YvanDube

One of my favorite parts of investing is collecting dividends from the companies I own. It’s not a huge income stream yet, but I have big plans over the next decade and building a portfolio of dividend stocks for passive income is one of the primary pillars of that plan. The only thing better than collecting consistent quarterly payouts from companies is collecting monthly dividends. On Tuesday I covered a monthly dividend real estate investment trust (“REIT”) that I owned in the past, STAG Industrial, Inc. (STAG). Today I will be writing about a monthly payer that I still own, Agree Realty Corporation (NYSE:ADC).

Investment Thesis

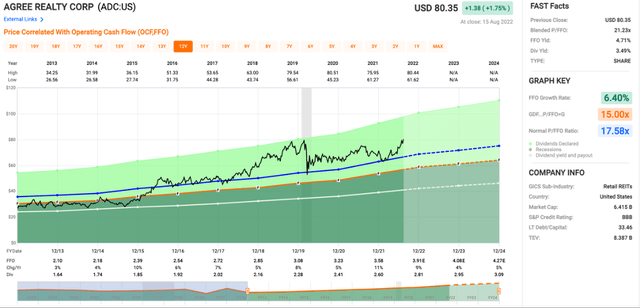

Agree Realty is a rock-solid net lease REIT that I plan to own for a long time. The business continues to hum along with new acquisitions, and I think the company has a long growth runway for years to come. However, now is not the time to be adding to your position after a 25% run since my last article on the company. Shares now trade at a price/FFO (funds from operations) of 21.2x, which doesn’t make shares a sell, but it is above the average multiple from the last decade of 17.6x. The 3.4% dividend continues to grow, and I will keep reinvesting my dividends, but I won’t be adding unless we see a selloff.

Portfolio Growth

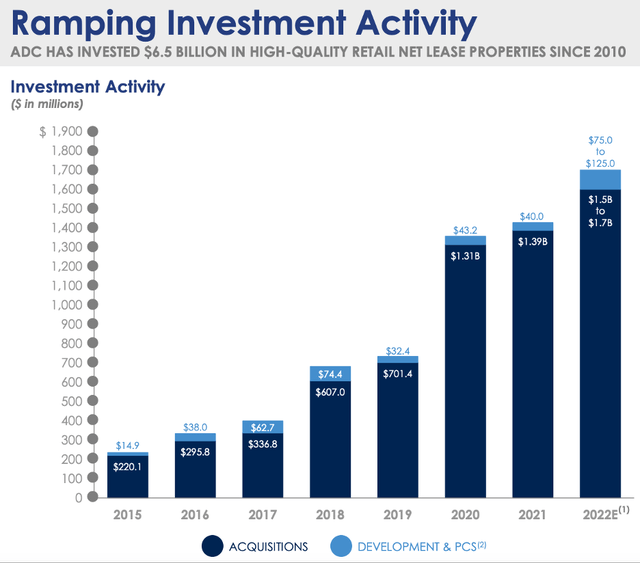

Agree has been a consistent grower over the last decade, but they have really stepped things up as far as acquisitions over the last couple years. After $1.3B and $1.4B in 2020 and 2021, respectively, they are projecting another $1.5B to $1.7B for 2022. Below is a graph that shows the company’s recent investment activity and how fast that has grown in recent years.

Investment Activity (agreerealty.com)

They also maintain a solid balance sheet, good cap rates for their portfolio which is primarily made up of investment grad tenants and can borrow at fairly low interest rates. However, now is not the time to be buying shares of Agree as the valuation as shares have run up in the last couple months.

Valuation

Agree has consistently commanded a high valuation relative to most net lease REITs. That has definitely been the case since 2015. As you can see below, the multiple hasn’t dipped below the average multiple of 17.6x very often and typically stayed closer to a 20x price/FFO. Shares now trade at 21.2x price/FFO, which isn’t a sign to sell if you are a long-term investor, but now is probably not an opportune time to add shares.

Management has continued to issue shares to fund acquisitions, and as the price has run up, equity issuances only get more attractive. I usually am not a fan of dilution, but REITs are a different animal. Agree is a REIT that has earned its premium valuation which allows it to issue equity at good multiples and invest in new acquisitions and redevelopments with a large spread. One of the other reasons Agree has earned a premium valuation is its consistent dividend growth over the last decade.

The Dividend

Since my last article on Agree, the monthly dividend was hiked 3% from $0.227 to $0.234. While a three percent raise doesn’t seem like much, the company has typically raised a couple times each year since switching from a quarterly payout to a monthly one. If the pattern from 2021 holds true, we will probably see another hike in the next couple months. While I’m not buying new shares, I am still reinvesting dividends. I like the compounding effect and I don’t have any plans to interrupt that unless the valuation gets even richer. If that happens, I don’t think I would sell, but I might choose to take the cash payouts instead of reinvesting.

Conclusion

Agree is definitely a sleep well at night net lease REIT in my mind. It has all the things I look for, from a solid (and growing) real estate portfolio with good cap rates, good management with skin in the game, and a consistently growing dividend. While those are all reasons to be bullish, I try to avoid overpaying for any asset in my portfolio. In my opinion, Agree doesn’t offer much in the way of margin of safety at prices above $80 per share.

While the 3.4% dividend is likely to continue to grow each year at a mid-single digit rate, I think we could see a better entry point in the coming months, especially if we see weakness in broader equity markets. Agree has certainly earned its premium valuation, but at 21.2x price/FFO, I wouldn’t be adding here. I will keep reinvesting dividends because I’m still bullish on the long-term future, but prudent investors looking to start a position in Agree Realty should stay patient for now.

Be the first to comment