:

The whole market will continue to consolidate. The complexity of this industry is increasing rapidly and the smaller players are finding it difficult to make the investments that are needed now. In sustainability, in innovation, in digitization. Moreover, the tailwind of Covid has fallen away, making it clear who are less well positioned. So only now that consolidation is really getting underway.

We have a strong balance sheet and we are ready to seize our opportunities in the consolidation battle. Both on the American east coast and in Europe.

We now see Ahold Delhaize gearing up for consolidation after the company just demonstrated it can successfully merge and grow without taking on excessive levels of debt or down-scaling investor returns.

Shareholder returns

As demonstrated in figure 2 the dividend per common share has grown substantially since the merger. The compound annual growth rate of the dividend is 10.8%, mainly driven by the 18% dividend increase of 2020. Nevertheless, looking at a longer time span, the last decade, dividend CAGR is 8.9%.

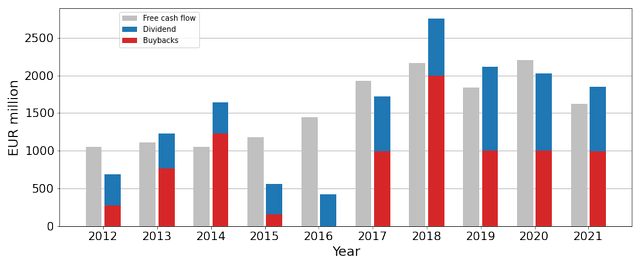

With an expected €1.00 dividend and the current stock price, the stock yields 3.8%. A yield of this magnitude combined with the nearly 9% growth rate is appealing. The only note of caution to be made is that free cash flow is not sufficient to cover the dividends and buybacks, see figure 7.

Figure 7 – Free cash flow versus dividend and buybacks ([aholddelhaize.com; chart by author])

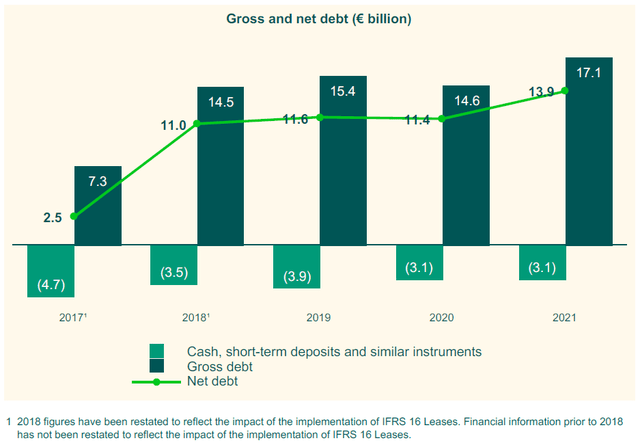

This inability to cover shareholder distributions with free cash flow appears to drive a deteriorating debt profile, see figure 8. However, the 2018 jump in debt was caused by an implementation of IFRS 16 leases. More important however is the company kept net debt constant even during the pandemic, but chose to let it rise in 2021.

On the upside the company opened 315 stores in 2021 which is much more than it opened the years prior. In that sense the increase in net debt can be viewed as in investment to achieve the 2025 outlook.

Figure 8 – Debt evolution (aholddelhaize.com)

Risks

The company sees several evolving market trends which it identifies as an opportunity, a selection:

- Long-term shift to at-home consumption

- Continued E-commerce growth

Whereas the company sees these trends as an opportunity, the may as well pose a threat. Addressing the first point on at-home consumption, the company states:

Higher demand for food at home, which started during the early days of the COVID-19 pandemic, appears to be here to stay (…) partly because the trend towards (…) hybrid working, seems likely to continue.

This statement does not take into account the hospitality industry is not running at pre-pandemic levels due to massive labor shortages. On top of this the use of food ordering and delivery platforms such as DoorDash (DASH) or Just Eat (OTCPK:TKAYF) became more commonplace during the pandemic. Use of these platforms means at-home consumption will grow, but does not necessarily have to benefit ADRNY, a dynamic Amazon seems to understand as it recently entered into an agreement with Grubhub.

When it comes to e-commerce, this industry will likely grow. The real question however is if Ahold Delhaize will be able to capture most of this growth and maintain or grow market share. Without a doubt the biggest competitor of Bol.com is Amazon (AMZN). Whereas traditionally Bol.com had a hegemony in Ahold Delhaize’s home markets, Amazon is now penetrating these markets as well. In that sense one could argue Ahold intends to cash on Bol.com before it will lose too much market share.

Valuation

The company is distributing a handsome dividend, performs share buybacks and is well-positioned for further consolidation in the wholesale sector. On top of this there is a clear strategy to develop e-commerce and grow the company. Since the merger between Ahold and Delhaize, and excluding the corona year, the PE ratio of the company moved in a bandwidth between 12.8 and 14.8.

As 2021 earnings per share were €2.17, and the company expects EPS to remain comparable, the PE ratio at the current stock price of €25.90 becomes 11.9. This means the company is currently trading at a discount compared to the last 5 years. Even though the stock is trading at a relatively low PE ratio, the price of €25.90 may prove somewhat rich if Europe is hit by a recession.

Given the current volatility in markets it cannot be ruled out the stock will trend lower. For a value play such as Ahold Delhaize, I’ll gladly add to my position when the forward dividend yield surpasses 4%, implying a price target of €25. With the USD/EUR trading at parity this translates into a price of US$25.

Conclusion

In spite of covid induced demand expected to taper off in 2021, the year turned out to be very good for Ahold Delhaize. For 2022 the company increased the outlook during the Q1 presentation and now expects similar performance as in 2021.

The performance shown by the company after the 2016 merger between Ahold and Delhaize creates confidence the (conservative) outlook will be met. Moreover, with the CEO expecting consolidation in the wholesale sector, Ahold Delhaize is well positioned to take advantage of this and grow the business through acquisitions as well.

The continued attention of management to dividend and buybacks make this a solid holding in one’s portfolio. The 2025 outlook is well achievable meaning the company can maintain dividend growth for the coming years. Given the current volatility in markets this stock presents an opportunity when the forward dividend yield surpasses 4%, implying a price target of US$25.

Be the first to comment