marchmeena29

AGNC Investment Corp. (NASDAQ:AGNC) stock is currently yielding 11.4% despite the fact that the mortgage trust experienced another significant sequential decline in its book value.

Simultaneously, AGNC’s net interest spread risks increased significantly in the second quarter, owing to higher interest costs.

With interest rates expected to rise in July and AGNC’s excessive book value declines in 1Q/2Q-2022, AGNC stock will trade at a lower valuation multiple.

I would buy AGNC under certain conditions and with the appropriate market discount to book value.

Central Bank In Focus

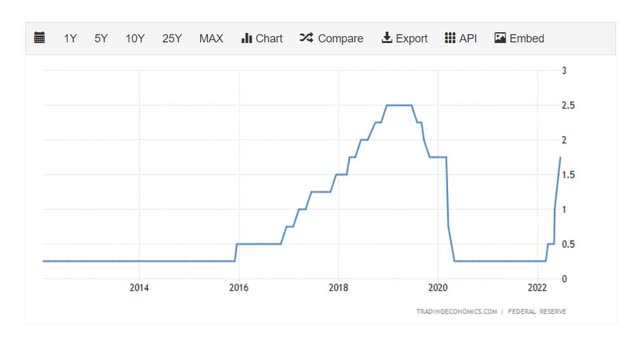

The central bank announced another 75-basis-point interest rate increase in July, the second such increase following the June hike. The rate increase last month was the largest since 1994, and it signaled to the market that the central bank was finally taking inflation seriously.

Given that inflation reached a new four-decade high of 9.1% in June, it is past time for the central bank to realign interest rates with the level of inflation in the economy.

Rates increased by 75 basis points, bringing the range of interest rates to 2.25-2.50%. While raising interest rates is necessary to combat inflation, it will raise interest costs for leveraged mortgage trusts.

Federal Reserve Interest Rates (Tradingeconomics.com)

Because of the central bank’s actions in July, AGNC will have to pay higher interest rates in the future, limiting the trust’s profit potential. Investors should expect AGNC’s net interest spread to narrow in the short term, while short-term interest rates will continue to influence interest rate volatility.

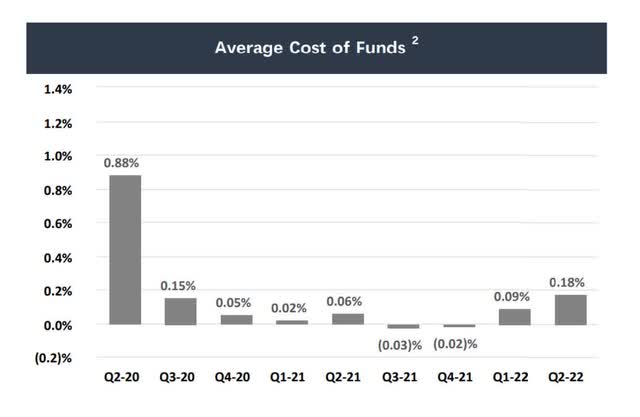

AGNC’s net interest spread was 2.7% in the second quarter, fueled by artificially low interest rate costs. However, with the Fed changing its tune, this net interest spread is set to contract.

AGNC’s average fund costs more than doubled in the last quarter, rising from 0.09% to 0.18%. While costs are still low, they are clearly rising, and the trust’s profits are expected to suffer. Furthermore, persistently high inflation may force the Fed to maintain its downward pressure on short-term interest rates.

Average Cost Of Funds (AGNC Investment Corp)

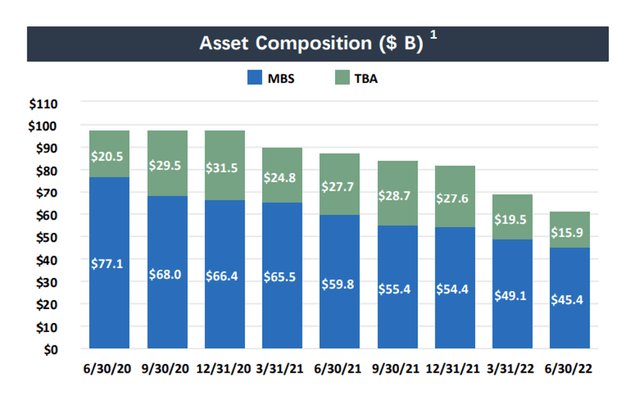

Shrinking Portfolio

Due to the widening of mortgage-backed security spreads and pressure on its book value, AGNC has reduced its portfolio and leverage, two key strategies that mortgage trusts can employ to reduce risk in a more difficult-to-read market. AGNC’s MBS portfolio has shrunk by 41% to $45.4 billion since 2Q-20. Mortgage-backed security investments fell 8% QoQ in 2Q-22.

Asset Composition (AGNC Investment Corp)

Periods Of High Interest Rates Not Attractive Investment Periods For Mortgage Trusts

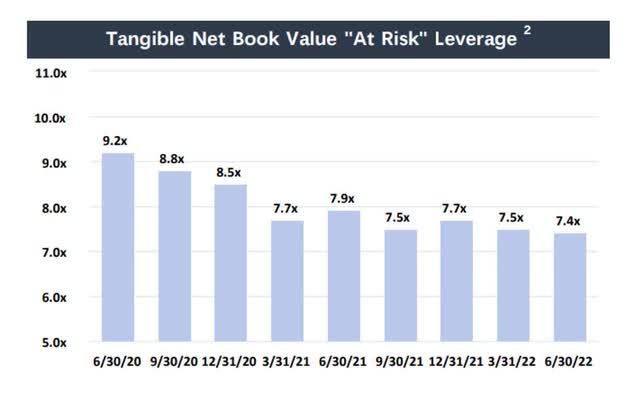

High-interest-rate periods are problematic for mortgage trusts because their business models rely on the availability of cheap debt. If the central bank raises interest rates, the business model as a whole becomes less profitable, which would most likely be reflected in a lower book value multiple.

With interest rates potentially rising to 3.5% by the end of the year, AGNC’s funding costs will skyrocket. Despite the fact that the trust’s leverage has been reduced from 9.2x in 2Q-20 to 7.4x in 2Q-22, high leverage and higher interest costs do not mix.

Tangible Net Book Value ‘At Risk’ Leverage (AGNC Investment Corp)

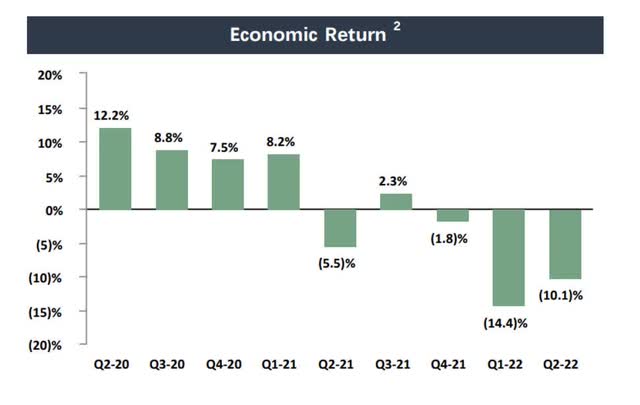

Need To Improve Economic Returns

The issues discussed here have resulted in very high negative economic returns of nearly 25% for AGNC since 3Q-21, resulting in steep declines in book value. A more predictable interest rate environment with no large rate swings to the upside or downside is the best thing that can happen to mortgage trusts. Because this is not currently the case, AGNC’s economic return potential will most likely remain limited in the short term.

Economic Return (AGNC Investment Corp)

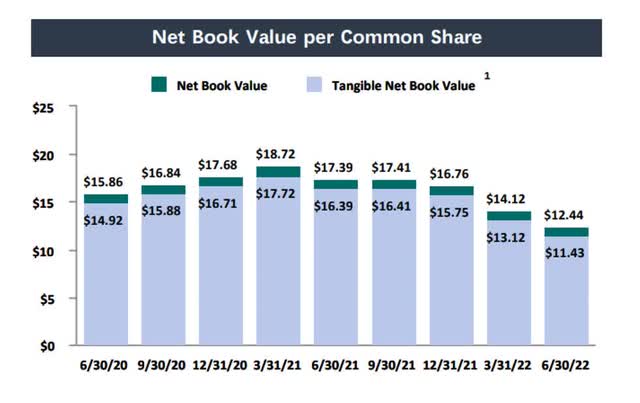

Huge Book Value Loss In 2Q-22

Given AGNC’s history of consistent book value losses, a significant discount to book value must be offered to make AGNC appealing as a dividend investment.

AGNC’s book value was $12.44 in 2Q-22, down 12.9% QoQ, due to an unexpected widening of spreads on agency mortgage-backed securities.

Volatility increased as a new market consensus emerged that short-term interest rates would rise much faster than previously anticipated. AGNC’s book value has dropped 34% since March 31, 2021.

Net Book Value Per Common Share (AGNC Investment Corp)

AGNC currently has a price to book value ratio of 1.01x, but given that the trust’s book value has decreased in four quarters since 1Q-21 due to rising spread pressure in the mortgage-backed securities market, purchasing AGNC is not recommended.

I’d consider AGNC as a speculative investment if I could get it at a 30% discount to book value, implying a stock price of $8.70 and a much larger margin of safety.

My Conclusion

AGNC’s current book value trend is problematic in multiple ways. Since 1Q-21, the book value has fallen in four of the five quarters, and by 12.9% only in 2Q-22. The uncertainty surrounding the trust’s book value stability could result in continued stock price weakness, especially if short-term interest rates remain volatile.

I believe AGNC’s valuation is too high to compensate investors for the risks they are taking with this mortgage trust. With that in mind, I’ll consider AGNC at $8.70, at which point, assuming no further book value losses, the stock would reflect a more reasonable 30% discount to book value.

Be the first to comment